Wednesday, April 7, 2010

The commodity V-boom

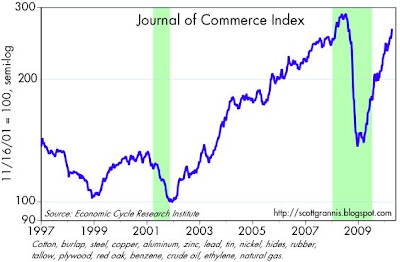

The ongoing boom in commodity prices is just too big to ignore, especially when virtually all commodity prices are rising, and rising strongly, as this chart shows. This is big news, and it doesn't get enough attention.

Commodity markets are at the real-time intersection of global supply and demand, which in turn are influenced by the decisions of billions of consumers, millions of producers, millions of manufacturers, millions of speculators, and millions of hedgers. And their decisions, in turn, are influenced by the monetary policies of the world's central banks, the fiscal policies of the world's governments, and the behavior of the world's currencies.

Commodity markets are beyond the control of governments and bureaucrats. Commodity prices aren't subject to measuring delays, seasonal adjustments, or revisions. Nobody can corner the global market for commodity prices.

Commodity prices are the closest you can get to the vital pulse of the global economy. And the pulse is strong, very strong.

What exactly are the commodity markets telling us? For one, demand for commodities is outstripping supply. Global demand has bounced back strongly after almost shutting down in late 2008. That shutdown led to unwanted inventory accumulation among commodity producers, who then took steps to cut back on production, shutter mines, and cap wells. Now the producers are scrambling to get back on line, and having trouble keeping up.

Two, it's likely the strength in demand is being augmented to some extent (how much is anyone's guess) by easy money. Every one of the worlds' central banks is pursuing an accommodative monetary policy. (Some, notably the Reserve Bank of Australia, are worried that interest rates may be too low, but no central bank has yet adopted a policy calling for monetary restraint.) Easy money has a way of causing unease among the investing public which can manifest itself in an increased demand for tangible assets (real estate, buildings, and commodities, which are the building blocks of all the world's things) and a reduced demand for money.

This chart should be prominently displayed at every meeting of every board of governors of every central bank. Its message is clear: the time for easy money is past; it's past time to start raising interest rates. The global economy is unquestionably growing, and there's a danger that demand could be driven to excess by too much money. At the very least, there is not a scintilla of evidence in this chart of the economic fragility that would be the only justification for an extended period of exceptionally low interest rates.

And to reinforce this message, I would add this chart of the price of gold. I would love to hear a central banker try to dismiss the inflation implications of this chart for monetary policy.

Subscribe to:

Post Comments (Atom)

23 comments:

Unfortunately, I am not a central banker (or perhaps, fortunately for others).

Gold is an unimportant yellow metal. Right now there are gold ETFs buying, and Indian and Chinese "investors" with medievel outlooks who pile their savings in. Add to it that stock markets have been shakey for a fe years (though there has been a snappy recovery in emerging markets).

But what is gold worth? What the next guy will pay. It does not generate earnings, or even interest.

This is a old-fashioned gold bubble, much like the mid-late 1980s, when gold nearly breached $1,000.

Fundamentally, I am appalled. In this day and age, I would hope people invest in operating businesses, or at least property. Investing in gold is for the tin-foil hat crowd.

But, hey, the tin-foil hats sometimes rule, as we see from creationism debates and fanatics who insist on catastrophic global warming, sans much empirical data.

i think bernanke doesn't want future editions of his economics book to cite how his raising rates in mid-2009 was a repeat of the historical mistakes of 1937.

Scott,

I am inclined to agree with your assesment. But what I think doesn't mean anything. Heck, my congressional representatives won't even so much as reply to my correspondence unless I am parroting their positions. Also, I don't think there is a snowball's chance in....the underworld the fed is going to start raising rates anytime soon. They are totally fixated on unemployment. Their mandate does not extend to keeping the price of gold near a certain level.

So what does an investor with a few hard earned shekels do with his serious loot? The long bull run in bonds looks OVER big time to me. So that's out. I have lots of ideas but I really think your opinion is a lot more important than mine. This is a significant issue and one that can throw a lot of people a curve. How to position yourself for this eventuality seems extremely practical to me.

that would be mid-2010 in my above comment...

John-

Land appreciates in inflations, and can earn income along the way. Uncle Sam will give you huge tax bennies to buy land, and local bankers will allow you to leverage up.

If you really think we will see inflation, land or property is a viable option.

Put gold on your wife's finger.

