So why are yields on Treasuries so low? Why are real yields on 5- and 10-yr TIPS near zero?

The following charts flesh out the details and speculate on what is driving this amazing apparent divergence between stocks and bonds.

Chart #1

As Chart #1 shows, US stocks have outpaced Eurozone stocks by roughly 85% since the bear market ended in March 2009. Moreover, Eurozone stocks until recently had failed to advance for almost 5 years. News last month of a trade deal with China pushed both markets to new high ground.

Chart #2

As Chart #2 shows, the US market has been outpacing Chinese equities for years. News last month of a trade deal added over 10% to the market value of Chinese equities while also boosting US equities.

Chart #3

As Chart #3 shows, the Chinese yuan has risen almost 5% since last September, when rumors of a trade deal first surfaced. The chart also tells us that the Chinese central bank is not trying to control or defend its currency by buying or selling its foreign exchange reserves. Sentiment and capital flows are therefore the key to the yuan's value, so the fact that it has risen in recent months is proof that the trade deal is a positive for China. Rising equity markets worldwide say that the trade deal is good for just about everyone, for that matter. What's good for China is good for everyone, since it means more trade and more prosperity.

Chart #4

That's a very good thing, since world trade has been stagnant ever since Trump's trade wars started in early 2018, as Chart #4 shows. We should soon be seeing a pickup in global trade and global industrial production, both of which have been stagnant or weak for some time now.

Chart #5

Industrial commodity prices, shown in Chart #5, have jumped 7.5% since news of the trade deal broke. This is likely due at least in part to the market's expectation that world trade and manufacturing activity will revive shortly. It is also good news for emerging markets, since they are very dependent on sales of commodities.

Chart #6

December housing starts blew past expectations (1608K vs 1380K), as was foreshadowed by a surge in the homebuilders' sentiment index, as shown in Chart #6. The US housing market looks to be on solid and fertile ground, and that all but precludes a recession for the foreseeable future. Indeed, this could be a precursor to a broader pickup in the US economy, which has been growing only modestly this past year.

Chart #7

Chart #7, Bloomberg"s Consumer Comfort index, recently reattained the high-water mark it set in the boom years of the last 1990s.

Chart #8

Incomes are rising, jobs are growing, and fewer and fewer people are getting laid off. In fact, as Chart #8 shows, the number of initial unemployment claims as a percent of the workforce is at an all-time low. That spells "job security" and all these things are boosting confidence.

In addition to the above economic "green shoots," key financial market indicators tell us that liquidity is abundant, the Fed is non-threatening, and the bond market has confidence in the outlook for corporate profits. What's not to like?

Chart #9

2-yr swap spreads, shown in Chart #9, are excellent leading and coincident indicators of financial market and economic health. Swap spreads both here and in the Eurozone are low, and that in turn suggests that liquidity conditions are excellent, systemic risk is low, and the outlook for economic growth is therefore positive.

Chart #10

Chart #10 shows 5-yr Credit Default Swap spreads, which are a very liquid measure of generic corporate credit risk and a excellent indication of the market's confidence in the outlook for corporate profits. Spreads today are very low; in fact, things haven't been this good for a long time.

Chart #11

Chart #11 shows actual corporate credit spreads by credit quality for the past 24 years, and they confirm the message of Chart #10. The private sector of the US economy is in great shape.

Chart #12

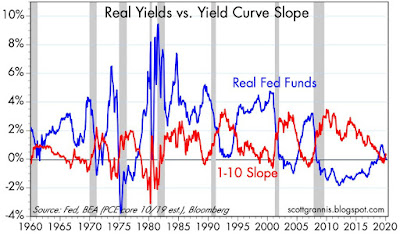

Chart #12 is the best way to track the stance of the Federal Reserve's monetary policy. It strongly suggests that two things the Fed has a lot of influence over—the shape of the yield curve and the level of real short-term yields—have consistently preceded every recession in the past 60 years. An inverted yield curve and high real yields are what crush economic activity. Today, however, the yield curve is upward-sloping and real yields are zero. Fed policy is thus absolutely non-threatening. Liquidity is not being restricted, and borrowing costs are low. Inflation is also low. It's monetary nirvana.

