Things are really heating up and changing by the hour. Markets are getting pretty nervous, but they are not predicting (yet) the end of the world as we know it. This post attempts to put the dollar and commodity prices in some long-term perspective. What stands out the most is that the dollar is relatively strong vis a vis most other currencies, but commodity prices are also very strong; this conjunction of events is without historical precedent, so it's tough to draw any conclusions (historically, the dollar and commodity prices usually move in opposite directions). The only clear threat remains the "nuclear option." That would indeed take us to an "end of the world as we know it" scenario, and in the process render all predictions useless.

Chart #1

Chart #1 shows the Fed's calculation of the dollar's value relative to other major currencies and relative to a a broad basket of currencies. Both measures show the dollar is well above its long-term average value, but not extremely so.

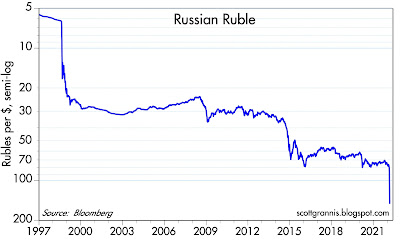

Chart #2

Chart #2 shows the value of the Russian ruble vis a vis the dollar. Few currencies (with the notable exception of the Argentine peso) have experienced such a dramatic decline over time. In the past 2 ½ weeks, the ruble has lost about 50% of its value against the dollar. While not unprecedented, this is clearly a terrible shock for the Russian economy and its citizens. Imported goods have effectively doubled in price almost overnight. This represents a massive tax increase on the citizenry. In a sense, Russia is paying for this war by stealing money from the pockets of anyone who holds rubles. Inflation is sure to skyrocket, and public unrest is sure to soar.

Chart #3

Chart #3 compares the value of the dollar (blue, inverted) to an index of industrial commodity prices. Note how the two tend to move together (i.e., inversely). But they've done just the opposite in the past few years: the dollar has been strong and commodity prices have been soaring. This tells us that the value of the dollar is not driving higher commodity prices. But since commodity prices are rising in terms of nearly all currencies, it's possible that the world's central banks are way too accommodative. In other words, it's possible that all currencies are being debased, and that's why hard assets are rising. In that case, look for inflation to be rising nearly everywhere.

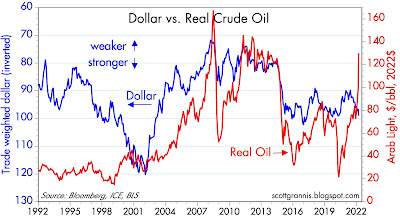

Chart #4

Chart #4 compares the dollar (inverted) to the price of oil. Here we seen the same pattern as with industrial commodity prices.

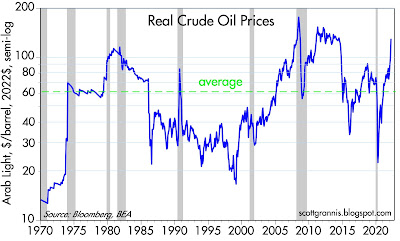

Chart #5

Chart #5 shows the inflation-adjusted price of oil. Note how virtually every recession has been preceded by a a very high real level of oil prices. Energy is so essential to growth that when oil becomes very expensive growth tends to weaken. It would be tempting to say that this chart is good evidence that recession risk is high, both here and in the Eurozone. But I think it takes a few more things to happen before recession becomes imminent. I go back to previous posts in which I point out that recessions are almost always preceded by very high real interest rates, a flat or inverted Treasury yield curve, and a significant increase in 2-yr swap spreads. Currently we have none of these conditions. Real yields are very low, the yield curve is still positively sloped, and swap spreads (in the U.S., but not in the Eurozone) are still within normal ranges. Liquidity is therefore abundant, and abundant liquidity is one of the best ways for an economy to avoid a recession. With liquidity, markets can efficiently shift risk to those willing to bear it; without liquidity, panic can ensue, much as happens when someone yells "Fire!" in a crowded theater.

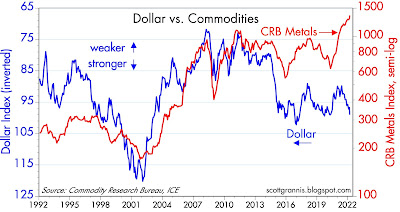

Chart #6

Chart #6 compares the inverse of the dollar to industrial metals prices. Metals prices typically go up as the economy strengthens, but in this case it's not hard to argue that higher metals prices are part and parcel of the general rise in all commodity prices, and that this is all a function of very accommodative monetary policy worldwide. It's also not hard to argue that the current surge in commodity prices will also feed back into higher measured inflation in the months to come.

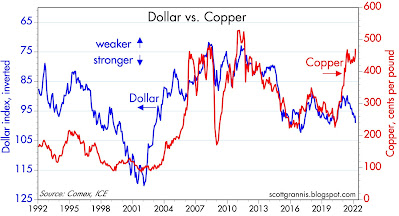

Chart #7

Chart #7 compares the dollar to copper prices. Same story as above.

