Tuesday, May 31, 2011

How to tell that the market is pessimistic

When everyone's optimistic about the prospects for the economy and financial markets, you've got to think twice before becoming optimistic yourself. Likewise, when the market is pessimistic, bad news is priced in and that gives optimists a cushion, or room for error. The market is full of clues as to whether its optimistic or pessimistic, if you just know where to look. Here's a quick recap of some key indicators which all suggest that the market is clearly pessimistic about the economy's ability to grow, about corporation's ability to sustain profitability, and about the Fed's ability to stimulate the economy.

The first chart, above, shows the level of yields on 2- and 5-yr Treasuries, and the spread between the two. Yields and spreads have a predictable pattern as the economy moves through the business cycle. Yields typically rise in advance of a recession, because every recession since WW II has been caused by a tightening of monetary policy which, in turn, was motivated by the Fed's desire to reduce inflationary pressures. Tight monetary policy pushes up short-term interest rates more than longer-term interest rates, with the result that the yield curve flattens in advance of recessions, and usually inverts (i.e., when short-term rates are higher than longer-term rates, that is a good sign that a recession is on the way). Once a recession hits, the Fed begins to ease, and short-term interest rates fall faster than longer-term rates; the yield curve steepens. Following a recession it typically takes a few years before the market and the Fed realize that a recovery has set in. The Fed then gradually raises rates and the yield curve gradually steepens.

This time is no different. We are still in the early stages of a new business cycle, and the market and the Fed remain quite doubtful about the economy's prospects. The yield curve is still quite steep, and short-term rates are as low as they have been in many decades. 2- and 5-yr Treasury yields are dominated by the market's expectation of future Fed policy, so for them to be this low implies that the market expects it will take a long time before the Fed starts to raise rates, and when they do, it is likely to be very slowly. That, of course, means the market holds out very little hope for a robust recovery any time soon. The market seems to be screaming that the Fed is "pushing on a string," and that monetary policy is virtually powerless to stimulate the economy and/or to push inflation higher.

This next chart shows the level of option-adjusted spreads on corporate bonds, arguably the best measure of the market's expectations of corporate defaults. As this chart shows, spreads are still elevated from an historical perspective, and about at the same level today as they were a couple of years following the 2001 recession. Spreads are still substantially above the levels that prevailed during the optimism that permeated all markets in 2007. Today's spread levels are consistent with a market that is still quite concerned that a weak economy (and possibility lingering deflationary pressures) will threaten the viability of corporate borrowers in coming years.

Similarly, the Vix Index of implied equity option volatility remains elevated, and is still substantially higher than what we see (e.g., 10-12) during periods of relative economic and financial market tranquility. It's not alarmingly high, of course, but that is not to say that the market is not concerned about the future.

This next chart is quite impressive, since it shows that the yield on long BAA corporate bonds (which comprise the majority of investment grade corporate bond issuance) is lower than the earnings yield on the S&P 500. This is a rare occurrence, since it means the market would rather accept a lower yield on bonds (which do not participate at all in a rising equity market, but have first claim on profits) than take the risk of the higher total returns that normally accrue to equity owners, who today are able to fully participate in the upside in addition to "earning" a higher yield. This can only mean that the market is unusually skeptical about the ability of corporations to sustain current levels of profitability. Looked at from a different perspective, corporate profits are very close to all-time highs, both nominally and as a % of GDP, but since PE ratios are below average (15.3 vs. 16.7) the market apparently assumes that the outlook for profits is dismal.

In short, if you are at all optimistic about the future, or just less pessimistic than the market, then equities offer attractive valuations.

Housing update: still soft, but probably not a double-dip

The release of the March Case Shiller home price index, which showed the non-seasonally adjusted number falling to a new post-recession low, is apparently confirming the view among many analysts that housing is now in a double-dip. That may be an irrelevant and premature assessment, however, given that the March number reflects the average of prices in the months of Nov., Dec., and Jan. Nevertheless, as these charts show, prices were indeed softening late last year and early this year.

The top chart shows the seasonally-adjusted Cash Shiller series, as well as the Radar Logic home price series. Both are telling approximately the same story. The second chart shows the inflation-adjusted version of the Case Shiller series measuring home prices in 20 major markets, while the bottom chart shows the Case Shiller series measuring 10 major markets, but extending back to 1987. On an inflation-adjusted basis, home prices on average have fallen almost 40% from their peak.

As to whether housing prices are still declining from their January levels, it's anyone's guess, but I am hearing anecdotal evidence to the contrary, at least here in So. California. Three homes in one neighborhood I'm familiar with sold within days of being listed, one for a price I thought was impossibly high. My nephew who is a mortgage broker in the Inland Empire reports that May was his busiest month ever, and he sees evidence of firming prices. Additionally, the chart below is an index of the equities of major homebuilders, and it shows no sign of weakness.

Much has been made of the big May selloff in commodities, but even that appears to have been temporary and not indicative of any economic downturn. The chart below of a diversified index of commodities shows that prices have already recovered over half of their early-May losses. Plus, copper prices have not declined at all in May.

