Friday, April 23, 2010

Strong growth in capex is very bullish

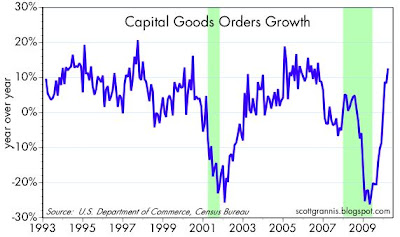

More very good news on the economic front today, with the release of unexpectedly strong data on capital spending by US businesses. This is one more of those V-signs of recovery. Capital spending is up about 13% from a year ago, and as the second chart shows, that's almost as strong as it ever gets. Strong growth in capex tells us a lot of important things: businesses are confident in the future and thus willing to take new risks; businesses are generating strong profits growth to fund new investment; and new investment today, by purchasing the tools and building the equipment that make labor more productive, is sowing the seeds of future growth and rising living standards. Capex is one of those things that feed on itself; the more we invest in productivity, the stronger the economy is likely to be.

To be sure, the level of investment is still quite low compared to where it's been in the past. But it is clearly moving in the right direction, and it's moving at pretty good clip. It's particularly impressive that business investment is so strong despite the tremendous amount of uncertainty that exists with respect to out-of-control federal deficits and the threat of higher tax and regulatory burdens. Just imagine how good things could be if these clouds of uncertainty weren't rolling overhead.

Subscribe to:

Post Comments (Atom)

2 comments:

If you overlay the year over year

percentage change of non defense capital goods orders ex aircraft

versus the 3 month moving average

of the monthly change in private payrolls you will see we are likely get some very strong private payroll numbers in the next couple

of months.

That makes perfect sense. Capex is strong because businesses are profitable and confident. Lots of profits and new investment almost guarantee more jobs in the near future.

Post a Comment