I've been making this point for quite some time now, so the purpose of this post is mainly to update the argument with the latest news. I would also like to recommend an article by Thomas Sargent and William Silber that appeared in today's WSJ: "The Market Is Too Serene About Inflation." They make essentially the same points I do, but they nicely add some historical context. In the 1980s, it took the bond market a long time to realize that the Fed had successfully brought inflation down from double- to single-digits. What we're seeing today is similar, only opposite: it's going to take the bond market a long time to realize that the Fed has allowed inflation to increase significantly.

And by the way, I was an avid student of inflation and the bond market back in those crazy days of the early- to mid-1980s. I worked for John Rutledge at his consulting firm (the Claremont Economics Institute) during that time, and we were almost alone in our conviction that the combination of Volcker's monetary policy and Reagan's tax cuts would result in a huge decline in inflation and interest rates. It took a few years, but we were finally proven right. So I'm not totally surprised to see the bond market making another mistake, even if the circumstances are quite different this time around.

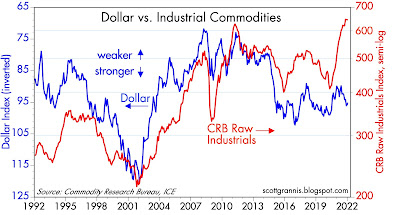

And it's not just rent that is going up, as Chart #5 shows. Industrial commodity prices (hides, tallow, copper scrap, lead scrap, steel scrap, zinc, tin, burlap, cotton, print cloth, wool tops, rosin, and rubber) are up over 25% in the past 12 months, and they now stand at a new, all-time high.

COVID-19 recommended reading: This article comes from a leading Israeli virologist. The short summary: 1) respiratory viruses cannot be defeated, 2) mass testing is ineffective, 3) natural immunity trumps vaccines, 4) those vaccinated can be and are infectious, 5) Covid death risk is highly concentrated among the elderly and those with several co-morbidities, 6) vaccine side effects are not insignificant, 7) children and young adults should never have been isolated, and 8) masks and lockdowns are ineffective and counter-productive.

I can't pass up the opportunity to repeat my prediction of April/May 2020: "The shutdown of the US economy will prove to be the most expensive self-inflicted injury in the history of mankind.™"

Chart #1

Chart #1 compares the yield on 10-yr Treasuries to the year over year change in the Consumer Price Index. We've never seen such a huge difference between the two, and I for one never thought something like this would or could ever happen. Where are the bond market vigilantes when we need them? Those vigilantes are supposed to ensure that interest rates are nearly always as high or higher than the rate of inflation. That's certainly NOT the case today.

Chart #2

As Chart #2 shows, oil prices have nothing to do with today's inflation problem. Ex-energy inflation is off the charts. And to judge by the huge difference between today's inflation and today's interest rates, the bond market has only just begun to be concerned.

Chart #3

Chart #3 shows the ex-post real yield on 10-yr Treasuries (i.e., the difference between nominal yields and the rate of inflation according to the CPI). Real yields today are lower than at any time in my lifetime. The last time we saw anything like this was in the inflationary 1970s.

This is crucially important: when real yields are hugely negative, as they are today, this provides fuel to the inflationary fires, because the returns on cash and cash equivalents are so miserable that it destroys the demand to hold cash. And as I've explained in many prior posts, it's the weak and falling demand for money that is driving today's inflation. Inflation won't end until the Fed corrects this problem, and unfortunately, it doesn't look like they will do that anytime soon. Just today, Powell promised that although the Fed is prepared to raise rates, they will be careful to do so in a fashion that won't rock the markets or the economy. Sorry, I don't think the bond market will take a lot of consolation from this sentiment.