In any event, I would argue that any weakness in housing should be viewed as an opportunity to buy, rather than a reason for despair.

Friday, May 27, 2011

Why the recovery continues to be subpar

April Personal Consumption Expenditures were a bit below expectations, but the story remains the same: consumer spending has recovered from the losses of the last recession, but it is growing at a subpar rate and is about 10% below its long-term trend level, as this chart shows.

It's been a subpar recovery, and that shouldn't be surprising. I've been predicting this since early 2009. Fiscal and monetary policy levers supposedly have been set to max stimulus for over two years now, but policymakers never really understood what they were doing.

Monetary "stimulus" that involves very low short-term interest rates and lots of bond purchases can't create growth out of thin air. Pumping money into the economy only makes sense if the economy is desperately in need of money, which was the case in the latter half of 2008. (At the time, the plunge in commodity and gold prices, the surge in the dollar, and soaring swap and credit spreads were key signs of a shortage of money.) Since then, easy money has only served to weaken the dollar, pump up gold and commodity prices, raise inflation expectations, and (finally) push actual inflation higher. Easy money hasn't done anything to strengthen the economy.

Fiscal "stimulus" that involves massive borrowings to fund huge transfer payments, make-work projects, and subsidize state and local budgets also can't create growth out of thin air. Taking money from those making a lot of it (e.g., corporations which have generated record profits) and handing it out to those not doing very much (e.g., by extending unemployment benefits, funding "shovel-ready" projects, and keeping union and public-sector employees on the job) not only can't create new growth, it destroys growth by creating perverse incentives.

Printing money, making money cheap, borrowing to force-feed spending—it's all an exercise in futility and ultimately counterproductive. Growth only comes when money is spent on things which increase the productivity of labor. Our standard of living rises only if our collective efforts result in more output for a given number of hours of work. Government has a dismal record when it comes to making productive investments, because the incentives are not properly aligned; the profit motive is missing. Force-feeding money to the economy only results in more speculative activity, since it's easier to bet on rising gold and commodity prices than it is to risk setting up a new company and hiring new people. Soaring deficits don't create new demand, they only create fears of huge future tax hikes and that dampens animal spirits today.

What has been working to create growth is the inherent dynamism of the U.S. economy, and the tireless efforts of entrepreneurs and workers who strive to improve their lot in life. Businesses have been busy restructuring, laying off nonessential workers, cutting costs, and boosting their profits. The economy has shifted massive amounts of resources from the troubled financial, housing and construction sectors, and into the up-and-coming mining, technology, and manufacturing sectors. The economy is growing despite the best efforts of politicians to create growth. Financial markets have recovered not because the economy is in great shape, but because the economy is much better today than markets feared.

The good news is that the evidence of stimulus failure is plain to see, and the mountain of debt it created is a lasting monument and a lesson to all. Congress has now shifted its efforts 180º: no longer is the debate about how much to spend on stimulus, but how much spending to cut. We really can't continue on the path of the last few years, and that is a great relief. We haven't yet figured out which path to take going forward, but by trial and error someone in Congress or the White House will figure it out. When somebody does, the magic formula will almost surely consist of cuts to wasteful spending and transfer payments, market-based reforms to healthcare, and lower and flatter tax rates coupled with tax-base-broadening reductions in deductions that will truly stimulate growth.

In short, out with the Keynesians, and in with the Supply-Siders.

Why the Fed's inflation targeting is not working

Years ago, in the early 2000s, the Fed told us that its preferred measure of inflation was the Core Personal Consumption deflator (though it also considered the headline PCE deflator important as well), and that its preferred target range for inflation was 1-2%. The chart above shows both the core and the headline versions of the deflator, in addition to the Fed's target range. Note that by either measure, inflation was above target for about five years, in the 2004-2008 period. Note also how volatile inflation has been in the past decade. Inflation has either been above or below its target, and erring by a lot, ever since the 1-2% inflation target was announced. So much for targeting inflation.

Actually, inflation targeting was never a good idea. Since monetary policy acts on the economy with long and variable lags, targeting inflation is akin to driving by looking in the rearview mirror. Similarly, it's akin to piloting a boat: once the boat is turning, it will keep turning for awhile, even if you turn the helm in the other direction. You can't wait for inflation to show up before doing something to prevent it, you have to anticipate where inflation is going and adjust policy proactively.

The Fed hasn't been acting proactively, they've been reacting, and that's one reason inflation has been so volatile. A reactive Fed undermines the value of the dollar because it creates extra volatility and uncertainty, and it also boosts the demand for gold and commodity prices as investors attempt to hedge against the dollar's loss of purchasing power.

Although inflation looks to be more or less within its target range as of April, on the margin prices are rising by much faster than appears in this chart, which only shows year-over-year changes in prices. The headline deflator is rising at a 4.6% annualized rate over the past three months, and at a 3.6% annualized rate over the past six months. The core deflator is rising at a 1.9% annualized rate over the past three months, and at a 1.5% annualized rate over the past six months. Without a tightening of monetary policy, and in view of the fact that the dollar remains very weak, the yield curve very steep, gold prices very strong, and most commodity prices are still very close to all-time highs, it is not unreasonable to assume that both the red and blue lines on this chart will move well above the Fed's target inflation range over the course of the year.

