What follows is a recap of the same charts I featured October 29th, plus a few extras:

Chart #1

As Chart #1 shows, market selloffs are typically accompanied by a rise in the market's fear and uncertainty. (The ratio I use to capture that is the Vix index divided by the 10-yr Treasury yield. The former is a direct measure of fear and also a measure of how expensive options are, while the latter is a proxy for the market's confidence in the outlook for the economy; higher yields typically reflect more confidence, while lower yields reflect uncertainty about the future.) It's worth noting that the "worry" level these days is significantly less than it has been at other times in the past several years, even though the market's response has been of similar magnitude.

Chart #2

Chart #2 shows the level of 2-yr swap spreads in the US and in the Eurozone. Swap spreads are excellent coincident and leading indicators of systemic risk and financial market liquidity. At today's levels, swap spreads tell us that liquidity in the US is abundant and systemic risk is low. The Eurozone isn't quite as healthy, however, since it struggles with Brexit and the Italian budget outlook, among other things such as generally sluggish growth.

Chart #3

Chart #4

Chart #3 shows the level of real and nominal 5-yr Treasury yields and the difference between the two, which is the market's expected annual inflation rate over the next 5 years. Inflation expectations today are very close to the Fed's 2% target. They have dipped a bit in the past week or so, and Chart #4 suggests that the reason is simply a sharp drop in oil prices. We have seen this pattern quite a few times in recent years. Today's 1.8% forward-looking inflation expectation is nothing to worry about. Indeed, it tells the Fed that there is no pressing need to tighten monetary policy, and that should be a source of comfort to the market. Indeed, in the past two weeks the bond market has priced out one Fed tightening, and now expects only two rate hikes (from 2.25% currently to 2.75%) by the end of next year, with no more rate hikes after that.

I note that gold has been flat for the past 5 years, and the dollar is only 4% above its 5-yr average. Neither suggest that the Fed today is too tight or too loose. The Fed is not likely the main source of the market's concerns.

Chart #5

Chart #5 compares the value of the dollar, relative to other major currencies, to an index of industrial metals prices. Note that there is tendency for these two variables to move inversely—a stronger dollar tends to coincide with weaker commodity prices and vice versa. The "gap" between the dollar's current level, which is on the strong side, and commodity prices, which are still relatively strong, suggests that the global economy is still healthy (i.e., demand for commodities is still relatively strong despite the relatively strong dollar). This runs directly counter to the current meme which holds that the global economy is slowing down meaningfully.

Chart #6

Chart #7

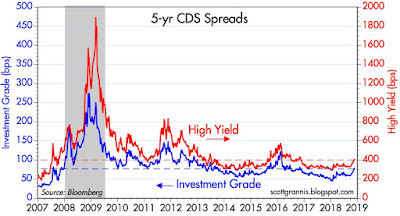

Chart #8

Charts #7 and #8 show various measures of corporate credit spreads. Spreads in the energy sector have been hit the worst, due to the recent decline in oil prices, but the damage is nothing compared to what happened when oil prices collapsed from $110/bbl in mid-2014 to $30/bbl in early 2016. The recent decline has brought oil prices back to where they were a year ago. This is not a major problem.

Chart #9

Chart #10

Chart #9 shows Bloomberg's measure of the S&P 500's PE ratio, which uses trailing 12-month profits from continuing operations. Since January of this year PE ratios have plunged rom 23.3 to now 18.1 (-22%). This reflects a rather sudden loss of confidence in the long-term outlook, especially considering that profits continue to rise, and are in fact up 22% versus November 2017, as Chart #10 shows. Curiously, the bond market appears to be much more confident about the future than the stock market (given that credit spreads are up only modestly, whereas equities have suffered a significant correction). This further suggests the equity market may just be in the throes of a panic attack. Looked at from the positive side, the recent decline in PE ratios has made the market that much more attractive.

Chart #11

Chart #11 shows the equity premium of the S&P 500 relative to the 10-yr Treasury yield. The current earnings yield of the S&P 500 is 5.5%, whereas the current 10-yr Treasury yield is only 3.1%. That investors are apparently indifferent to an equity yield that is more than 200 bps higher than the risk-free yield on Treasuries suggests that the market doesn't have much confidence in the outlook for earnings. Risk aversion has been an important part of the market's behavior in the current business cycle expansion, and it hasn't gone away even as economic growth has picked up of late. Consider how optimistic the market was back in the 1980s, when the equity risk premium was solidly negative for many years. It's been solidly positive for most if not all of the current expansion. Selling equities in favor of bonds today means giving up yield, so sellers must have the courage of their convictions.

