Chart #1

Since its all-time high last November, bitcoin has plunged by about 72%, while stocks have shed 21%. The market value of the cryptocurrency universe is now $855 billion, down from an all-time high of about $2.9 trillion. $2 trillion of bitcoin "wealth" has been vaporized in just over 7 months. And to think there are over 20,000 cryptocurrencies vying to see which one can gain or lose more than the others. It's crazy.

Bitcoin is the very definition of a speculative asset with no intrinsic value that anyone has yet discovered, whereas stocks represent ownership in established and productive enterprises. Moreover, stocks have an expected return that is a function of their future earnings, whereas holding and transacting bitcoin involve certain costs, with no offsetting dividend or underlying asset. You couldn't find two assets that are more different, yet their prices are moving in apparent lockstep. What is going on here?

Does the collapse of cryptocurrencies have something to do with this year's bear market in stocks? It's certainly tempting to think so, but hard to understand.

Late last year, I think, I made a comment or two on one or two posts to the effect that what most worried me about the future was a cryptocurrency collapse, since to my mind cryptocurrencies had essentially zero value. At the time, bitcoin was riding high, and stocks had yet to reach a peak. Hardly anyone was predicting a bitcoin collapse, much less one whose timing mirrored that of the stock market. It's been a wild ride.

I welcome comments from anyone who can shed light on this mystery.

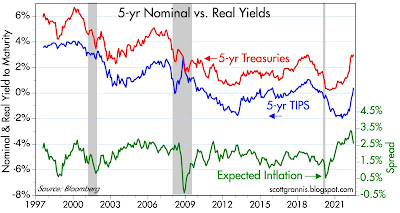

Chart #2

If the bond market and commodity markets are right, then the stock market is almost certainly overly-concerned with the potential risks of Fed tightening.

And it's also possible that stocks are overly-concerned with the ongoing collapse of cryptocurrencies.

26 comments:

I think stocks are overly concerned about the FED selling its balance sheet after years of QE. Never been done before. It's a fear of no liquidity going forward.

Crypto currency does have intrinsic value. It is a store of untraceable wealth (or believed to be such-we'll see)

At this point the Fed understands liquidity constraints and has many tools to alleviate any problems. It also understands the unexpected impacts of financial innovation having dealt with the derivatives meltdown; yes I know everyone was excited by MBS but the overwhelming meltdown was CDS. The problem with crypto is the Fed is constrained in its knowledge; even worse than CDS where at least Geithner and Greenspan knew its potential but did not anticipate that in its benign form it appeared to transfer risk to strong parties but in reality was a dual credit facility. Anyway crypto is totally different. It's an agent to transform illicit worthless assets into fungible assets and far more dangerous than CDS that managed risk until it didn't.

Crypto is not a market asset but is is marginable and that is truly dangerous as we don't know where the risk resides and it's also a morphing agent laundering enormous amounts of illiquid corrupt assets into fungible assets.

Right now it's freeriding on liquid markets and that is not good. Doesn't surprise me that it lead regulated securities as it could create excess liquidity from manipulated valuations and take the "winnings" into regulated markets; but now it's the opposite and liquid markets will suffer. JMHO

"if the bond market is right". priceless. it certainly has not been. punters all, with economist manque calafia acting as cheerleader.

About the crypto mystery

Crypto markets have a life of their own and clearly show momentum components but one of the potential relevant drivers of price action is the monetary hot potato effect.

With QE (apologies for driving this message home again), essentially there is a new deposit created at the same time monetary base is expanded. The deposit typically belongs to 'sophisticated' investors (hedge funds, pension funds etc). The 'investor' gets stuck with a zero earning asset (money) and has competition for 'risk-free' bonds. So the investor is holding a hot potato. This hot potato will not disappear from the system until reverse easing or tightening. However, the 'investor' will try to pass this hot potato to someone else and this 1-will tend to drive prices up (meaning lower returns going forward) and this has happened in corporate bonds, junk bonds, stocks etc and 2-will tend to push the 'investor' forward into higher risk investments such as 'retail' or 'meme' stocks and cryptos.

Once tightening is perceived to be happening, this is like a game of musical chairs. Once a chair is removed, the assets perceived as more risky will fall first. One has to wonder how many chairs will be removed assuming players want to dance.

"As long as the music is playing, you've got to get up and dance."

Chuck Prince Citi's CEO when the music was still playing and when it was felt that subprime was a minor issue that would be self-contained.

I think some stocks (AMD, NVDA ..) are very correlated with crypto because are heavily used for mining. It may explain certain correlation of bitcoin and stocks charts.

The answer is that it went into a bear market at about that time and Bitcoin will not go up during a bear market. Stocks and Bitcoin now dance the same dance, is the Fed going to tighten or not and by how much?