Yet despite the increasing likelihood that inflation is rising and is already at the upper limit of or above the Fed's preferred range, the Fed has somehow convinced the market that there will be no policy tightening until sometime next year. Savvy investors who realize that inflation is moving higher but the Fed is apparently unwilling to do anything about it for a long time conclude there is even more reason to seek inflation protection, and that feeds back into higher gold and commodity prices, and a weaker dollar.

Investors and speculators are thus several steps ahead of the Fed, as evidenced by the strong rise in gold, silver, and commodity prices this year. That will only contribute to inflationary pressures near term, keeping inflation volatility and uncertainty alive for longer than necessary. The Fed could do us all a favor by making policy more proactive, and that means paying attention to monetary indicators which point to rising inflation pressures, such as the value of the dollar, gold prices, commodity prices, and the shape of the yield curve.

Examining the inflation entrails

Here's an update to an interesting chart that shows the three major components of the Personal Consumption Deflator. The main attraction here is the huge divergence between the level of durable goods prices, which have fallen by about 25% since 1995, and the ongoing rise in the prices of services and nondurable goods, which have risen about 50%.

As I noted last month, there is a reason why durable goods began to decline (for the first time ever) in 1995: that was the year that China first started pegging its currency to the dollar (thus stabilizing and eventually strengthening it), which in turn set the foundation for China's strong export-led growth in the years to follow. Cheap Chinese imported goods have helped keep U.S. inflation low, while at the same time boosting U.S. standards of living. The services component of the deflator is a good proxy for wages, so the chart is telling us that an hour's worth of work today buys the typical worker a whole lot more in the way of durable goods that it did 15 years ago (actually about twice as much).

Thursday, May 26, 2011

Unemployment rolls have shrunk by 30%

The news that weekly claims last week were a little higher than expected is relatively insignificant (actual claims are flat over the past 3 months), and is greatly overshadowed by the ongoing decline in the number of people receiving unemployment insurance. Since early last year, the unemployment rolls have shrunk by about 30%, from 11.5 million to just under 7 million, and this is a trend that should continue. What this means is that more people are finding work, and more people are facing increasing incentives (having lost their benefits) to find and accept jobs.

Corporate profits remain very strong

As part of today's revision to Q1 GDP, we got our first look at corporate profits for the period. Total after-tax profits fell slightly from their fourth-quarter level, but as the charts above show, profits remain very strong nominally and relative to GDP. On an annualized basis and seasonally adjusted, after-tax corporate profits were $1.24 trillion, or 8.25% of GDP. In the past half century, corporate profits have only been stronger for a few quarters, in 2005-06.

It's a shame that despite the almost record-high level of profits relative to GDP, the federal budget deficit is even bigger. In fact, over the past two years, the federal deficit has totaled $2.7 trillion, while total corporate profits have been about $2.3 trillion. Considering that profits are money and money is fungible; that profits are a source of funds for the economy and deficit spending is a use of funds; this means the federal budget deficit has effectively absorbed every single dollar of corporate profits for the past two years. In my book, that goes a long way to explaining why economic growth has been so sluggish. Had the federal government not effectively appropriated the profits of the private sector to fund transfer payments and make-work projects, and to subsidize bloated state and local spending, the economy could have made tremendous progress and created millions of jobs in the process.

This next chart of PE ratios is constructed using a normalized S&P 500 index as a proxy for the value of all U.S. corporations, and after-tax corporate profits from the GDP tables as the earnings. What we see is that the equity market is trading at a fairly low multiple. Profits are very strong, yet multiples are distinctly below average. The only rational explanation for this is that the market does not believe that the current level of profits will be sustained. That may be the case, since it does appear that profits relative to GDP are a mean-reverting series (with profits averaging 6% of GDP over time), but nevertheless it shows that the market is very conservatively priced. The market is not making any heroic assumptions about the future of corporate profits, and instead is priced to the assumption that profits relative to GDP will decline significantly in coming years.

Looking inside the profits numbers, we see that nonfinancial domestic corporate profits rose significantly in the first quarter, which means that the weakness in the total number was confined to the financial sector. Also, as the above chart shows, nonfinancial domestic profits are unusually strong relative to total profits. The financial sector is still struggling in the wake of the recession, but the rest of corporate America is doing very well.

The biggest problem we have today is our bloated government, whose spending and borrowing needs are sucking the lifeblood out of the economy. Reducing the federal deficit by cutting spending would allow the private sector to reinvest the fruits of its labors, and that would in turn almost certainly fuel stronger growth.

Wednesday, May 25, 2011

I Am John Galt

My friend Don Luskin has a new book out that I'm reading, and I can already recommend it to anyone who likes Ayn Rand, Atlas Shrugged, free markets, capitalism, and the libertarian philosophy: I Am John Galt .

.

