Mainland China reported nine new coronavirus cases outside the epicenter of Hubei on Monday, the lowest since the national health authority started publishing nationwide daily figures on Jan. 20.Nevertheless, it appears to be spreading rapidly in other parts of the globe. One expert predicts that the virus "will ultimately not be containable." (HT: reader "Johnny Bee Dawg")

Several provinces have lowered their coronavirus emergency response measures, allowing more flexibility on transportation and helping firms resume production.

About 180 million workers have left their hometowns to return to work since Feb 10, when China ended the prolonged Lunar New Year holiday due to the virus outbreak, according to Reuters calculations based on transportation ministry data.

At the current daily travel flow rate of more than 14 million people, about 192 million people are likely to return to cities where they work during the last two weeks in February, beating a government projection of 120 million.

The following charts are my contribution to understanding the degree of panic that is priced into the market as of this morning. By some measures we have reached very high levels of panic, but not by others. Thus, I think the situation will remain in flux for awhile until we can better assess the degree to which the virus has spread outside of China and how lethal and it ends up being.

There is likely to be more downside risk before this is over. Whether that means you should sell now, consider what might happen if someone were to announce the availability of an anti-coronavirus vaccine and/or a way to reduce its severity. A reversal of today's panic pricing levels would almost certainly result in a huge market rally. Just today we learned that "Drugmaker Moderna Inc. has shipped the first batch of its rapidly developed coronavirus vaccine to U.S. government researchers." It will be months, however, before we learn if the vaccine is indeed effective and safe to use.

Chart #1

Chart #1 compares gold prices to TIPS prices (using the inverse of their real yield as a proxy for their price). Both assets are what might be considered to be true "safe havens." Gold is a refuge against all sorts of evils, while TIPS are free of default risk and government-guaranteed to pay a given real rate of interest. Both prices have surged of late, but they are still short of the levels they reached some 8 years ago, when global markets were still reeling from the shock of the Great Recession and its global financial crisis.

Chart #2

Chart #2 shows how real yields on 5-yr TIPS tend to correspond to prevailing levels of real GDP growth. With the real yield currently trading at about -0.4%, the chart suggests that the market is priced to a substantial slowdown in US economic growth to something a bit below 2%. That's meaningful, but it's not yet disastrous. A virus is not likely to kill the US economy, but it could definitely slow down overall growth.

Chart #3

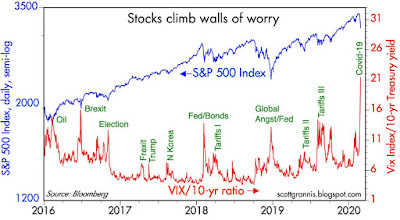

Chart #3 shows how panic attacks (spikes in the ratio of the Vix index to the level of 10-yr Treasury yields) almost always result in sharply lower equity prices. Today the ratio is much higher than it has been during other panic attacks which resulted in much bigger equity market sell-offs. The next three charts show the components of the ratio to better understand why it is so high today.

Chart #4

Chart #4 shows the history of 10-yr Treasury yields. Today they hit an all-time low of 1.3%. This is a big reason why the Vix/10-yr ratio is so high today.

Chart #5

Chart #5 zooms in on the data in Chart #4. Here it becomes clear that today's 10-yr yield marks the lowest closing yield in history. The previous record low was set in mid-2016, when markets were panicked over collapsing oil prices and the threatened breakup of the European Union (i.e., Brexit).

Chart #6

Chart #6 shows the history of the Vix index. Here we see that by this measure, today's level of "panic" is far below that of past panics. Markets today are pessimistic about economic growth, but markets are not expecting recession nor are participants willing to pay exorbitant prices to avoid downside risk.

Chart #7

Chart #7 shows Credit Default Swap spreads, which in turn are a highly liquid measure of the market's confidence in the outlook for corporate profits. Credit markets today are worried, yes, but hardly in a state of panic.