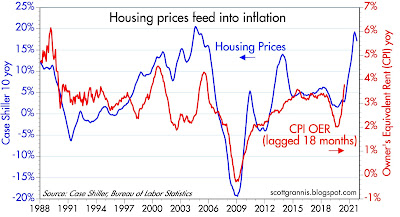

Chart #4

As Chart #4 shows, there is about an 18-month lag between rising rents (about 25% of the CPI is based on what homeowners think they would be paying to rent the house they own) and rising inflation. Given that rents are up only a little less than 4% in the past year, while housing prices nationwide are up about 20%, there is likely a lot of rent inflation that has yet to find its way into the CPI over the next year.

Chart #5

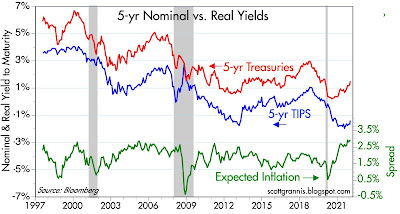

Chart #6

As Chart #6 shows, despite all the evidence of higher inflation, not to mention the runaway growth of the M2 money supply, as I illustrated in Chart #3 of last week's post, the bond market expects that the CPI will rise on average only about 2.8% per year for the next 5 years.

Keep your seatbelts fashioned, the next few years could be a wild ride.

COVID-19 recommended reading: This article comes from a leading Israeli virologist. The short summary: 1) respiratory viruses cannot be defeated, 2) mass testing is ineffective, 3) natural immunity trumps vaccines, 4) those vaccinated can be and are infectious, 5) Covid death risk is highly concentrated among the elderly and those with several co-morbidities, 6) vaccine side effects are not insignificant, 7) children and young adults should never have been isolated, and 8) masks and lockdowns are ineffective and counter-productive.

I can't pass up the opportunity to repeat my prediction of April/May 2020: "The shutdown of the US economy will prove to be the most expensive self-inflicted injury in the history of mankind.™"

UPDATE: links to articles should be fixed now.

41 comments:

explain please how the money supply is affected by QE given: the fed cannot buy treasuries directly. it buys them from the dealers. the dealers pay cash to buy, that cash goes to the gov. the fed then buys from the dealers and the cash plus profit (small) is given to the dealers. balance sheets of the 3 actors are affected relatively, but i don't see how the overall money supply is affected beyond the small premium paid. the dealers had to have the cash to pay to begin with.

I don’t pretend to know the exact sequence of monetary events last year nor all the money flows. But I do know that the only way for the money supply to expand is for the banks to create new deposits, and they usually do than when they extend loans to the public. So I’m forced to the conclusion that the banks effectively monetized most of the debt that Treasury sold last year—which, at the end of the day, makes it look like the banks lent the money to Treasury, Treasury sent out checks to the public, and the public decided to hold the bulk of the money they received in the form of bank deposits. Banks held several trillions worth of excess reserves, so they certainly had no constraints on their ability to lend. But I wish I had a better answer.

Hi Scott,

The article you linked in your post goes nowhere for me. Is it just me or are others getting the same? THX

Inflation- The economy is fundamentally weaker than it was 30+ years ago, so I think it will be harder to sustain higher inflation. I am not sure what to expect. On Real Estate: is the moratorium on eviction/foreclosure over? When that happens, will there be a giant collapse in RE prices?

Covid link- yes, this is what I suspected in terms of the evolution of the pandemic, but I believed it when they said the vaccine would reduce transmission. It clearly doesn't, and that is a huge failure in their communication. As such, Fauci, et.al. need to go. IF the recent revelation about the funding being rejected by the DOD and then allowed by Fauci, well, he is responsible for millions of deaths. I don't know if that is true, yet, however.

My guess- we go back to the recent growth and inflation rates in ~ 2 years. It will make the Obama years look like boom times. Not good.

Alpacino....same for me...the article doesn't take me to the articles, just a blogging site of some type.

The links to articles should be fixed now. Sorry for the inconvenience!

wkevinw: Re "The economy is fundamentally weaker ... it will be harder to sustain higher inflation" Economic weakness has nothing to do with inflation. If it did, Argentina (which has an extremely weak economy) would have zero or even negative inflation—instead it has a 40-50% annual inflation which has raged for years. Inflation happens because of an excess of money.

