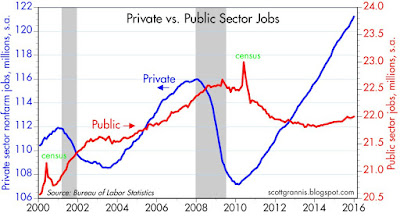

The chart above illustrates my first point above. On average, the private sector has been creating a little over 200K jobs ever months for a long time. In this context, December's report was simply more of the same. We'd have to see at least 2 or 3 more strong numbers before getting excited.

The trend in private sector jobs growth is a little over 2% per year. Add that to the 0.6% increase in labor productivity over the past 3 and 5 years and you get a GDP growth expectation of 2.7%. Nothing to get excited about, but it sure beats what's going on in most other developed countries. And consider this: the incremental growth of the U.S. economy this year will likely be almost as much as the entire annual output of Argentina.

One bright spot is that the growth of the civilian labor force (those who have a job or are looking for a job) has inched up to about 1% per year. But it's still the case that some 10 million people appear to have dropped out of the labor force (i.e., relative to past trends, there is a shortfall of about 10 million people in the labor force).

Another bright spot is the very slow growth of public sector jobs in the current business cycle expansion. The private sector is what powers the whole economy and pays the salaries of the public sector. The public sector has been shrinking relative to the rest of the economy for six years now, and that has freed up resources for the more productive private sector.

44 comments:

Hi Scott, First, Happy New Year! Thank you for continuing to write such an informative blog, it's always such a breath of fresh air. I tell friends it's like a graduate-level econ seminar that focuses on current events.

Looking at the last chart in this post, Private Sector jobs vs. Public Sector, got me thinking that non-profit jobs would be included in private sector, right? It might be interesting to show a chart of For-profit jobs vs. Non-profit jobs (Public sector being included in non-profit). Possibly even considering government contractors as non-profit since they get paid with taxed dollars.

Just a thought. Please keep up the great work.

Lots of interesting charts.

I am especially intrigued by the last one. If we're truly not quite at 122 million private sector jobs, then adding the 102 million NILF and Unemployed (http://www.bls.gov/web/empsit/cpseea01.htm) adults to the government employees, we have more takers than makers. (Takers are paid by confiscation of the makers $).

It looks to be Roughly 14-15 million net new takers since the end of 2007, almost the exact number of working aged adults added in the same time frame. That's not a good sign.

What's your take on the FED starting to raise rates? I'm fairly certain they'll have to reverse it before long because the interest on the debt will grow too fast.

yeah, the risk is our level of exports to china. yeah. all good now.

Asia closes up, great jobs report...and Wall Street tanks? Huh?

Fear of higher interest rates? Another Fed monetary noose on economy's neck?

Why the dump?

The only answer that makes sense is that the market is very nervous. Nothing is overvalued these days, except maybe Treasuries.

1. The total number for Oct and Nov were also revised up by 50K. So it was even better than that.

2. Wages did not grow. Guess the reasoning for corporate profit margins to compress is still not manifesting itself.

3. "How many are aware that U.S. exports to China account for less than 1% of our annual GDP? ". Just a general comment regarding the math: Country A's exports can be impacted by country C (or group of countries Cs), even if company A is just exporting to country B and not to C. It does not have to be direct connection. So, for example, if Chile (just for example, it's not necessarily correct) imports a lot from the U.S. but is harmed by declining exports to China, then the U.S. is impacted by subsequent declining imports from Chile. Again, this was just a comment about the math part, nothing beyond.

Scott, I think you get a lot of things right about the U.S. but a lot of things wrong about China and this is the reason why for the past 5 years you did not get the U.S. inflation picture right.

Thanks for your post.

We could argue all day about numbers and assumptions in an attempt to quantify what a disruption in the Chinese economy might mean to the U.S. economy. But at the end of the day, what carries the most force is the observation that the U.S. economy is not very dependent on the health of the Chinese economy, or any one economy for that matter. Of all the major economies, ours is the one least dependent on exports in general. Barring some cataclysmic disruption in China and/or the rest of the world, the health of the U.S. economy is not likely to be seriously affected by a weakening of the Chinese economy. I note, for example, that despite the disruption of the Eurozone economy (actually, a recession) that accompanied the PIIGS crisis, the U.S. economy was almost completely unfazed.

