Chart #1

Today's release of the November Homebuilders' Sentiment Index (red line in Chart #1) was almost literally off the charts. We've known for some time that the housing market was doing exceptionally well since mid-year, but this makes it clear. It also suggests that housing (and related industries) is going to be doing gangbusters in the months to come. Lots of upside potential in the housing market, helped to no small degree by super-low mortgage rates and an abundance of available credit.

Chart #2

Industrial production in the US surged from its lows, but gains in recent months have been more tempered. But as Chart #2 shows, industrial production in the US has enjoyed a much stronger recovery than in the Eurozone. Still lots of room on the upside in both regions.

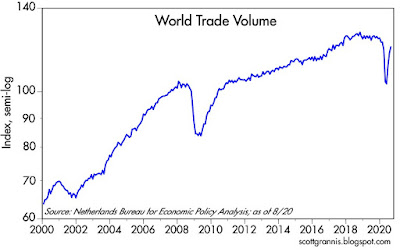

Chart #3

World trade, shown in Chart #3 (but with a regrettably long lag) has clearly rebounded strongly. This is critical for nearly every country, since global trade has been a very important engine for growth and prosperity.

Chart #4

The outlook for China has been improving for most of the past year, as reflected in the strength of the Chinese currency (blue line in Chart #4). It's important to compare the yuan's strength and weakness to the level of China's foreign exchange reserves, since this can tell us what is driving the yuan's value. In this case we see that forex reserves have been relatively steady for about the last four years. Meanwhile, the yuan's value has fluctuated considerably. What this shows is the China's central bank has not been manipulating its currency. It's maintained a relatively neutral policy stance, allowing net capital flows to drive the currency higher or lower. In the past year, capital inflows have apparently been quite strong, and since the central bank was not trying to absorb these flows (by creating more yuan and thus expanding forex reserves), the inflows resulted in a stronger yuan. In other words, strong demand for the yuan coupled with a relatively fixed supply of yuan caused the value of the yuan to rise. This most likely means that people have been more inclined to invest in China and/or less inclined to disinvest in China.

Chart #5

Capital inflows and increased confidence have also driven the value of Chinese equities higher, as we seen in Chart #5 (blue line). A Biden presidency is much more likely to be friendly and supportive of China than Trump's has been, and the market has picked up on that. Whether this is a positive long-term development for the US remains to be seen, but in general terms whatever is good for China is good for the world. At the very least this is yet another sign of the market's "risk-on" behavior of late.

With all this good news, it pays to keep an eye on what might go wrong. My #1 pick for a nasty surprise would be the Democrats gaining control of the Senate by capturing both of Georgia's Senate seats in an early January runoff election. That would strongly tilt the balance of power to the left, whereas the current state of affairs equates to a rather benign "divided government." Government is sometime best when it governs least, as the old saying goes.

I don't expect the Democrats to regain control of the Senate (hardly anyone does, it seems), so for the time being I remain an optimist. The Fed is not about to do anything that might harm the recovery, and the federal government is not going to try to implement a Green New Deal (which would be a futile and hugely expensive undertaking that would only harm US competitiveness while doing virtually nothing to address climate change). A divided government is quite likely to avoid economy-killing tax increases, but Biden will probably manage to reverse some of Trump's beneficial de-regulation policies. I think this paints a picture of an economy that will continue to flourish in the short-term (think V-shaped), but over the longer haul will follow the same sub-par growth path established during the Obama years.

16 comments:

Scott, thank you for update.

"but over the longer haul will follow the same sub-par growth path established during the Obama years."

Growth:

W. Bush (1) 2.8

W.Bush (2) 0.5

Obama (1) 2.0

Obama (2) 2.3

Trump (pre covid) 2.5

Total Debt Change Per President :

Bush (1+2): +105.08%

Obama (1+2): +69.98%

Trump (1): +33.62%

I'd take Obama's "sub-par growth" following Bush's complete fuckup of the economy, due to his deregulation and increase in national debt (sounds familiar?).

Whatever Biden does, the GOP can fix it as long as they nominate someone who does not have a serious personality disorder, isn't completely corrupt and is *actually fiscally conservative*. Otherwise, expect to get AOC as POTUS, because other than the tax cuts, when you consider the increase in debt, the tariffs, the farmers' and various industry subsidies by Trump, there isn't that much of a difference between DEM and GOP. I mean, when you look at the actual data, not your wishful thinking.

They ALL spend money. They might say they are fiscally conservative but it's just BS. The only difference, these days, is the support for the rule of law.

P.S. it is *certain* based on what he said and did that Trump would have proactively supported a massive asset bubble -- he would do ANYTHING to see the stock market keep going up. So, yeah, we would see "growth" and the stock market going up and as investors we would rejoice. Eventually, it would pop, we'd get massive deflation and the whole thing where we need a Dem to come fix things again.

Seriously, why can't we have a normal, rational and competent GOP as POTUS for once? FFS.

Great wrap up by Scott Grannis.

Japan equities near 29-year high, btw.

I sure would like to see a compelling explanation of what it means when a central bank buys sovereign debt, and then just holds it.

Will we have inflation or not? Central banks globally appear to be financing fiscal outlays. I'm not sure what is happening inside China.

If we do not get much inflation out of this cycle, I will say, "That inflation dog don't hunt anymore."

"Seriously, why can't we have a normal, rational and competent GOP as POTUS for once? FFS."

Truer words never written. We F-ed up big time when Romney was defeated because the crazy right could not get over his Mormonism (I think they call that bigotry). Anyways, Scotts last post suggested the political risk was behind us. I beg to differ. I may NEVER vote GOP again the way most republicans are acting defending the undefendable.