Markets are still on edge, with room for improvement

This chart compares the implied volatility of equity and Treasury options, and it's not surprising that they have been highly correlated over the past 5 years, since they reflect two sides of the same capital market. Implied volatility is a good proxy for the market's level of fear, uncertainty, and doubt, and as this chart shows, FUD is still somewhat elevated compared to the relatively tranquil days of 2006 and early 2007. I take this to be an indication that the market is still conservatively priced, still somewhat concerned that something might go wrong, and not overly optimistic.

It's also not surprising that the return to conditions of relative tranquility has been slow and gradual and not yet complete. "Once burned, twice shy," as the saying goes; the memory of the recent recession is still vivid, and there are still lots of things to worry about (e.g., trillion-dollar deficits and a gigantic increase in the monetary base).

As fear continues to slowly fade, to be replaced by increased confidence, equity prices should gradually rise and bond yields should rise as well, because increased confidence will lead to more investment, more jobs, and a stronger economy. Low Treasury yields are the market's way of expressing deep concern about the economy's ability to grow, so higher yields should naturally accompany an eventual improvement in the economic outlook.

Capex slows down, but the outlook remains positive

Capital goods orders (a good proxy for business investment) have not been very strong of late, growing at roughly a 5% annual rate over the past six months. But over the past year they are still up by an impressive 11%, and the pace of recovery following the recent recession has been much stronger than what we saw coming out of the 2001 recession. Pessimists will view the slowdown as a precursor to an economic slump, while optimists will see it as a pause that refreshes after last year's outsized gains. Other, temporary, factors likely account for at least part of the slowdown, e.g., bad winter weather and the Japanese tsunami.

In defense of the optimistic view, I note that Commercial & Industrial Loans have risen at a 13% rate over the past three months, and I take that as a sign of increased business optimism and an increased willingness on the part of banks to engage in new lending. C&I Loans are made primarily to small and medium-sized businesses, so increased access to credit is likely to fuel some badly-needed growth in this vital job-producing sector of the economy.

Tuesday, May 24, 2011

Mortgage update -- very cheap

With the recent decline in Treasury yields, 30-yr fixed-rate mortgages are now only inches from their lowest levels ever, and the only way they are going to get much cheaper is if 10-yr Treasury yields decline further.

Rates on 30-yr mortgages are largely driven by the 10-yr Treasury yield, since the duration (a combination of the interest rate sensitivity of mortgage-backed securities and their expected average life) of MBS tends to be similar to that of a 10-yr Treasury. As the chart above shows, the spread between 10-yr Treasuries and current coupon FNMA paper (the effective interest rate that a buyer of MBS receives after origination and servicing costs) is relatively low (currently 87 bps), and judging from the history of this spread, it is unlikely to decline much further. And while on the subject of spreads, the spread between conforming and jumbo mortgages is now 38 bps, which is only slightly higher than the average 22 bps spread which prevailed prior to 2007; in other words, jumbo rates aren't going to drop much unless conforming rates do too.

So if you are waiting for mortgage rates to drop meaningfully from today's levels, you should start praying for a real lousy economy. As the chart above shows, 10-yr Treasury yields have rarely been lower than they are today. They were lower only during the deflation and depression era in the 30s and 40s, during the height of the financial panic of late '08, and last summer, when the market feared the economy was entering a double-dip recession. Right now I don't see signs of a recession, a depression, or deflation, so I've got to believe that 10-yr yields are unlikely to go much lower than they already are.

Borrowing money today at a 30-yr fixed rate to buy a house is just about as cheap as it's ever been, and it's unlikely to get much cheaper.

Monday, May 23, 2011

Major currencies vs. gold

This chart is a companion to my previous post on the yen, since it illustrates how much stronger the yen has been than either the dollar or the euro (and by extension the DM). The red and blue lines show the price of gold in dollars and euros, respectively, while the gold-colored line shows gold priced in yen. Both axes have the same span: 15 to 1.

Note how gold has yet to hit a new high against the yen, whereas gold has almost doubled in dollar terms from its 1980 high. Note as well how the yen strengthened powerfully against gold in from the mid-1980s through the early 2000s, and how this correlated to Japan's very low (and even negative) inflation from the early 1990s through today. As Milton Friedman taught us, monetary policy acts on inflation with "long and variable lags."

Note also how major currencies have followed a similar pattern vis a vis gold—falling in value in the inflationary 1970s, rising in value in the disinflationary 1980s and 1990s, and falling in value in the 2000s. For gold bugs, this chart provides a good reason to believe that inflation in the U.S. and in the Eurozone will be substantially higher in coming years than it will be in Japan, even though the chart also shows that all currencies are depreciating against gold. In other words, gold is telling us that inflation is likely to rise in all countries, but much more so in the U.S. and Europe than in Japan. It will certainly be interesting to see how this plays out in the years to come.

Why Japan-style deflation is not a risk in the U.S.

These two charts show why a Japanese-style deflation is not a risk in the U.S., because they illustrate the source of Japan's deflation: an extraordinarily strong currency. The strong yen, in turn, is a direct consequence of decades of tight monetary policy. With the U.S. dollar now trading at all-time lows against other currencies in both nominal and real terms, it is a safe bet that U.S. monetary policy is not at all like the monetary policy that led to decades of very low inflation and even deflation in Japan. There are no valid monetary parallels between Japan's decades of deflation and the current state of the U.S. economy.