QE expands the money supply because ultimately the debt is held by the Fed and the money spent by the government with zero expectation that the debt level held will ever be reduced. This is why the fed holding Treasuries is such a bad idea - does anyone think they will actually reduce their balance sheet back down below a trillion? Ultimately, inflation is driven not by interest rates but by deficit spending by the government.

RE: Kevin - Economic weakness can drive inflation higher. Inflation can be cause by 1) more money entering the system and/or 2) less demand for money. Consider the lock-downs: We pumped more money into an economy that produced less, so naturally inflation spiked. Let's assume actual inflation is ~7% as reported, and GDP growth was ~5%. That means that we had a real slowdown of ~2% despite the nominal gain of 5%. Excess money + slower economy = inflation.

Thanks Scott, another great piece. Question, what is the impact of the loosening supply chain crunch and possible peak in new/used car prices in Q1 2022? Will that allow for lower inflation in Q2 and beyond for 2022? Thanks again.

Scott,

Is it possible that the bond vigilantes are simply being bought out by the “FED”? They are still buying over $100 billion in bonds and mortgages every month. As that program dies down perhaps the vigilantes will go wild.

In the 70’s and 80’s we had the great savings and loan bust. They had successfully used money from savings accounts that paid 1-2% a year to issue 30 year mortgages at around 4%. When short term rates went to 4% and then much higher, the industry collapsed. In today’s world the FED is buying all these long term low yield debt instruments. Is the Fed todays version of the savings and loan industry?

Looking forward to your continuing thoughts in the year ahead

Thoughts on the argument that inflation this time is driven more by supply side issues (which FED cannot control) instead of demand side and that once supply chain issues are cleared up inflation will start to moderate?

1) Bond vigilantes: “gradually, then suddenly”. Add to the inflation tiger being let out of its cage the astounding deficit spending of the U.S. government over recent years, and you potentially have an explosive bond yield increase scenario (which would surely bring about unexpected bankruptcies and other cracks in the system).

2) Argentina: Inflation rate correlated with national soccer skills? If so, the U.S. might have a chance to get past the group phase in Qatar later this year.

Are we setting up for a repeat of the early 70’s?

@marcusbalbus, if interested…

Think of the ‘dealers’ as financial intermediates. What QE achieves is a risk-free bond moving from a private market participant to an expanded Fed balance sheet in exchange for ‘new’ money (an operation that is meant to be reversed at some point). The typical private participant had decided before to buy a risk-free bond by transferring cash to the government and now exchanges this bond for ‘new’ cash. In the wholly consolidated picture, no new money has been created. However the bond held by the typical private market participant didn’t count as money (M2 etc) before but the new money does, so money supply, according to classic definitions expands.

Think of this private market participant. The intent was to buy an investment (risk-free bond) and now the participant holds cash which becomes a hot potato. There are second order and other higher order potential effects (which I’ll get into later) but the essential result of the Fed asset swap is that the private investor will try to exchange this new cash for other securities (asset inflation) and will therefore drive down the yield of other alternative securities. This way you get asset inflation and some people may feel richer and increase consumption or retire early but, overall, this has only a limited effect (clearly an unsustainable one) on consumer inflation until private and real productive ‘animal spirits’ take over.

So QE has not contributed significantly to consumer inflation through the money supply channel even if the process is responsible for a significant portion of the ‘reported’ growth in money supply. At the most, since the GFC and similar to Japan for decades, QE and related monetary subterfuges may have prevented the deflationary forces from completely taking over.

For a complementary perspective, read what Mr. Cullen Roche had to say recently:

Who Will Buy the Bonds? – Pragmatic Capitalism (pragcap.com)

Opinion: people may be surprised to find out how the Fed has painted themselves into a tight corner where consumer inflation hurts at a time when those holding risk assets feel they are safe. Imagine people find out the Fed has become truly irrelevant…Somebody will have to buy ‘these’ bonds.

