It's no secret that virtually every recession in the past 50 years (with the exception of the brief economic collapse of last year) was triggered by the Fed tightening monetary policy in order to bring inflation down. That explains why the equity market is reeling: the market believes that today's unexpectedly high inflation will provoke a serious Fed tightening which would inevitably pose a serious threat to the economy.

But even though inflation is much higher than nearly everyone expected (with the exception of economists such as Steve Hanke, John Cochrane, Brian Wesbury, Ed Yardeni, and Bill Dudley and yours truly),

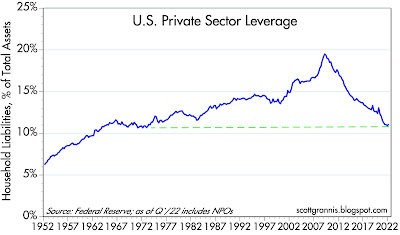

a recession is not inevitable this time around, for two very solid reasons: 1) the current bout of inflation was triggered by runaway federal spending that was monetized by the banking system, and that inflation source has all but dried up, and 2) the way the Fed is tightening monetary policy today is very different from how it worked before 2008, and much less likely to harm the economy.

In my

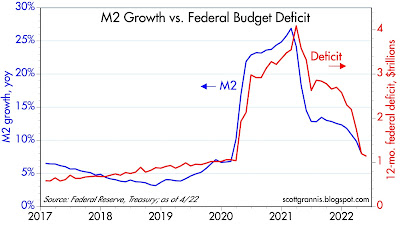

last post, I discussed how the evidence shows that enormous federal deficits resulting from Covid-related "stimulus" spending were monetized, resulting in an unprecedented increase in spendable money (M2) held by the public. In earlier posts I've discussed how the the tremendous uncertainties surrounding the Covid-related economic shutdowns boosted the demand for money, and how this delayed the onset of inflation by about a year. Inflation didn't start rising until a year after M2 started surging and until it became clear that the Covid threat was receding. Five weeks ago I

explained how money demand was likely to start falling, and how this could result in a surge of retail demand (and continued high inflation) over the next year or so.

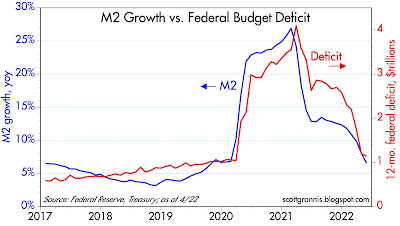

We now know that federal deficits have collapsed (because spending has collapsed and revenues have surged) and M2 growth has also collapsed. In fact, M2 grew at a very slow 1.3% annualized pace in the most recent 3 month period, and in April of this year it actually declined from its March level. This effectively removes a major source of future inflation potential going forward, thus making the Fed's inflation-fighting job a lot easier.

It's instructive here to recall how the great inflation of the 1970s was created. It began with the Nixon administration's 1971 decision to abandon the dollar's peg to gold, which in turn sparked a massive loss of confidence in the dollar that took 10 years to run its course. The devaluation of the dollar reduced the world's demand for dollars, and it was excess dollars being unloaded that fueled a decade of painfully high inflation. M2 grew at a rapid pace (8-10% per year) throughout those 10 years, so it's not surprising that it took Volcker about 4 years and two recessions before he could bring inflation down. Nothing like that is happening today.

Federal deficits have plunged, and are likely to remain relatively low and non-threatening for the foreseeable future. With his approval ratings nearing rock bottom, Biden hardly commands enough power to push through more spending bills, and meanwhile there is a growing awareness that past spending sprees are responsible for today's inflation. If Congress can simply stop spending more, economic growth and inflation will continue to boost federal revenues. Ongoing inflation will also erode the burden of all the federal debt that has been incurred in recent years. Doing nothing and allowing time to pass will go a long way to bailing us out. Unfortunately, there will be a cost to all this, and it will be borne mainly by the middle class as real incomes decline.

