I haven't made a post for over three weeks. If there's a reason, it stems from the uncertainty created by the unprecedented economic collapses suffered by most of the world's economies—in turn the product of the most colossal public policy errors in the history of mankind, all for a virus that is equivalent to a bad flu—coupled with the radically different public policy prescriptions of our two presidential candidates and now magnified by the Federal Reserve's recent decision to adopt a radical change in its policy focus. And to think that, despite all this, equity prices are making new all-time highs and interest rates are marking all-time lows. 2020 really does deserve to go down in history as the Crazy Year.

I can only offer some observations which may be of help to investors trying to sort out what this all means. I'm an inveterate optimist, but even so I am humbled by the task of trying to make sense of all this. For what they are worth, here follow some observations.

I can't argue that the market is over-extended, but neither can I argue that the market is too pessimistic (which long-time readers will know is my favored habitat). Current PE ratios are historically high, but forward-looking PE ratios are only moderately elevated. That's not all that strange given the extremely low level of interest rates.

The elephant in the living room these days is the November elections. There couldn't be a starker contrast between Biden and Trump. Biden's policies would undoubtedly be bad for the economy (e.g., sharply higher tax rates and much more regulation), while Trump's would be good (lower tax rates and more deregulation). Trump brings a lot of character baggage to the race, but his accomplishments (e.g., lower taxes, deregulation, strong-arming NATO allies, getting tough on China, winding down wars instead of starting new ones) remind me that the only way to understand Trump is to pay no attention to what he says or tweets, but instead to simply focus on what he does. Biden, on the other hand is a nice, decent guy, with few if any major accomplishments to his credit, but displaying all the signs of an elder politician that is way past his prime and bordering on senility. His worst decision ever could prove to be his selection of Kamala Harris as VP, since she is a socialist at heart and a policy lightweight yet would very likely succeed Biden before his term is over. Imagine our lives if and when BLM has a friend in the White House. Since the polls still favor Biden but the market behaves as if Trump will win, I can only conclude that great downside risk lies ahead should Biden prevail.

So now we turn to the charts and what they tell us about what's going on in the economy and the markets.

Chart #1

It's been a wild and crazy ride in stocks this year, with fear being the source of nearly all the volatility, as Chart #1 shows. Since the end of 2017, the annualized total return of the S&P 500 has been 12.9%. Whether that's adequate compensation for all the nerve-wracking twists and turns along the way, I'll leave it up to each individual to decide. And as the chart also shows, the level of nervousness (as reflected in the Vix index) is still somewhat elevated.

The main source of recent fears has been a lowly virus, fear of which convinced nearly every politician in the world to shut down their economies in unprecedented fashion. As I've noted repeatedly for many months, "The decision to shut down the US economy will prove to be the most expensive self-inflicted injury in the history of mankind.™" It probably sounded foolish at the time I first said it way back in early April, but it's rapidly becoming accepted wisdom as more and more countries tally up the damage while also realizing that it's tough—if not impossible—for anyone to show any correlation between lockdowns and the eventual course of the pandemic. In fact, the anti-lockdown Sweden probably made the best decision of all: its deaths per capita are in the same ballpark as other major countries, but its economy has fared far better.

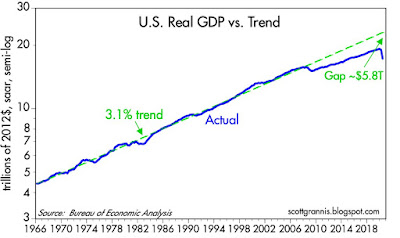

Chart #2

As Chart #2 shows, the US economy shrank at a 19.4% annualized pace in the first half of this year, with the worst of that coming in the second quarter, when GDP shrank at a 34% annualized pace. In level terms, real GDP fell by $2.26 trillion, a decline of 10.4%. In Europe it was much worse, with real GDP falling 15.2%; that decline sent the Eurozone economy back to levels last seen 15 years ago. The US economy, in contrast, was only set back a little over 5 years. Regardless, nothing even remotely similar has occurred in such a short period in recorded history.