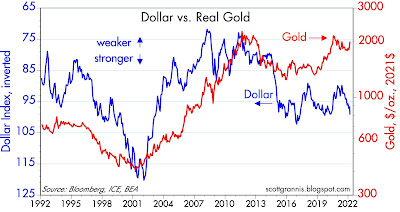

Chart #8

Chart #8 compares the dollar to gold prices. Here the correlation is not as high as with commodity prices. Gold has its own mind. Note that I've used the inflation-adjust value of gold. Gold is now approaching its highest inflation-adjusted level in history, by the way. So you may like gold as a safe haven, but you should know that it's extremely expensive at today's levels. People all over the world are willing to pay a very high price for gold because they are very concerned about all the bad stuff happening. And as I pointed out in a recent post, both gold and TIPS prices are very close to all-time highs. The risk-off trade is quite crowded these days.

Chart #9

Chart #9 is quite impressive, in that it shows that the prices of gold and crude oil tend to mean-revert over time, averaging about 20 barrels of oil per ounce of gold. By this measure, oil prices are only moderately expensive given the level of crude. If gold were to hold, say, at $2000/oz., then oil prices might continue to climb to $200/bbl without violating historical patterns (i.e., the ratio of gold to oil prices might fall to roughly 10). By inference, gasoline prices at the pump could break out to new all-time highs before this is over.

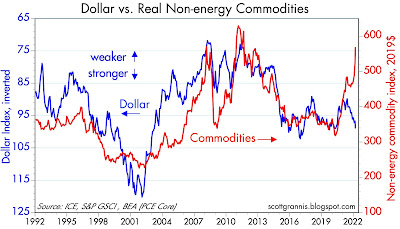

Chart #10

Chart #10 compares the dollar to non-energy commodity prices. Here again the same pattern as with all commodity prices.

Chart #11

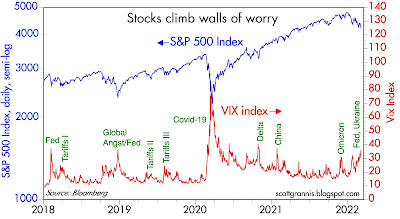

Chart #12

Finally, Chart #12 shows how rising uncertainty and escalating fears are depressing stock prices. We're not at extremes yet, so this can continue to vex investors. I don't pretend to know when this will end, but I do think that we will avoid an "end of the world as we know it" scenario.

10 comments:

this is what you get when a military complex organization like NATO tries to influence and court a region where bears live. This admin is going to crash the markets, democrats and their agenda are like bolsheviks, you will own nothing and fake happiness.....

This is why the PTB ousted Trump, he was going to leave NATO second term. Nato is just a military complex..

Too bad folks didn't believe in Ron Paul or Perot, letting a demented soul with a son who took corruption to new level in Ukraine.....the pale white horse, the markets have a long ways down to go.....

Another great wrap up by Scott Grannis. I always feel re-grounded in my understanding of the economy after reading Calafia Beach.

First, what is happening in Ukraine is a humanitarian catastrophe and Putin should be stopped.

Secondly, and much less importantly, this is probably a buying opportunity. Ukraine is a nation with 40 million residents, and a small economy. There are nearly eight billion people on the planet.

That said I hope Western powers establish a no-fly zone over Ukraine and destroy the convoy pointed at Kyiv.

sneaky and lame semiology on sp in last chart

The 'Currency Wars' have begun -- a veil of darkness clouds the global horizons -- uncertainty is great -- history will be neither instructive nor predictive in the near term -- protect your wealth and estate...

https://www.twitter.com/mckibbinusa

Great post as always Scott!

I see a lot of people calling for a recession due to the rise in oil prices however, gas consumption is only 4% of total US consumer consumption so I don't believe it will cause a recession at current prices.

hi Scott - great post and insight as always.

I think you're on to something you when you point out that the dollar isn't down relative to other currencies, but that could be due to all the major central banks printing money.

Do you have any thoughts on Zoltan Pozsar's recent report on the Ukraine sanctions ushering in a new commodity based currency regime (he calls is a Bretton woods III) leading to a weakening in the dollar relative to commodity prices? Would love to get your take on this view

https://plus2.credit-suisse.com/shorturlpdf.html?v=4ZR9-WTBd-V

Scott

The following is remarkable and shocking because it is true.

The Russian Ministry of Defense, the Foreign Intelligence Service of Russia (SVR), as well as Rostec and its many subsidiaries should all be designated by the Office of Foreign Assets Control as Specially Designated Nationals ASAP. Their assets should be blocked immediately and U.S. persons and companies should be prohibited from dealing with them. The Department of Commerce Military End Use(r) rule that applies export controls to these entities is not sufficient given the atrocities these entities are currently initiating and involved in.

Please help get this information to the public or to someone who will seek these sanctions.

Erne Lewis

360 301 3464

ernemarti@hotmail.com

Commodities are global in their nature, and while they are typically priced in U.S. dollars, commodity currencies typically move with the prices of primary commodity products due to these countries' heavy dependency on the export of raw materials for income

check this out for best reviews and suggestions > suggestmeshop

An even starker example of currency decline than Russia or Argentina is what has happened in Lebanon over the past 2 years.

Post a Comment