From the Lords of Finance,

To the Lords of Easy Money,

To the Lords of Irrelevance,

It’s time to join the Fray.

Scott: What do you think of the articles on Zero Hedge (and elsewhere) that posit that the stock market will crash because it has been held up for the past 10 years with easy money (QE)? The theory is that the FED will stop raising interest rates when the market tanks 30% or more because of fear that this will trigger a deep recession. So, if true, are we in a never-ending loop of threats of raising interest rates and reducing the FED's balance sheet, followed by large stock market corrections and then announcements of the FED saying "oh well, never mind" and then large rallies, etc.? When will the economy, if ever, be able to stand on its own without help from the FED?

I think there's infinite uncertainty and all bets are off right now.

FED tries to poker face inverse forward guidance as a tool all while market forces and exogenous uncertainty can negate the FED intentions.

Part of me thinks the asymmetric inflation policy forward guided by the FED is implicitly meant to allow interest rates to reset higher to stay from lower bound during next lowering cycle.

If we truly get 80's type inflation and FED does raise significantly after all the pain we will have fresh high ground from which to lower interest rates again like we have during the last few decades.

There could be an interest rate super cycle embedded into the rules and culture of US financial and economic institutions.

--About Ehud Qimron, professor of clinical microbiology and immunology at Tel Aviv University

-A word about this and the relevance to macro topics.

Concerning what he has voiced since early covid, not everything is wrong and some of it, very reasonable. The main issue is the thought process contamination by ideology. In science (like everywhere else), hypotheses need to be soundly verified and validated (that's what Newton meant when mentioning he had the vantage point of sitting on the shoulders of giants). Hypotheses also have to be generated, sometimes by observation with the potential risk of biases, but the validation process helps to eliminate bias (not perfect i know...).

The ideological tribe the 'expert' belongs to is of the Great Barrington Declaration type. Again, some sound principles and many valid scientific notions but, once integrated into an objective analysis, the approach is mainly theoretical, often is characterized by poorly defined or poorly application policy prescriptions and countries that have partly applied the 'school of thought' did worse on the covid and general disease burden scale versus costs. To still advocate unrestricted natural exposure with an abundance of safe and effective vaccines cannot be reconciled on a rational and reasoned basis.

The same thing applies for macro 'schools of thought'. Supply-side economics is a great idea but policies prescribed under this manner do not automatically become appropriate because your tribe says so.

Supply side economics like any tribal theory will most likely work when individual participants have access to a wide diversity of variable quality information with limited contamination by tribal thought. To say that adaptive behaviors come with costs is fine but to suggest that to let it rip would result in lower disease burden is childish (even if you're a highly credentialed professor or whatever).

I wish I could post a chart from the CDC.

New daily C19 infection rates are now six times higher than the previous worst peak, a little more than a year ago.

In other words, after all the masks, the lockdowns, the school closures, the travel bans, the vaccines...

Every day is Afghanistan for the public health sector.

Some wars you lose.

Hi Benjamin,

"In other words, after all the masks, the lockdowns, the school closures, the travel bans, the vaccines.."

So, absent the above, what would the covid disease burden have been?

It's possible to rationally look at this and reasonably guess. Take vaccines and look at what 'these' people did. You can argue about some assumptions but they're in the right ball park.

https://www.commonwealthfund.org/publications/issue-briefs/2021/dec/us-covid-19-vaccination-program-one-year-how-many-deaths-and

"In the absence of a vaccination program, there would have been approximately 1.1 million additional COVID-19 deaths and more than 10.3 million additional COVID-19 hospitalizations in the U.S. by November 2021."

A million here, a million there and soon we'll be talking real people.

Anyways, let's not fight the last war, covid will have reached flu-like endemicity within a few short weeks, a short time but probably long enough to test the meaning of 'transitory'.

Have you looked at the real wage trend for real people?

