It all began earlier this year when the M2 numbers began to show a significant slowdown, a development I have highlighted at length in previous posts. It's now pretty clear that the surge in M2 was a one-off phenomenon, fueled primarily by a monetization of multi-trillion-dollar-deficits which began in 2020 and continued through at least the third quarter of last year. Since then the federal deficit has plunged and M2 growth has gone flat. The thing that was driving inflation on the margin was money printing designed to enhance the "stimulus" of government handouts, and that has ground to a halt. That's great news, but the lags between money and inflation are "long and variable," according to Milton Friedman.

There's still a lot of inflation in the pipeline which will be showing up in coming months and quarters, even though the source of rising inflation has been all but extinguished. Soaring housing prices in recent years are now boosting rents, and will do so for at least the rest of this year; rents comprise about 30% of the CPI. Wages and salaries are rising, but they are likely to keep ratcheting up until the economy eventually adjusts to a new, lower-inflation equilibrium, and wages invariably lag rising prices. Energy prices have turned down in a big way in the past month, but lots of other prices are still moving up to offset increased energy costs that were created months ago. Commodity prices are plunging of late, but it will take months before commodity-derived products begin to reflect those lower input costs. And don't forget monthly social security payments, which are due to increase by a significant amount early next year based on the recorded inflation this year, which could well be more than the 5.9% adjustment that was made to 2022 payments. Think of this as "inflation momentum" which will take time to dissipate.

The market is now beginning to look across the valley of still-high inflation this year to the other side, when inflation news will start improving. Markets are good at reading the inflation tea leaves; if only politicians were so smart.

So here are the inflation tea leaves that most impress me, and which can only be the result of a sharp moderation in the growth of M2 money. Taken together, these developments are the polar opposite of what you would expect to see if the Fed were making a too-loose mistake.

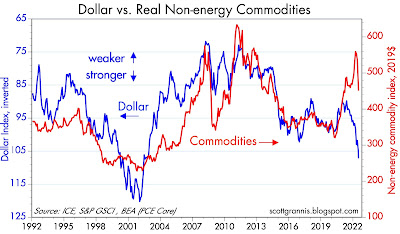

Chart #1

Chart #1 compares the level of the dollar (inverted) to an inflation-adjusted index of non-energy commodity prices. A strong dollar has almost always coincided with weak commodity prices, but we saw just the opposite in the past two years. Now, rather suddenly, commodity prices are diving, responding in more typical fashion to the fact that the dollar is quite strong these days. Copper prices are down 30% from their high earlier this month, reversing about half what it gained over the past two years. "Dr. Copper" is famous for reflecting changes in underlying economic and financial fundamentals.

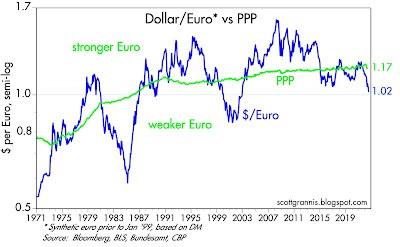

Chart #2

I first created Chart #2 about 40 years ago, and I have been updating it ever since. It's done a pretty good job, over the years, of comparing actual currency values to their "fair value" which is otherwise called purchasing power parity. If my estimates are correct, a dollar spent in Europe at the exchange rate of $1.02 per euro buys roughly 15% more stuff than it does in the U.S. We leave soon for 2 weeks in Italy, and I'll have a chance to test whether my calculations of PPP are correct.

The larger story is that a strong dollar means the world's demand for dollars is very strong, and that is helping to soak up all the extra M2 that was printed in prior years.

Chart #3

I commented frequently in the past year or so that gold was not moving higher on news that inflation was exceeding expectations because gold rose in anticipation of higher inflation today years ago. The recent weakness in gold is thus best interpreted as the gold market anticipating lower inflation in the years to come.

As the chart suggests, gold has been slow to respond to expectations for higher real interest rates (aka Fed tightening via higher real interest rates), but there is reason to think that gold has begun to catch on; Fed tightening today will result in lower inflation tomorrow.

Chart #4

Thanks to the introduction of TIPS (Treasury Inflation Protected Securities) in 1997, we have a direct reading of the bond market's inflation expectations are for coming years. It's called the Breakeven Inflation rate, or the rate which will make you indifferent to holding nominal T-bonds or TIPS (and calculated simply by subtracting real rates from nominal rates). The bond market now expects the CPI to average 2.5% a year over the next 5 years, and that's down sharply from an all-time high of 3.6% registered in mid-June. Wow.

Consistent with the improvement in the outlook for inflation contained in these charts, the bond market has adjusted downwards, by a whopping 100 bps, its expectation of the Fed's target rate at the end of 2023 (was 4%, now 3%).

All good news, of course, especially since it means the risk of recession (typically brought on by a punishingly tight Fed) is likely lower than the broader market thinks. And it's a clear message to the Fed that they needn't (and definitely shouldn't) panic and raise rates too much or too fast.

17 comments:

The U.S. $ is rising because the E-$ is contracting. Eliminating required reserves makes the domestic $ more competitive.