Chart #8

Chart #8 compares the inverse of the dollar's value against other major currencies to the inflation-adjusted price of gold. In general, the dollar's value tends to strengthen as gold prices weaken, and vice versa. But it's notable that in the past two years, just the opposite has been the case. Gold prices have surged and the dollar has strengthened. I take this to mean that the current rise in the price of gold is driven almost entirely be fear, and not at all by concerns that the Fed is making a policy mistake which will erode the dollar's intrinsic value. Gold is not rising because of inflation fears. Inflation expectations have been relatively steady at modest levels (1.5-2.0%).

Chart #9

Chart #9 compares the inverse of the dollar's value to an inflation-adjusted index of non-energy commodity prices. As with Chart #8, we see that a stronger dollar tends to correlate to weaker commodity prices and vice-versa. Commodity prices today are behaving much as we would expect, given the relative strength of the dollar. Gold is the one significant outlier in the commodity universe, which again suggests that it is being driven much more by fear and the desire for safety than by monetary fundmentals.

Chart #10

Chart #10 shows the level of 2-yr swap spreads in the US and the Eurozone. Both are trading well within "normal" ranges, which suggests that liquidity is abundant in the major markets that count the most. Monetary policy is not threatening, and systemic risks are low. This further suggests that the panic over Covid-19 is just that—the virus has yet to make a material impact on global financial and economic fundamentals.

In sum, while there are obvious signs of panic out there, we are not yet in the midst of a "run for the exits" panic. Things could get worse as the virus spreads, but the outlook could quickly change for the better if science finds a vaccine or a mitigating treatment.

What to do in the meantime is a tough call which depends on your tolerance for pain.

UPDATE as of market close Feb 25. The Vix/10-yr ratio has moved higher, and the equity sell-off has intensified. It's still a relatively modest sell-off however. The S&P 500 is only down a little more than 7.5% from its all-time high.

Chart #11

UPDATE: as of market close Feb 27. We are now entering true panic territory. The Vix/10-yr ratio, now at 31 (see Chart #12), is way above its last all-time high, which was 22.4 in late 2011, at the height of the Brexit/PIIGS default fears. As I mention above, the main reason for this very elevated level is the extremely depressed yield on 10-yr bonds, which today fell to a new all-time low of 1.26%. As Chart #13 shows, the Vix index is hardly in record territory. Nevertheless, it's fair to say that never before has the world been so pessimistic about growth and so desirous of safe assets (as witnessed by the 10-yr yield), but not yet in true panic mode (which would be reflected in a much higher Vix index). Things are ugly, but nobody is jumping out of windows yet. The problem is that we're dealing with an unknown variable (Covid-19) that could have a significantly negative impact on global GDP.

On the positive side, progress on a vaccine is underway. And should the virus fail to achieve pandemic status, the upside would likely be just as dramatic as the current sell-off.

Chart #12

Chart #13

UPDATE: As of Friday, Feb 28, 10:30am EST. The market is now in full panic mode, and things are getting very ugly. 10-yr Treasury yields are down to a new all-time low, 1.17%. The fear and panic that is surging around the world have the effect of greatly increasing what was already a strong demand for money and save assets. The entire Treasury curve is now inverted relative to the Fed's target (currently 1.75%), so the Fed will need to cut rates at least twice to offset the strong demand for money. Every day they don't makes things worse. And with the panic eroding confidence and weakening global economies, politics has now entered the fray, with the left accusing Trump of making things worse. Schumer on Tuesday said "the administration’s handling of the virus has been marked by 'towering and dangerous incompetence.'" This arguably improves the chances that Sanders becomes our next president and unleashes a wave of growth-damaging tax hikes and government power grabs.

It's the stuff of nightmares, and the market reflects this. Consequently, the seeds for a recovery are being sown. All it takes to spark a rebound is news that suggests things are not as bad as everyone fears. As Chart #15 shows, the Vix "fear" index is now at levels that have been the high-water mark for previous panics, with the sole exception being the full-blown global financial panic of late 2008.

Chart #14

Chart #15

UPDATE: as of 1:45 EST. The panic is slowly receding.

Chart #16

I've shortened the time frame for Chart #16. Now it covers only three years. Last Friday (Chart #14) the Vix/10-yr ratio soared mid-day to over 40, then retreated. It's now down to 31.

Chart #17

Chart #17 shows the Vix index by itself. Each bar represents one month of data, with the low, high, and closing levels. Note how the current Vix reading, about 30, is far below last Friday's high of almost 50. That day may well mark the max height of the current wall of worry.

