Today the Fed released its Q1/17 estimate of the balance sheets of U.S. households. Once again, our net worth reached a new high in nominal, real, and per capita terms. We have been struggling through the weakest recovery ever for the past 8 years, yet we are better off than ever before, and by a lot.

As of March 31, 2017, the net worth of U.S. households (including that of Non-Profit Organizations, which exist for the benefit of all) reached a staggering $94.84 trillion. That's up $7.3 trillion in just the past year, for an impressive gain of 8.3%, and up $27.2 trillion since the pre-2008 peak. Of note, household liabilities have increased by a mere $510 billion since their 2008 peak, for a gain of only 3.5%. The value of real estate holdings is up about $1.9 trillion (+7.6%) from that of the "bubble" high of 2006, and financial asset holdings have soared by almost $24 trillion (+45%) since pre-crash levels, thanks to significant gains in savings deposits, bonds, and equities. The gains in wealth are not just due to a raging stock market, since the market cap of all traded U.S. equities has risen by only $8.4 trillion since its pre-2008 high, according to Bloomberg.

In real terms, household net worth has grown at a 3.5% annualized rate for the past 65 years, as seen in the chart above. That works out to almost a 10-fold gain in wealth roughly three generations, and that's impressive by any standard. Perhaps more importantly, there is no sign that this rising trend has been compromised or degraded in the past decade.

On a real per capita basis (i.e., after adjusting for inflation and population growth), the net worth of the average person living in the U.S. reached a new all-time high of $292K, up from $63K in 1950. This measure of wealth has been rising, on average, about 2.3% per year since records were first kept beginning in 1951. By this metric, life in the U.S. has been getting better and better for generations. Real per capita net worth has almost quintupled in three generations.

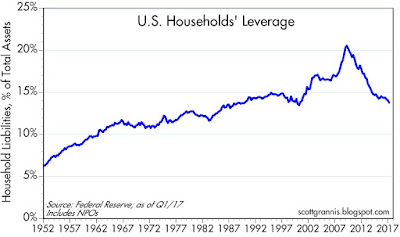

The ongoing accumulation of wealth is not a house of cards built on a bulging debt bubble either, regardless of what you might hear from the scaremongers. As the chart above shows, the typical household has cut its leverage by one third, from a high of 21% in early 2009 to 13.8% by the end of last quarter. Households have been prudently and impressively strengthening their balance sheets over the past eight years by saving and investing more and by reducing the use of debt financing.

Inevitably, skeptics will point out that although the amount of wealth created in the U.S. economy is spectacular, the distribution of that wealth is heavily skewed, being held mostly in the hands of relatively few. Zero Hedge has a good summary of the relevant facts. I (and many others) would argue, however, that the distribution of wealth is not nearly as important as the per capita amount of wealth. Consider: an employee of Apple, now the world's most valuable company (market cap of $808 billion as of today) may have zero personal net worth, but he or she enjoys a job that never existed before. Or consider users of Apple's iPhones who also may have zero personal net worth, but now enjoy more computing power and knowledge in their pocket than was even conceivable just 10 years ago. Increased wealth means more jobs, more opportunities, and more productivity for everyone. Society's accumulated net worth can be seen in buildings, factories, homes, gadgets, streets, and transportation networks, and all of this can be enjoyed and exploited by nearly everyone for their personal gain and/or happiness. It doesn't matter who owns the factory; what matters is how good the jobs are in that factory.

Inevitably, skeptics will point out that although the amount of wealth created in the U.S. economy is spectacular, the distribution of that wealth is heavily skewed, being held mostly in the hands of relatively few. Zero Hedge has a good summary of the relevant facts. I (and many others) would argue, however, that the distribution of wealth is not nearly as important as the per capita amount of wealth. Consider: an employee of Apple, now the world's most valuable company (market cap of $808 billion as of today) may have zero personal net worth, but he or she enjoys a job that never existed before. Or consider users of Apple's iPhones who also may have zero personal net worth, but now enjoy more computing power and knowledge in their pocket than was even conceivable just 10 years ago. Increased wealth means more jobs, more opportunities, and more productivity for everyone. Society's accumulated net worth can be seen in buildings, factories, homes, gadgets, streets, and transportation networks, and all of this can be enjoyed and exploited by nearly everyone for their personal gain and/or happiness. It doesn't matter who owns the factory; what matters is how good the jobs are in that factory.

Free markets and capitalism have proven to be the greatest creators of wealth and prosperity in the history of the world. They maximize wealth creation and opportunity for all, but they can't possibly deliver equality of wealth distribution. To expect it would be to fail to understand how free markets and capitalism work. Some people's comparative advantage lies in building companies and accumulating wealth, while others' advantage lies in supplying the labor that allows capital to be put to work for the benefit of all. Everyone needs each other, and everyone enjoys the fruits of our prosperity. You can't have an Apple without a Steve Jobs becoming fabulously wealthy, and you can't have an Apple without millions of people working to produce and use its products.

10 comments:

Well wealth distribution matters when your economy relies on consumption for 70% of its GDP...

You are right that if you work at Google or Apple or any other high tech firm -- your future is bright, but if you were working in a steel plant, no so much. There is no doubt that America has an amazing ability to create wealth, although it has its limits, since Amazon is trading at 198x and GM is trading at 6x there are issues if that high tech wealth evaporates tomorrow. lets say that Amazon goes to 40 or 50x p/e, now what?