In addition, when talking about cryptocurrencies, one has to separate all the altcoins and Bitcoin. There's Bitcoin and then there's all the other crap, mostly grift, and ponzy. Now

BTC and growth stocks hate higher interest rates for different reasons.

Growth needs lower rates for max financing. They don't care why rates are lowered or how.

BTC needs lower interest rates to function as a hedge against unrelenting debasement of the dollar to the point of economic collapse. This is the point of max value for BTC. It becomes the currency that cannot be debased.

If the economy can stand higher rates without breaking, BTC may never revisit its highs. Some tech stocks might if they can still deliver on their technology in a higher rate world.

The question is whether capitalism can function with a currency that cannot be manipulated.

And whether BTC will become a currency that can be manipulated in a way not yet apparent. It's just math, and math always finds a way.

ebg - this was a great take. I hadn't thought of that before. "I think some stocks (AMD, NVDA ..) are very correlated with crypto because are heavily used for mining. It may explain certain correlation of bitcoin and stocks charts."

Hello,

Cryptos and equities are parts of a retail wallets. As consumer confidence falls, the covid transfers ends,the demand for cash grows.

I liked to short bitcoin on 11/13/21. But I couldn't find a vehicle.

To me, it looks like a conspiracy to destroy the U.S. $. Powell just destroyed the deposit classifications and now See: The Federal Reserve Bank of New York erased:

“The Money Supply”

“This content is no longer available”

We have a traitor at the head of the FED.

Salmo: you can find the money stock measures here:

https://www.federalreserve.gov/releases/h6/current/default.htm

I thought @UrbanKaoboy had an interesting thread on Crypto, Liquidity, and BTC supply/demand. Perhaps some of his thoughts will shed light on this Crypto mystery tour:

https://threadreaderapp.com/thread/1526311908709502977.html

crypto offered two principal promises: store of value, since bitcoin is limited in supply, and blockchain trust (permitting wide scale disintermediation). the latter is still a long way off, and the former is being viewed as a limited supply of nothing in value. I happen to believe that crypto will shake out the speculators and eventually become valuable and useful...

Economists don't know a debit from a credit, money from mud pie. Keynesian economists have achieved their objective, that there is no difference between money and liquid assets. Take the MSB balances (a nonbank), in member commercial banks from 1913 up until March 31st 1980. Their balances in member banks were not included in M1 up until that point. They were designated as interbank demand deposits, IBDDs.

Take Savings and Loan & Credit Union deposits in member commercial banks as of March 31st 1980. They are included in M1, overstating the money stock. The FED’s Ph.Ds. don’t know the difference between banks and nonbanks. The FED also excludes large CDs from the money stock.

Chairman Powell: “The connection between monetary aggregates and either growth or inflation was very strong for a long, long time, which ended about 40 years ago”

We knew the precise "Minskey Moment" of the GFC:

AS I POSTED: Dec 13 2007 06:55 PM |

The Commerce Department said retail sales in Oct 2007 increased by 1.2% over Oct 2006, & up a huge 6.3% from Nov 2006.

10/1/2007,,,,,,,-0.47 * temporary bottom

11/1/2007,,,,,,, 0.14

12/1/2007,,,,,,, 0.44

01/1/2008,,,,,,, 0.59

02/1/2008,,,,,,, 0.45

03/1/2008,,,,,,, 0.06

04/1/2008,,,,,,, 0.04

05/1/2008,,,,,,, 0.09

06/1/2008,,,,,,, 0.20

07/1/2008,,,,,,, 0.32 peak

08/1/2008,,,,,,, 0.15

09/1/2008,,,,,,, 0.00

10/1/2008,,,,,, -0.20 * possible recession

11/1/2008,,,,,, -0.10 * possible recession

12/1/2008,,,,,,, 0.10 * possible recession

RoC trajectory as predicted.

This is how Bankrupt-u-Bernanke caused the GFC. This reflects the 24-month rate-of-change in required reserves. The truistic money multiplier, legal reserves divided by the money stock, was $206 per 1 dollar of legal reserves just before the GFC - not $10 per 1 dollar.

