Here's Bloomberg's take on today's March CPI release: "data showed inflation moderated last month, but not enough to forestall the Federal Reserve from raising rates at least one more time this year."

My take: There are only two things you need to know about inflation today: 1) without the Owners' Equivalent Rent component (which makes up about one-third of the CPI), the CPI would have declined at a -1.6% annualized rate in March, and 2) OER inflation has peaked and will almost surely decline significantly in coming months. In short, our national inflation nightmare is over. If the economists at the Fed can't understand this, they should be fired. There is absolutely no reason the Fed needs to raise rates further, and every reason they should begin cutting rates—beginning with the May 3rd FOMC meeting if not sooner.

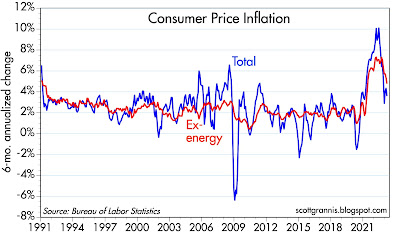

Chart #1

Chart #1 shows the 6-mo. annualized growth of the Consumer Price Index and the ex-energy version of the CPI. Both show that on the margin, inflation has declined significantly from its June '22 peak. Headline inflation is now running at about a 3.5-4% rate, not the 5% rate cited by most news sources today.

Chart #2

Chart #2 shows the one- and three-month annualized rate of change of the Owners' Equivalent Rent component of the CPI. Here we see a dramatic slowing in this major source of CPI inflation that has only just begun. And as mentioned above, without the 6% annualized March increase in this component, the overall CPI would have actually declined. If OER continues to moderate, as it almost undoubtedly will, headline inflation will all but vanish in coming months.

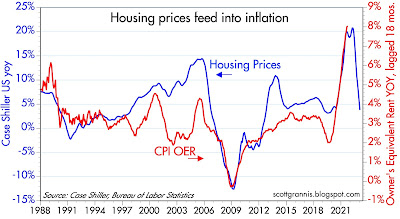

Chart #3

Chart #3 shows how changing housing prices feed into the OER component of the CPI. It takes about 12-18 months for changes in housing prices to show up in OER. Nationwide housing prices peaked almost a year ago, and now OER inflation has peaked. This is a big deal. It's almost as if we have advance knowledge of what the CPI will be doing in coming months: CPI inflation will almost certainly decline, given the weakness in housing prices (which won't go away unless and until mortgage rates come down significantly).

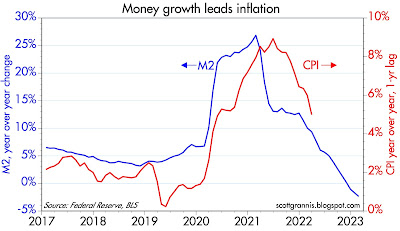

Chart #4

To paraphrase Wayne Gretsky, the Fed should be focused on where CPI is going, not on where it has been. It's on its way to zero, and that means the Fed should cut rates—and the sooner the better.

UPDATE (April 13). Today's Producer Price Index news just reinforces the theme that inflation is on its way out:

These measures are different ways of looking at the early stages of the inflation pipeline. Very little to worry about!

32 comments:

great insight! too bad I am afraid that Fed is probably still going to raise the rate in May. do not really understand why they do not see what you see.

Thank you Scott. Fascinating AND clear, as usual.

This may be an unfair question, but if you could pretend you are the Fed for a minute (and ignore all that you posted above), what rationale could you come up with to RAISE interest rates at the 5/3 meeting?

They clearly have the same data available to them that you do, yet are disconnected somewhere along the line in what to do with it. I'm curious where that disconnect may lie. I guess it's possible, but it's difficult for me to assume they're just blind or stupid, or that they're not willing/able to extrapolate. I have to assume some ulterior motive is causing them to ignore the data (or look at other data?) and wonder what you guess it might be and how they could even pretend to justify the decision.

One thing we can always count on with Scott, no "hedging"! You always says exactly what is on your mind. Right or wrong, no equivocation and that is admirable. ESPECIALLY when I agree! There is no doubt, inflation is in the rear view mirror BUT Samuel may have the right of it, I have said many times before, the damn Fed is always behind the eight ball.

This thread feels like Wall St consensus. I do not understand the disconnect?

https://twitter.com/bobeunlimited/status/1646132188717412353?s=46&t=RMHlxkwcr5wESIDLrpx9og

Deflation except for shelter/owners equivalent rent, agreed.

As Downtown Adam Brown said, they (Fed) aren't stupid (although I am getting less convinced of this), so there is some other motivation for things if they raise again.

Thanks for the post.

Scott Grannis on target again. This is getting tiresome.