The top chart compares the yen/dollar exchange rate to my estimate of the Purchasing Power Parity of the yen. Note that the yen's PPP (green line) rises almost continuously beginning in the late 1970s. This is a function the fact that Japanese inflation has been consistently lower than U.S. inflation since the late 1970s. (If country A has lower inflation than country B, then the currency of country A needs to appreciate vis a vis the currency of country B just to keep prices steady between the two countries.) The yen needed to appreciate against the dollar just to keep prices in both countries from deviating significantly.

Arguably, the most significant event in Japan's modern monetary history was the huge appreciation of the yen vs. the dollar beginning in 1985. The yen was 260 to the dollar in Feb. '85, and it had soared to 85 to the dollar by June '95—a tripling of the value of the yen in dollar terms. An appreciation of this magnitude, followed subsequently by decades of zero or negative inflation, is powerful evidence of very tight monetary policy.

Deflation is possible in Japan because for decades the value of the yen has risen enormously. That's the definition of deflation: when a unit of account buys more and more goods and services. In the U.S. we have exactly the opposite problem: the dollar is depreciating against most currencies and against gold and most commodities. The fact that the U.S. economy is weak is helping to keep some prices from rising, but not all. The prices that are the most depressed happen to be related to the sectors of the economy that are the most depressed (e.g., housing and construction-related sectors). That's not deflation, that's a relative change in prices that is helping redirect resources away from construction and towards other areas of the economy (e.g., mining and manufacturing).

The only constructive parallel between Japan and the U.S. today is that both countries are burdened with large and growing budget deficits, which in turn are the product of too much spending. Too much government spending can suffocate an economy, leading to many years and even decades of sub-par growth.

Thursday, May 19, 2011

Systemic risk remains low, so equities continue to rise

I must have showed this chart at least a dozen times since late 2008, but it's still worth showing again. The story here is that a big cause of the recession was fear: fear of an international banking collapse, widespread bankruptcies, a global depression, and just plain fear that the world was coming to an end. So it made sense to think that if and when fear subsided, then the world and the global economy would sooner or later get back on the path of growth, asset prices would recover, and that's what has been happening ever since.

In the chart above, we see that the Vix index, a good measure of the fear and uncertainty priced into the equity market, has been fairly low for over a year now, and equity prices have been slowly but surely recovering. The Vix is still somewhat elevated, to be sure, since it was as low as 10 back in late 2006 and early 2007, so the market is not entirely fearless. Ditto for credit spreads (below), which have come down a lot from their recession highs, but remain meaningfully higher than their pre-recession lows. Both indicators of fear, doubt, and uncertainty show that the market is still infused with a degree of caution, which further suggests that asset prices are not over-priced.

The upward blip in unemployment claims a few weeks ago gave the market pause, but as the chart above suggests, investors appear to understand that the rise was due to statistical noise rather than any actual weakening of the economy. In the next few weeks the 4-week moving average of claims should move back down to 400K or less, putting it back on track with a slowly rising stock market.

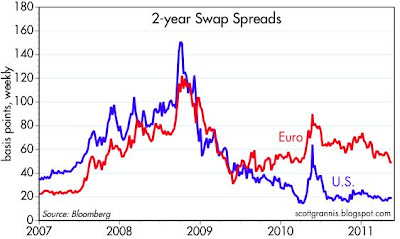

Swap spreads (above) tell a similar story. As a leading indicator of financial and economic risk, swap spreads in the U.S. are telling us that there is no reason to expect any calamity: economic and financial fundamentals are healthy, liquidity is abundant, and default risk is low. Europe is where systemic risk still lingers, in the form of looming sovereign debt defaults/restructurings. Still, the level of swap spreads in Europe is low enough to suggest that whatever problems Europe faces are unlikely to be calamitous—painful, to be sure, but unlikely to cause any significant disruption to the Eurozone economies. The market has seen the likelihood of a Greek default, it has been priced in (see chart below, which shows 2-yr Greek government yields at almost 25%, a level which indicates a very high likelihood of default), and it is unlikely to be earth shattering when it happens (German 2-yr yields are a mere 2%).

Meanwhile, life goes on, and some sectors of the stock market are at new, all-time highs, such as the relatively pedestrian consumer staples sector, shown below.

The Fed's role in all this (so far) has been to help the market deal with and overcome its lingering fears. Short-term interest rates have been set close to zero for more than two years, in part to accommodate the market's huge appetite for risk-free cash and cash equivalents. The world has been content to accumulate cash and cash equivalents paying little or no interest, as shown in the chart below. If a zero short-term interest rate were way below the market clearing rate, then the demand for M2 (i.e., the demand for cash and cash equivalents) would have collapsed, and nominal GDP would have exploded, but it has not (at least so far).

But there are increasing signs that we are transitioning out of the fear phase of this business cycle. As I've pointed out before, bank loans to small and medium-sized businesses have been growing this year, a sure sign of rising confidence. As banks lend more, they increase their deposits, and that increases the amount of required bank reserves, as we see in the next chart. Required reserves have increased at strong double-digit rates so far this year.

