Perhaps the Fed should have done more?

Or perhaps it's because QE was never designed to be stimulative in the first place.

As I've argued since October 2008, the main objective of QE was to satisfy the world's sudden and huge demand for money in the wake of the disasters that unfolded in 2008. This, after all, is one of the key functions of a central bank: to supply liquidity in times of crisis. If the Fed (in concert with other central banks) had not acted as it did, a shortage of money could have been plunged the world into a deflationary depression lasting for years. No one could have foreseen, in 2008, that the Fed would eventually have to supply over $2 trillion in liquidity to the banking system (in the form of bank reserves) in order to accommodate the world's demand for money, but that's what has happened.

By late 2008, the specter of years of deflation was very real. The chart above shows nominal and real yields on 5-yr TIPS, and the spread between them, which is the market's expected annual inflation rate over the next 5 years. This measure of inflation expectations plunged from 2.5% in July 2008 to a low of almost -0.5% in November 2008. The bond market, in other words, was braced for years of deflation.

Plunging home values, collapsing equity markets, soaring default rates, massive margin calls, and the near-collapse of the global financial system all combined to sow widespread fear and panic. As I estimated back in November 2008, the bond market was priced to the expectation that 24% of all corporate bonds would be in default within 5 years, which would have implied an economy much weaker than the Depression, and the equity market was priced to the expectation that corporate profits would decline by two-thirds.

As the first of the above charts show, the Vix index (a good proxy for the degree of fear and uncertainty that pervades the equity market) rose from 20 in late August 2008 to 90 by late October. As the second chart shows, credit spreads soared to unprecedented levels. Fear and uncertainty have remained relatively high since the Great Recession, and that has contributed to keeping the demand for money strong.

The surge in fear, uncertainty, and doubt that accompanied the near-collapse of global financial markets triggered several predictable responses: a desire to de-risk, a desire to boost cash holdings, a desire to deleverage, and a desire to seek out safe havens. The common denominator was a huge increase in the demand for money (cash and cash equivalents) and safe assets. Until the Fed launched QE1, however, cash and cash equivalents—the object of everyone's sudden affection—were becoming scarce. Strong demand for T-bills began early in 2008. From late 2007 through mid-2008, the Fed sold almost its entire holdings of T-bills—about one-third of the Monetary Base—in an attempt to satisfy the world's demand for safe assets. But it wasn't enough.

As the above chart shows, gold fell 25% from March through October 2008, a clear sign that money was in short supply and deflationary pressures were building. The CRB Spot Commodity Index plunged 37% from July through early December 2008. Shortly after the Fed began QE1 in October 2008, gold resumed its rise, and commodities resumed their rise several months later. QE1 was exactly what was needed to avoid deflation.

The monthly net flows of equity and bond mutual funds are evidence of a four-year virtual stampede out of equities in favor of the relative safety of bonds. The investing public shunned equities throughout 2009, 2010, 2011, and 2012 despite their spectacular recovery. Risk aversion has been the dominant theme in the markets for the past four years.

Households' efforts to deleverage began to bear fruit beginning in 2010, as the chart above shows. Household financial burdens (monthly payments as a percent of disposable income) fell 13% from the end of 2009 through March of this year, and they are now at record lows.

This is where bank reserves come into the picture. Thanks to Quantitative Easing, the Fed pays interest on reserves, currently 0.25%. Bank reserves essentially are just as bullet-proof as 3-mo. T-bills, the former risk-free standard, but they pay substantially more interest. Banks thus find it attractive to invest a portion of their deposit inflow in bank reserves. How does that work? Banks simply use some of their deposit inflows to purchase the Treasuries and MBS that the Fed buys every month as part of its QE program. Then the banks turn around and sell the bonds to the Fed in exchange for having bank reserves credited to their account at the Fed, where they earn 0.25% with essentially zero risk. Bank reserves are the new T-bills, and that's why banks have been content to accumulate $1.9 trillion of "excess" bank reserves (reserves that are sitting idle at the Fed, and not being used to support increased lending) since late 2008.