27 comments:

Scott,

Brian Wesbury just issued a good review of the coronavirus situation. You can find it at https://www.ftportfolios.com/Commentary/EconomicResearch/2020/2/25/time-to-fear-the-coronavirus

Small text error Scott: "It will be months, however, before we learn if the virus is indeed effective and safe to use." Change "virus" to "vaccine".

But this is a best case scenario. How often does the first vaccine to test really work? A better bet is >12-18 months.

In any case, your "months" is vastly better than the misinformation that our president is spreading.

Charlie: thanks for the edit, now corrected.

I suggest this is largely a "Bernie" virus as the C-virus could be a black swan for Trump as the '08 crisis was for McCain/GOP. Given that it will be awhile before this is fully contained and that it will likely get worse it could play into the dems hands in a way the impeachment nonsense did not.

God forbid a Sanders POTUS.

Well, I did learn that the acting Homeland Security Secretary told congress "months." I think it's safe to assume that he said so as a sort of compromise between what the president said and reality. Still, it was very brave of him to even marginally correct the president.

There'll be a lot of never-Trump scientists saying a lot of stuff. Just keep tuned to Fox so you all know what's really going on...

Scott,

Possibly one other unintended typo: Discussion of chart #5, Is it possible you are making reference to 2016, not 2006, as the prior record low?

aldom: thanks for the edit, now corrected to read 2016.

Another terrific post by Scott Grannis.

The mainstream media has a proclivity to sensationalize everything, and they have done so with the coronavirus.

In addition, public Health agencies have the same agenda as national security agencies---that is, dramatize and fear-monger everything on the way to chronically larger budgets.

Actually, death rates outside Hubei Province are rather low and confined mostly to old people and others with health conditions. Death rates from coronavirus may actually be lower than those from common flu.

I am not making light of anyone's death, of course.

In a previous era, we might have said something along the lines that,"There is a very bad cold going around and some old folks died."

Novel threats like coronavirus are difficult to talk about. We know that, like Benjamin describes, the media is in the business of sensationalizing. Officials and activists of all stripes also sensationalize – for political posturing, tribalism or even cover your ass groundwork.

We also know historically that the world and the markets have quickly recovered from these scares. We know that the virus is likely deadly usually only for the very old, young, and those in places with poor health systems. We know we should go about our day expecting to survive this.

At the same time, to NOT overreact seems to invite bad karma or allow for lackadaisical official responses. God forbid someone we know or love is infected. One day, there will be the existential virus risk. This just doesn’t seem to be it.

I hail from Singapore which had one of the highest infection rates outside of China for some time. I just told my mother over the dinner table that if I were to be infected with COVID-19, this is the best place to be in. What I fear though is not the COVID-19 but the local dengue infection cluster, which is more deadly as one might bleed out of his orifices till death.

I am heartened to share that we have the highest recovery rates in the world, outside of China. Of the 93 confirmed infections, 62 have recovered, 7 are in critical condition in the intensive care unit.

You may refer to this site for the pandemic infographics https://gisanddata.maps.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6

As a trader, I am amazed by how resilient the US market is to the coronavirus outbreak. Either the US is really insulated per Brian Wesbury's review, or it may simply be that the turd hasn't hit the fan. For us living here, the fear is real and not some sensation as some of you write. From Twitter feeds, it feels like the US treats this someone else's problem.

There was mass panic when our government raised the alert level to orange, signifying a community spread but the disease is contained. However, panic took over and logic went out the window. Everybody started making runs on the supermarket.

We are saved because of the resources put in to perform contact tracing for each and every case, so the authorities know where to nip the bud. The largest cluster happens to be from a church, and for some reason, churchgoers like to go places and carry the virus to another church. Which was how South Korea became the largest cluster outside of China.

It was from here that the virus was carried to the UK and onto Europe. Doesn't take long to spread some damage. Word from China is that the incubation period could be as long as 27 days. It's not pretty.

Italy is still looking for Patient Zero and their towns are on lockdown. They were confident that they had nothing until the situation exploded in their faces.

Then they share more than 700km of borders with Switzerland which now has their one case.