Can't decide if the recent move up in rates, while somewhat tepid is real. Probably not. This "transition" period will be interesting. If GA loses even one seat, look out below.

Not one chart that isn't a time series.

Roy your GDP numbers are wrong

It took me three seconds to recognize that.

You are entitled to your own opinions.

You are NOT entitled to your own numbers.

THE TRUTH:

Jimmy Carter (D): 3.25%

Ronald Reagan (R): 3.48%

George H.W. Bush (R): 2.25%

Bill Clinton (D): 3.88%

George W. Bush (R): 2.2%

Barack Obama (D): 1.62%

Donald Trump (R): 0.95%

For Trump, 2020 is estimated as a Real GDP -3.7 percent decline

Real GDP growth after about 2000 is hindered by slow labor force growth, no matter who is president. Blame women for not having enough babies, I suppose.

Mr. Eternally Optimistic Scott (who must be great fun at parties) says

" I don't expect the Democrats to regain control of the Senate (hardly anyone does, it seems)"

The Georgia election is set up perfectly for fraud with 600,000 requests for absentee ballots.

Absentee ballots encourage fraud that can't be detected.

Your conclusion is assuming an honest election.

This will not even be close to an honest runoff election, and Democrats are much better "cheaters".

Because truth is not a leftist value. Power is a leftist value.

And this Georgia runoff is all about political power.

Meanwhile, about 20 million Americans are still collecting state and federal unemployment compensation, and partial lockdowns are returning, not disappearing. Not to mention Hidin' Joe Biden "won" ... and there is not enough time to investigate and prove obvious (in my opinion) election fraud.

Trump fought the "deep state" and the deep state won.

An interesting summary of 2020 election fraud evidence from public sources is here:

https://hereistheevidence.com/

Cliff C.

Given the bi-partisan evidence provided in your link, maybe it's time for the Dems to stoop every bit as low as Trump has, and send THEIR army of lawyers to all those red states (also with lots of mail-in ballots) that had Repubs win senate elections. Must've been fraudulent, right? Let's find out.

Scott - would appreciate your thoughts/analysis with a Dem-controlled Senate and Biden presidency. Like a previous commenter, I see fraud in the GA runoff elections as a guarantee. They stuff the ballot box, throw out votes from GOP-heavy precincts, alter the counting of ballots with software, and increase voter registration a la Tom Friedman. Dems will likely lose the House in 2022 but not if they go all in now to take the Senate and institute one-party-rule rules for the foreseeable future.

pgrommit

That would be fantastic for DEMs to start bringing challenges to the results. Lets see if DEMs will do that.

If widespread fraud is proven by both sides, the Supreme Court is bound by the Constitution to send the vote to Congress, which gives each state one vote.

4 more years of Donald!

Im with ya. Got my fingers crossed, hoping DEMs will take up your challenge.

Johnny Bee--

I was being a bit tongue-in-cheek, but have to say your response was fascinating. You clearly think that "If widespread fraud is proven by both sides" would be good for the country.

I see where you are going with this. Trump stays in the White House, declares elections to be "passe", and proclaims himself Supreme Leader. It's all good, right?

Trump's greatest accomplishment, I believe, was prompting leftists to publicly reveal their true desires -- socialism --- and their true character -- horrible. Leftists used to pretend to be polite, with the goal of gaining power, and micro-managing our lives. They have not been polite in any way for the past five years.

Investigating November 3 election fraud before the January Georgia run-off election might prevent the level of fraud from increasing to unprecedented levels in Georgia. The Democrats will NOT let any Republican win in Georgia when getting two Democrat Georgia Senators is the key to getting US socialism, via packing the supreme court, and eliminating the Senate filibuster rule

The censorship in the media, conventional and social media, and the riots in the cities were 99.9 percent Democrats. They have turned our once fine nation into a banana republic. And it took Trump to spur leftists into into revealing what horrible people they really are. Truth is not a leftist virtue. Political power IS a leftist virtue. And political power is something this libertarian has wanted reduced since the 1970s, but federal and state government power keeps increasing, to an unprecedented peak with 2020's pandemic.

Scott

Regarding your post about civil disobedience, why not present the other side. Seventeen hundred healthcare workers have died from covid. That does not mean they all contracted from their patients. By the way, my wife is a nurse so you hit a real tender nerve with your comments. Maybe a more balanced view would include enjoy your big Thanksgiving dinner with a large group, but keep in mind you are putting at risk health care workers who have to care for you if you get covid and they had no say in how big your get together would be. Plus people who need medical help may not be able to get it because the hospitals may be full with covid patients. I am sure you know elective surgeries were postponed in many areas along with critical tests. I can say this from my own personal experience.

I like your posts, but would wish you would just keep it on economics and finance.

Do you need Personal Loan?

Business Cash Loan?

Unsecured Loan

Fast and Simple Loan?

Quick Application Process?

Approvals within 24-72 Hours?

No Hidden Fees Loan?

Funding in less than 1 Week?

Get unsecured working capital?

Contact Us At : gaincreditloan1@gmail.com

Whatsapps +1-(551) 356-3808 (call/WhatsApp)

Blogger The Cliff Claven of Finance,

In your own data Clinton has the the highest GDP, Jimmy Carter is not half bad and Obama is quite decent considering he got from Bush the worst economic depression in many decades.

So, yeah, a Dem won this time, but you know, maybe you should just drop the guns and come down from the hills... based on your own data.

What's important is the underlying structure.

I am certain %100 sure that Biden will maintain and strengthen this structure, just as I am sure Trump worked hard to undermine it, as he does now, daily.

Post a Comment