Banks are lending, but they are still somewhat cautious; required reserves (reserves required to support increased lending) are up only $75 billion since QE1 began. At the same time, the private sector has been trying hard to deleverage, so the net demand for loans has not been very strong. As the chart above shows, C&I Loans (a proxy for bank lending to small and medium-sized businesses) have only recently recovered to the levels that preceded the Great Recession.

Despite the addition of massive amounts of bank reserves, which banks could have used to support a virtually unlimited amount of new loans and money creation, the M2 measure of the money supply has not shown any unusual or excessive growth. As the above chart shows, M2 has been increasing at about a 6% annual rate since 1995, during which time the annualized rate of inflation according to the Fed's preferred PCE Core Deflator, has been a modest 1.8%; for the past 12 months this measure of inflation has risen by only 1.1%.

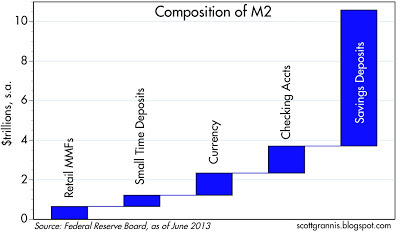

M2 has been increasing a lot faster than nominal GDP, however, which means that, as the chart above shows, the demand for M2 money has increased by 25% since the end of 2007. This is arguably the most dramatic demonstration of just how strong the demand for money has been in the wake of the Great Recession. On average, the world now holds 25% more money (in the form of retail money market funds, small time deposits, currency, checking accounts, and savings deposits—see second chart above) relative to total spending than it did just six years ago. Bank savings deposits account for the vast majority of the increase in money balances.

In a sense, QE helped provide banks with the wherewithal to support a huge increase in the public's desire to hold more money. All the extra "money" that the Fed has created via its QE program has simply been absorbed by the a world that was terribly anxious to acquire more money—not to spend it. That's why QE has not been stimulative and has not resulted in increased inflation: the Fed has supplied exactly as much money as was required to meet the world's demand for money. As Milton Friedman taught us, inflation is a monetary phenomenon that only happens when the supply of money exceeds the demand for money.

I see preliminary indications in the charts above that the world's huge demand for money is beginning to subside. The big decline in gold prices over the past nine months is a reflection of a big decline in the world's demand for safe assets—gold being the classic refuge from political, economic, and financial uncertainty. Real yields on 5-yr TIPS (which are a great "safe" asset since they are immune to default risk and inflation risk) have moved inversely with gold prices, which means that the demand for TIPS has closely tracked the demand for gold. TIPS prices have plunged of late because the world is less worried about inflation (5-yr breakeven spreads are down to 1.93% from a recent high of 2.6%) and less worried about the chances of recession (or, if you will, more confident that the economy can continue to grow at about a 2% rate). As the second chart above shows, real yields tend to track the real growth rate of the economy. Inflation concerns are subsiding, and demand for safe assets is subsiding, and that adds up a world that has become less uncertain. Reduced uncertainty can also be found in the Vix Index, which is once again approaching levels that are historically "normal." With reduced uncertainty should come a reduced desire to accumulate money, and higher prices for risk assets.

The huge net outflow from bond mutual funds last month is yet another sign that the public's demand for safety is beginning to decline—that markets are becoming less fearful and somewhat more confident about he future.

If recent trends continue, then the Fed's proposed "tapering" and eventual unwinding of QE would be fully justified, and in fact required to avoid a rekindling of inflation. If the world's confidence builds, even marginally, and money demand begins to decline, we could see the beginnings of stronger nominal GDP growth as the world attempts to reduce its idle money balances.

Since QE was never stimulative, the end of QE should not be depressing. The economy is very likely capable of growing without any further "stimulus" from the Fed. Higher interest rates are the best sign that the outlook for the economy is improving, however marginally. There's no reason to fear higher rates, because they will only happen if the economy improves.

