Wednesday, July 14, 2010

European crisis fades

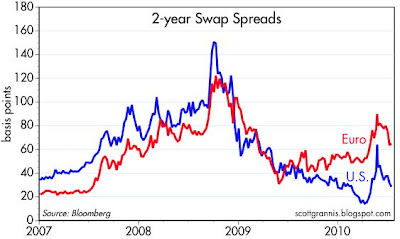

More evidence that the financial crisis in Europe is fading. Euro swap spreads are down 25 bps from their late-May highs. Greek 5-yr credit default swaps are down over 300 bps over the same period. US swap spreads are firmly in the range of what would be considered "normal."

I wish I had time to elaborate, but to me it is apparent that the real risk that everyone worries about is a systemic problem, such as a Greek default, that pushes the international banking system to the verge of default—a cascading series of defaults that leaves most developed economies paralyzed. The action so far suggests that this is simply not going to happen. What we're left with is the concern that there are still lots of debt defaults that are likely to occur. The question of the day is whether these defaults will disrupt global growth significantly. I doubt they will. Debt gets defaulted on all the time, and the world has suffered through pretty massive defaults (e.g., the serial defaults of Latin American countries in the early 1980s, the Mexican default of the early 1990s, and the $100+ billion Argentine default several years ago) without really skipping a beat. After all, debt doesn't create growth, so wiping out debt doesn't necessarily destroy growth. It can be disruptive, to be sure, but it's not a growth killer per se. All it amounts to is tearing up pieces of paper that say that party A will devote some of his future cash flows to party B.

Controversial, I know, but perhaps it will spark some debate. Meanwhile, I've got to get ready to explore another Egyptian ruin, this time at Kom Ombo.

Subscribe to:

Post Comments (Atom)

6 comments:

What about the default option? More at:

http://wjmc.blogspot.com/2010/07/what-about-default-option.html

All comments welcome...

All I can say is: take a look at your own track record prior to the Oct 2008 crash. Some economists are always so blindly optimistic and behind the curve. If you only look at headline numbers on the surface and ignore the root causes of the crisis, you will only be able to call a recession when everybody else can and that doesn't help anything. This is a balance sheet recession. This is the beginning of a huge deleveraging cycle. Until public and private balance sheets are cleaned up, the economy is going nowhere.

Egg,

Care to define "nowhere" for us?

Would love to have your GDP forcasts quarter by quarter for, say, the next couple of years?

Care to take a stab at it?

Hmmmm. I guess not.

Dr. McKibbin: My opinion of the default option is it would more honest and fair than the inflation at all costs than the road we are on. I recently asked a 90 year old neighbor of mine how they were holding up financially, and he said great because they have all their money in 30-year Ginnie Mae bonds. If the fed does a new round of QE, and all this QE eventually blows up into hyperinflation, he will be wiped out. With default, at least he'd have something left, and that would be worth more as we spiraled down into deflation.

I'll vote for the default option over inflation any day. Inflation affects everybody and everything, and it hurts the common folk more than anyone else. It is insidious.

Post a Comment