Roy, re China and inflation: Inflation is a monetary phenomenon, and it is a function of the interaction between the supply of and the demand for money. China has very little bearing on our inflation rate, except to the extent that a growing Chinese economy translates into more demand for dollars. In retrospect, it seems clear that the demand for dollars has been much stronger in general than I and others thought, and that is why our inflation rate has remained low despite a significant increase in the Fed's willingness to expand the supply of dollars.

Re China: in general I agree with Scott Grannis. On the other hand, the growth of China probably played the key role in the increase in commodities prices until just a few years ago.

There are also strange stories afloat that it has been the People's Bank of China that has been buying gold. Oddly enough, the world's central banks are big buyers of gold. It may be that gold prices have been artificially held up by central banks. However, central banks can probably persist in buying gold for generations, so this may not be an example of an artificial intrusion that will result in a bubble burst at any time soon.

Why the stock dump??

PUBs passed the Omnibus Bill in December, which officially ended their credible opposition to the unConstitutional policies of this President. This was a major shift in US policy, yet it registered barely a peep in financial commentary. This capitulation disgusted enough voters to matter. Markets took sharp notice.

Stocks immediately tanked nearly 700 points in those 2 days in December, with no other meaningful economic news occurring. Oil wasn't even down. This was followed by the worst first week of a year for stocks ever recorded.

Shrinking the size of government is an economic stimulus, as is returning government to its Constitutional bounds. PUBs engineered the first reduction of government spending in our lifetimes in 2013, and stocks responded immediately by rising over 30% that year. The PUBs have now reversed the sequester (it won't be back for many years), and have funded every Obama policy. The POTUS spent the week attacking the Bill of Rights with much applause from the mainstream media. He even wept to aid in manipulation.

Stocks are forward-looking. In my opinion, stocks are repricing to account for the significant loss of hope of fiscal and regulatory reform. This Bill has alienated PUB voters, and given the nomination to Trump. Establishment PUBs have never been more despised. Hope of reform had sustained this entire multi-year rally, as PUBs...particularly the Tea Party...gained seats in the last 3 elections. Another DEM Congress would be another economic disaster, just like the last one was. Markets know that.

This isn't Reagan's Republican Party. This Republican Party is proving to be no alternative to economic-crushing policies that have been pursued ever since the DEMs took over Congress in 2007, and Obama assumed the Presidency. This is the slowest recovery in US history, with both GDP and job growth significantly below trend. Instead of fighting and reforming, PUBs just locked in that malaise, and markets listened.

Markets have to adjust lower. Of course, any threat of China disrupting world growth, or threat of energy bond defaults will be exacerbated in the "loss-of-hope" environment I described above. If we were creating pro growth policies, and restricting outlandish government power, and running suitable candidates for office, the market would have shaken off these recent events.

It's going to take much longer to solve our problems because the PUBs stopped fighting back. Markets know that.

Scott, what is your response to ECRI/Achuthan on Friday that most of the job growth in 2015 is multiple part time job growth that cobbled together equals a full time job [over 35 hours] - he puts the share at 64% of job growth. Full time job growth hit an 11 month low, and part time combined to equal full time was at a high.

ECRI says job growth not translating into wage growth or consumer spending power because it is mostly a part time job growth situation.

Seems to make sense to me. Plus we have 60 to 65 year old engineers and senior wage earners retiring from higher salaries being replaced by young low wage earners [even though they have college degrees/mbas etc]. I see it with my son entering business world as most of his co-workers at are much older and many retiring at much higher salaries.

But the part time job growth issue is what I'm most interest in hearing your response to. I think the U.S. economic situation is worse than current numbers show....not recessionary...but clearly slowing. Seeing for the first time since 2009 more people in Detroit area losing jobs due to industrial recession from strong dollar. That a first.

Thanks....by the way...when was the last time your charts and commentary were negative?

Miller: According to the BLS, the number of part-time jobs (<35 hours/week) has not changed at all for the past 6.5 years: it's been right around 20.5 million workers, equivalent to 22.5% of the total number of jobs today. This is typical of recoveries, but doesn't sound at all like what ECRI sees. According to Treasury, federal income tax receipts have grown at an annualized rate of 10% for the past six years, a period that began with the post-recession low in employment of roughly 107 million private sector jobs (now over 120 million, for a 2% annualized gain). I don't see how those numbers square with ECRI's observation. Private sector jobs have been growing 2% per year, but taxes paid have been growing at a much faster pace. This doesn't sound like what you would expect from jobs growth that was mostly part-time and wage growth that was low or nonexistent. Taxes don't lie, but statistics can be manipulated to tell a variety of stories.

