Thursday, March 25, 2010

Long-term trend of commodity prices (2)

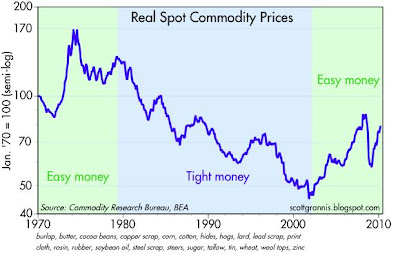

To further the discussion on commodity prices, this chart is the inflation-adjusted version of the chart I posted yesterday. Note that the monetary policy regime (which typically alternates between easy and tight) has a significant impact on the behavior of real commodity prices. Easy money not only facilitates commodity speculation using borrowed money, but it also shifts people's preference in favor of tangible assets versus financial assets. In an easy-money world, physical things (real estate, commodities, buildings, structures, offices) become more attractive than financial assets. We tend to build more things when money is easy, and those things require commodities. They become more attractive because their prices tend to rise—tangible assets hold their value (or maybe even make money) when inflation rises, whereas financial assets tend to suffer during inflation because inflation pushes interest rates up, and that depresses the value of financial assets.

Gold is the tangible asset par excellence, because it has proven to hold its value relative to other things over very long periods. But it too can exhibit exaggerated swings as monetary policy alternatives between easy and tight. In addition, in my experience, gold tends to lead other commodities.

So when money is easy, as it is has been and is now, people naturally tend to prefer to buy things instead of financial assets. Stocks have gone up over the past year (about 75% in nominal terms, but only 50% in terms of gold) but they are still very depressed relative to gold from an historical perspective, as the next two charts show. When monetary policy shifts away from its current extremely accommodative posture, as it must at some point, expect gold to decline and stocks to continue to rise.

Subscribe to:

Post Comments (Atom)

4 comments:

How is global money supply determined? Do we even have a good way to measure it?

Commodities are a global market, so do we not need to understand the global money supply, before we assert that a loose money supply has caused commodities to surge?

I suspect we will see a 20-year bear market in gold. Similar to the secular decline following 1986.

I contend investing in gold is for the tin-foil hat crowd, though if you time it correctly, you will make money.

Gold holds its value? Compared to what--a suit of clothes (the usual story)? How about compared to prime Manhattan real estate?

Did gold hold its value from 1986 through 2006? That was 20 years of not holding its value, but declining in value. P.U.

Gold belongs on your wife's jewelery box, not in your investment portfolio.

Buy operating businesses. Leave gold to the medievel monks.

One of the market axioms I have heard expressed is 'sell stocks on the third rate hike'. There are always exceptions I suppose and in the case of this cycle rates are at historic lows. Maybe it depends on the level of the hikes. Not asking for a comment here. Your comment that initial rate hikes should not impact equity prices significantly started me thinking. I agree. The initial hike may actually be bullish since it would signal a stronger economy and the resumption of serious bank lending spiking the money supply. It still looks to me to be many months away. Maybe it should not be, but I believe it is.

Benjamin,

If Scott doesn't mind I would like to take a stab at your global money supply question.

I do not doubt that the issue of the global money supply is an important one, it is just that I have never seen it mentioned in the financial press. I would think it would be quite an exercise compiling it. I did however find a little data on it. You can GOOGLE 'global money supply' and find several sites that discuss it in various contexts.

Hope this helps.

I tried the google search too- but found mostly the tin-foil hat, gold-nut crowd.

There are no reliable figures, or even roughly right numbers out there for global money supply.

Therefore, we can not assemble track records of money supply vs. commodities prices. So, if you are a monetarist, you are flying blind.

I suspect the commodities boom of 2005-2008 was not a monetary phenomenom, but rather reflected real demand, the emergence of commodity ETF funds, speculation, and even gaming of the NYMEX.

But since there are no numbers out there, I can't prove that either.

Fascinating topic.

Post a Comment