All of these developments are significant, and they all act to reinforce each other; rising confidence displaces fear, rising confidence boosts asset prices, and rising confidence and stronger markets fuel more investment, which in turn feeds back into more jobs, more production, and rising profits. This process is unlikely to be easily derailed, and it has a lot more room to run.

Making claims out of thin air (cont.)

Two weeks ago I argued that the large and unexpected rise in unemployment claims that occurred in April was likely the result of faulty seasonal adjustment factors—which expected a decline in unadjusted claims that failed to materialize—and predicted that claims would retreat in coming weeks. Fortunately, that's exactly what has happened.

The top chart shows the seasonally adjusted series, while the bottom chart shows the unadjusted data. Now that the seasonal dust has largely settled, we see that the supposed rise in claims was a statistical artifact that had nothing to do with what was going on in the economy. Case closed.

The top chart shows the seasonally adjusted series, while the bottom chart shows the unadjusted data. Now that the seasonal dust has largely settled, we see that the supposed rise in claims was a statistical artifact that had nothing to do with what was going on in the economy. Case closed.

Tuesday, May 17, 2011

Why Google is selling bonds

Yesterday Google decided to sell $3 billion worth of bonds, despite having $37 billion in cash. Greg Mankiw wonders why they would do this when the yield curve is very steep by historical standards. One of his readers suggests that it is because most of Google's cash is held offshore, and would be subject to a punishing tax rate of 35% if repatriated; Google is essentially betting that the corporate tax rate will be lower in the future, at which time they can repatriate the cash and pay back the bonds and come out ahead.

I would like to suggest yet another reason. First, I would note that the bonds Google is selling are of relatively short maturity: $1 billion of 3-yr bonds, $1 billion of 5-yr bonds, and $1 billion of 10-yr bonds. That gives you an average maturity of just over 5 years. To simplify the analysis, Google is effectively selling something like $3 billion of 5-yr bonds. Thanks to its AA- credit rating, Google is able to borrow at a rate that is about 50 bps on average above what the U.S. Treasury would pay for similar maturity bonds. That's not a terribly low spread, and the yield curve is relatively steep, but it is a relatively low spread over extremely low 5-yr Treasury yields, as the chart below demonstrates.

In short, Google is borrowing $3 billion at a yield that is just about the lowest yield in modern U.S. history. The Federal Reserve has been trying very hard to convince the world to borrow dollars, and Google is simply taking its advice. If corporate tax rates decline in the next year or so—a bet that looks more attractive almost every day—and if the economy improves and interest rates rise, Google will have executed a very profitable trifecta: it could repatriate its cash at a lower tax rate and buy back its bonds at a discount. And even if none of this works out, Google's cost of borrowing $3 billion will only be about 2.3%, which in an historical context is not very much. And if the dollar continues to depreciate, then borrowing dollars today in order to keep cash abroad will also prove to be a profitable strategy.

I would like to suggest yet another reason. First, I would note that the bonds Google is selling are of relatively short maturity: $1 billion of 3-yr bonds, $1 billion of 5-yr bonds, and $1 billion of 10-yr bonds. That gives you an average maturity of just over 5 years. To simplify the analysis, Google is effectively selling something like $3 billion of 5-yr bonds. Thanks to its AA- credit rating, Google is able to borrow at a rate that is about 50 bps on average above what the U.S. Treasury would pay for similar maturity bonds. That's not a terribly low spread, and the yield curve is relatively steep, but it is a relatively low spread over extremely low 5-yr Treasury yields, as the chart below demonstrates.

In short, Google is borrowing $3 billion at a yield that is just about the lowest yield in modern U.S. history. The Federal Reserve has been trying very hard to convince the world to borrow dollars, and Google is simply taking its advice. If corporate tax rates decline in the next year or so—a bet that looks more attractive almost every day—and if the economy improves and interest rates rise, Google will have executed a very profitable trifecta: it could repatriate its cash at a lower tax rate and buy back its bonds at a discount. And even if none of this works out, Google's cost of borrowing $3 billion will only be about 2.3%, which in an historical context is not very much. And if the dollar continues to depreciate, then borrowing dollars today in order to keep cash abroad will also prove to be a profitable strategy.

Gasoline price relief coming soon

Gasoline prices at the pump have only just begun to decline. This chart from Bloomberg, which shows gasoline futures prices (white line) and gasoline prices at the pump, according to the Auto Club (orange line), suggests that pump prices should fall to $3.50-3.60/gallon once the dust settles, based on the decline in gasoline futures prices that has already occurred.

This next chart compares gasoline futures prices (white line) to crude oil futures prices (orange line). The action to date suggests that gasoline futures prices could decline a bit more, given the decline in crude which has already occurred. This strengthens the case made above for a substantial decline in gas prices at the pump.

In very short order, the reversal of energy prices has removed a potential stumbling block to continued economic growth, and that is good news.