I've been posting negative stuff for many years, by the way, mostly about the headwinds facing the economy, such as huge growth in transfer payments, huge increases in regulatory burdens, the mess that is Obamacare, and high marginal tax rates. Since early 2009 my forecasts have been fairly consistent, calling for sub-par growth (i.e., not very optimistic) because of all the headwinds. I've been optimistic relative to the market, however, since I thought the market was overly pessimistic, and I think I've been largely right on that score.

By the way, when ECRI made a strong recession call a few years ago, I explicitly disagreed.

the reason for sell off is China...as mentioned here before...

but the ISM print from the other day should scare everyone, worse than the 2009 lows...

Wholesale auto inventory at high levels will eat into one of good green shoots for last 5 years...

2016 is not a good time to be investing....cash will show its strength again...

Gold will go up as China will break away from Dollar peg....they have too, they are close to backing their currency with gold..

The Chinese are smart and play the long game, the dollar is a reserve based off military might...that will wear out as the debt loop just keeps growing larger....

I agree ECRI was famously wrong on their 2012 call.

However, I can't quantify taxes paid as being anything worth placing a judgment on. Are these taxes paid including capital gains taxes on the stock market, or the higher capital gains rate which applies to dividends also, or the new health care tax? Or are you talking just about employment taxes on wages? To vague for me to conclude your logic flows to your argument.

I don't know where ECRI gets their numbers, but I think they are talking about part time jobs that are multiple to the same person equaling a full time equiv job. That sounds different than your citation of part time jobs.

I'll see if ECRI can clarify their assertion on multiple part time job growth for the same wage-earner.

Thanks...and buy the way, I still believe Richard Hokenson's assertion of rates going to zero [see his two CFA Journal article] has played out nearly exactly as he first predicted in 2009.

Keep up the good thinking and writing.

The one set of egulations, if gotten rid of, that would produce lots of economic growth?

Property zoning.

Scott,

Thank you for your replies.

1. The discussion should not be limited to a possible disruption due to the future of the Chinese economy, but also to understanding of the disruption due to the past of the Chinese economy (hence my comment about inflation impact). Re-balancing of the Chinese economy, which means reliance on the Chinese consumers instead of on investments would be a net positive to the U.S. economy and the global economy, even if it means Chinese GDP crashing down. Alas, so far this re-balancing does not seem to be successful even though it did positively impact some sectors (see your favorite stock Apple). Keeping my fingers cross for the sake of all Chinese people, but can't say I am too optimistic.

2. The U.S. economy is not a closed market. The USD is a *reserve* currency used globally. The market is not strongly efficient and information is not all known in real time so I am not sure how stating that inflation is all about monetary policy and all about demand and supply of money resolves anything as if the U.S. can be somehow immune to impact from the outside, in practice. It's not.

As I previously mentioned in my comment about Argentina, developing markets (including China) depend on confidence to success (not sufficient requirement of course). Once should ask themselves where is China on the confidence road. Not saying that we are there yet, but as a smarter man than me said (not difficult to find one) these things take longer than one expects but when they do happen it happens faster than one expects.

Regarding Europe, they kicked the ball down the road for awhile longer, mostly thanks to the drop in commodities and oil. The show is not even half over.

Miller: To follow up on my previous comment. The income tax receipts I mentioned include taxes on dividends and capital gains. So let's look at employment taxes, which are just FICA taxes. In the five years ending last November (most recent data available, and using 2010 as a base year since FICA taxes were reduced by 2 percentage points in 2011 and 2012) employment taxes have increased at an annualized rate of 4.6%. That exceeds the 4.2% annualized increase in Personal Income over the same period, and it also exceeds the 3.6% annualized increase in disposable personal income (i.e.,after-tax income) over the same period, and it exceeds the 1.4% annualized increase in inflation (personal consumption deflator). I think that supports the notion that the growth of jobs, wages, and salaries for non-upper-class workers have been decent, and not a mirage.

"PUBs passed the Omnibus Bill in December, which officially ended their credible opposition to the unConstitutional policies of this President."