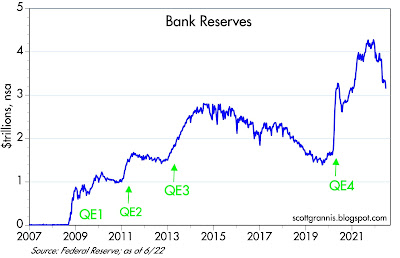

Prior to 2008, the Fed tightened monetary policy by draining bank reserves, which in turn created a liquidity shortage and forced short-term interest rates to rise, since banks needed to compete for scarce reserves by paying more for borrowed reserves to support their deposit base. In the latter stages of Fed tightening, very high real interest rates and scarce liquidity triggered bankruptcies and generally depressed economic activity—until the Fed realized that tight money was no longer needed. It's a sad story often told, but it won't necessarily be repeated.

Today, the Fed doesn't need to drain bank reserves, even though they are super-abundant (currently $3.3 trillion, an order of magnitude larger than required) and likely to remain so for the foreseeable future. Because the Fed now pays interest on reserves, it can tighten monetary conditions simply by raising the rate in pays on reserves, since that effectively sets a higher floor on all other interest rates. Higher interest rates have the added benefit of increasing the public's demand for M2 money (by making bank deposits more attractive and borrowing less attractive), thus limiting the inflationary potential of all the excess M2 that is sloshing around. With no need to drain reserves, we are unlikely to see threatening liquidity shortages.

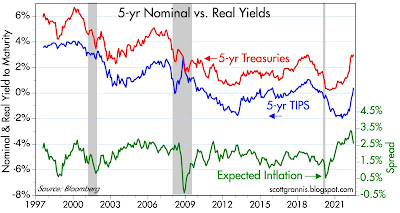

Meanwhile, the dollar is strong, inflation expectations are subdued, and excess M2 is declining. All of which reinforces the idea there is light at the end of this inflation tunnel. The situation is far from being out of control.

Nevertheless, we should expect to see uncomfortably high inflation for another year or so. The huge increase in housing prices in recent years will take at least that long to find its way into Owner's Equivalent Rent, an important component of the CPI, and it will take time for excess M2 to unwind. And meanwhile, supply-chains are still in disarray, and geopolitical tensions are working to boost energy and raw materials prices.

Chart #1

Chart #1 is an update of Chart #3 in my last post. The federal deficit over the past 12 months has declined to $1.1 trillion, which is WAY down from its high of over $4 trillion a year ago. Money printing is not likely to recur, and that greatly reduces the future inflation threat we face.

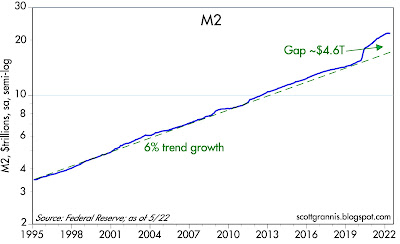

Chart #2 shows the level of M2 and the huge gap that exists today relative to where M2 would be if it had continued its long-term trend growth rate of 6% per year. The vertical dashed line marks the point at which I project the future path of M2 assuming it declines by about 1% every 3 months (in line with the decline that has already occurred in the April M2 data). At this pace the level of M2 would return to "normal" by around the end of next year.

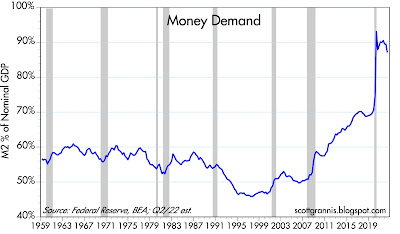

Chart #3 is one I have been showing for many years, since I think it is the best way to visualize the demand for money (think of this as the amount of cash the average person holds as a percent of his or her annual income). Money demand typically rises during recessions, as uncertainty causes people to become more cautious. It typically declines in the wake of recessions, as confidence returns and spending increases—exactly what's been happening over the past year. But as I've mentioned several times in the past, money demand has been extraordinarily high in recent years, and it seems very likely to decline going forward, which is why it's very important that money printing cease and the Fed raises interest rates to offset the decline in money demand. The last data point in the chart (Q2/22) assumes a modest decline in M2 (which is already underway), a modest 2% real growth rate of GDP, and inflation of 7%.

