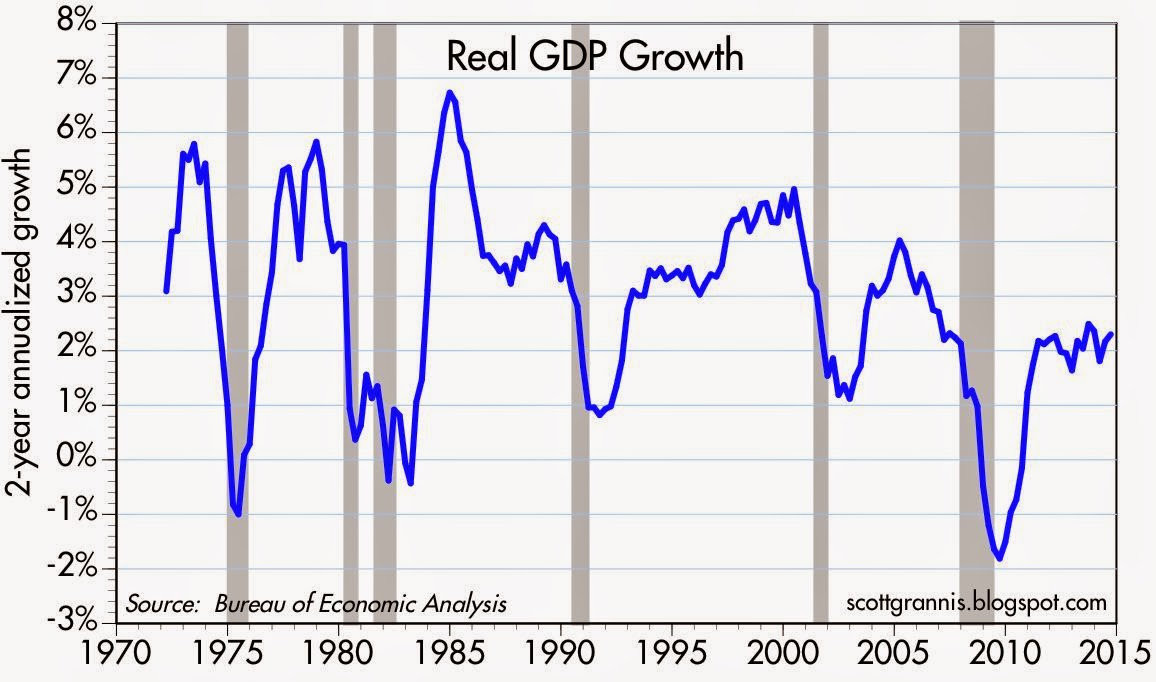

Third quarter real GDP grew somewhat faster than expected (3.5% vs. 3.0%), and on top of the 2nd quarter's 4.6%, that gives us annualized growth of just over 4%. Wow: has economic growth really ramped up than much? I'd like to think things have improved a bit of late, but in any event it's premature to reach that conclusion—we'll need to see at least another quarter's worth of stronger growth to be sure.

Abstracting from the quarterly numbers, which are always volatile, real GDP growth over the past two years has been 2.3% annualized (see chart above). It's also been 2.3% annualized since the recovery began in mid 2009. This has been a 2.3% growth rate recovery for over 5 years. Nothing much has changed, at least so far.

As the chart above shows, this has been the weakest recovery in history. The economy is now about 10% below its long-term trend growth potential. In other words, nominal GDP today would have to be $2 trillion higher to get us back on the economy's long-term trend. Due to a variety of factors (e.g., too much income redistribution, high marginal tax rates, too many additions to regulatory burdens, Obamacare, geopolitical uncertainty, unusually strong and persistent risk aversion, the retirement of the baby boomers), we are missing out on $2 trillion of annual income and 10 million or so jobs.

This is a big deal, and this is why the electorate is upset. We've made some terrible decisions and left an awful lot of money on the table.

But I do think it's likely that the economy is gaining strength on the margin. One reason for that is the big decline in government spending relative to GDP, which has dropped from a high of 24.4% to 20.3% in the past five years (see chart above), mainly because spending has not increased at all during this recovery. Spending is taxation, so what we've seen in the past five years is a huge decline in expected tax burdens. A considerable amount of weight has been lifted from taxpayers' shoulders. The private sector now has more breathing room. The private sector is now spending a larger share of its own money, and that means that spending in aggregate will be smarter, more efficient, and more productive. (Keynesians, by the way, get this all wrong: they think the economy has suffered because the government has not spent more and because the deficit has declined—that fiscal austerity is the culprit behind weak growth.)

