Yesterday the Fed released the May M2 numbers, and they were good. Since the end of January, M2 has grown at an annualized rate of just 1.3%. Over the past 3 months, growth has been a mere 0.08%—essentially flat. No longer is M2 surging at double-digit rates. If this keeps up, inflation could get back to something like "normal" by early next year.

It's rather impressive that all this progress towards lowering inflation has been achieved while the Fed has only raised short-term rates to 1.75%. As I said in my last post, this is not your grandfather's tightening-which-inevitably-leads-to-recession. That's mainly because last year's burst of inflation was the inevitable fallout from a bout of money-printing the likes of which we have never before seen, and which is very unlikely to continue or recur.

Stop the money-printing—as seems to have occurred—and you take away a major source of inflation virtually overnight. On top of that, the mere expectation that the Fed will seek higher interest rates while also shrinking its balance is working overtime. For example, 30-yr fixed rates on mortgages have zoomed up to 6%, almost twice what they were at the end of last year. This has slammed the brakes on the housing market by boosting financing costs and rendering housing unaffordable for many. Not surprisingly, lumber prices have fallen by more than half since March, suggesting a big cutback in new construction is coming. Meanwhile, we've all heard the drumbeat of recession forecasts from nearly every quarter, so everyone is tightening their belts. Seeing all this, the bond market in recent months has repriced to the expectation that inflation will plunge next year.

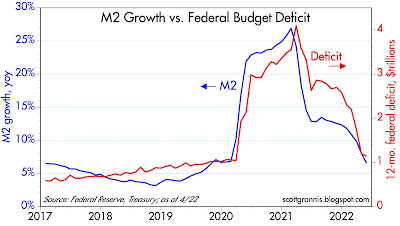

Chart #1

Chart #1 is arguably the most important one in the universe right now. What it shows is that the huge surge in M2 growth coincided with massive federal deficit spending. Milton Friedman long ago created a thought experiment now known as the "helicopter drop," in which the government prints up tons of cash and drops it on the country, and lo and behold, inflation blossoms. Only this time it's real: the government decided to send trillions of dollars of cash ($4-5 trillion) to nearly everyone as penance for Covid shutdowns. It was as if the economy were suddenly flooded with monopoly money dropped by helicopters. At first not much happened; inflation didn't start surging until early 2021, because that was when people began to see that the Covid scare was over and life needed to get back to normal. In the early stages, people were happy to hold on to the flood of new cash. Now, not so much.

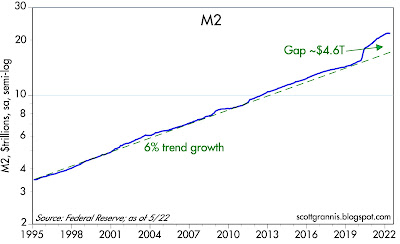

Chart #2

Chart #2 shows the level of M2, the best measure of easily spendable money, which includes currency and retail savings and checking accounts. Starting in April '20, M2 growth surged like never before, and it now stands about $4.6 trillion above its long-term growth trend. (Note that this chart is plotted with a logarithmic y-axis, which makes constant growth rates look like straight lines.) For the past 4 months, M2 has flat-lined, and that is a big deal. The bulk of the outsized increase in M2 showed up in demand deposits, which have surged by 170% (about $3 trillion) since March '20, and "other liquid deposits," which have grown by about $3 trillion over the same period. These are the hallmarks of money printing: banks simply creating money out of thin air in order to monetize/maximize Congress' desire to "stimulate" the economy with deficit spending. Thankfully, the chances of a repeat of this monstrous mistake are slim.

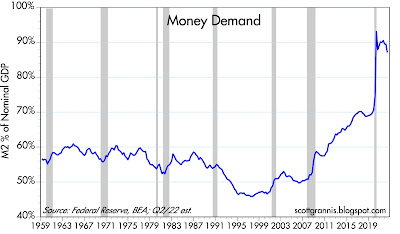

Chart #3

Chart #3 shows the ratio of M2 to nominal GDP, which is equivalent to the percentage of national income that is held by the public in the form of cash and bank deposits. The initial helicopter drop was welcome relief for most, and since the economy was locked down, it wasn't easy to spend it, so cash holdings skyrocketed with almost no impact on prices. But by early 2021, people began to realize that they were holding a lot more cash than they needed, so they began to spend it. That overwhelmed supply chains and drove prices sharply higher, with the result that surging inflation caused nominal GDP to grow at double-digit rates. Nominal GDP rose at a 10.7% annualized rate in the first quarter, and it is likely to grow by about 9% or more in the current quarter (e.g., 2% real growth plus 7% inflation), while M2 growth (as noted above) is going to be close to zero. This effectively reduces the ratio of M2 to nominal GDP, which is the most basic definition of money demand. No one needs to hold a lot of cash these days, especially since it's losing value due to inflation. As this process continues—slow growth in money combined with much faster growth in nominal GDP—money demand will return to levels more consistent with past history.

