Friday, April 23, 2010

Despite the problems in Greece, the Euro is still strong

This chart serves as a reality check to all the hand-wringing over the problem with Greek indebtedness. Greece has a problem, no question, but it could be solved by simply cutting government spending and not raising taxes. Even if Greece were to default on its debt, it wouldn't be nearly as tough on global financial markets as the subprime disaster or the Lehman failure; it would likely involve a restructuring of Greek debt that would cost bondholders some sizeable fraction (but much less than 100%) of their value. Default risk on Greek debt is now somewhat higher than that of your typical junk bond. Greece's problem is dragging down the euro because Greece might risk the unthinkable by pulling out of the euro and printing drachmas to inflate itself out of debt (which is simply another way of restructuring its debt, but probably the worst and most stupid way).

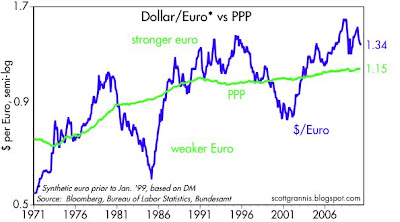

Despite all the problems, the euro is still relatively strong compared to the dollar—about 16% above its purchasing power parity according to my calculations. You might say that this is the market's way of telling us that on balance the outlook for Europe is still better than the outlook for the U.S.

Subscribe to:

Post Comments (Atom)

21 comments:

Seems like the US is lagging the world--Europe and Asia are moving ahead.

It is easy to be US-centric. The recovery began in Asia a long time ago. China is growing at an 11 percent annual rate.

I wonder if you will define/add color to your use of the word "stupid" as it relates to an exit/devaluation

Greece's debt overhang/.gov accounting fraud/tax avoidance/societal entitlement psychology/living way way way beyond their means is stupid.

A debt restructuring would be preferable to a devaluation. A devaluation would impact every citizen, rich and poor, by wiping out the value of their savings. It would trigger huge inflation, which would undermine living standards and growth for many years. It would amount to a breach of contract between the government and the people. Devaluations are sinister because they forcibly transfer wealth from the people to the government, and the poor and ignorant are the ones who pay the biggest price; the rich have many ways of hedging against a devaluation.

In contrast, if the government simply tightened its belt and foreswore any tax increases, this would immediately restore confidence in the future of the country and it would be easy to refinance its debt.

But Scott, would you buy the euro and sell the dollar ? What is your view of foreign currencies in general v the dollar (no, i'm not going to ask you again about the £ specifically !).

I thought from your comments about the need to raise US interest rates sooner rather than later that you think the $ is currently undervalued.

Also, I assume you talk almost always from a US-centric perspective, ie your comments and data pertain mainly to the US economy or the global economy. I thought you posted once about how the US is rare among developed economies in having a growing native population, contrasted with the eurozone and UK having declining populations and therefore poor future economic prospects?

Many thanks as ever and have a good w/end.

Rob

OT, but maybe good news is never OT: April 23 (Bloomberg) -- Sales of new homes surged 27 percent in March and orders for most durable goods climbed, indicating the U.S. economy sped up heading into the second quarter.

To me the danger of a restructuring lies in the solvency of many european banks. They are all stuffed with these Greek bonds. Not only that but also Portugese bonds, Irish bonds, Italian bonds, and so on. I fear that once the Greek tragedy is figured out the speculators will start in on the next one. It is looking to me like maybe the EU Central bank is going to have to monetize these bonds in order to save the banks. If there is a restructuring, the banks' capital ratios will be crushed. No one will be able to lend. Central bank monetization looks to me like the only way out. Inflationary big tme.

Latvia faced the same problem some months ago. The IMF clamped down on their public spending but it whacked their economy and tax revenues fell, hurting the economy again. Latvia is waiting on a European economic revival to pull them out. They can't do it by themselves. I fear they will wait a long time. Europe is in what a friend of mine humerously calls 'deep linguini'. No growth does not portend a strong currency to me. So much for the Euro as a reserve currency. King Dollar still reigns.

John-

Most outfits predicting 2 percent Euro growth going forward...not great but okay...global growth coming in a little higher...China forecast again near 10 percent for 2011, after 10 percent for 2010.

Europe, like the City of Los Angeles and US military, has to figure out how to put a lid on pensions.