So with all this good news, why are Treasury yields so low?

Chart #13

As Chart #13 shows, 10-yr Treasury yields today (1.8%) are just half a point above their all-time lows of 1.3%. Not only that, but 10-yr Treasury yields today are below the level of consumer price inflation, which has been averaging 2% or a bit more for the past three years. Whatever is going on, the world is paying very high prices for the safety of Treasuries. At the very least that is a good indicator that the bond market is not overly confident about the outlook for the future.

Chart #14

Chart #14 compares the 2-yr annualized rate of growth of GDP (which gives us a sense for what the market believes is the prevailing rate of growth) to the real yield on 5-yr TIPS (which is an excellent proxy for the prevailing level of real yields as well as the market's expectation for the effective stance of Fed policy over the next five years). Two things to note: real yields tend to track GDP growth rates, and the current level of real yields suggests the market is not expecting any meaningful pickup in US growth—nor any meaningful change in the Fed's current accommodative monetary posture—for the foreseeable future. Indeed, it wouldn't be hard to look at this chart and conclude that the bond market is expecting growth to slow down further.

Chart #15

Chart #15 shows the equity risk premium, which is the difference between the earnings yield on stocks (i.e., the inverse of the PE ratio) and the yield on 10-yr Treasuries (the world's proxy for long-term safety). That's the yield premium the market demands for taking on the risk of equities. That premium today is about 2.7%, and that's quite a bit above the average of the past 60 years. I take that as a sign that the stock market is still very cautious, as is the bond market. Which goes directly against the message of credit spreads, which are very tight and thus reflective of optimism.

Chart #16

According to Bloomberg, the current PE ratio of the S&P 500 (which is calculated using profits from ongoing operations) is a bit over 22. For the past 60 years it has averaged about 17. Chart #16 is based on a different calculation of corporate profits, since it uses corporate profits economy-wide, which is drawn from the National Income and Products Accounts. Nevertheless, it gives about the same answer: PE ratios are above-average, but still well below levels that later proved to be excessive valuations (e.g., 1961-62 and 2000). In other words, relative to the prevailing level of Treasury yields, current PE ratios look fairly attractive from a historical perspective.

Chart #17

I'll close with Chart #17, which compares the ratio of copper to gold prices (blue) to the level of 10-yr Treasury yields (red). Over the past decade, these two utterly distinct variables have shown a remarkable tendency to move together. The rationale for that is that the ratio of copper to gold prices is a proxy for changes in global economic growth conditions: stronger growth creates more demand for copper, while at the same time reducing demand for gold, and vice versa.. The recent uptick may be a precursor of more to come. If global growth picks up as many of the above charts suggest, then the copper/gold ratio should rise, and 10-yr Treasury yields should rise as well.

Bond investors would be well-advised to buckle their seat belts in preparation for a descent to lower bond prices. Stock investors who fret that an equity bubble may be forming should be braced for a bumpy ride higher.

23 comments:

Scott - any updates on truck tonnage traffic? Some of the other transportation measures look quite negative, but they appear to include railroad and other forms of transportation as well.

In addition to the numerous Green Shoots you've outlined, the December Industrial Production report had many good indicators below the negative headline numbers.

Tom in Chicago

Truck tonnage has not been recently updated; only October data available, which was strong.

I did notice that truck sales reached a peak annual rate 570,000 in September (Yahoo).

However, it then fell somewhat in October and then again in November to an annual rate of only 460,000. Fortunately, the most recent update shows that December sales recovered to a 497,000.

November Truck Tonnage was down quite a bit from October, which was down slightly. This index has become extremely volatile of late, so I don’t quite know what to make of it. But it is not supporting a stronger economy thesis.

Top blogging as always.

But I have to say, the trade tariff story is the most overhyped tale of all time.

Both the S&P 500 and the Shanghai Composite gained about 25% or more in 2019. That is, while trade relations between China and the US were tenuous, stock markets were booming.