Chart #12

Chart #13

Chart #14

Chart #13 compares the value of the Chinese yuan with the level of China's foreign exchange reserves. The yuan rose relentlessly from 1994 to 2013, despite the central bank's repeated interventions (i.e., buying dollars and selling yuan) to keep it from strengthening even further. But since then the yuan has been under pressure, and the central bank has had to sell foreign currency (any buy yuan) to keep it from declining further. This represents a sea change in the outlook for the Chinese economy. Before 2014 it was a magnet for capital, whereas now capital is fleeing the country. Still, capital flight has not been severe; the central bank has "lost" only about $1 trillion of its once $4 trillion in forex reserves.

As Chart #14 shows, the real value of the yuan vis a vis the world's currencies is still much stronger than it was throughout most of China's modern past. But on the margin it has been weak for several years now, and China's economic growth rate has slowed from 12% in 2010 to now only 6.5%. The bloom is off the Chinese rose, and if recent trends continue, China's economy could prove to be the world's weakest link.

Chart #15

Chart #15 shows how incredibly weak the Chinese equity market has been relative to the US equity market since China first entered the developed-country world in 1995. Chinese equities have suffered significantly more this year than any other developed countries' equity markets. This once again makes the point that China is the country that is hurting the most. If China doesn't find a way to deal with President Trump, what's bad for China could prove to be bad for everyone. I continue to believe that a deal is possible, since it would be in everyone's best interests to have lower tariffs and more respect for international property rights.

Chart #16

Chart #16 compares the US and Eurozone equity markets. The US has been outperforming Europe for the past decade, and to a sizable degree.

The global winds are at our back, but that doesn't mean we can ignore local headwinds. The following charts highlight some areas of weakness in the US economy that bear watching.

Chart #17

As Chart #17 shows, there has been a remarkable tendency for the physical volume of goods transported by US trucks and the level of the S&P 500 stock index. As the economy grows, so do equity prices. Truck tonnage was weak in the third quarter, and that appeared to foreshadow the October-November weakness in the stock market. But the latest reading of the Truck Tonnage index shows a significant 2.2% increase. On the surface, this would suggest that the economy is entering the boom phase that supply-siders have been looking for ever since Trump's impressive reduction in corporate tax rates. But it's also possible that trucks these days are scurrying around trying to deliver a flood of imports that were purchased in the hopes of avoiding increased tariffs scheduled for January.

Chart #18

Chart #18 shows the real and nominal level of capital goods orders, which in turn are a good proxy for business investment. By this measure business investment has increased by an impressive 16% since the November 2016 election. But investment has gone relatively flat in recent months, and it is far from impressive by historical standards. This could and should be better. What are companies doing with all their new-found profits? Buybacks are one answer, but they are still only a fraction of the current market value of US equities and thus not a satisfying answer.

Chart #19

Finally, Chart #19 shows how the wind has been knocked out of the residential construction industry in recent months. Most disturbing is the big decline in homebuilders' sentiment last month. We know that rising prices and higher mortgage rates have made housing much less affordable. But the current level of new housing starts is still far below its 2006 peak, and still below the level required to replace aging structures and accommodate new families. I've argued that this adds up to a pause or consolidation, not the beginning of another crash. Why can't prices stop rising or decline a bit, without that leading to the wholesale collapse of everything like what we saw in 2006-2008? Why can't the relatively strong economy continue to boost incomes and drive demand for more housing? Household leverage today is far below the levels that preceded the Great Recession, and mortgages are not being extended on ridiculous terms as they were back then. Still, it remains the case that what's bad for housing tends to be bad for the economy.

The horizon is not empty of threats, but the worst one (China) can be avoided or seriously mitigated by a trade "deal" that is in everyone's best interests. Free trade is a wondrous tonic for global growth, and free trade benefits all parties, contrary to what Trump's clueless Peter Navarro happens to think. All we need is for clearer heads to prevail. How hard is that?

18 comments:

do none harm

Hello Scott,

Thank you for sharing your views. They seem very sober.

Have you thought of using the differencial between Treasuries yield and Fed Fund rates in your fear gauge indicator?

Regards,

Bernardo, from Lisbon

Been following your helpful thoughts for years. You have not updated your US potential GDP versus actual recently. That chart and your comments would be insightful now.

Hello Scott,

October NFIB report confirms good prospects for US economy.

FI:

The average rate paid on short maturity loans fell 90 basis points to 6.4 percent.

Overall, credit markets have been very supportive of growth and will

not likely become an impediment for the next few quarters.