In May we are getting one raise or a pause, as of now it seems very unlikely there will be a cut; The Fed doesn't even play checkers, forget about Hockey...

Scott, you are so right. And you're additionally right to laser in on housing/OER's influence on inflation stats.

BC is a diplomat when he says it's tiresome. I think we've moved on to the asinine phase of the program!

Unfortunately it looks like the Fed's plan is to wait until things get really bad before cutting rates because they are afraid inflation will rebound. I guess a few bank failures here and there isn't bad enough. Maybe wait for another credit freeze?

Great post Scott! Some urgency should be communicated to the sleepwalkers at the Fed.

Beyond the immediacy of interest rates, the Fed needs to recognize that the pandemic and shut-downs were very disruptive to business operations and planning. There hasn't been enough people working and producing at normal capacity. The Fed's effort to create business uncertainty, a recession and unemployment for millions of people is 100% counterproductive to improving the supply side of the inflation equation. Notably, the Fed has already caused housing starts/construction to plunge when we already had been in a big production deficit for most of the last decade.

No one disagrees that rates needed to get to at least 3% or so, but the Fed needs to let our remarkably productive economy get back to normal and do its thing. We need more supply, not less. We need more workers producing, not fewer.

The Fed was behind the curve when inflation was on the way up, and it looks like it will be behind the curve on the way down. Too bad. If they had stopped raising rates two or three meetings ago, we probably could have avoided a recession.

Re "pretend you are the Fed for a minute (and ignore all that you posted above), what rationale could you come up with to RAISE interest rates at the 5/3 meeting?"

One possibility is that the Fed could decide to worry about the ongoing rise in the stock market. They hate to see signs of prosperity, since they think that is antithetical to a reduction in inflation pressures (i.e., they simply resort to Phillips Curve thinking). Another possibility is that they might feel that another hike is simply an insurance policy to lock in the improvement that is now obvious. In addition, it would give them that much more leeway to lower rates when the recession they are now predicting hits. "I'm going to beat you so hard you'll love me when I stop."

It's almost consensus that inflation is coming down from all the analysis and forecast I've seen out there, so the Fed should be clued in. What if they are on another mission, that is to leave the low int rate environment and never go back ?? Everyone looking for low rates to get the party started again may be dissapointed. This low rate environment contributed to assflation (asset inflation), inflation and wasnt exactly risk free.

Wesbury disagrees.

https://www.ftportfolios.com/retail/blogs/economics/index.aspx

It is interesting how two economists, schooled similarly can disagree so much. Back when I was in school, about 300 years ago, I distinctly remember one of my profs calling economics a "soft-science". Indeed!

I have an intellectual crush on Judy Shelton. Shame on our nation's politics for nixing her nomination to the Fed. Of all the mindless things we see these days this ranks up there...

@scott grannis and @downtown adam brown:

Re: "pretend you are the Fed for a minute (and ignore all that you posted above), what rationale could you come up with to RAISE interest rates at the 5/3 meeting?"

I think the simplest rationale is that markets currently have priced in around a 75% probability of a 25bps raise. Not providing a 25bps raise might then result in a (small) increase in inflation expectations. Through the expectations channel that might result in a (small) increase in actual inflation over the counterfactual.

Even Paul stinking Krugman gets it...

https://markets.businessinsider.com/news/stocks/paul-krugman-inflation-federal-reserve-interest-rates-cpi-pce-2023-4?amp

I guess fundamentally the Fed is a political organization, so the quantitative/objective information can be obscured by that (i.e. public relations/fed speak/perception). So, they may hike 25bps because of that-not because the numbers say they should.

They have a lot to do (a lot of it they do not do very well...)

https://www.wsj.com/articles/the-feds-climate-studies-are-full-of-hot-air-environment-propaganda-activism-banking-crisis-recession-federal-reserve-c47492e7?mod=djemalertNEWS

.

Scott,

As always enjoyed your latest analysis. Could you comment on the following two observations.

1. In the March CPI, gasoline fell 4.6% for the month. As gasoline comprises 5% of the CPI, gasoline’s price drop caused the CPI to drop .23 of a percent in March. Since mid March so far, much to my surprise, WTI has rallied from $67/barrel to $82 or over 20%.

Gasoline prices at the pump lag WTI prices by a week or two and from my observations are up 50-60 cents in April or 15-20%. This suggests that the difference between March and April will cause the CPI to rise a full percent on gasoline alone taking inflation back to 6% on a yearly basis.

2. Since the 2 recent bank failures and stress to banks, the Fed went from QT back to QE in a big way which I assume has increased the money supply in big way. Among other things that action has caused the dollar to fall sharply which should cause inflation in the US to go up. It appears that the central banks in general and the Fed in particular, reverse course dramatically on the money supply whenever there is a problem with the economy. Your position is that inflation is a by product of the money supply which I, to a large degree agree with. How can we say inflation is gone when we have no idea of future Fed actions, especially when we look at their track record.