But you are correct wealth creation is America is truly out of this world

Frozen: you are forgetting the principles of supply-side economics. Consumption does not drive growth or prosperity. The economy does not rely on consumption; consumption relies on production, supply, work, investment, risk-taking, productivity, etc. Production (supply) is the main driver of consumption and prosperity. You cannot consume if you don't produce. Wealth can grow faster than supply or demand (since it is the present value of future production), and indeed it has in recent years. Wealth does not drive consumption, but it can provide the seed corn for future production and consumption if it is deployed productively.

"Creative destruction" is an unfortunate but totally necessary part of free markets and capitalism. There will always be losers; there must be losers, because not everything remains the same as time passes. New ideas force out old, etc. Newer, more competitive firms kill older, less competitive firms. That is how progress is made.

It's enough to look at the first chart and note the rise of financial assets compared to real estate to figure out the "wealth rise" was only for a small percentage of the population (there's various data to back this up).

One of the results is the current POTUS. The majority can be ignored in obscure charts but not when it's time to vote.

The TAX plan and all else that you dream about cannot pass and will not pass until the health mass is passed. And if that cannot pass, will he be able to pass the TAX plan? No chance.

" The economy does not rely on consumption"

So, you're saying that household consumption as a percentage of GDP does not matter? So, China is doing fantastic while the consumption is 30-40% of GDP, and the current growth is not based on debt? Please.

"You cannot consume if you don't produce"

Can you produce is there's no one to consume it? How would you pay for the costs and debts?

"Consumption does not drive growth or prosperity."

So, this is it, if most of the wealth is at the possession of the few, has prosperity been reached? If you look at a chart that masks the distribution, the answer might be yes. But, then, people would vote against it. In non-democratic countries, there were other results.

Is it possible, just maybe, that it's not all 100% production or 100% consumption and it can in fact change according to the circumstances? (rhetorical)

Scott I completely agree with you, wealth has to be created to be spent -- hence the dilemma, since the wealth (mostly in stock market appreciation) is an asset owned principally by the 1% (and yes pension funds), but again, my comment was about distribution of wealth not about its creation. Finally, I agree that creative destruction is a founding principal of capitalism, but you too have to admit that its not so much destruction that we are seeing here -- its something else.

At this rate of top 1% wealth accumulation, I predict further electoral revolts against what has already become a not-so-subtle oligarchical form of democratic republic. I'm all for free-market capitalism, but our current system of government will come under more strain unless this widening disparity is addressed.

Wealth can be created but not spent. If capital gains taxes were eliminated, the value of the stock market was experience a one-time and significant increase. We would be more wealth as a country, but that would not necessarily translate into a similar jump in consumer spending, at least not right away. Wealth is forward-looking, since it is driven by discounted future cash flows. For spending to increase, the increase in wealth would first have to translate into increased saving and investment, then increased jobs, then increased spending. The holders of the bulk of that wealth are very unlikely to spend their increased wealth. The change on the margin would not be more spending, it would be more investment, since the after-tax rewards to investment would be significantly higher.

As for destruction, I note that weekly unemployment claims have fallen to levels not seen in many decades. As a % of the workforce, claims are at historical lows. The typical worker is less likely to lose his or her job today than at any time in the past 50 years. Job security, in other words, has never been so solid.

One way to address the unequal distribution of wealth would be to reform the tax code along the following lines: severely reduce of eliminate deductions, lower and flatter tax rates, and reduce or eliminate corporate income taxes. That would broaden the tax base while simultaneously lowering marginal tax rates for the middle class. A less progressive tax code would make it much easier for Middle America to accumulate wealth.

Today's tax code is steeply progressive. Middle income earners face a daunting increase in their marginal tax rates as they climb the income ladder. The rich have already climbed the ladder, so any increase in their incomes is taxed at a rate that does not increase. By using the tax code to redistribute income from those earning more to those earning less, we have paradoxically made it more difficult for those earning less to earn more. Government policies that attempt to redistribute income (or which try to accomplish something changes outcomes) invariably backfire, producing unintended and perverse consequences. Make it easier to get rich and you will find you have more rich people. And more prosperity for everyone.

I agree with this post, and would add that all layers of government, local, state and federal, should get out of the business of socialistic property zoning ASAP, and let free markets generate supply, which would reduce housing costs.

The Fed needs to forget about whether 4% are unemployed, or 5% etc. The Phillips Curve is deader than Jimmy Hoffa.

Egads, tight labor markets are wonderful thing.

If we want the voting public to embrace "free markets" then let's un-zone property and go for "tight" labor markets.

A sea of helped-wanted signs is nirvana.

Cheaper housing and higher wages is the right ticket.

Scott, totally agree that a more fair tax would be elimination of ALL deductions-including state tax and mortgage interest. Of course, we both know that will NEVER happen so address what MIGHT happen. If DT with a GOP congress cannot even get some form of tax overhaul done, they won't get anything done.

Why is this stuff SO hard?

Steve said: "Why is this stuff SO hard?"

Because the process for governing has been corrupted. The checks and balances the Founders envisioned have been/are being eliminated. IMO the legislative branch has been overshadowed by the executive and judicial branch, the former by fiat, the later by decree. If it is to be restored, term limits and lobbying reform must be addressed.

Post a Comment