Paying people for decades upon decades to do nothing,,,nobody in private sector does that.

How did you graph PPP vs the Euro? I'd like to see the Dollar vs PPP as well.

I see the dollar rising against the euro for the foreseeable future. The trouble is not only Greece or Portugal, which after all, can be bailed out because of their relativityly small size. The real danger is Spain, whose economy is six times larger than Greece, with a Gov. spending and borrowing as it there is no tomorrow, and real growth projections of zero next two years. So it seems to me the trade is now buy USD and sell €. As a full disclosure, I switched all my equities from European firms to American's six months ago.

Saludos.

Antonio,

I think you made an astute move to get out of the Euro. I fear this is only the beginning. Greece is a small part of the European Union (maybe 2-3%) but these people have been lying for YEARS about their finances. What American corporation could do that and not have criminal charges filed against their executives? People would go to jail. Why would anyone lend money to those people?

The short selling speculators will soon land on someone else and this will start over. Portugal? Ireland? Italy? ALL of these guys are tainted by Greece.

Stay out of Europe until more facts are known on how far this virus will spread. Like my old mentor once told me, 'son, there's never only one cockroach'.

As south Europe bonds holdings are at a decade high (those countries were the second choice destination, after Bunds, for 10 years) and given coming tectonic shift in an attidue towards country risk it is easy to expect some selling pressure from this source. And that could make the typical fire/contagion effect.

On the EUR positive side, coming yuan regime change might cause more reserves accumulation going forward, and more demand for EUR.

But of course they can wait some time and try to buy EUR much cheaper.

Scott,

You are quite familiar with the 2001 Argentina crisis I'm sure. Stratfor is reporting that Greece is a carbon copy of that crisis. They have lost all credibility with the financial markets and are hat-in-hand in front of the IMF and the EU.

The EU portion is expected to be EU30 billion. There is no fund for this so each EU member is going to have to pony up their share from their own coffers. And its going to have to be unanimous (why should Italy pay if Portugal does not?). Everyone pays through the nose for Greece's lies and high living.

The IMF is easier. Their portion is EU 15 billion and available immediately. However the US has veto power and it will likely be used if the EU fails to come through with their part. Greece belongs to a wealthy economic union and since the US is the biggest contributor to the IMF, there will be no funds unless the EU ponies up. The IMF money will also not come without draconian budget cuts from Greece. In Argentina these sparked massive protests and maybe a few riots. It will be worse in Greece. The Greeks are coddled people (retirement age is 52 and that's the reasonable part). Latvia required 25 to 40% cuts in public pay and its worse in Greece.

The coming bailout package is only for the debt rollover coming due May 19. It does nothing for the continuing deficit or the future debt coming due. The other EU members are going to be facing a virtually never ending budget line item for Greece and its not going to sit well with the publics. The politicians have a huge sales job ahead of them if they want to keep their jobs.

I see a restructuring coming. I don't think the politics of the EU will tolerate a one-for-one bailout. Somebody is going to eat some big losses.

I suspect that many of the bonds are in the portfolios of Europe's banks. I also suspect these bonds have been pledged to the ECB for cash loans to help keep the banks liquidity at acceptable levels. So a big hunk of Greece's debt is sitting with the ECB. If and when a restructuring comes it looks to me like the ECB will simply monetize the difference to save the banks. Or maybe some percentage of it. This is not going to sit well with the central bankers and it may well affect what bonds they will allow as collateral from other profigate countries.

Greece will set a precedent. As time goes on every EU member will go under the microscope of suspicion. Short sellers will hover like vultures and will immediately jump on anything that resembles weakness. EU member states will be making their own draconian budget cuts in coming months because they know if they do not they are next. This will all be a continuing drag on Europe's economy. There will also be not a small amount of political unrest.

For all of their problems, I do think Europe can come through this and emerge stronger. However they face a prolonged period of economic underperformance. They also face a period of confidence rebuilding with the credit markets. Its been nearly a decade and Argentina is still feeling the remnants of their debt restructuring. Bond money does not quickly forgive and forget.

The beneficiary of this in the short run is the US dollar. The uncertainty in Europe will cause money to leak out of the Euro for other havens. I suspect the US will get the lions share. It will help support the dollar. The weaker Euro will help stimulate the Eurozone but as they say in the rural south 'they have a long row to hoe'.