Chart #3

Despite all the economic and psychological devastation, some sectors of the economy have rebounded strongly. As Chart #3 shows, the residential construction industry as of last July is almost back to its pre-crash levels, and housing prices are now making new all-time highs.

Chart #4

As I've noticed while driving the freeways of Los Angeles lately, traffic is still somewhat light, but it has improved dramatically from April's lows. Chart #4 shows how motor gasoline supply has rebounded strongly in recent months, and that is as good a proxy for miles travelled as you're likely to find.

Chart #5

However, as Chart #5 shows, while the airline industry rebounded rather quickly through the end of June, since then growth has stalled. (TSA traveler checks are an excellent proxy for total air travel.) Air travel today is running about 70% below the levels that prevailed a year ago. Airlines have been hammered.

Chart #6

Chart #7

The Fed needed to greatly expand banking system liquidity in order to accommodate the huge increase in the demand for money, as shown in Chart #7. Think of this chart as showing how much cash the average person or business wants to hold as a percent of their annual income. Money demand has soared to previously unimaginable levels as the economy shrunk and tens of millions lost their jobs. People were desperate for the safety of cash because the virus and governments' response to it had put us into uncharted and frightful territory.

Chart #8

Everyone scrambled for safe havens. Bank checking and savings deposits exploded (see Chart #9). As Chart #8 shows, the price of gold and TIPS soared, a direct reflection of the demand for safety. But as Chart #9 also suggests, we have probably seen the peak of the demand for money and safety.

Vaccines are on the horizon, therapeutics are hitting the market, confidence is slowly returning, and in most of the world we are seeing a definite and very welcome slowdown in the growth rate of new deaths (see Chart #10).

So the economy and nerves are on the mend, albeit slowly and nervously. But we're not out of the woods by any stretch, with the biggest unknown being the future of monetary policy. The Fed recently announced a landmark shift in its policy-making. Instead of preemptively fighting inflation, the Fed is now hoping to see inflation rise. How exactly will this play out? No one has the slightest idea.

I have always been an advocate of very low and preferably zero inflation. From my years of experience in Argentina I know first-hand how inflation distorts an economy and business decision-making, and how it ruins the lives of nearly everyone. Not many realize that the biggest victims of inflation are those who are least able to protect themselves from it: the poor, the uneducated, and the old. Already we can quantify the losses accruing to anyone these days who is holding large amounts of cash or cash equivalents (e.g., currency in circulation which totals almost $2 trillion, and bank savings deposits which now total a gargantuan $11.6 trillion). This simple measure of "cash" is equivalent to almost 70% of GDP, and it pays almost nothing in interest. Ex-energy inflation is already running about 2% a year, so those holding cash and cash equivalents are suffering annual losses of roughly $270 billion in terms of purchasing power (2% of $13.6T). And its likely to get worse, since the Fed has all but guaranteed that short-term interest rates will remain very low for the foreseeable future while they also hope that inflation rises.

Chart #11

Even the smartest of investors can't escape the ongoing loss of purchasing power for holding cash, cash equivalents, and Treasury notes. Real short-term interest rates (available through investments in TIPS) are strongly negative. You can have the security of a 5-yr Treasury note, but you are guaranteed to lose almost 1.5% per year in the purchasing power of your investment. Yikes. And by the way, interest rates are extremely low for two reasons: 1) the demand for short-term, safe securities is intense (which causes their prices to be extremely high and their yield to be therefore exceedingly low), and 2) the Fed is promising to keep its Fed funds reference rate close to zero for the foreseeable future.

Chart #11 shows the history of nominal and real rates on 5-yr Treasury notes, and the difference between the two, which is the market's implied expectation of future inflation (currently about 1.7% per year for the next 5 years).