Monday, May 16, 2011

More Kudos to Paul Ryan

There's at least one person in Washington who has a grasp of our fiscal problems, and a comprehensive and sensible approach to fixing them: Paul Ryan. Here, some excerpts from his speech today to the Economic Club of Chicago:

Update: here's an alternative proposal that isn't quite as well thought out:

...the unsustainable trajectory of government spending is accelerating the nation toward a ruinous debt crisis.

This crisis has been decades in the making. Republican administrations, including the last one, have failed to control spending. Democratic administrations, including the present one, have not been honest about the cost of the tax burden required to fund their expansive vision of government. And Congresses controlled by both parties have failed to confront our growing entitlement crisis. There is plenty of blame to go around.

This trajectory is catastrophic. By the end of the decade, we will be spending 20 percent of our tax revenue simply paying interest on the debt – and that’s according to optimistic projections. If ratings agencies such as S&P move from downgrading our outlook to downgrading our credit, then interest rates will rise even higher, and debt service will cost trillions more.

This course is not sustainable. That isn’t an opinion; it’s a mathematical certainty. If we continue down our current path, we are walking right into the most preventable crisis in our nation’s history. Stable government finances are essential to a growing economy, and economic growth is essential to balancing the budget.

... chasing ever-higher spending with ever-higher tax rates will decrease the number of makers in society and increase the number of takers. Able-bodied Americans will be discouraged from working and lulled into lives of complacency and dependency.

... when it becomes obvious that taxing the rich doesn’t generate nearly enough revenue to cover Washington’s empty promises – austerity will be the only course left. A debt-fueled economic crisis will force massive tax increases on everyone and indiscriminate cuts on current beneficiaries – without giving them time to prepare or adjust. And, given the expansive growth of government, many of these critical decisions will fall to bureaucrats we didn’t elect.

First, we have to stop spending money we don’t have, and ultimately that means getting health care costs under control.

Second, we have to restore common sense to the regulatory environment, so that regulations are fair, transparent, and do not inflict undue uncertainty on America’s employers.

Third, we have to keep taxes low and end the year-by-year approach to tax rates, so that job creators have incentives to invest in America; and

Fourth, we have to refocus the Federal Reserve on price stability, instead of using monetary stimulus to bail out Washington’s failures, because businesses and families need sound money.

There is widespread, bipartisan agreement that the open-ended, fee-for-service structure of Medicare is a key driver of health-care cost inflation.

The disagreement isn’t really about the problem. It’s about the solution to controlling costs in Medicare. And if I could sum up that disagreement in a couple of sentences, I would say this: Our plan is to give seniors the power to deny business to inefficient providers. Their plan is to give government the power to deny care to seniors.

We have to broaden the tax base, so corporations cannot game the system. The House-passed budget calls for scaling back or eliminating loopholes and carve-outs in the tax code that are distorting economic incentives.

We do this, not to raise taxes, but to create space for lower tax rates and a level playing field for innovation and investment. America’s corporate tax rate is the highest in the developed world. Our businesses need a tax system that is more competitive.

A simpler, fairer tax code is needed for the individual side, too. Individuals, families, and employers spend over six billion hours and over $160 billion per year figuring out how to pay their taxes. It’s time to clear out the tangle of credits and deductions and lower tax rates to promote growth.

Update: here's an alternative proposal that isn't quite as well thought out:

HT: Steve Grannis

On the bond market's inflation forecasting abilities

How good is the bond market at anticipating inflation? Thanks to the advent of TIPS (Treasury Inflation-Protected Securities), we can now begin to answer that question in scientific fashion.

The chart above compares the actual rate of Consumer Price Inflation, using a rolling 10-yr annualized basis, to the market's expectation of what the CPI will average over the next 10 years (as embodied in the difference between the nominal yield on 10-yr Treasuries and the real yield on 10-yr TIPS). For example, in early 1999, the expected rate of inflation over the next 10 years (blue line) was a little less than 1% a year. Ten years later, in early 2009, the actual (annualized) rate of inflation over the previous ten years was 2.6%. Thus the bond market in 1999 underestimated future inflation by 1.6% a year, which adds up to a 17% cumulative miss.

Further, as the chart also shows, the bond market underestimated future inflation consistently from early 1997 through April 2001. In April 2001 the expected rate of 10-yr inflation was 2% per year, and we now know that the CPI has registered an annualized rate of increase of 2.7% over the 10-yr period ending April 2011.

On a less scientific basis, we can infer from this next chart that the bond market tended to underestimate inflation throughout most of the 1970s (because inflation exceeded 10-yr yields on average), and clearly overestimated inflation from the early 1980s until a few years ago (because yields greatly exceeded inflation).

In summary, inflation expectations embodied in TIPS pricing are not to be dismissed, but they need to be taken with a few grains of salt; the bond market is not infallible, and it has made some significant misses over the years in its estimates of future inflation. Regardless, I would note that since last August, when the Fed first floated the idea of QE2, 10-yr inflation expectations have risen from 1.5% to 2.4%, and the year over year change in the CPI has risen from 1.1% to 3.2%. Inflation and inflation expectations have moved significantly higher in the past year, even as they have declined modestly in the past month. Furthermore, the current real interest rate promised by 10-yr TIPS (the difference between current yields and current inflation) has narrowed quite a bit in recent years, thus offering investors who are looking for a real rate of return on 10-yr Treasuries a much smaller margin of error.