And don't forget that, for the let-it-rip-naturally-there-ain't-much-we-can-do school of thought, herd immunity was as much a goal as for the fringe group composed of public health fundamentalists.

i had my booster shot yesterday and have a sore shoulder but will survive. In my province, 'they' are talking about a year-end tax for the unvaccinated. i'm against and believe in learning through discussions instead but perhaps this is too democratic?

"An educated citizenry is a vital requisite for our survival as a free people."

–Thomas Jefferson

Whatever the case there's signs of policy enforcement exhaustion in the US now that there are facilities that healthcare workers with positive and symptomatic covid are allowed to take care of patients regardless of their age and condition.

This has been and will continue to be a very sad time for the vast majority of humans in developed society.

Time to add a new metric comprising the Misery Index - Inflation, Unemployment, now Itinerancy Factor. Itinerancy Factor inverse to Misery.

"wkevinw: Re "The economy is fundamentally weaker ... it will be harder to sustain higher inflation" Economic weakness has nothing to do with inflation. If it did, Argentina (which has an extremely weak economy) would have zero or even negative inflation—instead it has a 40-50% annual inflation which has raged for years. Inflation happens because of an excess of money."

I was not very clear:

1. GDP is NOT stated per capita- and the GDP per capita continues declines, for reasons that are too detailed for this venue: weak demand=> low inflation

2. Inequality/globalization: labor/lower income continues to suffer due to this (root causes are several) weak demand=> low inflation

3. Recent inflation is caused by "fiscal" money- which I predict will be cut back, weak demand=> low inflation

(Note- the recent Manchin/Sinema stuff is probably Kabuki. Several dem senators do not like the $6T spending plan, and allowed those two senators to take the blame because they can survive politically. It is not likely that the crazy spending will continue- in the short run.)

The inflation is transient, but as usual, the words are not defined, so transient may have been thought to be a few months, but will be 1-2 years.

Then we end up back like we were under Obama- or a bit less well off.

Interesting article in Barron's, published Friday, that inflation is likely to be more persistent than expected. The reasoning of the analysts they spoke with is similar to what Scott is saying here, ie that regardless of whether the supply-side pressures ease, demand-side factors will keep inflation elevated. For those who have a subscription, check out "Don't Trust the Conventional Wisdom: Inflation Isn't Peaking".

About the Barron's article

There is a line of thought suggesting that, once inflation gets embedded in expectations, it can become a self-fulfilling prophecy and then monetary velocity could potentially take off..

If you look at the early 70s though, despite a lot of real noise, wage inflation was ahead of consumer inflation:

https://fred.stlouisfed.org/graph/fredgraph.png?g=Jw1B

Now, for the last 12 to 18 months, an exactly opposing trend is developing. How will that translate for 'demand' in a disappearing transfer world?

Also (inequality aspect), out of the 2.5T "excess" cash found in Americans' checking accounts as a result of artificial monetary easing and commercial banks cooperating with the Treasury's largess, only 4% of that amount ended up staying in the lowest 50% of accounts. How will that translate for 'demand'?

The amount of money thrown at the system was truly unprecedented and it should not be totally surprising that the definition of transitory gets stretched. However, aren't 'we' living on borrowed time?

The WSJ article below is the first I've seen that does a reasonable job of explaining how the combination of vaccines and Omicron change the long term calculus. I don't spend endless hours trying to become a Covid expert - partly because for so long it's been so politicized to be unreliable - so maybe there are other similar / different analysis that are worthy. Anyway, I'll take this one. Vulnerable people (older, immune comprised) will need annual boosters but most of us won't. Had my bought with Covid - about 3 days of a moderately bad cold. Happy to have had it honestly.

https://www.wsj.com/articles/herd-immunity-is-over-superimmunity-covid-omicron-immune-system-virus-variants-antibody-antibodies-11642448736?st=grsnydy53g4jy0k&reflink=desktopwebshare_permalink

It will be sad to see that no matter what happens, there will be a significant slice of US that will spend the rest of their lives masked and fearful. Misplaced fear (seeded by the new model of "news") is the defining feature of most of the problems we face today.

