At this point it's almost perceived wisdom that the economy will soon slip into a recession, with the only doubt being the degree of severity. I remain skeptical, however. It's true that the Fed is very tight and the yield curve is very inverted—both being classical precursors to recessions in the past. But there are other precursors to recession that are not present today, namely wide and rising swap and credit spreads. And while some observers note with concern the unprecedented decline in the M2 money supply over the past year, I view it as a welcome return to something more normal—after all, M2 is still significantly higher than its historical trend vs nominal GDP. To be sure, the growth in private sector payrolls has slowed in recent months, and appears likely to slow further (from 4-5% a year ago to now 2%), but it's still far from being in recession territory.

I also think there's a good chance that the market is overlooking the fact that the current round of Fed tightening is unique in one important respect: the Fed is pushing short-term interest rates higher directly, without draining bank reserves (as they always did in the past). That means that this time around there has been no shortage of liquidity in the banking system, and that's a big deal. Liquidity (e.g., ample amounts of cash and an abundance of risk-free, interest-bearing securities like bank reserves and T-bills) is essential to functioning and efficient markets. Efficient markets, in turn, function as "shock absorbers" for all sorts of ups and downs in the economy. Are you comfortable holding certain high-yielding corporate bonds but afraid that all bonds will lose value in a rising-rate environment? Then use the swap market to neutralize the risk of higher rates while still retaining exposure to the companies you like. Swap spreads are pretty low these days, and that means you can easily swap out of the risk you are uncomfortable with. Efficient markets allow people to tailor their risk profile to suit their particular appetite for risk, instead of just bailing out of everything. Liquid and efficient markets are like being in an open-air theater when someone yells "fire!" There's no panic, because there are no crowded doors you have to exit through.

All eyes will be on Wednesday's April CPI release, with most expecting to see no change in the year over year measure (5.0%). I think there's a decent chance of seeing 4.8%, which would also mean that over the past six months, inflation will have been rising at a mere 3.1% annualized rate. If I'm right, it will likely be because the increase in homeowners equivalent rent will be decelerating, as it began to last month. (See this post for details.) An easing of inflation would go a long way to restoring faith in the future, since the market would view the Fed's job as mostly done—with declining short-term interest rates breathing life into most areas of the economy.

Here are a few charts to illustrate these points:

Chart #1

Chart #2

Chart #1 shows the level of 2-yr swap spreads. In normal times, this spread trades between 15 and 35 bps. Today it was smack in the middle of that range. Thus there is no sign of any unusual stress in the bond market, and to judge by this fact, liquidity is still abundant. This spread has spiked to 60 bps or more in advance of past recession, as Chart #2 shows.

Chart #3

Chart #3 shows the level of Credit Default Swap spreads. This is a highly liquid barometer of the health of corporate profits (tight spreads indicate strong profits, rising spreads indicate deterirorating profits). As with swap spreads, there is no sign of distress here. Indeed, the market seems to have largely brushed off the risk associated with the collapse of Silicon Valley Bank last March.

Chart #4

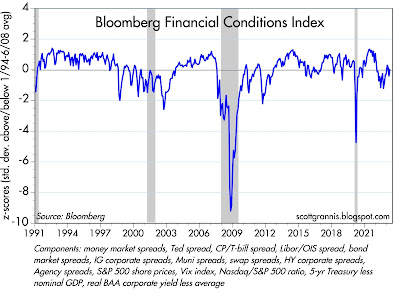

Chart #4 is Bloomberg's index of financial conditions. It aggregates all sorts of sensitive, market-driven indicators (see the components listed at the bottom of the chart). Today, financial conditions appear pretty much normal, whereas they reliably decline in advance of recessions.

Finally, my contrarian instincts perk up whenever I hear almost everyone warning about an impending recession.

15 comments:

Powell is letting the economy burn itself out, just like Volcker did. He's attempting a "soft landing".

N-gDp is still too high.

https://fred.stlouisfed.org/series/A191RP1Q027SBEA

Reserve Bank credit shows inconsequential tightening.

https://fred.stlouisfed.org/series/RSBKCRNS

The FED's preferred inflation index shows minor deceleration.

https://fred.stlouisfed.org/series/PCEPILFE

The FED's "holding pattern" will impact R-gDp more so than inflation.

Scott, thank you as always. It is most helpful that, when presenting the technical points (money flows, yield curve, etc), you consistently explain how that information is relevant and actionable. It is a gift - especially for those (like me) that are not equipped to master monetary theory. ;-)

“We are all Keynesians now”. The Keynesian economists have achieved their objective, that there is no difference between money and liquid assets.

