The Fed, not supply chain bottlenecks, is to blame for a significant rise in inflation. If the Fed were targeting low and stable inflation correctly, supply chain bottlenecks would result in an increase in some prices, but not all. Think of stable monetary policy as putting the economy on a fixed spending budget; if you spend more on some things, you perforce need to spend less on others. Today, consumers have a super-abundant spending budget which is allowing a wide variety of price increases, some of which are sizable. (How many prices are declining these days? Offhand, I can't think of any.) This inflation episode is not transitory, it is semi-permanent, and it will last until the Fed decides to tighten monetary policy, an event which still resides uncomfortably far into the future. Unfortunately for Biden, his administration will carry the burden of the blame for higher inflation; unfortunately for consumers, they will carry the burden of paying for the Fed's mistake.

Unfortunately, the bond market is still in the early stages of pricing in the likelihood of higher inflation. Interest rates are thus likely to rise further, and this will periodically weigh on asset prices because it increases the chances of a significant tightening of monetary policy which would inevitably lead to another recession. Fortunately, this risk is not imminent because the Fed has taken great pains to insist that it won't happen for at least another year or two.

Curiously, the bond market is currently pricing in the expectation that the outlook for economic growth in the US will be dismal. We can see this in the exceptionally low level of real yields on TIPS. I, however, remain convinced that growth will be stronger than expected, just as inflation will prove to be higher than expected. Regardless, I continue to believe that the future path of economic growth in the US will be sub-par; that is what I forecast in 2009, and that continues to be my forecast. Sub-par growth is the natural result of a burdensome tax and regulatory environment which began under the Obama administration and is now with us again in the Biden administration.

Regular readers of this blog will know that the events I'm describing are unfolding in an unsurprising fashion. I first noted the huge jump in M2 in May of last year, and how it could boost inflation if the Fed failed to respond to a subsequent decline in money demand. In August of last year I inaugurated the mantra "borrow and buy," as the best way to profit from easy money and rising inflation. In practice, that meant avoiding cash and buying assets with roots in the nominal economy (e.g., property, commodities, and productive assets such as equities). Last March I said the Fed was too easy, and I also wrote about the problem of unwanted money. I argued last April that rising inflation was not temporary. Last May I said the Fed was playing with fire. Last June I wrote about my experiences with inflation while living in Argentina, and how it was a lesson for the US. I emphasized last July that inflation had broken out to the upside. A month ago I described monetary policy as a slow-motion train wreck.

So here we are today: despite all its exhortations to the contrary, the Fed has made an inflationary mistake which it's very unlikely to correct anytime soon. (In fact, monetary policy has never been so easy.) And despite the economy's rather impressive recovery this past year (both real and nominal GDP are now higher than just before the Covid shutdowns began), the market remains convinced that the future of economic growth is bleak.

I'm more pessimistic than the market about the outlook for inflation, but I'm more optimistic about the outlook for growth. As a result, I'll stick with "borrow and buy" until real interest rates rise significantly. I'll avoid cash and embrace debt; I'll be a seller of bonds rather than a buyer; and I'll be a buyer of property and equities.

What follows are my customary charts which illustrate many of these points.

Chart #1 (M2 less Currency) is the virtual elephant in the room: the biggest story not being told. The explosion of the US money supply since March of last year is unprecedented and widely unremarked. There is now some $4 trillion of extra money sitting in retail bank, checking, and savings accounts in the US—above and beyond the amount we would have expected to see at this time. At first, all this extra money was fine, since the public's demand for the safety of money was intense in the months surrounding and following the Covid shutdowns. But now that the economy is chugging along and almost fully recovered (more on that below), there are trillions of dollars that are no longer wanted. As consumers attempt to spend down their money balances, they simply push prices higher. High inflation will be with us until this begins to change, and that is not going to happen soon, so swears the Fed.

Chart #1

Chart #2

Chart #2 shows the 6-mo. annualized increase in the CPI (both total and "Core" versions). I believe this is the best measure of the rate at which inflation is currently running, and it hasn't been this high since the early 1980s. At this rate the CPI should post at least a 7% rise for the current calendar year.

Chart #3

Chart #3 illustrates how changes in housing prices impact the CPI with about an 18-month lag. The big rise in housing prices began in the middle of last year and now we're just beginning to see how this is contributing to a rise in the rental portion of the CPI (which is about one-third of the total CPI index). (It takes time for higher home prices to feed into higher rents.) This means that today's higher housing prices will contribute to higher inflation for at least another year.

Chart #4

Chart #4 shows the ex-inflation version of consumer price inflation. It makes sense to strip out energy prices since they are by far the most volatile component of the CPI. Yes, gasoline prices have surged, but so have a lot of other prices. In the past six months, this measure of inflation has risen at a 6.3% annual rate.

Chart #5

Chart #5 shows nominal and real 5-yr Treasury yields, and the difference between the two (green line), which is the market's expectation for what the CPI will average over the next 5 years. Inflation expectations by this measure have surged from about 0.5% in mid-2020 to now 3.1%. That's a huge increase, but it's still far below where inflation is running currently. The bond market has been slow to catch on to the rising inflation seeds that the Fed has been sowing for the past year. Expect all of these lines to rise further in the future.

Chart #6

Chart #6 strongly suggests that interest rates are still far below where they should be given the current level of inflation.

Chart #7

We all know there is a chip shortage which has seriously hampered the ability of factories to turn out new cars. At the same time, consumers' appetite for buying cars has surged, thanks at least in part to the $4 trillion of "unwanted" money that consumers have been accumulating in their bank accounts over the past 18 months. The result is an explosion of used car prices unlike any we've ever seen before (see Chart #7). This speaks loudly to the thesis that there is simply too much money these days chasing too few goods. A classical case of rising inflation.