19 comments:

A very brilliant thesis, Mr Grannis...

It also has been my conjecture, that the Central Bank has been, in the last two years, been providing financial relief to varies industries in order to avoid a systemic collapse..

The primary beneficiaries was of course the overreaching banking industry, Wall Street and the mortgage sector. I should not forget the little three, as well..

The FDIC, should be encourage to invoke rule 2020, removing deposit insurance from any bank, which continues to invest in any tradable securities, whether using internal depositories or external funding...

I would also add, that if indeed we are correct, then the Federal Reserve mislead most of the nation and in particularly the taxpayer...

In the name of the People's Economy, the Central Bank, cleverly, bailed out family and friends...

What a country !!

Thank you Scott. I try to read all your postings but this one in particular was very informative. Feels like a graduate econ seminar. Please, a little clarification: I thought last month's run from bonds was due to investors thinking they were overvalued. Do you think it's because they'd rather invest in stocks?

This is not a post, it is a minor treatise. Great work.

Well, has or will QE be stimulative? Maybe it is semantics.

QE helped to avoid a sustained recession/depression, That is stimulative.

Right now, I think QE is stimulative of this reason: Depositors, I suspect, are beginning to spend their money.

Wr are seeing the mantra that "retail sales numbers are better than the jobs numbers, so the job numbers may be goofy..."

Maybe so--but I think depositors are finally spending their money. Taking the wife out for birthdays dinner, maybe buying a new car, a new outfit etc etc.

Remember, when the Fed does QE, the seller changed a claim on future production, for the right to make a claim immediately on production. That, when you hold a bond, you have to wait until it matures before you spend the money. Cash you spend when you want.

So we have a lot of cash floating around. That's good, I say.

As for inflation, I think the economy is much, much less inflation prone than in the 1970s.

I say bring us Fat City for a long time, then let's worry about inflation. Better seven fat years before we think lean again.

I like prosperity.

of course, when it comes to markets, perception is reality so it will be interesting to see the affect of "easing the ease". I am not convinced that bonds are finished. if anything, inflation perception seems to have eased. to me the real value in the bond market today is in high yield munis.

At this point, I am experiencing little "uncertainty" as an investor -- US growth is "stuck" at less than 2% -- unemployment is "stuck" at around 7+% -- inflation is "stuck" at below 2% -- moreover, real working wages are in long-term decline -- real home values are in long-term decline -- and the employment to population ratio is in long-term decline -- wishful thinking is not an investment methodology, and the economic problems facing investors today are unlikely to change in the coming decades from what we see today -- the truth is that the macroeconomic information available to investors today portends little to be hopeful about -- just look at all of the charts over the several years on Scott's blog for a taste of what I am talking about.

The good news is that the economy is likely going to be "stuck" in its current state of decline for at least the next 30 years -- thus, a long-term investment horizon is called for -- my advice (and mantra) continues to be that young investors do whatever they must to acquire world-class skills that earn premium wages that convert into acquisitions of dividend and rent-earning equities over a lifetime -- the investment window we are in is a "buy" opportunity for those who maintain a long-term 30-year plus investment perspective -- buying cheap dividend and rent-earning equities over the coming decades is imperative if one hopes to become financially independent -- people who no longer enjoy a 30-year plus investment horizon have made their beds and will live with whatever they get in the coming decades, which is likely to be declining valuations -- investors who can buy the equities being sold by old people will win big-time later during the 21st century -- keep your focus on the world economic forecasts that reach out at least 30 years or more -- short-term investors have little hope in the meantime...

Great post, Scott.

According to this "think tank" the FBS could make a great deal of money..

http://blogs.marketwatch.com/capitolreport/2013/07/10/uncle-sam-could-net-458-billion-via-bond-buyback-economist-says/

I wonder now how much money they will generate by selling the MBSs? Or if they have appreciated, will the banks demand there return for their unusable funds held by the Fed?

