Tuesday, April 27, 2010

Home price update: still relatively stable

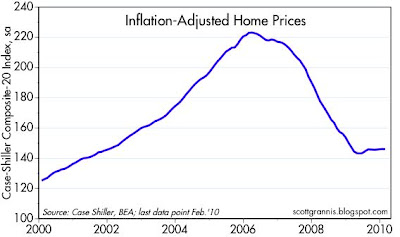

These two charts are my inflation-adjusted versions of the Case Shiller home price data. The top chart shows the composite index of 20 large metro areas, while the bottom chart goes back much further in time but shows only the top 10 areas.

I note that prices have been relatively stable for the past year. This is a good sign that the price adjustment process has done its job, and that a 35% decline in real prices was enough to allow the market to clear. Mortgage rates have also declined in recent years, further adding to the affordability of homes and further enhancing the clearing process. This is exactly what you would expect from a market that suddenly found itself with a huge excess inventory of high-priced homes; prices have to fall by enough to entice new buyers into the market.

Many observers continue to believe that this plateau in home prices is only temporary, and that it will be followed by yet another plunge, triggered by an avalanche of foreclosures that are set to hit the market over the next year or so. The second chart might support that notion, since it shows real prices today are still about 40% above their 1987 levels. But I have two reasons why that may not be a valid point: 1) prices in 1987 were relatively depressed, coming at the tail end of the housing price slump that began in the early 1980s; and 2) real housing prices tend to rise over time by a little over 1% a year, and the rise in real prices shown in the second chart works out to 1.5% per year annualized. I can't say definitively that prices won't fall further, only that it is not unreasonable to think they won't; prices today may be pretty close to their long-term equilibrium (or mean-reverting?) levels.

Subscribe to:

Post Comments (Atom)

14 comments:

I think people are playing a fools game right now. We just had a massive insolvency crisis in large part from real estate.

The government is trying its best to blow another bubble to avert calamity. And we keep sucking future demand to the present.

Trying to catch a falling knife in hopes it reached bottom is dangerous business.

If this next round of flippers and government subsidized home buyers find themselves 25 - 30% underwater in 2 years times it won't be a pretty sight.

I think you underestimate the power of the confluence of these developments: an economy that is definitely in recovery mode; prices that have fallen significantly; mortgage rates that are close to all-time lows; monetary policy that has never been easier.

Scott,

I know we disagree and your prognostications have been superb thus far.

However, your view actually worries me instead of giving comfort. We reached a point where your described confluences were absolutely necessary just to stabilize the economy and then get it turned around.

More specifically, monetary policy that has never been easier. I know the Fed gets what it wants in the short-run, but they have no clue what they will receive in the long.

If there is any uncertainty about what will be the end result of the Fed's current policy, surely it is whether they will manage to keep inflation from exceeding 2% a year. If inflation exceeds their target, then tangible assets, particularly housing, will almost certainly be the beneficiaries. We're already seeing this in the commodity markets and in the price of gold.

At the risk of sounding like a real estate broker, I gotta say, "Now is the time to buy."

You will not be buying at the top. You may be buying near the bottom.

Residential, commercial, industrial, often half-off from peaks.

That real estate deflation sends powerful deflationary shock-waves through the economy, giving the Fed wide latitude to print money.

M2 is up minutely in last year. Bernanke seems like a steady fellow, earnest in his intentions. He won't make any big mistakes.

I see a long, long rally ahead in equities and property. Especially in Asia (where there is some sort of property fever going on in real estate right now).

OT, but I have a q for SG: Suppose some cultures place a high (and admirable) premium on work and savings. So they develop high savings rates.

They save so much, that there is not enough reasonable options for investing the savings. Even if interest rates go to zero, they still save as it is part of their culture, and as government does not offer a safety net.

I am thinking of a Japan or China. In Japan, in some periods, savings rates are so high, that consumer demand is stifled--meaning the eoonomy looks troubled, inducing higher savings rates as people prepare for bad times.

China is often providing hundreds of billions of dollars annually (and much more to come) to global capital markets.

Even if interest rates go to zero, global savings will continue to pile up.

What is the upshot of this?

This is an article written almost two years ago,,,,Scott we have got to be close to a year over year positive on an inflation adjusted basis which according to this article,,,is a buy....

http://seekingalpha.com/article/83216-u-s-housing-market-forecast-2008-2010

brodero: the year over year change in the real price index is only slightly negative and should soon turn zero or positive.

Benjamin: your theory of a global savings glut (which Bernanke also believes in) is quite unfounded in my view. Check out this article written by a friend of mine. He makes a lot of the classic arguments against this theory and I think they ring true:

http://www.realclearmarkets.com/articles/2010/04/27/the_closed_world_economy_and_the_global_imbalance_myth_98406.html

Scott, can you address the foreclosure issue brought up by this email I received from a friend. (you may have already but I missed it if you did)

Thanks,

Bob

----------------

Brace Yourself For Another Plunge in Housing

According to LPS - Lender Processing Services - the leading provider of data processing, servicing and default manangement services to the mortgage industry - there is a 9 year inventory of foreclosed homes sitting on bank balance sheets. This figure includes the number of homes likely to end up in foreclosure over the next couple of years and is based on a three-month average of foreclosed homes sold by banks:

As of March, banks had an inventory of about 1.1 million foreclosed homes, up 20% from a year earlier, according to estimates from LPS Applied Analytics. Another 4.8 million mortgage holders were at least 60 days behind on their payments or in the foreclosure process, meaning their homes were well on their way to the inventory pile. That “shadow inventory” was up 30% from a year earlier...Based on the rate at which banks have been selling those foreclosed homes over the past few months, all that inventory, real and shadow, would take 103 months to unload.

As home values continue to decline, high unemployment persists and more homeowners resort to strategic default (or "jingle mail"), the number of foreclosures will likely accelerate this year. In addition, Congress does not appear willing to extend the home buyer tax credit program when it expires in 4 days. To make matters worse, 58% of all modified mortgages re-default after just 8 months - a glaring failure of Obama's taxpayer-financed mortgage modification programs.

This in turn will lead to another massive heart attack in the banking system, which no doubt will again be paid for by taxpayers. The moral of this story is that if you are contemplating buying a home, your best move will be to hold off for at least another couple of years to see where this is going. I have said since 2003 that we could see a 75-85% decline in housing prices before a real bottom is hit. I still maintain that view and it would appear that the data may well validate my conviction

Bob: I think this passage says it all: "I have said since 2003 that we could see a 75-85% decline in housing prices before a real bottom is hit."

Someone who constantly sees a downturn for years and years regardless of market conditions is not someone who one should use a guiding light.

The "news" about a huge inventory of foreclosed homes has been around for a long time. Anecdotal evidence of action in the very hard-hit Inland Empire (prices down 50% or more in some cases from their highs) tells me that foreclosures aren't happening fast enough; the demand for homes at these levels and with these mortgage rates is insatiable. Banks can't sell them fast enough. Auctions are met with 10-20 offers and bidding wars are the norm.

Not only is this old news, but the macro fundamentals are working to provide strong support to housing: low interest rates, a recovering economy that is now set to begin creating new jobs, and a strong global economy.

Bob,

Bill has it right.

Bob...there are many things wrong with e-mail your friend sent you.

That came from a poorly constructed article from the WSJ.

I don't want to go into all the problems with the article but one

glaring one is the assumption that full 4.8 million will go into foreclosure...aint gonna happen...

Thank you, everyone, for your comments.

Bob

Post a Comment