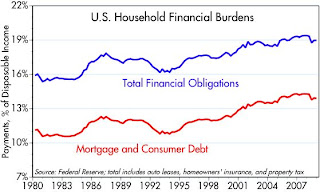

Here's an updated chart (with data through 12/31/08) from a post in late December. The story remains the same: households in aggregate did not acquire excessive debt burdens in the years leading up to the housing crisis, contrary to the popular perception. Institutions were the ones that were caught with their pants down, having grossly underestimated the risk of housing price declines and mortgage defaults. The losses have been absorbed for the most part by now, and economic life is continuing.

Here's an updated chart (with data through 12/31/08) from a post in late December. The story remains the same: households in aggregate did not acquire excessive debt burdens in the years leading up to the housing crisis, contrary to the popular perception. Institutions were the ones that were caught with their pants down, having grossly underestimated the risk of housing price declines and mortgage defaults. The losses have been absorbed for the most part by now, and economic life is continuing.In my last post on this subject, I speculated that once the institutional losses were recognized, we would discover that consumers on average were still in decent shape, and the economy could therefore resume its upward march. With the wind seemingly at my back, I would argue further that there is no reason to think that consumers are going to be behaving any differently in the future; no reason to expect a huge increase in the savings rate, and no reason to expect a big decline in consumption spending. Well, perhaps some changes, of course, but my point is that we needn't expect that we are entering some brand new world or that the economy will be significantly different from what it has been.

My last post generated some controversy, and I expect this one will too. But I think the improving economic fundamentals that I have been pointing for the past several months lend weight to my arguments.

9 comments:

Scott,

I have no comment to leave you here. I left a "green shoot" at your most recent unemployments claims posting. I found it intriguing and I thought that you might find it so as well.

Again - I think this chart may be misleading. It reflects PAYMENTS as % of income NOT the Consumer Debt Balance itself. This would not be affected by individuals our regularly make minium or partial payments on their consumer credit liabilities.

That said - everything I see would indicate that many consumers are trying to repair their balance sheets - a good thing!

Lets hope we can restart & rebuild the economy on something other than consumer debt fueled consumption this time !

Comparing the stock of debt to income tells you nothing. You need to compare stocks to stocks and flows to flows. Debt payments are a flow and income is a flow. Debt payments as a % of income is thus a sensible way to look at debt burdens.

And again, I think the message of the chart is that the consumer did not create a debt-fueled consumption boom. I think it makes more sense to say that consumers bid up the price of houses to unsustainable levels.

Bankruptcy filings by American consumers increased nearly a third in 2008, according to a new report.

The American Bankruptcy Institute said overall consumer filings rose to 1.06 million in 2008, compared with 801,840 during 2007. The ABI based its study on data from the National Bankruptcy Research Center.

Bankruptcy filings by American consumers surged in February, according to a new report Wednesday.

98,344 consumers filed for bankruptcy protection last month, up 29% compared with 76,120 filings a year ago, The American Bankruptcy Institute said. Filings rose 11% versus January.

The number of bankruptcies filed by American consumers increased 41 percent in March compared with a year earlier, according to the American Bankruptcy Institute.

ABI predicts there will be 1.4 million consumer bankruptcies in 2009.

That equates to about a 40% increase year over year. How does that transalte into consumers are in no worse shape than they were in the past?

You would expect bankruptcies to rise in a recession. People lose their jobs, etc. I don't see anything way out of the ordinary, especially considering the collapse in real estate prices.

I understand the stock to stock and flow to flow comparison. But are balance sheet effects really that negligible, especially in light of high unemployment rates? Growth in consumer demand must be financed from dissaving, increased credit growth, or increased income. Where is it going to come from? In what time frame?

So far, in this contraction we have seen debt to GDP ratios actually increase, although not at the previous rate. Yes, this is a stock vs a flow, but the ratio does eventually have to start moving the other direction. How do you see that happening? Is inflation the complete answer, or are debt defaults and productivity growth going to play a major role? I personally view the moving of bad private debt onto the government balance sheet as very inflationary, but am interested in your take.

As a supply-sider, I don't put much emphasis on consumer demand, because that is not what drives the economy forward on the margin. In the final analysis, the world can only consume an amount equal to what is produced. The key things on the margin are investment, risk-taking, and work. Any of these could get the economy back on an upward track, since they are the things that lead to productivity gains. The key to growth is making the current supply of the factors of production more productive--getting more out of a given resource base.

Confidence is one important catalyst to increased output, and I think there are growing signs that confidence is returning.

I would add that growth is not a zero-sum game. Consumers don't have to save more and consume less in order to have growth, because producers can independently decide to produce more or workers can decide to work harder.

This reminds me that the whole concept of saving is flawed. The savings rate calculation is deeply flawed, because it does not include unrealized gains, and realized gains, because they are taxed, are treated as dissaving.

Now that you point out you are a supply sider, I understand the thread in your writing that makes you stand out from most of the other econobloggers.

I agree with you that growth is the way out of our current constraints, and am less than sanguine about prospects for sustained growth in the face of heavy government intervention, inflationary policies, and high taxation.

Paul: Thanks. I do think that the supply-side approach is a better way of analyzing the world. I'm amazed that it is not more popular. But that just gives me an edge.

BTW, I have posted many times to the effect that Obama's policies will mean a much slower-than-normal recovery. I've remained optimistic about the economy and equities because a) it's easy to be optimistic when the market expects Armageddon, b) I think people always underestimate the ability of the US economy to overcome obstacles, and c) I have faith that the American people and the markets will eventually force a correction to Obama's hard-left policies that are the major threat to the future.

Post a Comment