Chart #8

Chart #8 shows us that over half of the small businesses in the US are reporting paying higher prices for a wide variety of things. We haven't seen conditions like this since the high-inflation 1970s. If there weren't an excess of money out there, higher prices for some things would perforce result in lower prices. Thus, the current inflation episode is very unlikely to prove transitory. It won't end until the Fed hits the monetary brakes, and that won't happen until we see real and nominal interest rates move up in a big way.

Chart 9

Chart #9 shows the finished goods version of the Producer Price Index (as contrasted to the final demand version which has become more popular in recent years). Here we see an astounding 12% increase in the past year. This foreshadows more inflation in the pipeline for the CPI, since producer price hikes tend to be passed on to consumers.

Chart #10

Chart #10 is a new one for me, inspired by a similar chart in a recent version of Steve Moore's daily newsletter. The different lines represent different age cohorts. The green line represents the mature segment (over 55) and it's also the most productive (due to experience). Youngsters (the blue line) have almost all gone back to work, but a whole lot of older folks have not. As he notes, "Older workers who dropped out of the workforce when Covid hit (they were the most vulnerable) have not come back."

Charts #11 & 12

The reason for this looks to be related to all the transfer payments lavished on the private sector.

Chart #11 shows transfer payments (e.g., social security, welfare, food stamps, medicare, unemployment benefits, subsidies, etc., all of which are income received not in exchange for work) as a percent of disposable income. Incomes were hugely boosted by lavish benefits and profligate subsidies voted by politicians in an attempt to mitigate the damage caused by shutting down the economy.

Chart #12 shows the labor force force participation rate (the age-weighted average of the lines in Chart #10). Funny how the surge in transfer payments in the wake of the 2008-09 Great Recession coincided with the beginning of a big drop in labor force participation, and how the same thing happened last year in the wake of the massive wave of Covid payments.

Big transfer payments are thus one reason the economy is likely to grow at a sub-par pace going forward: millions of our most productive workers are staying at home, either retired or living off their Covid-era savings.

Chart #13

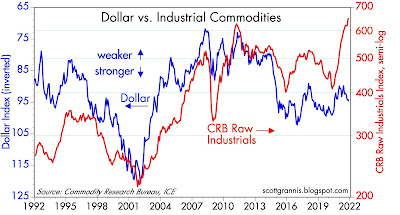

Chart #13 compares the value of the dollar (inversely represented by the blue line) and an index of industrial commodity prices. These two lines tend to move together, since a stronger dollar tends to depress commodity prices and vice versa. There's been a huge divergence in this relationship in the past year, however, as the dollar has been fairly steady against other currencies but commodity prices have surged. A possible explanation for this is that the global economy has rebounded very strongly from the Covid slump, resulting in very strong demand for industrial commodities. This is corroborated by strong capital goods orders in the US, and a noticeable increase in manufacturing activity. This foreshadows continued economic growth both here and in the rest of the world, and thus it casts doubt on the bond market's apparent belief (as shown in the form of negative real yields) that future growth will be dismal.

Chart #14

Chart #14 suggests that it is too early to worry about the negative consequences of future Fed tightening for stocks and the economy. With the exception of last year, every recession in my lifetime has been preceded by very high real interest rates (blue line) and a flat to negatively-sloped yield curve. Neither condition holds today. Indeed, this chart today suggests that the future looks bright. Unless the Fed does an about-face soon, it could be years before real interest rates are high enough to depress economic activity. In the meantime, credit spreads are very tight and liquidity is super-abundant.

Consequently, the outlook for corporate profits is still quite positive, and the economy is nowhere near the brink of another recession.

56 comments:

Scott,

I agree with everything you say, except for one thing. 😊

You characterize the inflation we are seeing as a Fed “mistake.” I don’t think it is a mistake from their point of view. Inflation solves a lot of problems for both the federal and state governments.

The task for your readers is to work to not be hurt by what the Fed is intentionally doing.

Love your blog. I look everyday. Thanks so much,

Michael

Michael: thanks for your comment. I believe the Fed’s purpose in life is to maintain a stable value for the dollar, which is equivalent to targeting low and stable inflation. Without a monetary anchor, we are in a world of hurt. By allowing (and undoubtedly encouraging) higher inflation, the Fed is doing harm to the economy. High inflation hurts most those who are least able to protect themselves (e.g., the working class). In contrast, it helps the government by reducing the burden of debt. This is a form of taxation which is insidious. So naturally I think the Fed is making a grave mistake. But those who would like to direct the Fed in its duties (among whom I include the Biden administration) are likely pleased by recent developments: the burden of our $20+ trillion federal debt is

… declining daily, having recently posted one of the lowest levels (relative to GDP) ever. One of my goals in publishing this blog is to help those who might not otherwise understand how best to navigate the financial shoals.

Scott,

Thanks for your update.

Just found another FRED data warning about recession.(RECPROUSM156N)

Still...the PCE core in September was 3.6% year-over-year. The Fed pegs to the PCE core.

https://www.bea.gov/data/personal-consumption-expenditures-price-index-excluding-food-and-energy

I think things are cooling off. Oil will start self-correcting soon. Supply chains are snarled, but some one-offs there, like SE Asian factories shutting down on C19. GM just said it can make cars.

Probably, the Fed overdid it. Curiously, the US dollar has been trading higher since June.

Property zoning is a killer, limiting supply. No dancing around that one.

So put together urban riots, OPEC gouging, property zoning, huge federal deficits, supply-chain snarls, a huge war machine and an even bigger healthcare-welfare complex, Biden regulations, and M2 growth to the moon...and you get 3.6% core inflation.

Is the 40-year-disinflation trend over? Maybe...but maybe not.

As for the over-55 workforce, why on Earth would we go back to work when our investments have grown like kudzu? The SP500 is up more than 20% this year. Why go back to a job that pays less than simply pulling out a sustainable amount of your retirement savings?