2006 jan ,,,,,,, 45496 ,,,,,,, 0.04

,,,,, feb ,,,,,,, 43084 ,,,,,,, 0.01

,,,,, mar ,,,,,,, 41242 ,,,,,,, -0.02

,,,,, apr ,,,,,,, 42920 ,,,,,,, -0.03

,,,,, may ,,,,,,, 43648 ,,,,,,, -0.02

,,,,, jun ,,,,,,, 43278 ,,,,,,, -0.01

,,,,, jul ,,,,,,, 43328 ,,,,,,, -0.03

,,,,, aug ,,,,,,, 41162 ,,,,,,, -0.06

,,,,, sep ,,,,,,, 40865 ,,,,,,, -0.08

,,,,, oct ,,,,,,, 40088 ,,,,,,, -0.08

,,,,, nov ,,,,,,, 40543 ,,,,,,, -0.06

,,,,, dec ,,,,,,, 41461 ,,,,,,, -0.07

2007 jan ,,,,,,, 43113 ,,,,,,, -0.11

,,,,, feb ,,,,,,, 41214 ,,,,,,, -0.09

,,,,, mar ,,,,,,, 39159 ,,,,,,, -0.11

,,,,, apr ,,,,,,, 41072 ,,,,,,, -0.09

,,,,, may ,,,,,,, 42699 ,,,,,,, -0.05

,,,,, jun ,,,,,,, 42034 ,,,,,,, -0.05

,,,,, jul ,,,,,,, 41164 ,,,,,,, -0.08

,,,,, aug ,,,,,,, 39906 ,,,,,,, -0.07

,,,,, sep ,,,,,,, 40460 ,,,,,,, -0.07

,,,,, oct ,,,,,,, 40161 ,,,,,,, -0.04

,,,,, nov ,,,,,,, 40331 ,,,,,,, -0.04

,,,,, dec ,,,,,,, 41048 ,,,,,,, -0.04

2008 jan ,,,,,,, 42398 ,,,,,,, -0.07

,,,,, feb ,,,,,,, 41070 ,,,,,,, -0.05

,,,,, mar ,,,,,,, 39731 ,,,,,,, -0.04

,,,,, apr ,,,,,,, 41642 ,,,,,,, -0.03

,,,,, may ,,,,,,, 43062 ,,,,,,, -0.01

,,,,, jun ,,,,,,, 41616 ,,,,,,, -0.04

,,,,, jul ,,,,,,, 42083 ,,,,,,, -0.03

,,,,, aug ,,,,,,, 42055 ,,,,,,, 0.02

,,,,, sep ,,,,,,, 42456 ,,,,,,, 0.04

,,,,, oct ,,,,,,, 46930 ,,,,,,, 0.17

,,,,, nov ,,,,,,, 50363 ,,,,,,, 0.24

,,,,, dec ,,,,,,, 53723 ,,,,,,, 0.30

The rate-of-change in long-term money flows (proxy for inflation) turned safe assets into impaired assets.

M1 NSA money stock peaked on 12/2004 @ 1401.5. It didn’t exceed that # until 4/2008 @ 1406.6.

Revised:

2004-12-27 1467.7 2008-10-27 1514.2

Dec. 2004's money #s weren't exceeded for 4 years. That is the most contractive money policy since the Great Depression.

By c. 1995 legal reserves ceased to be “binding”. This coincided with the start of the unrestricted boom in real-estate (Greenspan dropped legal reserves by 40%).

Bernanke's contractionary money policy coincided with the “collapse” of the housing bubble, the peak in the Case-Shiller's National Housing Index in the 2nd qtr. of 2006 @ 189.93, or at first, sufficient to wring inflation out of the economy, but persisting until the economy plunged into an economic depression.

Make no mistake. We are under attack. The deregulation of interest rates, Reg. Q ceilings, was also a ruse:

Louis Stone -- whom the movie "Wall Street" was dedicated to - Vice President Shearson/American Express wasn’t fooled:

WSJ: "In a letter of March 15, 1981, Willis Alexander of the American Bankers Association claims that: 'Depository Institutions have lost an estimated $100b in potential consumer deposits alone to the unregulated money market mutual funds.'

As any unbiased banker should know, all the money taken in by the money funds goes right back into the banks, in the form of CDs or bankers acceptances or other money market instruments; there is no net loss of deposits to the banking system. Complete deregulation of interest rates would simply allow a further escalation of rates by the banks, all of which compete against each other for the same total of deposits."

Neither was Dr. Philip George: “The riddle of money, finally solved”

http://www.philipji.com/riddle-of-money/

That is corroborated by Scott Grannis' "demand for money".

All bank-held savings are temporarily frozen, lost to consumption and investment. There are c. 11 trillion dollars of savings that are unused and unspent in the payment's system.

See: R. Alton Gilbert (who wrote – “Requiem for Regulation Q: What It Did and Why It Passed Away”), in his letter back to me on December 11, 1978:

“Such savings are invested in many ways, including deposits at commercial banks.”