Bout not bought. Another defining feature of what's wrong with current times - spell check.

Thank you Scott. Great article as always. How do you position for this "wild ride"? What are your favorite tail risk rate hedges? Thank you again.

Maybe things are not so dark on the inflation front, as long as we can go back to normal in regards to pandemic rules.

Evidently, due to pandemic restrictions, Americans en masse began to order 20% more product than they used to, while curtailing spending on services.

If we can just go back to sensible spending patterns---that is, more on booze, ballgames and broads---then we can get rid of this inflation menace.

"Evidently, due to..."

Putting ideology aside, 'we' are coming back to pre-covid trends with services back on trend and with durable goods forward consumption from the future (a lot from production overseas) brought to the present due to another round of easy money.

https://fullstackeconomics.com/content/images/size/w1600/2022/01/04DurableSpending-1.png

What happens next?

What happens next is related to how one felt about the general trend in 2019, after a 30% debt-to-GDP mutational rise (variant-type). What 'we' may realize is that the debt disease is still with us even as the virus (and all related controversial measures) falls into oblivion.

Japan is seeing traces of inflation after having increased ++ its money supply (about 10%) and it wants to transform capitalism, sliding the slippery slope to full MMT mode.

https://www.reuters.com/markets/asia/japans-dec-consumer-inflation-hovers-near-2-year-high-2022-01-20/

And China has been easing...

Interesting times for sure.

My bet is that the Fed (with members looking at their melting investment account balances) will show very little resistance to make another volte-face shift in 'policy' and try to make easing great again.

Carl-

Please resume spending on bars, booze, ballgames and broads immediately. It is your patriotic duty.

Might do you some good anyway. Americans are wwaaaayyyy too uptight right now.

Listen at the 2:00 mark:

Cain: 'America's too uptight!' - YouTube

A few years later,

https://www.msn.com/en-ca/news/canada/herman-cain-s-twitter-says-covid-19-not-as-deadly-as-media-implies-he-died-of-covid-19/ar-BB18BhaU?ocid=msedgntp

Sad

Here's a man, a real one,

Who held to his strong opinions,

Who clinged to his deep beliefs,

Until the very end.

Whatever it took.

Was it in Tulsa?

Or in Arizona?

But in my book,

A failure to mend,

A foolish disregard for mischiefs,

A blind faith to wrong convictions,

And now he's gone.

He was 74.

Regarding Cain - it is sad that many older people lost a few remaining years.

I'd counter it's not nearly as sad as what the shotgun approach to Covid has been.

https://bariweiss.substack.com/p/im-a-public-school-teacher-the-kids

"The data about learning loss and the mental health crisis is devastating. Overlooked has been the deep shame young people feel: Our students were taught to think of their schools as hubs for infection and themselves as vectors of disease. This has fundamentally altered their understanding of themselves."

Along with Covid, shamed for their climate impact, privilege, and practically everything about them.

An entire generation of kids.

Anecdotally, my wife and I discussing some friends worried about their kids. They are highly successful young adults just starting their career, but are negative, bitter, angry at the world. Won't sustain relationships, not easy to get along with. The observation is their very progressive, anti-religion parents have spent 25 years ranting about what an awful world it is. What should one expect the kids worldview would be. Shame to see that now. Not an uncommon observation. Being privileged isn't all it's cracked up to be.

Scott,

What is your take on the equties market now?

Thanks for your writings, this is my first (and free) eco source.

"Regarding Cain - it is sad that many older people lost a few remaining years.

I'd counter it's not nearly as sad as what the shotgun approach to Covid has been."

Exactly.--Cain had several pre-existing medical conditions that should have prompted him to be more cautious with his individual health. This does not logically mean that the "shotgun approach" to masking and isolating everybody makes sense.

