Late August last year was a time of rampant pessimism, incessant talk of an imminent double-dip recession, and lots of hand-wringing about the risk of European sovereign debt defaults. The major themes back then were very similar, in fact, to the themes of today. To counter the pessimism, I ran a post just over a year ago with 20 bullish charts, which through sheer good luck coincided almost to the day with the onset of an equity market rally that extended through April of this year. Bullishness was definitely not in vogue back then, and neither is it today. So I thought it might be interesting to revisit those charts to see how the economic fundamentals might have changed. The charts that follow are updated versions of the charts I showed last year, and in the same order, so you can open the original post in a separate window and compare the original to the updated chart and commentary.

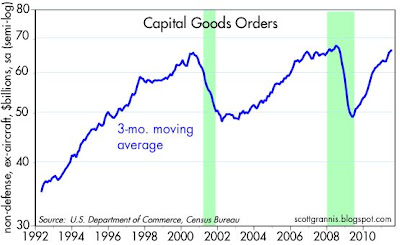

Last year I noted that strength in new orders for capital goods reflected rising confidence on the part of business, and it also augured well for future growth. Since then, capital spending has continued to rise at an impressive rate, forming a clear V-shaped recovery. This indicator continues to be very bullish for the economy's future prospects.

Rising industrial production was a bullish indicator last year, and it continues to move in a positive direction. Granted, the pace of increase has slowed somewhat from what it was a year ago, and this coincides with what we know has been a slowdown in the economy's growth rate in the first half of this year.

This index of spot commodity prices has risen almost 20% since late August of last year. Back then, I noted that rising commodity prices reflect "strong growth in global demand and/or accommodative monetary policies worldwide [and] all but preclude the deflation that so many are worried about, and rule out the existence of a double-dip recession." That remains the case today.

Trade was bullish for growth last year and it continues to be today. Exports are growing at strong double-digit rates, and have surpassed their pre-recession highs. The global economy is likely still expanding, and this provides a strong backdrop for continued U.S. growth.

Corporate credit spreads today are 30-50 bps higher than they were in late August '10, and they are trading at levels which have preceded recessions in the past. This would be an obvious red flag if it weren't for the fact that spreads have widened primarily because Treasury yields have plunged to historic lows. The average yield on a high-yield bond hasn't risen at all over the past year, and has in fact dropped from 8.5% to 7.75%. Investment grade bond yields over the same period have risen marginally however, from 4.3% to 4.5%. I don't think this adds up to an obvious negative, but it is certainly less positive, and it undoubtedly reflects the threat of collateral damage from possible Eurozone sovereign bond defaults. Regardless, the fact that 2-yr swap spreads are still within a range that would be considered "normal" (15-35 bps) helps offset the marginal deterioration in corporate credit spreads. The low level of swap spreads is a good indication that the U.S. banking system is healthy and the level of systemic risk in the U.S. economy is low. The risks are mainly in Europe.

Everything I said last year about the yield curve applies again this year: "The slope of the yield curve has been an excellent leading indicator of recessions and recoveries for many decades. The curve typically flattens or inverts in advance of recessions, but today it is still very far from being flat or inverted. The curve is strongly upward-sloping, which reflects easy money and expectations that monetary policy will eventually need to tighten as the economy improves. We've never seen a recession develop when the curve was this steep and monetary policy was this easy." Although the yield curve today is somewhat less steep than it was a year ago, the real Fed funds rate is more negative, and Fed policy has become even more overtly accommodative than ever, with the Fed having pledged to keep the funds rate very low for at least the next two years. In sum, monetary policy remains a strong reason to expect continued economic growth.

Last year I noted that "the fact that the demand for temporary and part-time workers is steadily increasing may not guarantee a continued recovery, but I think it argues strongly against a double-dip recession being underway." Today we see that demand for temp and part-time workers has been relatively flat in recent months, whereas it was increasing at this time last year. I don't think this is bearish, nor does it rule out a double-dip recession. It most likely reflects the fact that the economy has been in slow-growth mode for most of this year.

Auto sales in the second quarter of this year suffered a setback in the wake of the Japanese tsunami supply-chain disruptions, but they look to be recovering. Despite the rather severe setback, sales are still up 5.6% from their August '10 levels. This remains a positive, but less so, due to the slower pace of growth this year.

Announced corporate layoffs this year are marginally higher than they were a year ago, but they remain at very low levels from an historical perspective. There is no indication here of any meaningful deterioration in the jobs market, especially when combined with the relatively flat behavior of weekly unemployment claims this year.

Last year's comment for the most part still applies today: "China and almost all emerging market economies are growing like gangbusters, and global trade is recovering nicely. What's good for emerging market economies is good for everyone, since the more they produce the more they can buy from us." I note however that the pace of growth in many emerging market economies has declined measurably in the past year. Brazil, for example, has slowed from 9.3% year over year growth last year to 3.1% as of June '11. This remains a positive for the U.S., but less so than before.

Corporate profits have been nothing short of spectacular in recent years, now exceeding all prior records. It's very hard to see a recession developing when profits are robust. Strong profits are the result of significant restructuring and cost-cutting efforts, and that means that a lot can go wrong with the economy before corporations have to undergo significant retrenchment. Looking forward, corporations have significant resources they can mobilize to fund expansion and new job formation, should the political environment and the outlook for the Eurozone improve.