They were bagman for Barrocko; yes, their entire leadership was

on broad with Obombsa.

What surprises me, has been the market decline for this

month, despite good employment reports.

What does the market know? Is this just a serious and long over

due correction?

The question of the hour is this: Who is buying US treasuries other than the US?

William: I suspect China buying of Treasuries and TIPS. Yuan depreciation play. The world is flooded with capital. The supply side is like the Mississippi. Did you know the global auto industry has excess annual capacity of 20 to 30 million units?

What the world needs is more demand.

China's foreign exchange reserves have fallen by almost $700 billion since mid-2014. The central bank has sold that amount of reserves, held mostly in notes and bonds denominated in dollars and euros, in order to support the yuan as capital has been withdrawn from the economy. So it's highly likely that China has sold significant quantities of Treasuries in the past 18 months and continues to do so.

It's possible that the purchasers of a good portion of the notes and bonds the central bank has sold are in fact Chinese businesses, investors, and institutions who have decided to take their money out of the country in order to avoid an expected depreciation of the yuan. I note that the dollar has risen significantly since mid-2014, but U.S. and eurozone yields are flat to modestly down over that same period. On balance, then, it would appear that money has left China to seek better opportunities in dollars, euros, and overseas bond markets. This has left the yuan weaker and overseas bond markets steady to stronger.

It's also possible that U.S. investors have been slowly rotating out of equities and into bonds—thus purchasing some of what China was selling—over this same period, thus sapping some of the strength of our equity market.

When Hedge Funds anticipate a bear market / recession -as S Druckenmiller, J Rogers and other do - they typically short certain US stocks and buy US treasury bills and bonds as a hedge.

It's been widely reported that China has been selling their exchange reserves (US bonds) to ease the fall of the Yuan as has Saudi Arabia to support its currency (also anticipated to be devalued) and other emerging markets as well for the same reason. The sovereign wealth funds of Norway and other oil producing nations have also been selling.

Oh, McKibbin's question actually was who is buying?? It's typical that when stocks fall hard - as they have - US treasury bonds rise. It's a well know reaction so investors anticipate a positive return from buying bonds and it's a very liquid and safe place to park money. Happens with almost every sharp stock market fall.

It's not enough to ask who's buying or selling. That's because for every sale of bonds there is a purchase of bonds, etc. The better question is to ask how investors' willingness to hold different asset classes is changing. Changing demand for an asset, not just sales of that asset, are what drive prices.

Investors are obviously less willing to own Chinese assets these days, more willing to hold dollars, less willing to hold yuan, etc.

I actually don't think that makes sense, Scott, because it is the Central Banks of China, Saudi Arabia, Brazil, etc which are initiating the sales to support their currencies. I believe that if the Central Banks had their preference they would prefer to own the US dollar bonds but they don't have a choice when their currency is perceived to be over valued (due to a weakening economy) and is under attack. I would guess that sovereign wealth funds would rather retain their US bond assets but also need to sell in order to provide funds for their government's operations.

It's not as though these entities are willful sellers taking their profits.

William: I disagree. Central banks are not initiating anything, they are responding to the changing desires of the market. Investors want out of the yuan, so the central bank is forced to sell reserves. Central bank sales are the symptom, not the cause of what is going on.

OK, Scott, I see what you mean now. Sorry about that comment.

No apologies needed. It was a good comment and helped me to refine the argument.

Copper prices now below levels...of 10 years ago. Off more than 50% from recent levels.

Ben Jamin, good points about Cu.

Declining Cu can not be reassuring about

world economic growth.

For those whom are in love with governmental unit

data.

http://www.thefiscaltimes.com/2016/01/04/Oops-Feds-Screwed-10-Years-Housing-Data

Scott,

Given that rate increase uncertainty is demishing do you have any current thoughts on REITs and MLPs??

Rent earning equities are winning right now...

http://www.wsj.com/articles/how-to-profit-from-rising-rents-build-apartments-1452614388

But I am very cautious about buying new stocks right now -- conversely, I am getting very interested in the dirt cheap commodities available, especially gold and silver.

Watch for $20 oil, $700 gold, and #9 silver for the strongest buy signal.

Gold/WTI just hit 36x. This is getting historic.