Contrary to the FED's accountants, RRPs drain both reserves and the money stock. They should be a subtraction from both the FED balance sheet's assets and liabilities - not just a swap in liabilities (regardless of term limits as the operations are constantly rolled over). If you look at page 15 in The Federal Reserve Bank of Chicago’s “Modern Money Mechanics” you will see that “sells of securities” decrease both the assets and liabilities of “Factors Changing Reserve Balances”

Also, in PG. 305 in my 1963 Money and Banking book. PG 366, 382, & 398 in my 1958 Money and Banking book.

The Keynesian economists at the FED don't know a credit from a debit. And they don't care about the money supply, just the level of interest rates or R *. Otherwise, they would separate in their accounting, bank from nonbank sells of securities (like they did in the 70's, with RPDs, reserves for private deposits).

Hi Scott,

Great post as always. I think its a bit premature to claim victory on inflation. China is the wildcard here. They have not fully reopened. Once they re-open, what happens to commodities? I would guess, commodities will go up. Once China fully re-opens and commodities go down, then I think we can claim victory on inflation. Cheers.

"The larger story is that a strong dollar means the world's demand for dollars is very strong, and that is helping to soak up all the extra M2 that was printed in prior years... "

Very helpful. And bon voyage to Italy! If you catch-up with Mario Draghi while there, don't believe a single thing that cat has to say. :-D

Excellent review of the situation, IMHO.

I hope the Fed does not overtighten.

The Fed shouldn't but of course they WILL raise rates too much...

The number of unemployed people per job opening is at an all time low.

https://www.bls.gov/charts/job-openings-and-labor-turnover/unemp-per-job-opening.htm

So, while a rise in the ratio is typically called a recession, it will be different to have it rise from such a low level.

Closing that Gap will help ease inflation pressure, but it will take a while too.

For the first time ever I find myself uncomfortable with Scott’s assessment.

Sure M2 growth has slowed, but what if it has been too high for much longer than the Covid years, and seems all this created a mountain of debt that is now ready to bite us back, in particular with inflation with no end in sight, and this time no growing China to bail us out with cheap goods and surpluses.

Seems to me all the western welfare states are unsustainable and have been sustained essentially with stimulus which is apparently no longer feasible without generating inflation, a problem that can’t be kicked down the road by irresponsible politicians.

So sorry Scott, I don’t share your optimism this time around.

"The larger story is that a strong dollar means the world's demand for dollars is very strong, and that is helping to soak up all the extra M2 that was printed in prior years... "

This is an interesting statement which does not resist rational analysis though.

USD move from the US to foreign lands with negative trade balance but, apart from some adjustments of reserves held by foreign central banks, USD come back (capital account) to the US (mainly through foreigners buying US government debt). So, the "demand" component may put some pressure on the exchange rate (many factors in play here) but has no material effect on the "extra M2 that was printed". To the extent that changing levels of reserves may contribute at the margin, foreign countries' decisions about those levels have domestic roots and there are no concerns about "soaking" extra deposits in US commercial banks.

-----

The following came out recently and does a nice job at summarizing (text and graphs) the drivers behind "excess" deposits that have been "created":

https://www.federalreserve.gov/econres/notes/feds-notes/understanding-bank-deposit-growth-during-the-covid-19-pandemic-20220603.htm

The article also explores how USD may potentially leave the US commercial bank system. However, the ways USD may leave are limited. The big one though was the huge amount of money that would have ended in commercial banks but that otherwise ended in money market funds and eventually back on the central bank's balance sheet through reverse repo operations, although, as Salmo Trutta mentions, not recorded as such as the operations are felt to be reversible and temporary...

https://fred.stlouisfed.org/series/RRPONTSYD

-----

"I hope the Fed does not overtighten."

This reminds me of some 'debates' about covid when i was in favor of some public policy tightening in order to obtain an optimal cost-benefit outcome and others were arguing to let it run its course ("naturally".

Why not let market forces decide where interest rates (including the "natural" rate) should be, including the spread for real credit risk?

The reliance on central bankers is so un-American, no?

Hi Carl: I enjoy reading your thoughtful comments here to Scott's analyses. IMO, reliance on central bankers is hardly un-American-- what would be the alternative, sir? A return to the gold standard? That would plunge millions of people around the world into greater poverty almost overnight-- how does that serve America's interests?

Thankful for this forum-- would also appreciate comments if others here are unsettled by China's ongoing property developer defaults? Also, does anyone feel a Spidey-sense of a Bernie Ebbers-situation emerging where we uncover fraud-- perhaps a regulated, American institution ensnared in previously undisclosed crypto-currency exposure? Thanks again.

-On frauds

It appears that peak fraudulent behavior is a leading indicator, as to when a cycle turns for the worse, when committed, but is a lagging indicator, when revealed.

-On China

More comments would be welcomed. The property market is soo important in China's economy so it appears that they (central planners) cannot afford (socially speaking) a downturn. In China, central bankers have become directly involved in easing financing conditions for property developers. The story will be "ongoing"..