How to position oneself: I didn't bring this up in the post because the post doesn't represent anything new or different from what I have been saying up to now. Asset allocation advice remains the same: Short T-bonds, since interest rates will have to rise if a) inflation rises, and/or b) growth comes in stronger than expected, as commodities are suggesting. Long equities, since growth is likely to be better than expected. Long real estate, especially properties that have collapsed in price; also because I think equities are still undervalued relative to corporate profits. Increased borrowing or leverage is appropriate (fixed rates, not floating) given low interest rates and the likely appreciation of tangible assets. Long commodities. Long gold may be appropriate but I think it's quite a speculative proposition at these levels and not for the faint of heart. Long corporate bonds, especially of the high yield variety, since stronger growth and easy money will reduce default risk.

To back up my opinion that the fed is nowhere near a rate raising point, Alan Greenspan is telling it like it is this morning in congressional testimony.

"If the Fed as a regulator had tried to thwart what everone percieved as a fairly broad consensus that the trend was in the right direction, home ownership was rising and that was an unmitigated good, then Congress would have clamped down on us. There is a presumption that the Fed is an independent agency..and it is UP TO A POINT (emphasis mine) but we ARE A CREATURE OF THE CONGRESS (again, emphasis is mine) and if ....we're running into a bubble and we need to retrench, the Congress would say, "we havn't a clue what you're talking about".

The above is from cnbc.com

Folks, the Fed is NOT going to raise rates ANYTIME soon. Careers of fed governors will be destroyed by the congressional and executive powers that be if EVERY SINGLE LEVER is not pulled to bring the unemployment rate down ASAP. The price of gold or any other commodity is MEANINGLESS to these people (I mean here the politicians) Many in the fed are likely fully cognizant of the commodity price signals but they are not going to buck the Washington political crowd on unemployment.

Protect yourself. If we see inflation coming we can position ourselves to minimize the damage or even benefit.

Just my take. Again, my opinion does not matter. It is REALITY that matters. We all have choices, and we all live with the consequences.

Scott,

Absolutely fabulous comment above. I agree.

You too, Benj. Excellent answers in my humble opinion.

John-

I make it up as I go along, but you should be aware that Cato Institute has long held the position that monetary policy is too tight.

For myself, I don't see how any single nation or punditry can blah, blah much about monetary policy, as capital flows freely across borders, and cash too.

You can open up a bank account in China, and pull money out of the US branch (East-West Bank for one, and many others). I won't even mention currency traders, and cross-broder credit default swaps etc.

So while we obsess with the Fed, we have a global money supply and many monetary authorities, and there is unlimited spillover from one nation to the next. No one asks what is the money supply of Arizona vs. California. The USA vs. China?

Sheesh, I go to Thailand and pull money out of ATMs from my US bank.

Forget the Fed. Forget gold.

There is a commodities boom now. but it is speculative, not inflation. BTW, sugar just got cut in half.

maybe krugman was right; we need a bubble.

Scott -

Why is agriculture not participating in the overall rally for commodities? Take a look at a chart of DBA or RJA for example...

Puffer,

Not trying to speak for Scott, but it looks to me like the index he is showing includes a mixture of softs, hards, and energies. Apparantly the commodities that are moving the index are the hards, or industrial commodities like copper, and energies, like oil. Every commodity is not moving up sharply: ags and natty gas for instance.

hope this helps.

John

Well, maybe I was shooting my mouth off a little bit with "Forget the Fed."

But, it is inevitable that the Fed's influence will continue to wane in years ahead, as we enter a more-globalized economy with free cross-border flows of capital and cash.

Decisions made by Chinese monetary authorities may become more important than the Fed (inevitably, within 20 years). The global money supply is not controlled by the Fed.

What is the world in fact follows a contracionary monetary policy? Still want to bet the Fed can ovepower that?

Hi Benj,

I do not doubt that as time marches on the monetary policies of other nations will play a larger role in global economics. Its just that I can't swallow the notion that its going to happen in my lifetime (that may not be so far off!) Many countries are following a different monetary policy as we discuss this - Ausrtralia and Brazil for instance - but their economies are dwarfed by the US. They simply cannot involve enough money to move the needle. Just watch the overseas markets. They are very correlated to the US markets. We go up, they go up. We go down, they follow. And what can move the US market? The Fed. And they will move every overseas market right along with ours. Trust me. I have watched this phenonenon for many years. As I said, I agree that the influence will wane as the overseas markets grow in size and sophistication. But for as far into the future as I can see right now, the US Federal Reserve is the 800lb Gorilla in the global financial markets. They rule the roost.

John-

Well...how about the huge recovery in Asian economies, that preceded our own so-so recovery (which I hope gathers steam)?

Are they pulling us out, or we them? Have their monetary authorities acted to prompt growth? And that is helping pull us out? After all, the Far East has a bigger econmoy than we do. Should we have been watching China monetary authorities for a clue to what would happen here next?