Chart #4

Chart #4 is worth a thousand words, but I'll try to use a lot less. What it shows is that commodity prices (red line) typically rise and fall in inverse relation to the value of the dollar (blue line). A strong dollar usually depresses commodity prices, and a weak dollar typically boosts commodity prices. Except for the past two years, that is, as both commodity prices and the dollar have soared. However, note the recent dive in commodity prices: this very likely reflects the repair of supply chains and less frenzied demand.

It's also encouraging to see the dollar so strong. If the Fed were doing the wrong thing (i.e., supplying way more dollars than the world wants to hold), then the dollar would be weakening, but it's not. The Fed has not lost control of the situation, and inflation expectations are not "unmoored."

Chart #5

Chart #5 shows more good news. Bank reserves have plunged in recent months, having retraced almost 40% of the rise that accompanied the surge in M2 that began in April '20. Bank reserves, recall, are created when the Fed buys securities from the banking system—when it grows its balance sheet. The process of unwinding QE4 is now well underway, but this has not had any negative impact yet because reserves are still abundant and banks therefore still have an almost unlimited capacity to increase their lending. In other words, there is no shortage of liquidity during this tightening, contrary to what happened with previous tightenings, which were all about the Fed intentionally restricting liquidity in order to boost interest rates. This is a crucial point of difference.

Chart #6

Chart #6 shows that real yields tend to correlate with real economic growth: stronger growth supports higher real yields, and weaker growth results in lower real yields. It also suggests that the bond market is expecting real GDP growth to average about 2% per year for the foreseeable future. This is the same rate that has prevailed since the Great Recession. It's sub-par and not very exciting, but it's a lot better than recession. Unfortunately, there are still headwinds out there in the form of oppressive regulatory and tax burdens, and the uncertainty which naturally accompanies high inflation and the Fed tightening needed to tame it.

Chart #7

Chart #7 shows households' financial burdens (i.e., monthly payments for mortgages, loans, homeowner's insurance, and property tax as a percent of disposable income), which are very low from an historical perspective. Households have plenty of room to take on additional financial burdens, but they're not. A sturdy household sector will lend important strength to the economy going forward.

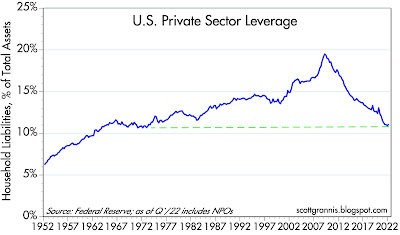

Chart #8

Chart #8 shows that the leverage of the private sector (i.e., total liabilities divided by total assets) has declined significantly over the past 14 years, and now stands at levels last seen in the early 1970s. The federal government has leveraged up, but the household sector has done just the opposite. Government profligacy is balanced by household prudence. Things could be worse.

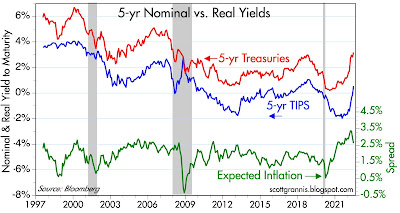

Chart #9

Chart #9 shows the level of nominal real yields on 5-yr Treasuries and the difference between them (green line), which is the market's expectation for what the CPI will average over the next 5 years. Inflation expectations peaked at 3.7% last March, and they have since plunged to 2.7%. Inflation expectations by this measure now are consistent with, for example, a forecast for inflation this year of 6%, followed by 2% per year for the next four years. Bottom line, the market expects inflation to normalize in fairly short order, which is not impossible given the sharp slowdown in M2 growth of late.

On a final note, I would remind readers that I have been worrying about high and rising inflation for most of the past two years, and I think I was correct in doing so. But with the impressive slowdown in M2 growth and the strong likelihood that the banking system will no longer monetize federal deficits, the outlook has definitely improved.

Regardless, inflation is likely to continue at an elevated pace for most of this year. Wages are being bid up, rents are soaring (playing catch-up to housing prices), higher energy costs are being passed through to many areas of the economy, and some supply chains (Ukraine in particular, a huge source of global food production) are still strained. And, last but not least, money demand is likely going to continue to decline as households attempt to spend down their outsized money balances. It's going to be a bumpy road for awhile.

Markets are good at looking across the valley of despair and seeing hope on the other side, and that is not unreasonable in the present situation.

15 comments:

your hubris on being able to predict the events to follow from this recent period of deranged monetary and fiscal policy, based on simpleton charts, is only slightly less egregious than that of the FED.

"...simpleton charts" - plus a lifetime of studying monetary theory, and the experience of managing billions professionally. Remember Richard Feynman? His brilliance was the ability to explain physics with the help of "simpleton" observations. It ain't about the charts, lol!