Chris: re the reason for last month's bond selloff. There are several. One, as I say in this post, is that the demand for the relative safety of bonds has declined. Two, the market has become somewhat more optimistic/less pessimistic about the prospects for growth, and thus the market sees that tapering makes sense and eventually the Fed will raise rates. Three, bonds were quite expensive and that was only justified as long as one could remain very bearish about the economy; the market has lost some of that conviction. I don't see tremendous enthusiasm for stocks yet.

I disagree. Reserves are not stuck. Money supply goes up or down with new loans and paying off old loans. The reserves stay the same unless the Fed increases or decreases them. If reserves didn’t increase money supply then why is there a thing called the M1 multiplier? Look at it on FRED. It has been going down and now is a little negative. This is due to the Fed buying bonds from banks which doesn’t increase money supply directly. Only buying bonds from non-banks increases money supply directly.

To the degree that bank sellers of bonds repurchase bonds, the newly created reserves puts money into the central government which spends it into the economy which creates deposits. This is indirect but accounts for M1 multiplier being about 1.0. The banks selling bonds doesn’t increase the money supply but the money that goes to the Federal government ends up as deposits. Such deposits end up as reserves so reserves don’t change.

Reserves have velocity just like M2 has velocity.

Demand is increased by creating new money or by increased money velocity. While money velocity is lower newly created money is higher and is putting support under the economy.

Fantastic analysis Scott. Thank you!

Yes, brilliantly wrong - since 2008.

"The main objective of QE was to satisfy the world's sudden and huge demand for money"

Interest rates are the price of money. High demand = high interest rates.

I assume you meant $2 trillion, not billion.

$2 trillion didn't move the needle since deleveraging of shadow banking sector was much larger than that. Total credit market debt outstanding by ABS issuers along fell from $4.5 trn in Q3 2009 to $1.7 trn in Q1 2013. That's a 2.8 trn reduction for those who are paying attention.

A car dealer doesn't care if the dollars come from the buyers' cash, inhouse financing, securitized deep-subprime loans or whatever. Money is fungible. Looking at excess bank reserves only is myopic and misses the big picture.

Benjamin won the lottery. Ben Bernanke, the most powerful man in the world, is playing the market again. This time to the upside.

I think Carmen Reinhart was right. She said the only thing they have left to deal with excessive debt is inflation.

If is obvious there is no leadership to restructure the economy. That would create more inequality and we can’t have that. So inflation it is.

@Joseph Constable, the problem with restructuring the US and European economies is lack of time and patience by society -- likewise, default is suicide for nationstates -- that leaves (drum roll please) inflation as the only viable path forward -- for the record, the Fed is already committed to a 2% annual inflation target, which equates to a 100% erosion in the dollar over a 50 year period (which is not that long) -- said another way, inflation has already been "baked" into the economy -- fiat currencies lose value over time -- that's reality -- always has been -- always will be...

A general question to the board.

If you were a banker and Ben called and said he wanted all your treasury bonds and notes as well as your MBS and they would replace them with non-usable cash and would pay a paltry 25 bases points, would it be in the bank's best interest to said yes?

Is the bank going to lose a large revenue stream?

Will the bank earn more income or less?

I am still waiting to hear how the Fed pays for all of it's meddling campaigns or if in fact they turn on the giant printing press in the sky...

Then of course, the economy is like a tall ship, with the Central bank as it's skipper charting it's way through trouble waters..

Yes, a few study courses, a theory or two, a degree and good God now man has the ability to master a fully integrated economy...

Hear is an article about Japan's experience with Nippon QE...

I hope I hear from Ben Jamin, our Japanese resident scholar regarding it's use in the land of the rising sun...

A hat tip, for Mr Grannis' forward vision and his clear declaration of it's cause and effects.

http://business.time.com/2010/11/04/does-qe-work-ask-japan/

How QE really works or does not work.

From the Department of Central Planning and Manipulation..

An excellent body of work!

http://www.nakedcapitalism.com/2011/03/this-is-how-qe-really-works.html

Another interesting analysis. Thank you.

Post a Comment