If those assumptions hold, then the ratio of M2 to nominal GDP would fall back to 70% by around the end of next year, which is where it was prior to Covid. A painful round trip, to be sure, but not the end of the world.

Chart #4 shows how an increase in housing prices (blue line) takes about 18 months to show up in the Owner's Equivalent Rent component of the CPI (currently, OER is about 30% of the CPI).

Chart #5

Chart #5 shows the rates on 30-yr fixed rate mortgages. Mortgage rates started exploding last February, rising from 3.25% at the end of last year to now almost 6%. Not surprisingly, the number of new mortgage loans originated already has plunged by one-third since February, thanks almost entirely to soaring borrowing costs. This is evidence that Fed tightening has already had a significant impact on the economy—it's already cooling the super-hot housing market. The Fed doesn't need to raise rates so much as it needs to convince the market that rates are going higher, and they have accomplished that already.

Chart #6 shows the current shape of the Treasury yield curve (blue) and what the market expects it to look like at the end of next year (red). The market fully expects the Fed to raise its target funds rate to about 3.5% or so between now and then. Longer-term rates haven't changed much and are not expected to change much going forward.

If there's one thing that is looking pretty bad these days, it's consumer confidence (Chart #7). Confidence is abysmally low, and that owes much to the huge increase in food and gas prices along with disapproval of the Biden administration's handling of things. On the bright side, this lack of confidence is working to keep the demand for money stronger than it otherwise might be, and that lessens the inflationary potential of all the extra M2 out there.

It's also nice to see that credit spreads are not soaring. Chart #8 looks at the "junk spread," which is the difference between investment grade and high-yield debt. Spreads are up, to be sure, but they are nowhere near worrisome levels.

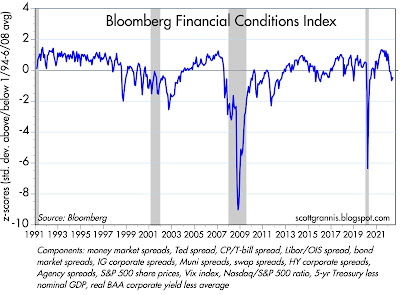

Chart #9

Bloomberg has an index of financial conditions, shown in Chart #9. Here we see the same story: conditions have deteriorated somewhat, but they are far from being worrisome.

Chart #10 shows 5- and 10-yr Treasury yields and the difference between the two, which is the market's expectation for what the CPI will average over the next 5 years. Inflation expectations are up, but they are not out of control—currently about 3.2%.

Chart #11 compares the current level of 5-yr real yields on TIPS (red) with the current real Fed funds rate (blue). The red line is effectively what the market expects the blue line to average over the next 5 years. The Fed is expected to tighten significantly, but from a very accommodative stance to begin with.

Chart #12

As Chart #12 suggests, the current level of the 5-yr TIPS real yield is consistent with real economic growth of about 2%. In other words, the bond market expects the economy will grow at a moderate 2% pace for the foreseeable future. This is somewhat slower than the 2.2% annual pace that the economy managed from 2009 to just before the Covid crisis hit. There is every reason to think the economy will continue to grow: job openings far exceed the number of people looking for a job, and there are still millions of workers who are sidelined currently but potentially available to rejoin the workforce. Meanwhile, business investment (e.g., capital goods expenditures) is stronger than it has been for decades.

Chart #13

Chart #13 shows the Fed's calculation of the real, inflation-adjusted and trade-weighted value of the dollar vis a vis other currencies. That the dollar is so strong these days—despite trillions of dollars of newly minted M2—can only mean that while things could certainly be better here, we are in much better shape than the rest of the world. All central banks have been ultra-accommodative, but the dollar and the US economy are the best safe-havens given today's geopolitical turmoil.

-----------

There is definitely light at the end of the inflation tunnel (though it's about a year long), and there is little reason to think that Fed tightening—which has already had a significant impact—will be as much of a threat to the economy as past tightenings have been. With one major caveat: Congress must resist Biden's pleas for more taxes and more spending. More taxes would weaken the economy and more spending would aggravate inflation pressures, but neither seem very likely in my judgment.