Trump's trade tariffs, applied to a lone trading partner, might raise about $60 billion in taxes in 2020. By comparison, the US government will apply $3.6 trillion in taxes upon American workers, businesses and others in 2020. Trade tariffs are the mouse that roared.

And, as the charts above show, world stock markets are hitting all-time record highs even though world trade has been flat for several years.

American macroeconomists have an obsession with "free trade" and international commerce. Some have even become cheerleaders for huge and growing current-account trade deficits. I hope American macroeconomist soon become as obsessed with free markets in US property development as they are with "free trade" with the Communist Party of China in Beijing.

When free trade theory is sacralized, it becomes "free-trade theology."

I congratulate President Trump if China really does buy $200 billion dmore in US product in the next couple years than it would have otherwise.

Why are interest rates so low? I don't know. But interest rates have been trending down since about 1980. The world is awash in capital. Maybe that is it.

No disrespect Scott but you are he umpteenth economist in the past umpteen years to be predicting lower bond prices (higher yields). This is absolutely the same as trying to time the stock market.

Why are bond yields so low? Simple. Supply and demand. Only so much money will make it into stocks and other hard assets and it's got to go someplace. Investors still have an '08 hangover (as evidenced by your own work) and who can blame them? I suppose eventually that will wear off but by then it will probably be time for another recession!

Investors betting on higher yields are making the same mistake as investors betting on lower stock prices. It's a waste of time and energy. There's always a bull market somewhere (OMG, am I sounding like JBD?) and better to focus on that.

Where is everybody??

So Much Winning!!

Its on. God Bless Trump

Nice article, but what about the "stress" in the repo market? Thanks

"What's not to like?"

Economic growth (Real GDP growth) under Trump has averaged under 2.5%.

Many Republicans complained bitterly when Obama had and average of 2.2% growth after the recession ended.

Now 2.4% to 2.45% is "The best economy in 50 years".

And that's AFTER a large corporate tax cut and record deficit spending for the current point in the business cycle.

If a president could be impeached and convicted for outrageous bragging and exaggerating, Pence would be the president !

If it were up to me I'd impeach "Shifty" Schiff and "Nasty" Nancy Pelosi.

The China proposal for a trade "deal" is $200 billion of BS, just like every other trade related promise from China in the past.

China significantly cut imports of US agricultural products in 2018 just so they could propose doubling purchases in the future to make a deal ...'We'll double purchases!" ... (just getting them back to where they were before!).

While "bragging" about housing starts, which were amazing ... why would you ignore 4Q 2019 Real GDP, projected to be weak, and the decline of November Factory Orders, decline of November Durable Goods Orders , and decline of December 2019 Industrial Production ?

And for the first three weeks of 2020, U.S. railroads reported 723,293 intermodal units, down 8.1 percent from last year !

Seems like there's data mining.

Re "what about the stress in the repo market?"

This is much ado about very little. Although I don't always agree with Bill Dudley, I think his recent observations on this issue are spot on. As he notes, the Fed has been buying T-bills and paying for them with bank reserves. Bank reserves are a close substitute for T-bills, as I've noted many times over the years. The Fed isn't really creating money, it's just swapping overnight securities (reserves) for 3-mo. securities. The purpose of this is to create more securities of a very short maturity, which in turn provides the overnight liquidity the market is apparently demanding.

Read the full article here: https://www.bloomberg.com/opinion/articles/2020-01-29/fed-s-repo-response-isn-t-fueling-the-stock-market

As he also notes, there is nothing about the Fed's repo operations that necessarily drives stock prices higher. The Fed is operating correctly to satisfy the market's demand for liquidity.

office Remote turns your phone into a smart remote that interacts with Microsoft Office on your PC. office.com/setup The app lets you control Word, Excel, and PowerPoint from across the room, Microsoft365.com/setup so you can walk around freely during presentations.