Benjamin, re PCE Core: On a 6-mo annualized basis, the PCE Core has increased at a rate of 5% or more for the past four months.. If it rises 0.8% in the October release (less than the CPI rose), it will be up at a 5.5% rate in the past six months. The GDP deflator (the broadest measure of inflation) rose at a 6% rate over the past two quarters. I think it's quite fair to say that inflation is currently running at a rate of 5-6% and quite possibly more.

More info on producer prices: prices for processed goods at the intermediate level are up 25% in the past 12 months; prices for unprocessed goods at the intermediate level are up over 50% in the past 12 months. Translation: there is a whole lot of inflation in the production pipeline.

Hello Scott,

I very much agree that the rise in M2 and the subsequent rise in prices is Macroeconomics 101.

We have been the beneficiaries of deflationary forces that may soon be dissipating. Namely...

China: The "One Child" policy pushed fertility rates below replacement rates. This has created a demographic nightmare and a reduction in productivity. In a word they have become the worlds largest nursing home with all the costs.

The younger generation is not embracing their parents 996 work culture. The Tang Ping or lying flat movement will have implications for the amounts of future deflation shipped around the world.

Can we innovate faster than the government can print/confiscate money? Can we compensate and off set China's declining productivity as it transforms into a consumer driven economy with lower rates of productivity?

Thanks for all the great content

Gerard

Hotdogs. Hotdogs are down 3.3% YOY. For some reason I keep laughing about this.

- J.R.

Scott - thanks for your always great commentary. Since banks don't borrow at Fed Funds anymore, would raising it make any difference? Wouldn't raising rates just expand bank margins and encourage lending?

Too soon, JR. Too soon. Some of us are heavily invested in hot dogs.

;-)

Scott Grannis: Oh, you're probably right about inflation in the present. I am wondering about a couple years out, given the 40-year disinflation trend.

Will the global disinflation trend reassert itself, or will we be in a an era of moderate inflation, say in the 4% range, for the next several years?

BTW, I can remember in the 1980s when the Wall Street Journal editorialized that inflation below 5% was good enough and that the Fed and the Reagan Administration shouldn't clampdown too much.

Still, the Fed has probably overdone it and certainly federal spending seems ossified and haywire at the same time.

the fed has lost control....

Drunken sailors....bubbles like at no other time in history of America....

It started with Bernanke put....never ended...

people are going to get crushed, they forgot what it was like to live in 70's

your home was a roof, nothing else....it will revert to it again.. ..

Benjamin, re long-term inflation outlook: Inflation is a monetary phenomenon. It is not caused by demographics or anything else non monetary, especially global conditions. If inflation were a by-product of global trends, then Argentina would have 2% inflation; instead, it has 50% inflation. Japan has had low inflation for a long time, thanks to its monetary policy, not its demographics. Our Fed did a good job bringing inflation down in the early 80s, and they kept at it until a year or so ago. Now they are making a mistake, a mistake that has been over a year in the making. I've documented the whole thing; it's not a surprise and it's not a function of government spending (though wild government spending undoubtedly provided some cover for the Fed's mistake). If anything, the Fed and the deep state succumbed to the allure of MMT. Well, now we know that MMT is bunk. You can't flood a country with money and expect inflation to remain low.

If I have contributed anything to the inflation debate, it has been my singular focus on the basics: the supply of money vs the demand for it. Everyone knows what the supply is, but hardly anyone even mentions the demand for money these days. I believe I am more sensitized to this thanks to the years I spent living in Argentina, when the inflation rate averaged about 7% per month.

I would argue incessantly that lower inflation is better than higher inflation; that the best inflation rate is zero or close to zero. A medium of exchange that maintains its value over time is a thing of beauty. But it's hard to deliver, as we have seen.

Scott Grannis: Well, you are probably right....

Just as you have discussed money demand, so I have pondered 1,000 times why fiscal stimulus cannot be delivered by cutting taxes on people who work and invest, rather than more and more spending.

And, the supply-siders are onto something---oil and housing will cost less, the more it supplied. Housing and oil costs do feed into inflation as measured (as well as lower real living standards). I understand about one-time price hikes vs. sustained inflation...but still.

My guess is we see moderate inflation for a few years. Not my cup of tea, but we have seen worse.

To me, the key fundamental error in US policy today is the taxing of the productive, and the handing out more and more money to people who are unproductive, from an classic economic viewpoint.

As David Stockman puts it, the DC "welfare-warfare complex."

Hi Scott,

It seems like the West has become too complacent. It has been too long since we had a major *sustained* economic crisis (outside temporary GFC & covid interruptions), marked by runaway inflation from fiscal & monetary recklessness, and associated political instability.

It seems to me that central banks outside of DMs are behaving more rationally and responsible. They are hiking rates due to higher inflation. Even African central banks are hiking whereas DM central banks seem afraid too. It seems they have lost their independence and doing whatever their political leaders want them to do.

Minsky famously argued that stability creates instability, and vice versa. Emerging markets have been chastened by past crises into implementing prudent policies. The West has been seduced by a long period of low inflation & artificial stability into reckless and complacent policymaking.

It seems unlikely to me that the West will manage to forever escape the repercussions of this marked deterioration in leadership and fiscal stewardship. If people's assumption that stability can be taken for granted proves wrong, we will have the worst bear market since 1970.

Thanks for all your posts!

Alpacino: I agree that developed countries are vulnerable to a fall, but I think the Covid crisis—which shut down a major portion of most economies for about a year—counts as a very serious crisis. Economically, the Covid shutdown was very severed though relatively short-lived. It did leave a legacy of caution among many people. Politicians shamelessly stoked the public’s fears in order to test the limits of their powers. That in turn may be why central banks are reluctant to tighten; everyone is still on edge. Let’s hope that a few years of disruptive inflation will be the only price we end up paying for all this.