-On the binary counterfactual: modern central banking vs gold standard

The role of central banks has indeed evolved since Bagehot days and you may want to think of this as a pendulum. Similar to what Keynes initially suggested, cyclical fiscal support and easy money to mitigate demand destruction makes some sense as long as policies are reversed over the whole cycle. Now, with bipartisan support, the Treasury-Fed complex' job seems to be to feed asset bubbles and to come to the rescue even before pain is felt while progressively increasing debt which depresses potential real growth. The American Dream is becoming out of reach for more and more hard-working Americans so are you surprised polarizing populism is on the rise?

Powell's ultimate objective was the abject capitulation to the erroneous Gurley-Shaw thesis.

The FED:

Raised, then eliminated Reg. Q ceilings

turned the nonbanks into banks

increased reserve requirement exemption amount and the low reserve tranche

40 percent reduction in required reserves

payment of interest on IBDDs

elimination of reserve requirements

elimination of 6 withdrawal restrictions on savings accounts

https://marcusnunes.substack.com/p/its-a-kind-of-magic?utm_source=%2Fprofile%2F12818479-marcus-nunes&utm_medium=reader2

Secular stagnation is the deceleration of velocity. Velocity declines as the volume and proportion of bank-held savings grows. Banks don't lend deposits. Deposits are the result of lending.

I have already heard from many shoppers on Amazon and at local retailers that the "inventory whip" referred to by Zerohedge (and indirectly here at CFB) has begun to show up in retail price data.

The question for stock market investors is, has the market begun to look across the valley, or is the FED still so behind the curve that some devastating increases in interest rates still await us?

Like I said:

The only tool, credit control device, at the disposal of the monetary authority in a free capitalistic system through which the volume of money can be properly controlled is legal reserves. The FED will obviously, some time in the future, lose control of the money stock.

May 8, 2020. 10:38 AMLink

Daniel L. Thornton, May 12, 2022 agrees with me:

“However, on March 26, 2020, the Board of Governors reduced the reserve requirement on checkable deposits to zero. This action ended the Fed’s ability to control M1. In February 2021 the Board redefined M1 so that M1 and M2 are very nearly identical. Consequently, it makes little sense to distinguish between them. In any event, the checkable deposit portion of M2 cannot be controlled now because there are no longer reserve requirements on these deposits. Here is the reason the Fed cannot control these deposits.”

https://www.dlthornton.com/images/services/Some%20Thoughts%20About%20Inflation%20and%20the%20Feds%20Ability%20%20to%20Control%20It.pdf

Intrigued by the comments on RRP and Scott's earlier post on IOR. These are very technical concepts out of reach of most readers, like your truly. So in the hope of opening up the discussion to digestible level, I did some research.

Seemingly, RRP is a post GFC mechanism to help set a more precise Discount Rate. Assuming the loan is merely overnight, the bank "sells" briefly a security to the FED and gets back the security plus a tiny amount of interest in a RRP. Presumably, the RRP coupled with discount window, the rate the Fed sets to loan money the banks need on a day-to-day operating basis allow the Fed to control the short-term interest rate banks pay on deposits and influences what they charge to loan the money out.

On another issue:

IOR has SOARED according to data I found on the Fed website. Is that significant? Will bank's earnings be higher than expected because of this?

Seeking education and insight here. Links appreciated. Thank you Scott and posters for years of such great information!

@EHR

There are several viewpoints around RRPs (supply and demand issues) but IMO, the most convincing viewpoint involved the unusual degree of 'money' which appeared in the system (QE and commercial banks buying government debt) while the Fed eventually stopped the SLR (liquidity ratio) relaxation rule that had been put in place with Covid, a situation which made banks unable to effectively accept a lot of deposits (in theory, they can't refuse really but they can offer a low, zero or even a negative rate). Depositors, facing potentially negative rates, turned to money market funds. The cash there needed to go somewhere and one of the channels was the RRP window which resulted in downward pressure in the overnight yield offered and even negative rates, an aspect the Fed has trouble with (credibility, technical reasons etc) so they made changes in order to put a floor on rates and to allow the RRP 'temporary' facility to grow.

It's not clear what this all means but the RRP balance has grown ++ and this is another example of the elastic definition of transitory. When you think about it, it's kind of weird because the Fed has been sucking out reserves out of the system at a very high rate while, simultaneously, flooding the system with new reserves.

My guess would be that the size of the RRP balance will go down with tightening but it looks like (opinion) the Fed may be much closer to easing than most market participants anticipate so then...can the Fed become somehow independent from the Treasury?

-----

IOER will have a positive impact on banks' bottom lines, if everything else is held constant...Even if the rate on reserves has multiplied, this remains a fraction of interest income at commercial banks and remember that, to obtain net interest income, one has to deduct the rates allocated to deposits (which should rise more or less proportionally, even with a lag). IMO, banks are in a very tight spot now with yield curves pointing to the possibility of difficulty in taking advantage of duration mismatch, especially in a recessionary environment.

Thank you!

I've got news for you. We are 6 months into a full-employment recession characterized by a drastic fall in living standards. Real GDP and price indexes are disconnected from reality.

Post a Comment