According to this Bloomberg index of financial conditions, there has been some meaningful deterioration in the financial fundamentals in recent months. Moreover, the index today is low enough to signal the possibility of a double-dip recession. Of all the charts reviewed so far, this is the first to clearly signal concern. I would note, however, that the deterioration in financial conditions can be traced directly to the rising risk of Eurozone sovereign defaults, which have introduced great uncertainty into all markets—not to any deterioration in U.S. fundamentals. As I've said before, it's Europe, stupid.

Both of these measures of shipping costs have declined in the past year. From what I gather, this decline has much more to do with a significant increase in shipping capacity in recent years, than with any significant decline in shipping demand. Still, it probably adds up to a modest negative.

Last year at this time, it looked like prices for residential and commercial real estate had bottomed, and I thought that this effectively eliminated real estate and construction as sources of further economic weakness. Since then, prices have drifted a bit lower, and the recovery I hoped to see by now has so far failed to materialize (a fact that is also reflected in the recent decline in the stocks of major home builders). While I continue to expect things to improve, these charts suggest otherwise, but I don't think they are a significant negative. I note that construction spending has been flat so far this year.

Although the year over year growth in the Leading Indicators has dropped a bit since August '10, there is nothing here to suggest the approach of a double-dip recession. On the contrary, this indicator continues to strongly point to continued economic expansion.

The ISM manufacturing index last year was quite a bit stronger than it is today, so there has been some meaningful deterioration in this measure of the economy's growth fundamentals. Nevertheless, the index is still substantially above the levels that in the past have signaled the onset of recession, and is consistent with a modest pickup in growth to the 2-3% range. Additionally, I note that the ISM service index this year is roughly unchanged from its levels of last year.

In conclusion, most of these charts still support a bullish outlook (albeit a less bullish outlook compared to a year ago), especially in the context of a market that once again has become extremely bearish. Although there has been some deterioration in the economy's growth fundamentals over the past year and in recent months, there is still no indication that the economy is at risk of another recession.

Thursday, September 8, 2011

Subscribe to:

Post Comments (Atom)

14 comments:

M2 money supply took another $30 billio leap last week. Could this still be Europeans stashing money in US banks? Seems like it's gone on for quite a while now.

werserwi

Very impressive!

Scott,

Thanks for revisiting this. It appears the economy and markets are rhyming with last year. If the equity markets behave in a similar fashion, we are in for a fall/winter rally that carries into January 2012. Incidently, the market has taken back all of those gains past november 2010. IMO equities are offering truly uncommon values vs bonds.

Another tour de force by Scott Grannis.

I am especially impressed by corporate profits--this is what the private sector can do, eliminate costs and still produce. They take opportunities to demobilize resources, when possible.

Compare that to our coprolitic federal agencies, which only cost more every year.

Does society exist to support the economy, or does the economy exist to support society?

None of your chart metrics reveal anything about how the economy works in people's lives.

Awesome post. I thought your bullish case last year was solid. This year? I'm not so sure...Europe scares me. At least today there is little risk of more massive regulations (although they keep trying hard).

I was just 30 feet from Ben Bernake in Minneapolis today for his speech. The most significant thing he said was:

"While prompt and decisive action to put the federal government's finances on a sustainable trajectory is urgently needed, fiscal policymakers should not, as a consequence, disregard the fragility of the economic recovery."

In other words, cut spending, lower tax burdens. The problem is Obama hears this same line and will want to spend another trillion dollars and tax millionaires and billionaires.

This was the third blogpost from Scott Grannis on his blog in September 2008.

It was ISM-M.

The economy was already in a NBER recession for eight months.

Grannis (like his club for growth buddy, Wesbury) is a useless prognosticator.

Thank you for providing updates.

yep. no reason to be cautious, careful or skeptical. grannis proves it makes sense to cheerlead your way to prosperity. uh. THE EUROPEAN DEBT CRISIS IS A SEVERE LIQUIDITY SHORTAGE, ABSENT A FULL GUARANTEE OF ALL SOVEIRGN DEBT.

Note the excellent chart on the drop in real estate values, both commercial and residential.

Commercial has actually taken a bigger whack then residential.

No Fannie or Freddie involved.

Be wary of politically correct explanations for anything, from the left or the right.

I enjoy your site and commentary, Scott. I am a complete layperson when it comes to economic issues, but I guess I don't understand what all this means. While the charts are interesting, what does it tell us that the charts were bullish a year ago, nothing really got better in the real economy (perhaps worse, actually) and today those charts are still bullish, albeit less so? Is that good? That seems bad to me. If the weatherman tells me it is going to get sunny in the afternoon, but I look out and it's raining, and the same thing happens everyday for a week, then I'm starting to care less about what the weatherman is saying, and more about what it going on outside my window.

Fuddsker tells the truth!

If you have followed my posts over the past several weeks, you would know that I think the market is extremely bearish. Gold at $1900 and 10-yr Treasuries at 2% are symptomatic of a market that is expecting extremely bad things to happen. I think the charts show that this degree of pessimism is unwarranted. The underlying economic and financial fundamentals, while certainly not perfect nor as good as they have been, are still in reasonably good shape.

To use fuddsker's analogy, it's as if the weatherman (the market) were predicting the coldest weather on record, but when you look out the window you see that it is only 60º.

We live in a bifurcated economy, one sunny track for the winners (maybe the top 15%) and another dismal track to a hand-to-mouth existence for the rest.

Post a Comment