BTW, just as the military bureaucracy never wants a war to end, so the public health bureaucracy wants perma-wars.

Now, they want to vaccinate school-kids. People who face extremely minute risks from C19.

So why vaccinate kids? Well, "they might expose adults." But adults have had all the chances in the world to get vaccinated if they want, and for free. Some adults don't want to be vaccinated. That should be their business.

The C19 goalposts get moved weekly. This was supposed to be a two-week lockdown. No conclusion is ever reached. Now, booster shots and proof of vaccination to enter a store or restaurant.

What about next year? More of the same?

Scott,

What is your view on the potential impact of $120 per barrel oil (BofA recent estimate) next summer on the risk of a recession. Clearly, the price of oil is not the central driver it once was, but it a key raw material and consumer cost.

Look forward to your thoughts -

Tom

Benjamin,

"the public health bureaucracy wants perma-wars."

Your ideological explanations could make sense.

Your biological explanations make no sense. :)

The extent of the political noise and the relative inability to define common goals (with a resulting unnecessary covid disease burden) on your side of the border is simply mind boggling.

The head of public health in my province can't wait to go back to anonymity and he (and his MD wife) are starting to find it painful to have constant and around the clock police surveillance around their house (as a result of death threats and hate/divisive speech on the internet).

It's only a virus which doesn't care about the size of government.

Scott,

"Let’s hope that a few years of disruptive inflation will be the only price we..."

The issue then seems to revolve around the definition of "transitory" which basically means non-sustainable. i think the recent inflation surge is quite typical of the late-stage upswing phase in inflation seen as recessionary conditions are imminent (like just prior to the last two recessions), is an artefactual manifestation of artificially inflated demand based on a new pile of debt added to an already money-velocity-reducing excessive pile and the fear of raising Fed fund rates from 0% to 0.5% is simply a reflection of the embedded and unprecedented financial vulnerabilities and wild asset price inflation. The next few weeks and couple of months could prove to be incredibly interesting and may provide an opportunity for the Fed to close the gap between the quoted 6.2% inflation rate and the 0% Fed Fund rate.

Underlying premises:

-Inflation picture:

https://ggc-mauldin-images.s3.amazonaws.com/uploads/newsletters/Image_2_20211112_TFTF.png

-Since the GFC, money supply growth (and deposits growth) has been predominantly a story of artificial money, not loans and leases and, with covid, these trends have accelerated. See following, page 16. This is similar to what happened in Japan over time but the course of human events is compressing.

https://www.yardeni.com/pub/mmt.pdf

-The real disposable income surges seen during the pandemic (driven by government going into debt and driving excess demand and 'supply shortages') are simply forward goods consumption brought today and compensated by future tax (confiscation) unless we definitely enter the MMT world:

https://fred.stlouisfed.org/series/DSPIC96

Going forward (IMO this is quite imminent; imminent remains to be defined like transitory), the high inflation numbers are contingent upon either a continued subsidy from government to support consumption (Fed-facilitated subsidy) and/or a radical reversal of trends established since the GFC, trends which, somehow, have become deeply entrenched.

Scott,

One of my observations is that worldwide debt is so excessive, that the only way out is inflation. Argentina type inflation which I too witnessed is not desirable, but a 5 year period of 8-12% inflation could in effect solve the debt crisis as long as the fed does not allow interest rates to go too high. Your thoughts?

Carl-

I am fine with voluntary vaccinations of the majority of the population, and especially the elderly or those with co-morbidities. I got two shots.

But vaccinating children, who are immune to C19? Arresting people for going to the beach?

Beyond that, if you want to talk science, most believe that C-19 will eventually become endemic, that is we will all have been exposed to it, it is just a matter of time. It is a losing war.

I still wonder at the origins of this virus. According to the literature it is difficult for a virus to hop between species. But C-19 infects deers, primates, lions, tigers, cats, dogs, minx and several other species.

Why would a virus evolve inside of a cave inhabited exclusively by bats to become infectious to such a wide variety of animal species?

George: A slug of inflation like that would indeed wipe out a lot of debt, but I doubt interest rates would remain low in the process. The only way to stop a big bout of inflation is to tighten monetary policy dramatically, and that would surely result in higher interest rates. The trajectory of rising rates would determine whether debt service costs got out of control or not. Currently the “burden” of federal debt service (interest costs as a % of GDP) is fairly low.

Note also that rising inflation not only wipes out the value of existing debt, but it also increases nominal GDP, which boosts government revenues. The WSJ today has a nice article about that; states have never been so flush with cash.

Net result: inflation is very good for government, very bad for the rest of us, especially the little guy.

@Benjamin

Fair enough. It's still a relative conundrum when you think about the relative (US relative exceptionalism) hesitancy (lack of trust) when a detached and objective analysis is done related to vaccine efficacy and safety (if the idea is to reduce disease burden or to optimize a community-based common-interest response). Yeah, i know, the sense of community is going through a bear market of its own but the 'right' animal spirits should eventually win the day (i hope).

For the 'origin' theories, all options need to be considered but, in my humble book, so far, the natural option remains the most likely.

“History is much more the product of chaos than of conspiracy.”

Zbigniew Kazimierz Brzezinski

-----

"a nice article about that; states have never been so flush with cash."

So why states (as well as corporate and household balance sheets in the aggregate) are so flush with cash? Is it because of a strong rise in growth of money supply from productive private loan origination?

Long answer:

During Covid, aggregate personal income actually rose mitigating the impact on state revenues and federal transfers (including direct grants) caused the federal transfer to state tax ratio to jump.

Short answer:

F_d_r_l d_b_

The classic answer (classic and orthodox economic thought) to rising government debt has always been rising interest rates and, unfortunately, the US Treasury has discovered an incredible amount of (potential and future) fiscal room. Since the GFC, rising debt has been associated with lower debt burden and my bet is that this will continue for a while although 'we' are getting closer to non-linear changes.