See e-mail – : My comment: Savings are not a source of “financing” for the commercial bankers

Dan Thornton

Thu 3/9, 2:47 PMYou

See the graph below.

http://bit.ly/2n03HJ8

Daniel L. Thornton

D.L. Thornton Economics LLC

And large CDs aren’t even included in M2 (as in FOMC’s proviso “bank credit proxy” which used to be included in the FOMC’s directive during the period Sept 66 – Sept 69).

Or take George Selgin (advisor to Congress): July 20, 2017

“This is nonsense, Spencer. It amounts to saying that there is no such things as ‘financial intermediation,’ for what you claim never happens is precisely what that expression refers to.”

From a system’s perspective, commercial banks (DFIs), as contrasted to financial intermediaries (non-banks, NBFIs): never loan out, and can’t loan out, existing deposits in any deposit classification (saved or otherwise) including existing transaction deposits, or time “savings” deposits, or the owner’s equity, or any liability item.

Commercial banks acquire earning assets through the creation of new money. When commercial banks make loans to, or buy securities from, the nonbank public -new money, demand deposits, are created — somewhere in the commercial banking system.

The non-bank public includes every institution (including shadow-banks), the U.S. Treasury, the U.S. Government, State, and other Governmental Jurisdictions, and every person, etc., except the commercial and any of the District Reserve banks.

Effective June 15, 2022

https://www.newyorkfed.org/markets/rrp_faq.html

"An RRP is a liability on the Federal Reserve’s balance sheet, like reserves, currency in circulation and the Treasury’s General Account. When RRP transactions are settled, the New York Fed’s triparty agent transfers the cash proceeds received from RRP counterparties to the New York Fed. This movement of funds from the clearing bank to the New York Fed reduces bank reserve liabilities on the Federal Reserve’s balance sheet,"

“The bond underlying the repo transaction is still recorded on the Fed balance sheet”

“Of course, if the buyer of a reverse repo or a security sold by the Fed is a nonbank and pays for the purchase using its bank account, the money supply is directly affected.” And 90% are purchased by nonbanks.

I.e., the FED has been tightening credit for a long time - 2,466,420.

Salmo - could you not locate a borrow on BITO ?

Crypto markets are aggregating disposable income (even some taking out loans) and wealth from financially inept people. Some of that wealth is surely taken from rising stock prices.

The aggregate pool of dumb crypto money is then churned and traded by financially smart and sophisticated people who are investing in traditional debt, equity, and derivative markets.

So there will be times of correlation and uncorrelation between crypto and traditional textbook financial markets that have actual fundamental value as the sophisticated investors win and lose with each other absent transaction costs.

Ataraxia makes sense.

I'm certainly not particularly knowledgeable about crypto. Then again - when presented with competing hypothesis, one should lean towards the one with the fewest assumptions. Crypto (and MMT, CRT and so on) require disciples to believe in mind numbing complicated presuppositions and assumptions to such a point they become too invested in the thesis to have common sense.

My guess is crypto has a serious future as a key lubricant in blockchain smart contracts - but even that will require a stronger tie to its dollar value. Then again, it may end up a particularly elegant invention and nothing else. It seems silly to think it is a threat to replace the dollar.

Crypto always struck me as nutty.

But as they say, "If you are not confused, then maybe you don't understand the situation."

In the meantime, Russia nationalized Japan's share in Sachalin natgas project. And the EU is on the verge of lack of 40% of natgas supply this winter. So strong USD, fly to safety trade ahead?

The current US administration likes to call this "global inflation" now. As my colleagues used to say, nobody likes to "freeze (starve, etc.) in the dark"- due to high energy prices/lack of supply. In the US we are mostly arguing about price. In other parts of the world, it's more serious than that.

So, in order to deal with the inflation/supply chain issues, etc., the EU just put NatGas back on the green fuels list. Following the science, don't you know. I believe they took similar action on nuclear a few weeks ago. In the meantime, I believe they had to put more coal plants back online. I had a little chuckle.

This kind of action is what makes following the economic bouncing ball so interesting (or tedious). You never know what the elites (our "betters") are going to think of next.

Don't know if this statistic is correct, but something like 25% of all bitcoins have never been traded. The initial owner is still the owner today. That means that the losses are in fact a fraction of that total $2.0 trillion. Bitcoins are exactly where they were in December 2020.

Granted those who bought bitcoins at $67,000 got hit, but that'sa tiny minority. The upward explosuon in the price was unexplained as for the downward pricing again no real reason excpet in a falling market you sell what you can rather than what you want...

I wouild agree that inflation pressure, especially on food is the great unknown. Victory against inflation may be premature

Scott makes a good point about Bitcoin NOT being an inflation hedge -- then again, gold does not currently appear to be acting as an inflation hedge either -- we are still early in this inflation saga -- I am watching the cryptocurrency world closely, but again, Scott makes a good point.

Post a Comment