If somebody wanted to say that people with pre-existing conditions who died from Covid were stupid not to take these precautions, one might have to agree. But, one does not have to agree that every person should take the exact same precautions.

Look up the definitions of liberty and freedom if you are confused.

"I'd counter it's not nearly as sad as what the shotgun approach to Covid has been."

The Cain question and the whole questions are mostly two different questions. The Cain question only underlines that a more 'relaxed' or less 'uptight' approach will increase the risk of negative health consequences. On an individual basis and without taking into account the effect on the group one of the relevant questions is: If the person would have rationally understood the consequences in retrospect, would he have done the same thing? My humble experience (on the ground) suggests that many do regret. For those, it's especially sad. It's really about the tension between the right to choose and the right choice.

"Look up the definitions of liberty and freedom if you are confused"

For those who want to take this to a higher level of thinking, the covid virus had both an individual and a related collective impact (disease spread etc) so that one's liberty or freedom ends where another one's starts. If what you do (or don't) has an impact on you AND the group (other individuals), then it's helpful to see the principles used by Supreme Court judges in order to define some kind of compromise.

-----

For a perspective on equities, Mr. Grantham is not always right, especially with timing, but he comes to an interesting 'take':

https://www.gmo.com/americas/research-library/let-the-wild-rumpus-begin/

"the covid virus had both an individual and a related collective impact (disease spread etc) "

Sounds nice but not well supported by the last two years' experience.

The covid vaccines most likely do not stop the spread (as originally claimed). UC Davis, not exactly a right-wing organization did a study. It has been buried by the media outlets, as expected: "A new study from the University of California, Davis, Genome Center, UC San Francisco and the Chan Zuckerberg Biohub shows no significant difference in viral load between vaccinated and unvaccinated people who tested positive for the delta variant of SARS-CoV-2. It also found no significant difference between infected people with or without symptoms."

Have you noticed the "Stop the Spread" campaigns have disappeared? There's a logical reason for that.

https://www.ucdavis.edu/health/covid-19/news/viral-loads-similar-between-vaccinated-and-unvaccinated-people

There is some evidence that vaccinated people that get breakthrough infections may have a lower viral load for a period on the order of weeks.

Public health vs individual rights as conferred by the constitution is precisely the legal theory in question. It looks like the key legal theory is that the federal govt does not have the authority to require large public health actions by individuals. State and local governments might.

The only proven way to prevent spread is by isolation/quarantine. This is not a long term (sustainable) way to prevent the long term waves of this pandemic. Eventually people require social contact to live, acquire food, shelter, clothing, etc.

Covid19 evidently infects feline populations quite readily, so, forget about human isolation as a strategy. Millions or billions of pet cats probably have it worldwide.

The vaccines have been useful in dealing with this virus. They act more like a prophylactic than a vaccine as previously defined.

Note that the CDC had to change the official definition of vaccine to get through all the regulatory hurdles.

"The covid vaccines most likely do not stop the spread..."

-Why do you selectively pick and choose published evidence that supports your narrative as opposed to the quite clear balance of evidence that overall demonstrates the very high likelihood that covid vaccines have greatly contributed to decreased transmission and covid disease burden?

This 'process' may 'work' in politics and even with some macro theories but it cannot coherently hold very well when a reasonably diverse source of good quality scientific evidence is available.

Why are so many individuals eager to emphasize the right to choose over making the right choice?

And why the focus on 'fear' and 'uptightness' when so many facts are reasonably available?

Here is the link to his talk in Hong Kong by the way. Should mention a buddy is good at Bayesian probabilities and I sent him the article Dr. Ho refers to.

https://youtu.be/_tv9Ox4EtMk

Well Doom and Gloom everywhere but Apple has again reported a fantastic quarter. Congratulations to Scott Grannis

Hello,

So, now mkt expects 5 hikes in 22, but is no worried about the

economy growth.

Best to all.

Post a Comment