The outbreak in Iran is a concern since they are trying to figure out how the disease got there. The deputy health minister was unaware that he was infected and was coughing in front of a TV presenter. Goodness. Since Arabs like to hug and kiss when they greet, they'll really spread the virus fast.

I hope the US doesn't get affected because you can't shutdown a province like China does.

Posted this elsewhere by accident. This is a duplicate. Sorry...

2900-2950 area on S&P has "support" because the the October unfilled gap, and the semi-log moving averages.

Worth a shot at selling some TLT at that point, and leaning into broad stock indexes.

Markets bottom once we fully understand "the problem". Nothing has to be fixed for markets to bottom. On the contrary....Once the problem is understood, markets know its just a matter of time until the problem gets solved in a free society. Markets also bottom at the culmination of fear spikes, like Scott ably shows in these charts. So we are nearing a good inflection opportunity.

If this was just virus, Id be in already. But I think the market has been too complacent about the DEM candidates.

Bernie is the worst for America, of course.

The VIX/10 year yield is showing extra fear because of Bernie.

Imagine a populace who rejects poor peoples' record prosperity....for a Communist. That is shocking. The REAL fear is that the election could be compromised by crooked dealings, and temporary corona fears. Trump could win more easily without the virus complication.

If Bernie wins Super Tuesday, markets should react badly (a puke out) and take it seriously. Id buy on that "crash" and spike in fear for this cycle. If markets DONT take Bernie seriously, then I think it may be time to raise more cash. We will just have to see.

FYI....the virus sure did help China to end their protests, and to hurt Trump's chances of election. Every event has winners and losers. Communist dictators have never really minded mass deaths.

There may be a price to pay for embracing a president who is a lousy manager, a pathological liar, appallingly ignorant about a wide range of topics, and unable to process facts that do not agree with his "gut" or whatever he happened to see on Fox news last night, amongst other personal failures.

Let's get ready, Bay-Beee!

Market enters buyable area for this leg. Implied open was down 600 more this am (Friday). It can go lower. Come to papa.

Its finally worth it to begin to step in some today. Layer it.

Bond prices have risen almost to targets. The entire decline has been very orderly.

Weekend could bring horrible news...or we could find that more of China is back to work, and cases keep falling.

85% of Starbucks stores in China are open, and busy. (That news source is from SBUX, not Xi. Maybe more believable.)

TV tells us a Fed cut would be irrelevant to markets. We shall see about that.

Israelis may be moving quicker than US on a vaccine to test.

The Iran cases are located within miles of a nuclear plant staffed with Wuhan Chinese.

Media getting kinda silly. Almost as if they are stoking panic.

Bloomberg News has a bit of a slant, these days. Shocking!

My favorite is Yahoo Finance with their huge red banners whenever you just check a quote over the past couple of days.

"MARKET ROUT!!!" And then some rabid headline of doom.

That wasnt the quote I was looking for, but thanks Yahoo.

The returns on the S&P have been extraordinary, weeks after CNBC runs "MARKET TURMOIL" specials at nite like they've done this week. Those shows have historically been great entry points, when look a few weeks out.

Charlie: Barack is gone. You no longer have to fear Him. We now have a guy who is incredibly competent and hard-working.

In other news:

Israeli scientists: 'In a few weeks, we will have coronavirus vaccine'

Quote from Science & Tech Minister of Israel.

https://www.jpost.com/HEALTH-SCIENCE/Israeli-scientists-In-three-weeks-we-will-have-coronavirus-vaccine-619101

Wait, Donald Trump is "incredibly competent"? Good Lord, that is not a moniker I would ever have used to describe him. Truth be told, it's a little scary that he is POTUS during this panic with his constant tweets effectively belittling the world reaction.

Johnny Bee Dawg: Is that quote from a politician or a real scientist? Hey, one thing we might agree on is that scientists are mostly liberals. So choose your source of information accordingly, I guess.

If there is a vaccine in a few weeks, then I'm an idiot. If not, then some of you should seriously question the way you obtain and process information about science. And by vaccine I mean "needle in your arm" real, not some fantasy broadcast on the TV.