Bottom line, the October report sets the stage for solid growth in the

economy and in employment in the fourth quarter, while inflation and

interest rates remain historically tame. Small businesses are moving

the economy forward.

re "Have you thought of using the differencial between Treasuries yield and Fed Fund rates in your fear gauge indicator?"

Yes, but I prefer to use just Treasury yields. I look at the difference between 1 yr and 10 yr, and 2 yr and 10 yr. I also look at the difference between the real Fed funds rate and the 5 yr real yield on TIPS, as the latter is essentially the market's forecast for what the real FFs rate will average over the next 5 years. If that difference goes to zero (currently it's about 75 bps) then that would signal the market's belief that the Fed will do no more tightening. A negative difference would be a good indicator of a coming recession.

Re "You have not updated your US potential GDP versus actual recently"

I haven't, but mainly because it is still telling the same story: there is a huge gap, which measures approximately $3.2 trillion. This gap won't begin to close until real GDP grows by more than 3.1% per year. We're almost there.

I will feature an update to this chart after the second revision to Q3 GDP, due out next week.

Hi Scott, solid set of graphs! But still missing the most important one 😉

Hi Scott What is your current view on Apple. To me it is a very overblown reaction to what were very good numbers. There was 3-5bb in conservative guidance for the 4th qtr due to the stronger dollar and just not being able to correctly estimate the actual sell through for all the set through in all the markets for all the products. In addition I think the 4th qtr had 1 or 2week lesson sales for the new high end phone as they did last year. ...so that slightly brought he overall iPhone unit numbers down even though asp and total revenue were record highs. They also ,made mention on the call that the reason they are getting rid of unit sales was not because they are trying to hide declining trends as som talking heads are spewing..but rather they believe that unit sales over a 90 day period cannot not estimated properly for a variety of reasons and in fact overall rev. margins and other numbers are more relevant to how they view the co. At 13-14x's. and with theme still predicting record numbers for the 1st qtr. a 25decline seems ridiculous and leads me to believe that what is going on in the market are liquidations and redemptions from momentum and hedges and some slight repricing of growth trends. How do read the reaction?

Thank you for such sensible comments Very interesting and reassuring in the midst of unending crisis journalism.

There was one comment I could not pass, however. You seemed to conclude that it is not hard for common sense

and clear thinking to prevail. I know you are an optimistic person, but surely you know that will not happen. But

maybe you were being facetious or ironic.

In any event, you write the very best evaluations of market and financial matters I have ever seen.

Thank you.

Dwight Oglesby

Epic post.

Thanks Scott.

A big spike in the fear index would have likely signaled a bottom.

We have pretty big market declines occurring with very little panic measurements, as you say, Scott.

Half the stocks were down over 20%, but now its less than half.

This lack of panic COULD mean there is more to go until the fear kicks in, and markets puke out.

28 House seats lost to DEMs on day after election. Now its up to 40 after more votes were "found".

Market had to re-price for that.

America couldn't stand Maxine and Nancy being out of power. Sand in the gears.

Bullish Percents are thus far holding above their October lows. If they reverse up here(Brexit deal??) then we could be out of the woods. If they take out the October lows, there is more pain ahead, and those fear measurements will end up registering later.

do none harm, eps J. hold off, refrain, cork the ego.

https://www.cnbc.com/2018/11/27/apple-shares-slide-after-trump-says-iphones-could-face-10percent-tariff.html

Our illustrious idiot POTUS once again threatening absolutely insane policy of slapping a 10% tariff on iphones. What kind of dumbass laws do we have that a President can effectively threaten the future of a great American business?

2020 can't come soon enough.

Aren't those Chinese telephones?

And just like that, Fed Chair Powell concedes to the Mighty President, Donald J Trump.

Market likes.

Hi Scott! Best regards from Kazakhstan!

It has been a real pleasure to read what you have to say about markets and the Economy. And I cannot thank you enough for what I learned from you over recent 3 years. Thank you so much.

But I noticed one thing that troubles me.

All indicators are working perfectly, but I think most of them failed to predict what happened with the markets in 2007 and 2008 or even 2000-2002.

I explain why,

For most PMs the best timing to shift their portfolios would have been late 2006 or at least 2007 (and 1999 for dot.coms) but all indicators that we observing now were showing perfect development that time. Nothing was wrong, except mb for rising debt and leverage, but who could really tell when enough is enough when economy is booming?

Cheers

Damir

HI Scott,

Great post, thanks. Yesterday's weak market was largely attributed to an inverted yield curve, this time accomplished by substituting the 5 year yield in place of the 10 year. Is that legitimate or are people twisting the data to support their bias? And are any of the yield curve charts in your recent post signaling a different conclusion since publication?

Thx,

Ned

Post a Comment