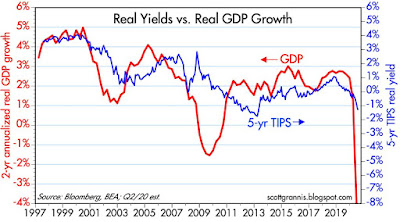

Chart #12

Chart #12 compares the ex-post real yield on Fed funds (blue) with the market's expection for what the real funds rate will average over the next 5 years (red). Both are hugging -1.5% per year. Nobody thinks rates are going to rise from their very negative real levels for many years. That thinking is driven by a combination of 1) pessimism over the economy's long-term growth prospects and 2) a belief that the Fed will deliver on its current promises to keep rates low for a long time.

But here is the real story: by promising to hold interest rates at today's rock-bottom levels for an extended period, the Fed is trying hard to discourage people from holding cash and short-term investments. The Fed wants you to spend that money instead, and it would also like you to borrow money instead of save it. The new mantra is "borrow and buy."

It shouldn't take long for people to begin to figure this out. In fact, many already have, as we'll see in the following charts.

Chart #13

Chart #14

Chart #15

Unless, of course, the Fed is able to react to a declining demand for money by withdrawing the bank reserves which it has recently injected. What are the chances they can withdraw trillions of dollars of new reserves at just the right time to avoid unwanted and unexpected inflation? It's anybody's guess, but the stakes have never been higher.

Chart #16

Ultra-low interest rates on cash equivalents and short-term securities also encourage people to buy other types of assets. Chart #16 shows the current yields on selected sector investments. In order to find a yield higher than the Fed's 2% inflation target, you need to look at things like lower-quality corporate bonds, REITS, and emerging market debt. Stocks too offer attractive yields, with the S&P 500 currently showing an earnings yield of 3.66% (the inverse of its current 27.3 PE ratio). Stocks, in other words, are benefiting from very low interest rates. In a new age of near-zero interest rates, PE ratios of 27 may seem high from an historical perspective, but in actuality they could well be seen as attractive. And in any event, PE ratios based on 1-yr forward earnings expectations today are only 21.2. It's not obvious that stocks are over-extended at today's prices.

Chart #17

Inflation expectations have picked up a bit in recent months (see Chart #11), but they are still well within normal ranges. Likewise, the yield curve has steepened a bit (see Chart #17), but it is still relatively flat from an historical perspective. The bond market appears to be in the very early stages of anticipating rising inflation and an eventual Fed tightening. There is lots of room left in this trade.

As for Covid:

The three charts below come courtesy of Brian Wesbury at First Trust. In the first, we see that Covid deaths occur overwhelmingly among people 65 and older (gulp, that includes me!). Unfortunately, the MSM have utterly failed to communicate this effectively to the population. As a result, the country has been swept up by a pathological paranoia that has resulted in, among other bizarre behaviors, young people wearing masks outdoors even when walking alone or riding a bike. In the second we see how dramatic the decline in hospitalizations has been in states previously categorized as "hot spots." The third chart is welcome news of a quick-and-easy Covid antigen test which is just around the corner.

.

Finally, I recommend this 7-minute video ("Shut up and put on your mask") from Graco. In support of its thesis, I recommend this summary of a recent NBER study that found that lockdowns and mask mandates do NOT lead to reduced Covid transmission rates or deaths. All they succeed in doing is to destroy economies and lives, while handing immense power to public officials who have trampled the civil and constitutional rights of billions of individuals by making decisions not supported by facts. Thus, a very dangerous precedent has been set that poses significant risks to economies and the general well-being of the entire planet in the years to come.

If you want to really worry, this is where you should place your chips. Think of a mask mandate as the first step on a slippery slope to despotism and socialism. We are not "all in this together;" our leaders are not more intelligent than a market of billions of individuals. Kamala Harris, I do not need you to tell me what to wear and what to think.