Betting on inflation to 'manage' this debt without productive growth comes with very real deflationary risks.

Carl-

As you may know, the globe was in a 40-year-long disinflationary trend from 1980 to 2020.

So, now we see moderate inflation in the US, and some hints of inflation elsewhere, though not showing up in CPI's as much as PPI's.

Some bad luck here, like OPEC limiting production and snagged ports, supply crunches etc. C-19 is not a normal economy.

My guess is that disinflation reasserts after a couple of years.

Perhaps the Fed has overdone it. On the other hand, this is the first good economy for the bottom quarter of the US labor force in 60 years. That is not nothing.

Well, time will tell. Best of luck to all.

@Benjamin

Of course time will tell and this too shall pass but i wonder if we are not reaching some kind of peak complacency?

For the bottom quarter apparently having a good time, when one looks at deflated real wages' recent trends, it doesn't seem like things are going in the right direction.

https://www.edgeandodds.com/wp-content/uploads/2021/11/image-67.png

-courtesy to edgeandodds.com

And what about Japan, the leading indicator which was relatively spared by the pandemic? Recent trends have recently been reported and point to further steps towards the MMT slippery slope. The report by itself is absolutely catastrophic but, like frogs who get used to boiling water when the temperature rises slowly, the report is received with relative apathy. Fundamentals look terrible there and sentiment is very fickle.

https://www.bnnbloomberg.ca/japan-s-economy-shrinks-as-kishida-mulls-stimulus-package-1.1681785

In no way i am 'predicting' something like the French Revolution and people still don't agree on the proximate causes but the trigger was a poor harvest and the rising price of bread. And the rest is history.

Anyways, at the very least, this phase of the cycle is absolutely fascinating.

Looking forward to further discussions along the way.

"In no way i am 'predicting' something like the French Revolution"

A less bloody solution could be to split the country into more autonomously governed and taxed coalition of states led by California for those that favor the economic and social experiments, and Texas/Florida for those that are, well, conservative in the original sense. I suppose there are those on both sides that would find this appealing.

In other words, considerably less federal power, and more power to the states as laboratories of democracy.

No, I don't see the path there either.

Carl-

True, inflation-CPI is outstripping wages, but not for for the bottom quartile of employees.

https://www.econlib.org/why-is-inflation-bad/

Also, CPI is a little dodgy, and PCE-core will deflate by a bit less.

I think the bottom quartile is doing well, relatively.

I am not a fan of social welfare---that said, you gotta make sure the employee class is cut into the deal. Open borders for immigration and trade...not sure that clicks. Add into higher taxes on wages and monstrous property zoning-higher rents....

We have a pair of political parties who think anyone who works hard for a living is a sucker.

^Interesting perspective.

Except the inflation that the "bottom" is 'seeing' (grocery store, gas station, medical bills etc) is much higher than CPI. In our digitized, dematerialized and knowledge-based modern world, the ordinary folks are not 'seeing' the productivity gains promised by the new era being translated into actual real improvements in standards of living (except for Facebook maybe :)). And they are looking for jobs that pay better (also looking for answers).

Recent 'consumer' confidence and sentiment surveys may be a reflection of that.

Of course, it's possible that nominal retail sales may continue to be driven by rising government debt for still some time, bread and circus type.

Anyways, the huge disconnect between real yields and inflation has to be reconciled somehow and we're about to find out. Maybe both trends will muddle through and meet in the middle somewhere but there are other less benign scenarios.

Carl-

Verily, the Treasury yields tell us institutional investors think inflation is transitory.

I get some commentary from Moody's, and we should all take the mood-elevators they do---at least our lives would be worry-free. Alfred E. Neuman had the right idea.

That said, I think oil prices have done their move, and supply-chains will get worked out, and housing is showing signs of topping out too. (Housing is a serious problem, due to restrictive property zoning, but it has made its move too).

Wages may bump up some more, but again there are limits.

I am less worried about the national debt than some, as it appears central banks can sit on their balance sheets indefinitely, meaning interest payments flow back into the Treasury.

I am worried about more and more spending on the welfare-warfare state, creating more and more economically unproductive people who have a claim on output---and who live by taxing productive people.

Well, let's see what happens. I suspect moderate inflation for a couple years. But past 24 months, my crystal ball gets foggy....

OK, let's see what happens.

Given your inputs, you may be interested in the following related to expansion of balance sheets across the board. They kind of mention that zoning restrictions around large popular US urban centers have a hard time explaining rising global asset prices in all classes and sort of mention the elephant in the room (interest rates). At any rate they mention two possibilities (to which one should add further extend and pretend): either we've entered a new era or reversion to the mean is not dead.

https://www.mckinsey.com/industries/financial-services/our-insights/the-rise-and-rise-of-the-global-balance-sheet-how-productively-are-we-using-our-wealth?utm_source=newsletter&utm_medium=email&utm_campaign=newsletter_axiosmarkets&stream=business

Carl-

Oh, for sure, interest rates play a role.

In addition, I have always had reservations about QE, which pours money into global capital markets. So the Fed is trying to stimulate to US economy by buying bonds on the global market. Like trying to inflate a balloon by lowering global air pressure.

This is why I am open to simple money-financed fiscal programs (MFFP), though prudently administered. If you want to stimulate the geographic US main street market, then spend money there.

I prefer such MFFP actually be tax cuts, such as Social Security tax holidays. The Fed can buy Treasuries and place them into the SS fund to offset losses.

Worth noting: where housing supplies are adequate, like Japan, little housing inflation.

PCE core running at 3.6% for several months. Should start drifting lower soon. With luck.

"I am worried about more and more spending on the welfare-warfare state, creating more and more economically unproductive people who have a claim on output---and who live by taxing productive people."