Interesting inputs for discussion, especially about the rate of inflation change in the coming weeks and months and the strength of the underlying real economy for growth (demand side).

First, some clarifications about comments and charts.

-"The federal government has leveraged up, but the household sector has done just the opposite. Government profligacy is balanced by household prudence."

The "balanced" part is misleading.

Compared to 14 years ago (in % of GDP):

yes household debt went from 100 to 80%

but business debt went from 70 to 80%

AND US Treasury debt went from 40 to 110%

-"Bank reserves have plunged in recent months, having retraced almost 40% of the rise that accompanied the surge in M2 that began in April '20."

This is misleading as it implies that the central bank has tightened already (net decrease in securities held) which is not really the case. Securities held outright as assets (as mentioned by Unknown in last thread) has remained quite stable lately. The composition of liabilities has changed however. The recent 'plunge' in bank reserves is essentially the result of the Treasury issuing debt and depositing much of this debt at the Fed in the TGA account. When this occurs, reserves (and M2) are temporarily withdrawn from the system. The highly variable level held at the TGA has caused distortion of reported reserves numbers, including recently, but this 'money' withdrawn from the system is expected to go back in the system and is not part of the present tightening schedule which is to come.

For details, see:

https://www.yardeni.com/pub/fedbal.pdf

Figures 3 and 5

Energy is a core inflationary force. If it wasn't for the insane SPR release, WTI would be much higher. The SPR ends in October. What then? If you think a deep recession is not coming, then inflation is going to roar.

If there is a recession and with it demand destruction, then there will be no investments to increase supply. Once the recession is over, supply will still be lower than demand. We'll get inflation again.

The only thing that can save the economy at this point is if the GOP nominates a sane, young , centric individual (i.e. not an individual with a personality disorder or who is a religious fundamentalist) to take over and deal with supply shortages instead of more stimmies.

Interested in what you think about the latest crypto debacle. The shadow sector and the interconnection between hedge funds and the like with the banking sector is concerning. The transparent liquid markets take a hit when crypto tanks as crypto is not highly liquid; but margin calls will be met. What do we really know about exactly how crypto functions given its global reach and unknown participants? The issue is default contagion but how can it be tracked?

PCE core May just posted at 4.7%, down from 4.9% in April.

The Fed made some mistakes but they also had an awful run of bad luck too. Ukraine, OPEC, droughts. C19.

The US has horrible housing shortages along the entire West Coast, due to property zoning, not the Fed's doing.

I wonder if the Fed should sell its balance sheet at all.

The Fed perhaps should consider a more tempered approach to raising rates.

Atlanta GDPnow's latest forecast is -1%.

re: "the ratio of M2 to nominal GDP" The “demand for money” is fickle. It fluctuates more than the money stock. But the FED discontinued the G.6 Bank Debits and Deposit Turnover Release in Sept. 1996 for spurious reasons.

In 1931 a commission was established on Member Bank Reserve Requirements. The commission completed their recommendations after a 7-year inquiry on Feb. 5, 1938. The study was entitled “Member Bank Reserve Requirements — Analysis of Committee Proposal” its 2nd proposal: “Requirements against debits to deposits”

http://bit.ly/1A9bYH1

After a 45 year hiatus, this research paper was “declassified” on March 23, 1983. By the time this paper was “declassified”, Nobel Laureate Dr. Milton Friedman had declared RRs to be a “tax” [sic].

The commodity vs dollar index is indeed one of the more interesting divergences for decades.

Commodities are starting to show signs of slowing down for reasons you state. It is looking like the inflation is indeed "transitory", just not as transitory as the powers that be wanted.

I was guessing a 5 handle on the CPI by October. It could happen, but I now guess a few months later than that.

Thanks for your work.

Good news. We can always talk ourselves into a recession though. Sentiment is a powerful snowball.

-On the topic of a "sturdy housing sector" and "outsized money balance" versus the potential for real growth, the comments in this presenting post echo what many suggest in relation to the private consumer to carry through the monetary and fiscal drag. Many, including Fed's Bullard, suggest that the consumers are in good shape as result of the covid 'relief' and saving behavior with 3.5 to 4.5T waiting to be spent.

First, saving, by itself, will not raise cash balances at the aggregate level.

Also, dissecting the numbers, 50% of these excess deposits result from QE which is only an asset swap ie you have an investor ending up with a money 'deposit' counting in M2 instead of a Treasury bill and this money is a hot potato that will channel asset inflation. Another 40% of these excess deposits is a result of commercial banks effectively financing government debt and printing deposits to match the new debt asset held (no new net wealth in the private sector). It's the equivalent of the true helicopter money experiment that Milton Friedman described. Are we richer or stronger to face a downturn if helicopter money is dropped? The remaining 10% of excess deposits is the result of typical lending by commercial banks and the real growth of such deposits is getting negative...