We have a situation where politicians (or ex-lobbyists, same thing) have been put in positions that scientists should occupy. See HHS secretary. Other previously non-political positions are either occupied by political loyalists or empty. We don't know for sure yet but I'll bet this lead directly to the Travis AFB fiasco that's currently unfolding.

Side note: I used to get $14 standby flights on cargo planes between Hickam AFB and Travis AFB. One of the cool benefits of service in Hawaii in the '80s.

Yes. Trump is the most effective, competent, hard working and productive President of my lifetime.

Methodically accomplishing what he promised he’d attempt when he campaigned.

And he’s very smart, and keeps the public informed with Tweets.

And he has the best political instincts of anybody in DC.

Thank God he’s in charge during a crisis.

To be clear, I don't mean to give investment advice. I don't have expertise to make predictions about the virus or the stock market. However, statements claiming vaccines "soon" or "in weeks" are pure government propaganda hogwash. Please take that into consideration.

The mere announcement of an effective vaccine, even if not widely available for 2-3 months, would probably be viewed by markets with a gigantic sigh of relief. The virus would undoubtedly continue to spread, but we would know that the contagion could be eventually controlled and the damage to the economy and confidence would be limited.

Another angle on the vaccine is that odds are decent that the worst of infection counts will peak and diminish once warmer weather gets here. Widespread availability of the vaccine may be for following seasons. So with hope, a vaccine will be received with great relief by the markets soon, and ready to protect next season.

I have a real hard time believing that this reaction in the markets is only related to coronavirus. The ten year trading at 1.12% is NOT just Cvirus related but genuine recession concern. Time will tell.

I wonder how Fed Treasury purchases and repo actions affected markets this week.

All that markets need to bottom is understanding of “the problem”. Nothing has to be fixed to bottom.

Once we understand a problem, markets know it will get fixed.

Market doesn’t care if a vaccine is ready to inject, or mass produce.

That’s months away. Could be Israel, could be Moderna. But that misses the point.

If scientists actually make a vaccine, that means they understand the virus.

That means they understand “the problem”, and markets know the problem will get fixed.

This was the 3rd worst Jan-Feb in US history. Worst ever was 2009, Barack’s arrival.

2nd worst was 1933 and good ol FDR.

3rd was 2020, fear of Bernie.

Vaccine or not....today, down 1000, was a pretty good entry point.

Will add more in any early week puke-out.

The S&P Low Vol - Long Treasury 50/50 combo has been fantastic for months.

Combo is up 7% year to date, as of today’s close, but TLT is nearing its target.

The history of Fed Funds adjustments since 1953 shows that the Fed follows T-Bill rates. T-Bill rates are market rates. Markets set rates and the Fed follows. The only instance when the Fed took preemptive action was the early 1980s when Volcker forced back-to-back recessions to quash inflation. With T-Bill rates at 1.25% the Fed has room for a 0.25% Fed Funds cut immediately. Another 0.25% cut requires T-Bills to fall to 1.00%

https://youtu.be/kIL5m5XznNY

Here is a great 5 minute video by a doctor, explaining everything we know about coronavirus, and what to do about it.

Zero hype or politicizing. Zero fear-mongering.

Its the flu. People get it. Dont spread it. How to avoid it.

New England Journal of Medicine: Coronavirus Could Be No Worse than Flu

JOEL B. POLLAK

28 Feb 2020 https://www.breitbart.com/health/2020/02/28/new-england-journal-of-medicine-coronavirus-could-be-no-worse-than-flu/

The death rate for the coronavirus with reported data is 1.4%, but with virtually no reports of mild illness, which all know to be extensive, The actual rate could be as low as 0.1% which is typical for flu. The best measure is the experience under the US healthcare system. Under the new “Right to Try” law, new anti-viral drugs have had a dramatic effect when administered to the most ill. Those requiring treatment have been few, but rapid recovery has been reported in each instance.

I highly recommend a recent article by Clarice Feldman in American Thinker:

https://www.americanthinker.com/articles/2020/03/coronavirus_when_all_else_fails_try_reason.html

It's a good wrap-up of what's known to date, and it provides some good reasons for why this virus has been over-hyped and is likely to prove much less dangerous than the press would have you believe.

Post a Comment