Thursday, March 25, 2010

Slow M2 growth not necessarily bad

From today's money supply data, we see that M2 has grown only 0.9% in the past year. Since 1960 at least, M2 growth was only lower than this in late 1994 and early 1995. Is this a cause for concern, or a portent of deflation? Not necessarily. Recall that in early 1995, almost at precisely the same time that M2 growth approached zero, the stock market began a powerful rally that lasted through early 2000.

As I've discussed several times before, slow money growth that comes on the heels of unusually fast money growth typically reflects a decline in the demand for money, not a tightening of monetary policy. This decline in money demand goes hand in hand with a recovery in confidence and with a recovering economy. People tend to accumulate money balances when uncertainty is high, then spend the money as uncertainty is gradually replaced by confidence and eventually optimism. I think this is one of those times.

So rather than fear slow money growth, we should welcome it as a sign that people are again deciding to put their money to work, rather than hoarding it. By spending their M2 balances, the public is helping to get the economy back on its feet, and at the same time minimizing the risk of deflation.

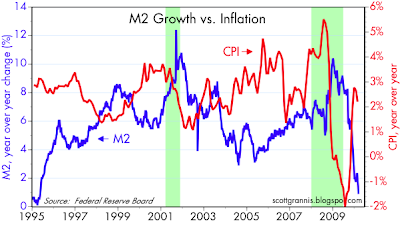

UPDATE: Mark Perry and I have been having a friendly back-and-forth over the issue of whether my call for rising inflation is consistent with the pronounced slowdown in M2 growth shown in the above chart. As partial support for my view, I submit the following chart, which simply compares M2 growth and growth in the consumer price index. I would note that the two lines display a substantial degree of negative correlation, which is to say that inflation has a tendency to rise as money growth declines, and vice versa. I think this is consistent with what I have described above, namely, that changes in M2 growth reflect changes in money demand, and this can have important implications for economic growth and inflation. You can see his latest commentary on M2 growth here.

Subscribe to:

Post Comments (Atom)

11 comments:

Actually I am not sure where you are getting your data...

Housing sales are crashing...again.

Best Buy reports sales up only 7% on a same store basis....vs. comparisons last year when Circuit City was open.

Sales tax receipts are still contracting on the margin and income tax receipt contracting even more.

WalMart is reporting constrained sales....sure, drug sales are fine, but most of those dollars comes from government.

And all of the above while government is stimulating the economy with a $2 trillion dollar deficit.

I am not sure how much longer our pension funds and retirement accounts can keep funding this spending orgy by Washington...but once the money runs out, we are going to have a bunch of retirees standing there naked.

alstry: I suggest you take your complaints to the stock market, and/or go short S&P 500 futures.

Scott,

Why would I do that....there are over 21,000,000 Americans working for Obama and state, county and city governments receiving defined benefit plans....now being paid from a $2 trillion dollar deficit.

Think about it, government workers are paying themselves by borrowing practically unlimited dollars simply to give themselves paychecks...wouldn't it be nice if private sector employees could do the same?

San Jose will be forced to contribute over 40% of Police and Fire salaries to pensions after July 1st....that is a lot of cash flowing into the market and bonds each and every month regardless of fundementals.

Why would anyone want to short a market when you have that much money flowing into pensions each and every paycheck and forced to purchase equities under the trust agreeements?

We could include most endowments, large family trusts, and many other retirement accounts that are directed to follow modern portfolio theory.

Could you imagine if people were forced to invest with Madoff just like many retirement accounts are forced to invest in the market regardless of fundementals???

Madoff's game could have lasted much longer than just 30 years.

Ironically, Madoff started just about the same time when America went from being a strong producer/creditor nation to a consumption/debtor nation.

You think it is a coincidence?

Scott,

Here is a link for San Jose's rising pension costs:

http://www.mercurynews.com/breaking-news/ci_14698574?nclick_check=1

Even you have to admit, paying over 40% of an employee's salary to a pension is a bit ridiculous for a public entity in a state that is essentially broke.

Could you imagine where where market would be if this kind of insane money that we are borrowing wasn't flowing into the market each week?

And we thought the margin was high prior to the crash of 1929???

Scott,

You are a very patient man.

SHUT UP SCOTT GRANNIS

Scott,

I'd appreciate hearing your updated thoughts on inflation possibilities given the slow M2 growth.

And alstry, let us know when you turn positive on things -- a contrarian signal for us believers.

Cabodog: Please read my update to this same post, which I had prepared prior to reading your most recent comment.

I jumped the gun; it was Mark Perry's post that prompted my question to you. Good to hear two sides of the story.

Scott,

This is your blog....keep up the great work;)

In parting, to advise anyone to short the market when pensions are being flooded with hundreds of billions of borrowed money is definitely living life on the edge.

Now the only question for us to determine is how high will our annual deficit grow....$5 trillion per year....$10 trilliion?

Just think, if we just handed every American $1,000,000 and taxed it 50%...we would pay off the national debt.

We just did that to a greater degree to bankers....and doing it to a lesser degree to government workers and welfare recipients....now let's see what happens when the rest of the population figures out what occured......unless of course something happens to distract us.

What inflation?

Maybe we will get lucky. Economic growth but little inflation, due to huge overhangs in all real estate markets and worker productivity gains.

But inflation? in what? Wages? Real Estate? Manufactured goods (outside military hardware)?

Very tough case to make that we will see serious inflation.

Post a Comment