Download norton antivirus to make your computer virus free with the best support and tech team. norton.com/setup Feel free to contact us. Norton web security is commonly used antivirus gives the least requesting to use and https://my.norton.com/home/setup most intutive affirmation for your PC and your mobiles .present it and negligence viruses,spyware,root-units - , Download norton 360 hackers. https://my.norton.com/home/setup for more nuances visit.

To enact the Norton setup, select the Activate Now option at the base. https://my.norton.com/onboard/home/setup To recharge the membership for Norton, select the Help choice and snap on Enter item key. https://my.norton.com/onboard/home/setup Cautiously type the right Norton item key in the clear. norton.com/setup Snap on the Next catch.Go through with for more details. Download Norton Mobile Security and Antivirus application that can shield your records from getting norton.com/setup affected from any online malware or contamination norton setup product key.

Go to the Norton Security Online page and click Get Norton Security Online. Type in your Xfinity ID and password, if you're asked. Create a Norton account, then sign in.norton.com/setup Choose whether you want to install it on this device or another one. Start your installation. Click Run. Let the program run. If Windows asks for permission, click Yes.

Go to Roku page record enter Roku com association code appeared on Roku TV. roku.com/link My Roku com associate not working use new Roku code.Roku is a streaming device, which is a reasonable roku setup and other Set-up Box. roku.com/link Roku is a bundle of amusement, where client can stream for boundless motion appears, web setup, news, roku.com/link animation and a lot more projects.

Giving users an unparalleled streaming experience, Team roku.com/link takes great pride in being the number one streaming service roku.com/link providers in the world.Sanction Roku associate, go to roku.com/link record enter Roku interface code appeared on Roku TV. My roku com interface not working use new Roku code. Roku.com/link To download click for more subtleties.

Webroot SecureAnywhereMobile Free keeps you secure when perusing, shopping, and depending on your Android gadget. webroot.com/safe This application utilizes the Device Administrator authorization. webroot.com/safe Webroot AntiVirus is a decent, secure program that effectively perceives and shields you from Mac malware. webroot.com/safe It has safe program includes that solitary work in Safari, which additionally makes Webroot's less viable at recognizing a few Windows dangers. Go to the link for more information:

Download Webroot Geek Squad Antiviurs webroot.com/safe If you own a device or system and you are connecting it to internet or another device then you must have antivirus webroot.com/safe software. Virus or any risky threat like Malware, Trojan, Spyware, webroot.com/secure Rootkit or online hacking or attack can steal your data and damage your system. Click on webroot.com/safe to download your Webroot antivirus product and also get Webroot Installation Help at webroot.com/safe Webroot Support Help.

The Canon, the famous brand has everything in it's variety starting from their cameras,canon.com/ijsetup to cinematography solutions to the scanner as well as printers – each single thing has its own specific productivity. Download from canon.com/ijsetup and setup on your device. Canon printers are all in one printer that facilitates print, copy and scan. ij.start.canon The canon printers are designed for personal as well as business use.Canon IJ Network Tool is a free application that allows you to install,ij.start.canon view or configure the network settings of the printer that is connected through a network.

Canon printer that can be downloaded via ij.start.canon page is the best wireless printer that you can connect to your device and print data smoothly. ij.start.canon Canon ijsetup CD is not the well-suited technique to use ij.start.canon setup installation for longer. One can also install from anther origin if your device is having issues in the online installation or any other.ij.start.canon Click download and start the canon ij setup downloading. On the completion, ij.start.canon double-tap on the downloaded file and start installation.

Visit ij.start.canon to download Canon printer drivers and software then install ij.start.canon and setup in your Windows & MAC Computer.ij.start.canon is the official Web address Provided By Canon So You can Download Driver, ij.start.canon Manual & Guides for your Canon Printer.

Here is a complete guide for the Canon Printer setup. ij.start.canon Follow the given process for hardware setup, ij.start.canon network configuration and printer driver installation.Download Canon Printer Drivers from ij.start.canon

then Install and setup your canon printer product by visiting canon ijsetup.