Re: REITs: I think the long-term outlook for REITS is good. The Fed is nowhere near having to tighten aggressively, the economy has lots of untapped growth potential, and they would benefit significantly if the Fed makes the mistake of not tightening sufficiently (i.e., they are a hedge against an unexpected increase in inflation).

To all, here's a link to a summary of Rob Kirby's analysis of the current markets. Kirby takes a more China-centric view of the US economy, but his insights into the Chinese investment psyche are keen. The most important point of Kirby's analysis is that we not assume that "all is going wrong for China". In fact, much is going right for Chinese elites, including expansion of exports via devalued Yuan, institution of seemingly effective capital flight controls over the Yuan, reduction in US treasury reserves, and acquisition of dirt cheap commodities around the world (including vast quantities of gold bullion). The only losers will be Chinese citizens, who will be experiencing a concomitant decline in their standard of living, which is irrelevant to Chinese elites. Again, China is may very well be winning at their own game here, albeit at US expense. As for US monetary and fiscal policies, reread Scott's postings over the past several years and you'll get a picture of that reality. Here's the summary article link:

http://usawatchdog.com/economic-collapse-happening-now-rob-kirby/

Rob Kirby, referenced in the link above, has been predicting doom for a long time. The "vast quantities of gold bullion" that China has acquired now total about 57 million ounces, which is worth some $60 billion, which is less than 10% of the $700 billion in foreign exchange reserves that China has sold in the past 18 months.

In my experience, central banks are famous for loading up on gold when it is expensive, and selling when it is cheap.

here's why grannis is a dangerous sophist: what about those who export more to china than we do that we export to? it's really shameful for any blogger to dismiss any dislocation. i say shame on grannis.

Scott is correct, China's gold reserves stood at 56.66 million troy ounces at the end of December according to Reuters.

"In my experience, central banks are famous for loading up on gold when it is expensive, and selling when it is cheap." So true, Mr Grannis, and another compelling reason to

disbane them.

Hear is the real story behind the December employment reports.

http://nypost.com/2016/01/11/the-breakdown-of-decembers-extremely-misleading-job-report/

Hans: thank you for reminding us that the jobs data can at times be skewed by faulty or badly estimated seasonal adjustment factors. That is one reason why I always look at the trend over at least the most recent six months before deciding whether things have changed. But seasonal adjustment cannot be dismissed out of hand, as the NY Post author attempts to do. Over time, seasonal adjustment factors tend to do a pretty good job of smoothing out the data. But on a month to month basis not so much, and certainly not as reliably. You will note, I'm sure, that I drew no hasty conclusions from the surprisingly strong December jobs number.

Nice link, Dr McKibbin.

Interesting read, which will require more thought and contemplation.

Mr Kirby said the FBR rig the market, however, the admission was

that they front loaded it. I would require a further explanation

as to the meaning of that phrase.

This is also what Mr Kirby said, " What is Kirby’s prediction for the price of gold and silver by the end of 2016? Kirby boldly says, “I think it could be many multiples of the price right now.” What do Kirby’s billionaire contact say? Kirby reports, “They say they think we are very close to the end."

Perhaps the word boldly should be replaced with foolish and absurd as precious

metals will suffer another drawndown year and as well to Mr Kirby's reputation.

I also find it disturbing, when an acclaimed source is that of a man

with enormous wealth, as if this authenticates his expertise.

BTW, how good or bad has been Mr Kirby's pontificates?

Dr McKibbin, hear the manifestations of Herr Kirby

which would only allow for a rational person to

conclude that he is nothing short of a crank.

One bizarre narrative after another, leaving the informed

reader shaking their head.

http://www.silverdoctors.com/tag/rob-kirby/

Mr Grannis, you are a wise man indeed. Unfortunately, many including me

do not have either the time nor resources to wait for BLS's

revisions. Why do not these governmental units merely delay

their announcements until they have the finial data?

If these type of reporting was done by commercial interests, some

governmental unit agency or Senate panel would be conducting

an investigation.

Has anyone noted the delay in the issuing of publicly traded quarterly earning reports?

IMHO, the timing and accuracy of governmental unit's statistics

are misleading and only lead to bafflement for the general population.

These types of practices results in a disdain, by Americans, for

any related subjects to economics, allowing for the sustained growth of

ignorance, which should be considered a public health issue.

I better go now, as my utilities and credit card companies have just

issued revised billing data.

Post a Comment