The US has been pretty undiciplined with its spending also. Soon, we may face similar problems. It is imperitive that we face up to our fiscal responsibilities and address our own deficits during the coming economic recovery. We have enourmous assets and a deep, deep well of global trust and good will. However even that can be squandered by Greek style undiciplined spending over time.

This has gone longer than I intended. I wish everyone a nice remaining weekend.

Lyric: PPP (purchasing power parity) is a theoretically derived exchange rate. PPP is the exchange rate between two currencies that would result in prices being roughly equal across borders. When I say the euro's PPP is 1.15, I'm saying that if the dollar/euro exchange rate were 1.15 then prices in Europe would be roughly the same as prices in the U.S.

There is a PPP for every currency pair. So you need to specify which pair you are talking about. Dollar versus ??

John: Greece is not yet a carbon copy of Argentina prior to the 2001 crisis. One of the important causes of that crisis was Argentina's adoption of an IMF "reform" plan in 1998 (or thereabouts). The IMF insisted that Argentina had to slash its government budget deficit by cutting spending and by raising taxes. They ended up not cutting much in the way of spending (very difficult given endemic corruption), but they did raise taxes. Higher taxes weakened the economy and undermined confidence in the government's ability to service its debt and keep the exchange rate pegged to the dollar. Capital started leaving the country and central bank reserves fell. The central bank cheated on its dollar peg, and eventually the whole thing collapsed.

Scott,

Thanks for the input.

So Argentina never made the budget cuts demanded by the IMF. I assume there was no access to the capital markets. And there was no monetary union with stronger countries and the currency just collapsed.

The Greeks are IMO just as bad as the Argentines when it comes to making the budget cuts. They however, must face the EU membership issue if they fail to do so. They can't devalue their currency because its the Euro. Its either make the cuts or they don't get the cash. And they may not get the cash anyway. It looks to me like its either a default/restructuring or the EU countries pay dearly to subsidize them. Argentina's choice was apparantly to make the cuts or allow the currency to collapse.

You are right. Its not exactly the same thing because Greece is an EU member while Argentina was not. But it sure looks like the verses are rhyming.

At the time, I argued that Argentina should not have raised taxes per the IMF's request. Higher taxes only gave more room for the government to avoid spending cuts, and higher taxes turned off investors. Argentina had a fairly simple solution that it neglected to implement: keep taxes low, freeze spending, and dollarize the currency. The idea behind this suggestion was to keep investor confidence high. With confidence, it is easy to finance deficits, and with high confidence and lots of foreign investment, deficits can be serviced by growth in GDP.

Very very good explanation. I am learning a little something here.

I would suspect higher taxes also contributed to capital flight. We are seeing it now in Greece.

Dollarizing the currency would have put Argentina on a hard currency standard, but without the spending cuts the deficit continued to rise. Since they did not dollarize, they just printed more pesos (or whatever it was) and collapsed the currency. Nightmare. The suffering had to have been horrendous.

Venezuela looks like they are going in the same direction.

Since Greece has been cooking the books it appears the capital markets are closed for all practical purposes. It will be interesting to see what the European parliments decide about bailout money and if Greek government can cut their spending enough to satisfy the IMF, the ECB and the other EU governments. I am not optimistic.

I fear this is going to end badly.

I'll try again: would you buy the euro and sell the dollar ?

For those of you following the Greek drama HSBC's Steven Major has some excellent positive commentary on the crisis on Bloomberg.com this morning. Its about 6 minutes of video.

Moodys downgraded Greece's debt to BB+ this morning. This is a hoot. After virtually admitting to downright fraud in their bookkeeping Moodys gives these people investment grade status until this morning!! And its STILL BB+. These ratings agencies are IMO nearly worthless.

CDSs for Portugal are up again today. It appears they are the next country to be targeted by the speculators. This is going to get a lot worse before it gets better.

Rob,

It appears that if Scott has an opinion on your question he prefers to keep it to himself, which is fine. Currency speculation is trecherous under the best of circumstances.

I will take a stab at your question: As an investor myself, I would expect the Euro to weaken VS the US Dollar until this sovereign debt crisis reaches some sort of resolution. I doubt the Euro reaches 1:1 but it could see 1.15 over the next several months. I am avoiding Euro denominates assets.

Just my opinion. Hope it helps.

Post a Comment