Meanwhile, it seems increasingly likely that the electorate next week will repudiate the current administration's policies. At the very least we are likely to see congressional gridlock, which could keep spending from growing and reduce the burden of government further. More likely, we'll seen Congress make progress on reducing our onerous corporate tax rate, which could result in more new investment and more new jobs. We might even see some much-needed reform of our absurdly distorted tax code, and some sensible, market-based reforms to healthcare.

You can already feel the policy winds shifting. Instead of headwinds, we are starting to get tailwinds. This is very good news. There is a lot of ground to make up, and a lot of upside potential if we get things right in the next few years. It pays to remain optimistic.

12 comments:

Great Depression recovery was slow as well

http://www.mkbergman.com/wp-content/themes/ai3v2/images/2014Posts/gdp_growth.png

Recessions caused by financial collapses are just worse

Took massive fiscal stimulus (war spending) to end the Depression

Guess what boosted GDP in Q3, Fiscal spending (again war spending, although any fiscal spending of similar size would have been good)

Also BTW, on the issue of the electorate, midterm elections are always dominated by white americans, who are the GOP base.

Wait until 2016 to see how the electorate actually votes

Great to see Scott's Output Gap chart updated.

Another excellent wrap-up by Scott Grannis.

I wonder if FICA tax cuts would not be more effective than other tax cuts.

Granted any tax cut is a good idea, and I would entirely eliminate corporate income taxes if I could (balanced by large cuts in federal agency spending, which is mostly wasteful "national security" fat).

But FICA taxes are extra nuts---we tax people for working and hiring! We tax people for being productive! From the moment of inception too!

I think an excellent program would be to halve FICA taxes (on both employer and employee) from about 15.2% now to 7.5% or so.

The lost revenue can be made up by having the Fed buy Treasuries, and depositing them into the Social Security Trust Fund. About $500 billion a year.

About the same size as the QE programs now suspended.

We have not seen inflationary effects from the QE programs concluded, so perhaps inflation would not be a concern---moreover, by lowering the cost of labor, FICA tax cuts would be deflationary.

It will take a lot of QE by the Fed to overcome that deflationary impulse. we are near deflation now, of course. Europe is there, as is Japan.

You tell me why when a guy hires another guy, we immediately slap a 15.2% tax on that situation.

Cut FICA taxes!

Gold falls below $1,200.

If you have owned gold the last three years, you have suffered 11% annual inflation.

They are printing too much gold.

Velocity of M2 Money Stock for Q3, 2014

2014:Q3: 1.532

2014:Q2: 1.535

2014:Q1: 1.533

2013:Q4: 1.562

2013:Q3: 1.569

Essentially flat for 2014 but still down from Q3, 2013.

http://research.stlouisfed.org/fred2/series/M2V

Benjamin: Again I find myself completely simpatico with you. I've long thought that FICA taxes could be the dumbest, most unproductive tax imaginable. And especially so these days when hiring is such a desired outcome.

Can you get your '16 campaign together? The country needs you, Ben!

Re FICA. To fix the problem of FICA we should privatize social security. Currently it's just a Ponzi scheme managed by politicians. The vast majority of people end up receiving a miserable return on their money. They could do much better by investing on their own, and they could own their accounts.

As I mentioned in April, the governmental unit will distort the economic numbers between then and November the 4th.

I strongly suspect they will get weaker after the elections.

Again, the only reason America has not seen another recession is cheap money.

The debtors are raping any and all savers..Times are very good for free loading debtors.

And of course, the FRB will continue it's cheap money program six years after the govcession! Was dat really a surprise to those whom have no faith in that institution?

Scott

Americans don't feel wealthy because for most of them they are actually poorer than they were 10 years ago. More than 100% of the income gains made in the past 15 years have been grabbed by the top 30% of the income bracket. The other 70% are actually poorer than they were. New jobs created in the US are at a income rate equal to 70% of what jobs were created a decade ago.

Now, it remains that despite Obama and his henchmen best efforts (sarcasm implied) America's economy is growing at the fastest rate in since 2002. Which as an investors should tell you something. Despite your desired social agenda, as an investor you do better under a "socialist democratic administration".

Just saying...

Question: how much of the current rally is due to investors' hopes that today's elections will bring better policies in the future?

Post a Comment