Take a look at GDPnow for Q2 and at revisions in Q1 numbers just released. Consumer spending was already under pressure and disposable income clearly entering negative (both real and even nominal!) territory. The increasingly unequal distribution of incomes makes these changes even more significant. The distributional Cantillon effect of QE is starting to bite.

Housing activity has been going down for a while for the bottom 40-60% and the pressure is slowly creeping up instead of the typical expected trickle down effect. Real credit card spending, starting with lower income groups has recently entered negative territory for the more than 125k income group. Another case of reverse trickle down. Inequality is reaching new levels as high housing prices for some is translating into much higher and unaffordable rents for many.

The outlook for real growth looks very poor and the 'money' deposit cushion is a mirage. Based on the above, the inflation outlook points to very strong disinflationary forces.

Very good article, i have a few points of concern that prevent me from agreeing with you.

We are reading too much in to month to month data and ignore the long term.

1. CPI is up to 8.6% and is under counting the increase in cost of housings. It seem to me that real inflation today is more of 15% in USA. We are seeing wage growth and there is a lot of pressue in the job markets. Future wage increases will push inflation higher.

2. We are ignoring the rates - even using the CPI of 8.6 and 10 year yield of 3% we are at negative 5.6%. You cannot stop inflation with negative rates.

3. We are ignoring the goverment deficit and the money printing needed to cover it. It is great that Uncle Sam has more collections before April 15th. But how much do we need to print to cover the deficit? Even at 1 Trillion a year money base will grow by 600B this year. lower capital gain taxes this year and higher interest will force bigger printing next year.

I am afraid that we are not out of the woods yet.

Hi Scott:

Thanks again for sharing your knowledge & expertise -- available over the internets at no cost! (wonderful.)

M2 decline / flattening was also noted this week by David Rosenberg & other thoughtful analysts-- yet Elon Musk, Mark Zuckerberg & other tech titans warn of impending doom which seems incongruous as they have ready access to M2 charts, yet they bellow of doom. So, in your opinion, is that just social-engineered doomsday-speak to assist the FED in softening demand, or do they see something in the tea leaves & chicken bones the M2 charts fail to reveal? Gracias.

Chris, re M2: I've written at length about M2, and I've been a student of M2 since the early 1980s. The vast majority of observers/economists pay very little attention (if any) to M2 because the connection between M2 and the economy and inflation has been very hard to discern and/or quantify. I think that is a function of not taking into consideration the demand for money, which is half of the equation of supply and demand for money. It's hard to quantify the demand for money, it's easy to see how much money there is.

The demand for money is relatively easy to measure when interest rates are very low or zero or negative, because in that case you know that no one is holding money balances because of the expectation of a return—they hold money because they are just very anxious to avoid losses. So in recent years, M2 has effectively measured the demand for money, and it has been very, very strong (because M2 growth has been very rapid). But when inflation starts to show up, then you must realize that the demand for all that M2 has declined and money is a hot potato that is preferably spent in favor of something that will retain its value.

The more people worry about the stock market, the economy, and inflation, the more that increases the demand for money and that, in turn, lessens the inflationary significance of increase M2 money balances.

The other important point that many seem to be missing is that the source of all the M2 growth was excessive government spending that somehow got monetized. That was a one-off event which is very unlikely to be repeated. The economy has been adjusting to excess M2 for over a year now, and prices in many areas are no longer rising. Housing has seen a peak, consumers are retrenching, and commodity prices are declining significantly. This tells me that on the margin, M2 is becoming less concerning. If M2 growth continues to be very low, then I would expect to see inflation moderating within a year or so, if not sooner.

Scott, another excellent presentation and Tal Sh you nailed it on your 3 points.

Some personal observations on inflation

1. My SSAN check went up 5.9% last January and along with 86 million others will go up a forecast 8% next January

2. My military pension went up a similar amount last January and like SSAN go up a large number next January along with millions of federal government workers and pensioners

3. The company I work for just gave 900 of us a 40% pay raise. Addition raises are probably forthcoming due to attrition.

4. My residences have gone up in value by 20%the last year and new leases a little less, yet the CPI only shows housing costs rising 4% last year. As I travel the country I rarely see for sale signs.

5. In my gold holdings, the price of gold is down 10% over its all time high several months ago, but the dollar is up about 10% over the last year. Unless you live in the US, gold is at an all time high. Exact same thing can be said about oil.

6. My kids in high school and college have a plethora of summer and part time jobs to choose from that full time would pay up to $45,000/ year.

7. Unlike 2008, I know of no one who has less than 20% equity in the real estate.

Do I see inflation in this country subsiding below 5% in the next year? No, unless the shortage of workers goes away, the country gets in a decent recession and the dollar keeps rising.

Post a Comment