Why is gold going up then?

Although inflation has been falling, it foresees easing that will lead to more inflation. Although these higher interest rates are a risk to this scenario, people are betting that the Fed will always cave, as it just did with the "new" term loan facility. Ironically these higher interest rates are not being paid by the banks, but are being enjoyed by the banks, at the expense of the Fed, and the eventual expense of the taxpayer, or more likely, future inflation.

Question to Scott or Salmo please: What is wrong with a gold standard? The thinking that a fixed amount of currency which leads to a gradual deflation (good thing) leads to economic busts makes no sense to me. Why does currency have to increase with growth? It is infinitely divisible after all.

Great post

The so-called legal link to gold, or the "gold standard", prior to the "gold cover" bill of March 19, 1968, was fictional, the economic tie tenuous, and its protection was another myth. For example, in April 1933 we nationalized gold, made the dollar inconvertible, and by administrative fiat capriciously raised the dollar price of gold in a series of steps from $20.67 to $35 per ounce. All of this was done even though we were a creditor nation and had a chronic surplus in our balance of payments.

It was solely the Pentagons fault that the U.S. $ ceased to be convertible into gold, as the private sector, contrary to the public sector, ran trade surpluses up until the dollar was no longer convertible into gold.

Gold is going up because the US $ is going down.

Thank you Salmo. I guess you mean by the Pentagon the war in Vietnam.

However, I was talking more about the period from the mid/late 1800s until the first World War when most of the western world was on a gold standard, and which is blaimed for boom and busts of the period. But I do not see any proof or relationship of this.

The U.S. had a net liquidity deficit in every year since 1950 (with the exception of 1957), --up to 1976, when the private sector contributed its first trade deficit. These deficits were entirely the consequence of excessive U.S. government unilateral transfers to foreigners (re: foreign policy – solely our far flung military bases and personnel).

During all this time the private sector was running a surplus in all accounts: merchandise, services and financial. The Vietnam Ten-year War administered the coup d’etat to our gold bullion standard. By 1968, in an effort to keep the dollar at the $35 par, we had exhausted nearly two thirds of our monetary gold stocks, or approximately 700 million ounces to about 260 million ounces.

It is economically advantageous for creditor nations, and for the world economy, if creditor nations operate with trade deficits: deficits proportionate to their creditor status. That is, the deficits should be large enough to enable the nationals of debtor nations to acquire a sufficient amount of foreign exchange to enable them to service their international debts.

The one factor that explains our paradoxical situation is the continuing high demand for dollars by foreigners for long-term investment in the U.S. (bridging the payment's gap in our trade deficits).

It is in fact unprecedented that a country could have chronic foreign deficits and not have its currency drop sharply in the foreign exchange markets. This is the first time that a reserve currency country could operate with chronic international deficits and not have its currency “dethroned”.

To be effectively competitive in foreign markets, requires that we sell lower unit costs and higher quality products. This means concentrating on production, innovation, and product quality. It means giving workers a financial stake in increased productivity (share in profits, etc.).

Sheila Bair: "The Fed needs to hit pause on further rate rises to provide time to assess their impact on the financial system."

https://www.ft.com/content/b860ebb6-f202-4ec6-a80c-8b1527c949f4

Sheila Bair for Sec. of the Treasury, please.

"About 40% of American stocks are owned by foreigners and about one-third of corporate bonds. If foreigners start fleeing, both plunge."

What If the Dollar Falls? | Mises Wire

See The Eurodollar contract was discontinued into SOFR.

https://www.clarusft.com/the-eurodollar-is-no-more/

If the FED cuts the O/N RRP rate (which is dominated by foreigners), the dollar will fall.

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202304

Short-end, one month, is way below two month bucket. Tax receipts?

Tax Receipts: Californians do not have to pay a nickle until Oct (2022 tax or 2023 estimates!) because of the Fed Gov't's liberal use of "disaster zones" (an unusally wet winter in Calif). They didn't think this through very much.

"It is in fact unprecedented that a country could have chronic foreign deficits and not have its currency drop sharply in the foreign exchange markets. This is the first time that a reserve currency country could operate with chronic international deficits and not have its currency “dethroned”..."

Salmo: So Dick Cheney was right... Deficits don't matter... and as long as the Pentagon plays boogeyman to global peace, there will always be fear & misery & need for save haven in this world-- so any "fault" of the Pentagon might seem ongoing, yet advantageous, in fact a pre-requisite to sustain Dollar dominance means generating scarcity of Dollars at-will; ginning-up fear & conflict b/c TINA...

Post a Comment