Right.

The "type of economies" we are seeing in modern times are not exactly in any textbook I used in college. China= central planning capitalism? US (and others)= socialized capitalism?

The "big government" advocates always say that we don't have "real" capitalism and we are better off because of all the social spending?

If you "own" some property on paper, and the government taxes it at high rates and regulates everything you do with it, you do not have all types of ownership, as the lawyers would say. Is that some kind of socialism (government/centrally planned economy?) They use the taxes to pay those with the "claim on output".

I just saw an article about the State of CA not allowing nat gas electrical generators, so you have to get a solar rig. That's how it works.

"In addition, I have always had reservations about QE, which pours money into global capital markets. So the Fed is trying to stimulate to US economy by buying bonds on the global market. Like trying to inflate a balloon by lowering global air pressure.

This is why I am open to simple money-financed fiscal programs (MFFP), though prudently administered. If you want to stimulate the geographic US main street market, then spend money there."

There is plenty of academics that show models where helicopter money would result in productive growth and low inflation as a result of prudent management through collaboration of monetary/fiscal policy and the introduction and maintenance of "nominal rigidities".

Yeah right.

MMT has been tried in a way a long time ago in Spain (discovery and exploitation of silver (and gold) mines). Spain moved from not enough to too much money in relation to economic potential (sounds familiar?) and they discovered that an artificial and unbacked increase in money inevitably led to a loss of purchasing power. Of course, silver 'deposits' increased during the Price Revolution (inflation rates increased but remained quite low but the inflation eventually had a devastating effect on the poorer segments of the population.

i thought of leaving a few academic references but here's a picture:

https://2.bp.blogspot.com/_pMscxxELHEg/SUZyt85GtvI/AAAAAAAAEAY/1OCiStcRWJk/s1600-h/LewisQuantitative.jpg

Through QE, central banks injected excess cash which remained trapped within the financial system due to the fact that the excess debt remains tied (although less and less so if the meaning of the word "temporary" is lost in the translation) to issued government debt and somehow switching to MFFP-helicopter-type easing means that (IMHO) shyt would hit the fan.

No picture here but That Smell...

My bet is that the traction that MFFP et al is getting will stop and one of the inputs is that the 30-yr Treasury sits at 1.97% now. We'll have to see what happens.

The Spain-gold-silver story is an interesting one, and muddy enough that we can all project our beliefs onto it.

But we know French laborers migrated to Spain to work so they could get the gold-silver. So you had more people working in Spain after the little lumps of metal arrived from the New World.

"Gabacho (Spanish pronunciation: [ɡaˈβatʃo]; feminine, gabacha) is a word used in the Spanish language to describe foreigners of different origins in previous history. Its origin is in Peninsular Spain, as a derogatory synonym of 'French'."

Derogatory as the French too simple laborer jobs, cleaned stalls etc.

That is to say, people will work for what they believe is spendable.

Sure, Spain had inflation but also greater output. What counts? Real output or inflation?

The US may face moderate inflation for a couple of years. The country also dodged a C19 depression. I can't say the Fed is too wrong. Maybe inflation will get out of hand.

In the 1980s, during the Reagan boom, The Wall Street Journal editorialized that any inflation rate under 5% was good enough.

Maybe so.

Nasdaq closes at record high again.

At least we are going out with a bang!

^The price revolution in Spain was a typically complex and dynamic multi-variable equation and historical records are sketchy so one could say it’s anybody’s ’guess’. Some even mentioned the flagrant idleness of women as a significant cause. However, the specie money coming in from the New World (same as unbacked printed money) that went into circulation first contributed to increased money velocity (along population growth and credit use growth) but then when specie money became excessive, there was quite a powerful link to inflation levels in Spain, a phenomenon which coherently spread to neighboring Western European countries in correlation with a trade deficit for Spain (specie moving out and exporting some inflation to others).

The Habsburg monarchs ‘invested’ the new money stock into wars and mostly unproductive ventures (including income-transfer-like and entitlement-like populist products). As a social commentator of the period mentioned in 1600: “The effect of an apparently endless flow of American silver into Seville had been to create a false sense of wealth as consisting of gold and silver, whereas true wealth lay in productive investment”. The leaders who held the purse spent the new ‘money’ and even used projected New World specie inflows as collateral for ever rising debt.

The result of all this for Spain who used to be the leading global Empire was to try to reform through higher taxation and that, with inflation, affected most the commoners and rekindled the embers of growing inequality.

Of course, later in the period, a resurgence of the plague and lowered birth rates didn’t help.

There was also noise about foreigners coming in to steal jobs.

Despite all this new unbacked ‘money’ that passed through Spanish hands, it did little to improve the situation on the ground for the common people.

Sounds familiar?

After Spain’s decline, many rightly observed that easy and unbacked ‘money’ had destroyed the Spanish work ethic but then it was too late.

For Spain, discovering America was a poisoned gift just like the discovery of apparently unlimited credit potential for the holder of the international reserve currency.

Carl-

Verily, the tale of Spain gold and silver is interesting.

BTW, total Bitcoin in circulattion is about $1.3 trillion. From nothing a few years ago. Backed by nothing.

But if someone offered me a Bitcoin to paint their average-sized house, I would do it.

There is an old somewhat crude joke out there, along the lines of two guys go home with their wives one night. No addition to GDP.

The next night the pair of husbands decide to swap wives...but the wives balk. Finally a "shopping day," paid in advance to each wife, of $500 by visiting hubby, is decided upon.

The deeds are done, and GDP rose by $1000 on said night.

But I agree with you, Spain should have invested in farms, plant and equipment, not wenches and wars.

Funny thing, if Spain just minted gold-plated lead bars, and said they were gold, kept under seal and which backed paper money, then Spain could have gone ahead and built farms, plant and equipment without the lucre from the New World.

