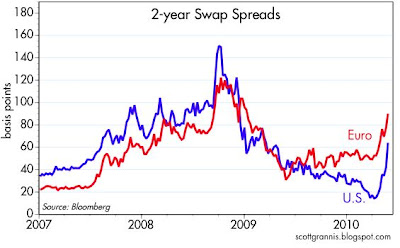

Swap spreads are an excellent indicator of systemic risk. (See my basic swaps primer for more details.) Currently, swap spreads are saying that something is very wrong in Europe, and U.S. investors are getting very worried about a possible contagion. Sharply rising swap spreads reflect a primal fear among investors that counterparty risk is on the rise: it's as if everyone were rushing for the exit at the same time, attempting to reduce their exposure to the risk that sovereign defaults turn into major bank defaults. The market is suddenly very distrustful of nearly everyone's solvency.

The Vix Index is a good indicator of the market's level of fear and uncertainty. Fear and uncertainty started rising over concerns that a Greek default could trigger other defaults that could eventually throw a wrench into the Eurozone economy. Now those fears are being fanned by the merger of four failing Spanish banks, and rising tensions in the Korean peninsula that threaten to spill over into weakness in major Asian economies. So many problems that might have unpleasant consequences, what is an investor to do? Run for the exits.

The world's appetite for risk is suddenly less. Stocks are down, commodities are down, even gold is down from its recent high. Short-term Treasury bill yields both here and in Europe are extremely low as a result (0.15%).

I don't have any particular insight into how the world's problems can be resolved. What I do know is that the surge in swap and credit spreads, coupled with the surge in implied volatility, offer a powerful financial incentive to those brave souls willing to shoulder the risk that the world as we know it comes to an end. Disaster insurance is now expensive enough that many will decide to forego it, and many will decide to sell it. Swap spreads can't rise by much more or stay this high for much longer without there being some confirmation of the market's fears, in the form of massive bankruptcies and widespread economic destruction. Implied volatility could spike higher, as it did in late 2008, but already the potential return to selling options is becoming quite tempting.

Another thought: how can the market move so suddenly from being calm to being stormy? Greek credit default swaps were just over 100 bps about six months ago, and now they are 700, even in spite of the Eurozone's willingness to socialize the costs of Greece's debt burden with a $1 trillion bailout package. 2-yr euro swap spreads were 50 bps in early April, and today they spiked to 90 bps. Have the economic and financial fundamentals so suddenly deteriorated? Or is it that the market is just not liquid enough or deep enough or smart enough to handle just a tiny increment in perceived risk? After reading and absorbing the message of "Panic

Here's my take: Market inefficiency and misguided public policy, not a fundamental economic deterioration, are most likely the source of these wild price swings. The market is not well suited to dealing with the uncertainty that arises from sovereign blunders, so it offers outsized returns to those who are. I believe that sooner or later enough brave souls will be found to shoulder the risk; sooner or later politicians will stumble on the proper solutions—with the help of an outraged electorate; sooner or later the economic recoveries that are underway in all the nooks and crannies of the global economy will trump the pain of debt defaults. I don't see that the world is coming to an end, so I'm not going to rush for the exit.

7 comments:

Why should a restructuring of Greek debt--the worst case scenario, just about--lead to such bearishness?

Is it the complicated leveraging of debt by hedge funds etc. that is exacerbating worries?

Something does not add up.

First, excellent work Scott thanks

Spreads are very important to follow but it is always good to look at the components.

4/23/10 2 year swaps 1.25

2 yr treasury 1.10

Today 2 year swaps 1.25

2 year treasury .75

The whole swap widening is a flight to treasuries....

Benj,

I think it would help to read Scott's post again. I needed a couple of readings myself.

One of the purposes of markets is to provide liquidity for illiquid long term investments. As Scott said, markets are, like people, imperfect and sometimes are inefficient when having to deal with panics. This particular panic is based on the belief (justified or not) that European soveriegn debts are too great for their respective governments to deal with...some call it a solvency crisis which is accurate IMO. Since debt involves counterparties, one default can cause others, which cause others, etc. It is fed by lack of transparency between banks that are the largest lenders. One bank fears to lend its excess reserves to another for fear they won't get it back. It all drives a need for liquidity which leads to the selling of any and all securities without regard to fundamentals. It is the job of governments and their institutions (central banks among others) to provide the liquidity and policy responses the markets need to regain the confidence necessary for orderly operations....and therin, IMO lies the greatest risk; government and/or institutional policy mistakes. Scott covered some of this in his post so I won't repeat it but unless the governments fail to address the underlying issues, this should settle down within a few more days. Panics require a lot of energy that is difficult to sustain for long periods of time...note I said 'difficult', not impossible.

Our markets bounced a little today. Perhaps a countertrend rally is near.

Brodero: Indeed, as I think I mentioned a few days ago, the widening of swap spreads is almost entirely due to declining government yields. For one thing, this means that higher swap spreads are not posing a direct threat to economic growth (via higher interest costs). Two, it means this widening is all about a flight to safety/quality. Three, given that the changes on the margin are focused on risk-free yields, I think this highlights the market's concern that risks to the banking system could result in weakness in the economy; lower risk-free yields are generally associated with weaker expected economic growth. Four, very low risk-free yields are also highlighting the market's ongoing concerns with deflationary risks.

John-

Yes, thanks for your comments.

Still, the market is too jittery given the positives out their in the real global economy.

Of course, we can say the market is irrational and inefficient, and by that statement then anything makes sense.

Something is causing the jitters, I suspect. I think the house of cards created by huge speculative leverage is one reason.

Like everyone, I would like to see real leverage decrease over time.

If the market is irrational and inefficient, then maybe speculative excesses need to be purged as well. by regulation if necessary.

I think we can finance true productive investments just fine without speculative trading volumes of debt, equities and commodities dwarfing real volumes, by factors of 20-to-1 to 100-to-1 or more.

Scott,

First thanks for your recommendation of "Panic". I just finished. It was a great read. BTW, Eric Falkenstein's book/blog reach similar conclusions re CAPM, etc.

Bottom line, the market is just insane sometimes.

Regards,

Michael

trust is in short supply in the market. first you have that whole accounting failure leading to enron etc. then you have the whole ratings failure leading to massive misallocation of capital to alt/subprime mortgages. then greece announces that its debt is actually much larger than previously thought, thanks to some debt-hiding derivatives...investors seem now to believe the worst before the news comes out. i think this is a good time to invest, but it does test the soul.

Post a Comment