See George Selgin “I’m glad to see, upon reading on, that Prof. Summers explains himself in the comments. Still, I was taken aback upon first seeing this tweet by him attributing SVB’s troubles to its having done what all banks always do! (borrowing short to lend long).

Money is not neutral (“affect nominal variables and not real variables”). ” inflation continues to outpace Americans’ rising wages – for the 25th straight month”.

See: “Quantity leads and velocity follows” Cit. Dying of Money -By Jens O. Parson

The FED should discontinue publishing income velocity. Vi can move in the opposite direction as Vt, the transactions' velocity of money (Irving Fisher's truistic metric, not Friedman's). A bank originating a mortgage, which it distributes to a nonbank, e.g., a GSE, increases Vt, but does not affect Vi (i.e., increases AD).

Always a privilege to read a Scott Grannis post. I always feel better in touch with the US economy after each post.

BTW, China is slipping into deflation, and Japan cooling fast.

The Fed seems to be getting the message, with buzz about a "pause" at next meeting.

To reverse the deceleration in R-gDp (FOMC schizophrenia: Do I stop because inflation is increasing? Or do I go because R-gDp is falling?), Congress needs to drive the banks out of the savings business (which won’t reduce the system's size).

The 1966 Interest Rate Adjustment Act is prima facie evidence.

Classic deleveraging starting. Can cause false signals if focused on just liquidity.

Bank failures: it’s all about liquidity (substack.com)

FRANCES COPPOLA

#1 “the NY DFS’s chart above shows that the deposits that fled were predominantly interest-bearing”

#2 “a large concentration of uninsured deposits, without sufficient funds management contingency plans,”

Large Time Deposits, All Commercial Banks (LTDACBM027NBOG) | FRED | St. Louis Fed (stlouisfed.org)

Dr. Lester V. Chandler (“After earning his doctorate in economics at Yale University, Chandler taught at Dartmouth and Amherst before accepting a position as Gordon S. Rentschler Memorial Professor of Economics at Princeton University”):

1961 “Professor Pritchard is quite right, of course, in pointing out that commercial banks tend to compete with themselves when the issue savings deposits”

Commercial banks pay for the deposits that the system already owns. I.e., all time deposits, interest-bearing deposits, have been shifted from demand deposits.

Savers never transfer their savings outside the payment’s system unless they hoard currency or convert to other National currencies. So, savings flowing through the nonbanks never leaves the commercial banking system. It’s stock vs. flow. The only way to “activate” monetary savings is for their owners, saver-holders, to spend or invest outside of the banks.

Eurodollars and the U.S. Monetary Supply - Review - St. Louis Fed (stlouisfed.org)

Fed: “Based on estimates over the period for 1973-79 — a period of rapid growth in the Eurodollar market— Eurodollar flows were shown to have only minor effects on the U.S. money stock. This evidence warrants the conclusion that the Eurodollar market does not pose a serious threat to the ability of the Federal Reserve to control the money supply.”

Disintermediation for the DFIs can only exist in a situation in which there is both a massive loss of faith in the credit of the banks and an inability on the part of the Federal Reserve to prevent bank credit contraction, as a consequence of its depositor’s withdrawals.

There was no disintermediation for the commercial banks until Bernanke “did it again”.

The removal of Reg. Q ceilings for the banks (the nonbanks were unregulated prior to 1966), was a monetary policy blunder.

Discounting under Volcker wasn't at a "penalty rate".

BAGEHOT’S DICTUM: the central banks should lend early and ‘without limits’ to solvent firms at a ‘higher interest rate’ with ‘good collateral’.

Discounting was made a penalty rate on January 6, 2003

One thing worries me.

The Federal Reserve is now paying 5.15% interest on excess reserves.

Commercial banks are getting a nice yield for doing nothing and taking no risks.

I get the feeling the Fed is tight with commercial bankers. Just a thought.

Maybe that will choke off banking lending.

Same thing happened in the early stages of the GFC. Remunerating IBDDs induces nonbank disintermediation, an outflow of funds, or negative cash flow. It inverts the short-end segment of the retail and wholesale money market funding yield curve. During the GFC the nonbanks shrank by 6.2 trillion dollars while the banks expanded by 3.6 trillion dollars.

The Covid-19 inversion is even more pronounced.

“The 3-month annualized rate of total CPI less shelter has been running steadily at 1.2%.”

What is the best way to track or chart swap spreads using publicly available information?

Post a Comment