Money is funny.

"Funny thing, if Spain just minted gold-plated lead bars, and said they were gold, kept under seal and which backed paper money, then Spain could have gone ahead and built farms, plant and equipment without the lucre from the New World."

With fiat currencies and with the advent of the USD as the ultimate anchor, one could argue that we've been reaching the ultimate financial alchemy stage. One could suggest that the illusion started with the backing of the future taxation capacity and is 'progressing' to the MMT stage when people have to believe that credit is purely created out of thin air.

It's puzzling that somebody with your specific thought processes shows discomfort with basic and regulated fractional reserve banking which really just was very timid step towards financial alchemy in comparison to the recent bold move towards easing and the incredibly reckless (my opinion) momentum towards extreme unconstrained debt monetization.

It seems a similar theme is playing out with the M2 growth mantra as motivation for optimism. When US central authorities print money (backed or unbacked) in our USD-backed global economy, they mostly decide the ratio of money to total assets and private money demand can't do much about it.

Venice, many centuries ago as a city state, had succeeded with an experiment using money printing but the key underpinning was that the support had to be temporary and had to be somehow reversed. How will that happen in your great again country?

Recently JP Morgan came out with a report indicating that cash balances were higher for many (not mentioned: as a result of some private participants lending to the government) and they are able to put a positive spin on the 'redistribution' phenomenon during the 'recovery'.

https://www.jpmorganchase.com/institute/research/household-income-spending/household-cash-balance-pulse-families/?jp_cmp=email_=stakeholdernote_=pulsectc

And yeah GDP and CPI measures suck but what else is there?

Oh and BTW the Treasury curve is flattening and if the Fed wants to taper they now face a 30-yr yield at 1.91. But we have to go through another debt-ceiling episode first..

Carl-

Verily, fractional reserve banking has always created "money" out of thin air. People who describe themselves as rockribbed conservatives, gold-standard stalwarts to the moon often fail to understand this point.

Fractional commercial banks print money, even when on the gold standard!

So, the commercial banks of a nation or economy can create too much or not enough money at any time, even without the Fed buying a single Treasury or toying with interest rates.

Minus the Fed, we are depending on commercial banks (who have their own interests) to create just the right amount of money. One problem is, banks can stop lending (printing money) when they think loans will not get back back. Sensible enough. Except that tends to crater the economy, in the real world, when banks in a group stop lending.

Theoretically, in free markets, adjustments are made and lower asset values encourage lending again...but you know, a citizen can get very anti-social after not eating for just a few days.

Well, a huge topic, and after puzzling these matters for a few decades, I agree with my late, great Uncle Jerry:

"If you are not confused, then maybe you do not understand the sitation."

I am just a wag. No worries, maybe you are right.

Nasdaq just hit a new high yesterday. When I was young (think Eisenhower) we were taught markets are forward looking. Hard to teach an old dog new tricks.

Oh, by the way thanks for the back and forth. The idea is to bounce ideas. Arrogance and humility required.

It's a weird world we live in and humans always try to explain the unexplainable.

i still end up feeling more educated after reading your perspective.

There are reasons to be optimistic. For example, from Yahoo finance:

"Even before the pandemic, a substantial portion of the country had little cash on hand to cover unexpected expenses. Roughly 40% of Americans would have had difficulty in covering a $400 expense in 2017, according to data from the Federal Reserve, suggesting that almost half the country was living paycheck to paycheck. In 2020, this figure was 36%, showing that stimulus payments have helped some Americans to be more prepared in dealing with short-term expenses."

So the optimistic and inflated view seems to suggest a positive trend. :)

On gold-backed currency.

If I remember my history, there were times when the supply of gold "artificially" controlled the value of the dollar.

Prof Friedman had a better, I think. He advocated a basket of commodities to back the currency. I agree with that- the concept of diversification.

You could manage the basket kind of like they do the S&P500. As specific items gained or lost value they could be included or excluded from the basket. Then the value of the commodities would respond to the changing economy over time.

Not that hard...on paper anyway.

Carl-

I enjoy and learn from your commentary also. The macroeconomy is an evergreen topic, ever worthy of perusal.

Wkevinw--

Verily, there are many commodities to "back" a currency.

The first metallic standard was silver, in Old China, and banks are still called "silver houses" in China.

One puzzler: The strongest currency today has no backing at all, and is not issued by a sovereign.

Bitcoin.

The world is in a violent deflation if you own Bitcoin. Makes no sense at all to me.

BTW, for those who believe in gold, the good news is you can safely harbor gold through gold funds or ETFs, for almost no transactional costs, through online brokerages.

Ergo, you can convert savings into gold at the click of a mouse, and then sell to make purchases.

The US dollar may defate in value in the years ahead, probably will.

So, gold is a very viable option for those so inclined.

Benjamin Friedman (as far as i know) discussed the possibility of commodity-based money as an intermediate solution between uncompromised hard and fiat soft money but identified three basic issues: technical issues, trust issues and timing issues. For the third issue, it looks like it's never a good time to discuss necessary reforms of the global international money system except in times of crises when unsustainable trends become obvious (forced cooperation). Mr. Friedman however correctly foresaw that soft money would inevitably lead to excess government 'investments' and (eventually) debasement of the 'currency' which started with the final delinking to gold in 1971 in favor of floating exchange rates backed by the ultimate taxing capacity of the US in USD.

A very interesting input here is the work that Mr. Benjamin Graham (father of value investing) produced. Mr. Graham had painfully survived a period when 'money' became disconnected with the real economy and thought it was important to establish a mechanism to prevent that link to be severed again. His commodities-based money system was not perfect and it was put aside. Mr. Graham believed in cycles.