BTW, interesting op-ed in WSJ today. Writer says the DJI becoming detached from U.S. and even global economies. The big multi-nationals can make money, regardless of national downturns.

Big rally on DJI coming, said the writer. Worth a ponder.

Another sign that nationalism is over, when it comes to global companies, their loyalties, monetary policy, or maybe how we should invest?

I see a huge schism brewing: We call for even more free international trade, but inevitably that will lead to a loss of control over our own economy. I guess that is the price of progress.

Scott,

Recently saw a report that discussed the Dallas Fed trimmed-mean PCE index, a statistically based measure of core inflation that eliminates most extreme price movements in each month. It has been running at +1.0% over the last year and +.6% (annualized) over the last 3 months. I'd appreciate your thoughts on this inflation measure, I have my doubts about a index that drops outliers. Also wondering if you remain bullish on emerging markets. Thx.

Last post here for the day.

I mentioned my own shop. I am NOT a paid financial advisor, nor do I seek to be. I read and post here for my own enjoyment. I think Scott Grannis provides a very underappreciated service. I throughly enjoy the site and hope to have the privilege of hanging around for awhile. Just sayin.

Nite, ya'll

Benjamin--you can dismiss Gold if you like but it's difficult to dismiss the CRB raw industrial commodities index. I assure you there is no bubble in tallow, burlap, scrap lead, hides or wool tops. Yet that index which hit a high of about 540 in late 2007 and a low of 315 in Dec '08 looks poised to break above 510. Surely that represents two things: 1. A stronger global economy and 2. A weaker fiat currency compared to real assets--those real assets include gold, real estate, and a host of other "stuff".

Steve makes an excellent point. When the price of things goes up in dollar terms (like commodities), that is a direct reflection of the dollar's loss of value. Inflation is essential the process whereby a currency loses it value or purchasing power. You ignore the message of gold and commodity prices at your peril.

puffer: Agricultural products would be the last sector of the commodity markets to experience rising prices as a result of a monetary inflation. If an investors senses that his central bank is pursuing an inflationary monetary policy, the most rational reaction is to protect himself by a) reducing his exposure to cash (e.g. borrow more), b) increasing his exposure to tangible assets that maintain their purchasing power relative to other things (e.g., gold, durable commodities, real estate and structures), c) increasing his exposure to stronger currencies (e.g., swiss franc, aussie dollar), d) favoring equity investments in companies whose cash flows will not be harmed by rising prices.

j: re the Dallas Fed's trimmed mean measure of inflation. The thing to keep in mind always is that the last place to look for signs of inflation is in the official measures of inflation. Once it shows up in the CPI or the PCE deflator, it's too late from an investor's perspective. It's much better to follow the sensitive, market-based, leading indicators of inflation, and commodities and gold figure importantly in that list.

Similarly, when inflation catches people by surprise, wages are among the very last things to benefit. High and rising inflation is a very effective destroyer of consumers' purchasing power. I learned this lesson many years ago when I lived in hyperinflationary Argentina.

BTW, I enjoy everyone's perspectives here.

Sugar is half off its peak.

Eucalyptus going okay, but not great guns (paper pulp).

Natural gas so-so.

Housing soft as quicksand. Commercial space maybe worse. Wages dead. Cost of manufactured goods (except military hardware) going down, not up. Worker productivity rising nicely.

In the long-run, I suspect commodities get cheaper and cheaper. Man is too inventive. Today we have dozens upon dozens of R&D shops, private and public, effectively linked together by the web. Even very technical knowledge is transmitted and independently vetted almost immediately.

Palm oil yield per acre rising at 4 percent annual clip.

The VC community has money, and even now (after recent declines) is much, much larger than 20 years ago. No good idea goes unfinanced, especially in energy, and many dubious ideas do get financed.

Commodities may have bounced off of recent lows in the super-recession. But competitive pressures will rein them back in.

Gold is a false signal--speculation, not demand.

Oil is a cartel, and speculation. Also a false signal.

Buy gold now and you may wait 20 years to break even. Like buying gold in 1986-indeed, if you bought gold then, you are still down, adjusting for inflation. That's a terrible investment. And no yield along the way.

Look, the Fed is just one monetary authority among many that determine the global money supply, and borders are completely porous now. We wanted free trade and capital flows--well now we have it. I don't see how we can even control the effective money supply in the US.

The last commodities boom (2007) barely budged the CPI, and the outlook is softer now.

It may be the globe's money supply is being starved--we don't know.

In the long run, I see a secular boom in Asian economies. If you can, invest there.

Man, I just don't see inflation.

Oh and by the way--gold does earn rent--you lend it out.

Post a Comment