If I had to hazard a guess as to whether the bond market is more likely to over- or underestimate inflation in coming years, I would go for the latter. I base that on the Fed's clearly accommodative monetary stance, its avowed desire to push inflation higher, the historically low level of 10-yr Treasury yields, and the bond market's record of underestimating inflation during times of monetary accommodation (accompanied importantly by a very weak dollar and rising gold and commodity prices) as happened in the 1970s.

I refer readers to several of Mark Perry's posts in the past week for a reasoned but opposing viewpoint.

Bank lending update

The significant increase in bank lending to small and medium-sized businesses (otherwise known as Commercial & Industrial Loans, and shown in this chart) is not getting the attention it deserves, so I continue to revisit this series each week. C&I Loans have posted a 10.7% annualized gain over the past 3 months, and have jumped over $50 billion from last September's low. Those are impressive gains on the margin, but still only a drop in the bucket of total bank credit (about $9.1 trillion) and the M2 money supply (about $9 trillion). Nevertheless, this series continues to demonstrate that in aggregate, banks are increasingly more willing to lend, and businesses increasingly more willing to borrow, and that adds up to an increase in confidence overall, which is an essential ingredient if the economy is to continue expanding.

Friday, May 13, 2011

Swap spread update

Time to once again to revisit swap spreads, which in the past have proven to be excellent leading indicators of major changes in the economy and financial markets. U.S. swap spreads have been trading at very benign levels for over a year now, suggesting that our financial markets are healthy, liquidity is back, and systemic risk is very low—all the conditions you would want to see for an ongoing recovery. The change on the margin that is interesting is coming from Europe, where swap spreads have been trending down all year, after rising last year over concerns that sovereign defaults (e.g., Greece, Ireland) could cause havoc among European banks and that in turn could translate into bad news for the economy. The level of euro swaps is still a bit elevated, but swaps are now low enough to suggest that sovereign debt restructurings (which increasingly look inevitable) do not pose a significant risk to the European banking system or to the economy.

Producer inflation continues to heat up

(This is a repeat of yesterday's post which seems to have disappeared)

Inflation at the producer level continues to move higher, whether or not you include food and energy. Over the past six months, producer prices are up at a double-digit rate: 11.5% annualized. Core prices are up at a 3.1% annualized rate over the same period.

Compare these numbers to what we saw during the 10-yr period ending Dec., 2003, in which core producer price inflation averaged just 1% per year, and the headline PPI averaged 1.6% per year. That same period saw the headline CPI average 2.4% per year, and that was the lowest level of inflation in a 10-yr period that we had seen since the 1960s. Not coincidentally, the Fed was following a relatively restrictive monetary policy during that period, during which time the real Federal funds rate averaged 2.4% per year (today it is -2%), the dollar was generally appreciating, and commodity prices were for the most part unchanged.

The recent decline in oil prices undoubtedly will result in a decline in the headline PPI in the months to come (thank goodness, otherwise we'd be talking about double-digit year over year producer inflation), but it won't necessarily cause the core PPI to decline. Indeed, as I've noted before, it is noteworthy that core prices have been picking up of late even as oil prices have soared: if the Fed were tight enough to keep inflation at bay, then a big rise in oil prices would have resulted in a decline on average in non-oil prices. The fact that both headline and core PPI inflation have been picking up for the past 18 months is good evidence that monetary policy is indeed accommodative.

Easy money works first at the commodity and producer level, and eventually makes its way to the consumer level. By the time easy money shows up in the consumer price index, it's been out in the wild for many months and even years. And by that time it's almost too late to do anything about it. Gold and commodity price speculators for years have been anticipating the rise in inflation that is now underway. The only question now is whether inflation will prove to be as high as the runup in gold and commodity prices is assuming. Unfortunately I don't know the answer to that question. But I do know that deflation risk at this point is just about zero, and that nominal GDP is going to be picking up significantly in the years to come, and that is going to prove to be fertile ground for cash flows for all sorts of companies. That should be good news for equity investors, for holders of corporate and emerging market debt, and for owners of real estate.

Making claims out of thin air (cont.)

(This is a repeat of yesterday's post which seems to have been lost)

Last week I argued that the huge and unexpected rise in unemployment claims was most likely due to seasonal adjustment factors. Further, I predicted that if this were true then we would see claims fall back down in subsequent weeks. Today's number (which showed a decline of 40K) is right on track in confirming that diagnosis and prediction.

The top chart shows seasonally adjusted claims, while the bottom chart shows the raw, unadjusted data. In the raw data, we see there has been no meaningful rise in claims. The expected seasonal adjustment factors that would indicate a decline in the raw data didn't happen. Seasonal events don't always happen the way the seasonal adjustment factors expect, and this was one of those times. Expect to see further declines in the seasonally adjusted claims number in coming weeks.

Subscribe to:

Posts (Atom)