Amazon Prime Video service on your Smart TV or streaming device should be successful. Amazon.com/mytv This gives you unlimited access to tons of movies and TV shows, both for yourself and your loved ones. Amazon.com/mytv

the activation process is so simple and straightforward that everyone can activate Amazon Prime Video on Amazon.com/mytv Open the app and go to the Amazon website and register. Fill in your Amazon Prime account details and you will see the Amazon Prime verification code on your screen. Amazon.com/mytv Enter it there For more information, you can visit our website and benefit.

If you eagerly wanted to know what is amazon prime video then the answer is amazing. Amazon.com/mytv It is more than a fast delivery option. Amazon Prime is a subscription service provided by the amazon.com/mytv with unlimited entertainment with lots of other benefits. amazon.com/mytv On your mobile device or computer, go to amazon.com/mytv. Sign in to your Amazon account. amazon.com/mytv Enter the code shown on your TV in to the Amazon website.

Amazon Prime is a subscription service that caters to the media needs of people through the Amazon Prime platform. Amazon.com/mytv Notifies visitors about topics such as Register TV, Amazon Prime TV and MyTV code.Amazon.com/mytv To register your device on the Amazon website you go to our website Amazon.com/mytv and enter the given code. Amazon.com/mytv Amazon Prime Video is one of the best platforms to watch movies and TV shows continuously on the internet. Amazon.com/mytv You can now watch your favorite shows not only on your laptop or computer but also on your Smart TV and streaming sticks. It is also available on a few selected set-top boxes at a cheaper cost.

Open the Amazon app on your TV. Amazon.com/mytv Sign in with your newly created Amazon Prime account. Amazon.com/mytv There will be a 6 letter code on your TV screen. Enter the code shown on the TV screen in the activation window on your PC. Amazon.com/mytv If you are a person whose eyes open wide when finding new TV shows or movies to watch, then Amazon Prime is just for you. If you are a person whose eyes open wide when finding new TV shows or movies to watch, then Amazon Prime is just for you. Amazon.com/mytv Amazon Prime Video is a streaming services provided to Amazon Prime members. Amazon.com/mytv click here. How to activate Amazon prime on TV using .Amazon Prime is the largest distributor of films, web series, drams etc in the world.

If you are a person whose eyes open wide when finding new TV shows or movies to watch, then Amazon Prime is just for you. Amazon.com/mytv If you are a person whose eyes open wide when finding new TV shows or movies to watch, then Amazon Prime is just for you. Amazon.com/mytv Amazon Prime Video is a streaming services provided to Amazon Prime members. Amazon.com/mytv click here. How to activate Amazon prime on TV using. Amazon Prime is a paid subscription which gives you access to a large range of services fast delivery, unlimited video streaming, exclusive access to deals, amongst others. Amazon.com/mytv allows its subscribers unlimited streaming of movies and TV shows. Amazon.com/mytv Amazon Web Services Scalable Cloud Computing Services: Audible Download Audio Books DPReview Digital Photography IMDb Movies, TV & Celebrities Shopbop Designer Fashion Brands.

To watch online prime videos on devices like computers, laptops, smartphones, and smart tv. Amazon.com/mytv You need to enter the 6 digit amazon activation code at Amazon.com/mytv or to watch the prime video for free. Watch amazon prime episodes on your device to sign in or create a new amazon account using email and password.

Amazon.com mytv is a registration portal of Amazon Prime from Amazon.com/mytv which members can watch thousands of movies and TV shows. Amazon.com/mytv Amazon Instant Video application on your LG TV or Blu-ray Player and then Amazon.com/mytv Prime Instant Video to start watching. Amazon.com/mytv Amazon.com mytv is a registration portal of Amazon.com/mytv Amazon Prime from which members can watch thousands of movies and TV shows.

Here are some easy steps to installation Canon Printer Driver. Users can download the Canon IJ Scan Utility software for free of cost from the canon.cpm/ijsetup manufacturer’s site. It is available in the MP Driver package. Make sure to install the driver that is compatible with the version of OS used on your Personal Computer or laptop.

Post a Comment