News from Japan (recent 10% of GDP 'stimulus' announcement (WSJ):

"Lawmakers in both Mr. Kishida’s ruling Liberal Democratic Party and in opposition parties have advocated greater spending while generally not making a major issue of the debt. Some in the LDP say it isn’t a problem now because Japan issues debt in its own currency, the yen, and its inflation and interest rates are both around zero. The government is currently paying less than 0.1% interest on its 10-year bonds."

In a way this has become a self-fulfilling prophecy: the stimulus (it is felt by the crowd) has been rendered necessary (soon to be unavoidable?) as a result of a "struggling" economy.

i think there is a future for real-stuff-backed currencies; it's just not clear how it will come about.

what about the dxy??

Carl--

I wonder what physical asset could back a currency. Little lumps of yellow metal? The value of which is determined by jewelry buyers in China and India and central-bank purchases?

Oddly enough, some has said the great German inflation was tamed when the government acquired mortgages on real estate. This is similar to the Federal Reserve buying back Treasuries.

If you are worried about a sovereign nation being able to honor its debts, then surely the sovereign nation that has effectively bought back 50% of its debts (see Japan) is less-risky.

I call that Mobius-strip economics. Japanese taxpayers owe money to themselves.

Americans owe huge debts offshore, and I have been waiting for the USD to collapse since about 1979. I am running out of decades. I sometimes wonder if the declines in living standards across America are related to this relentless borrowing to buy offshore goods.

Interesting to note:

"Who Owns US Stock? Foreigners and Rich Americans. - Tax ...https://www.taxpolicycenter.org › taxvox › who-owns-...

Oct 20, 2563 BE — Our new analysis shows that foreign investors owned about 40 percent of US corporate equity in 2019, up substantially over the last few"

---30---

So when US multinationals have globalist ideals...do not be surprised. China is good!

My guess is the Fed should keep buying back UST until they own about 50% of the national debt. Maybe slowly, but still. Maybe they should buy US equities too, so at least some shares remain in American hands.

Well, Jerome Powell is the boss-man at the Fed for another four years. A lawyer by training, so maybe we have hope.

The Billion Prices Project (BPP) is an academic initiative at MIT Sloan and Harvard Business School that uses prices collected from hundreds of online retailers around the world on a daily basis to conduct research in macro and international economics and compute real-time inflation metrics.

Recession risk is low ?

University of Michigan data released today:

Consumer Confidence at 10 year low

Buying Conditions at the all time low

Inflation Expectations highest since 2008.

That does not add up to "low"

Benjamin,

A lot to unpack here. It’s a relevant exercise because fiat money is a social construct and, at this point, the USD is backed by ‘trust’ and the perceived capacity for present and future taxation by the state (unless you believe in MMT, more on that below).

-The German hyperinflation episode

It’s a relevant example if one aims to understand the importance of the ‘backing’ of a sound currency. Post WW1, the elephant in the room is the fact that Germany ended up on the losing side. Still, when comparing Germany and England, the English government went into debt with issues of debt that were clearly backed by future taxation capacity whereas the German government funded itself using debt monetization to an extent that, at one point, suddenly, the money situation spiraled out of control with a flight from currency. The inflation issue became most acute after the military occupation of the Ruhr by the French in January 1923. The German government decided to encourage passive resistance, making direct payments to striking workers and the payments were financed by discounting (lower yields than inflation) treasury bills with the Reichsbank. Massive discounting effectively became equivalent to fiscal transfer to the recipients of the loans.

Weimar Germany took a direction whereby government went into debt without any credible capacity to reach a sustainable path. When you refer to the government « buying » mortgages, i’m afraid you’re confusing the symptom for the disease. What, in fact, happened is that ordinary people lost trust in the centrally printed (literal printing then) currency (including farmers, who fed the populace) and there were various grassroots initiatives to use agricultural commodities as currency and, with the new currency regime, the government issued asset-backed bonds backed (at least linked to) by farm land and other landed property (and also industrial production assets) to match new currency issued. Reparation payments were suspended for a while and, after the end of 1923, the Dawes plan made reparation payments more palatable but the major factor behind the disappearance of inflation was the clear and defined commitment of the government to reach a balanced budget and very clear limitations (October 15 1923 Rentenmark Ordinance) on currency available to fund the operations of government, which was downsized. Money supply continued to grow but as a result of private sector initiatives despite relatively high interest rates (painful for some interest rate levels à la Volcker). As a result of inflation, tax payments had been delayed and when inflation became under control, tax collection became timely and increased significantly, helping with government budget balance.

A potential conclusion is that money backing is critical to a sound currency and moving away from a real-economy link or anchor comes with the significant risk related to public officials playing with fire. Interestingly, the new era low interest rate environment has allowed the party to get going much longer that would have been possible otherwise. Is that a good thing? Is Japan showing the way? More on that later..

Of course, the USD still has potentially amazing taxing capacity and has the added margin of safety related to high levels of protection from a flight from currency due to an unrivaled international reserve currency status. Where would global people run to?

...

...

^Message: The US government is far from Weimar-style inflation and sliding towards MMT-type debt financing is not a sufficient condition although it would be a necessary step, a step linked to potential non-linear change scenarios. MMT-like transfers, similar to Weimar Germany, could be like when people start hitting hard drugs. Things could go downhill very rapidly.

Disclosure of a potential bias: easy money is like drugs; short-term fun in exchange for long-term hardship, or the opposite of delayed gratification. FWIW i think the US is now failing the marshmallow test but suspect that she will reasonably be able to restructure, before it’s too late and, until then, after money ‘highs’ and in due course, fully expect downward money velocity secular and excessive-debt-related forces to more than compensate upward money supply growth driven by noble intentions.

Carl-

Let's pick up this discussion in Scott Grannis' latest and greatest post.

Innovation fosters resilience in hiring patterns. "Exciting times for employment opportunities!

Positive Hiring Trends Emerge in India Despite Slowed Y-o-Y Growth

Post a Comment