Today the Conference Board reported that its March survey of consumer confidence reached its highest level since the Great Recession. As the chart above shows, despite the substantial improvement in confidence, confidence is still at levels that were associated with recessions in the past. We've made a lot of progress, but this is hardly what you would call an enthusiastic or overly exuberant recovery. It will likely take years before confidence reaches levels that would be associated with optimism.

New single-family home sales, shown in the chart above, have increased about 50% from their lows of three years ago. That's a big gain, but sales are still abysmally low from an historical perspective. Still, it's a recovery, and we are likely still in the early stages of the housing market recovery.

The housing market hasn't made much progress in the past year, but builders remain reasonably confident in the future. Bad weather has held back a lot of activity, but that is passing and we should see more gains reported in the months to come.

The above chart shows how gold prices and real yields on TIPS have moved together over the past several years. I've inverted the real yield scale for TIPS in order to have a proxy for TIPS prices (rising real yields equate to falling TIPS prices). The price of gold and the price of TIPS have both declined significantly in the past year, and I think this is a good sign that the world's demand for safe assets is declining. This is equivalent to saying that the world is becoming somewhat less risk-averse. Risk aversion is giving way to risk-seeking, albeit slowly. We're still in the early stages of a recovery, still far from reaching the late, overly-optimistic stage. Consumer confidence, gold prices, and TIPS prices are all saying the same thing.

The PE ratio of the equity market says the same thing: things have improved in recent years, but pricing is still reasonable from an historical perspective. No signs yet of irrational exuberance.

In order for there to be real, substantial improvement in the economic outlook I think we need to see signs of important changes in fiscal policy, such as reduced regulatory burdens, tax reform, and lower marginal tax rates, particularly for businesses. Until then, the economy is quite likely to continue growing at an unremarkable, 2-3% pace. The economy has been doing so for a little more than 4 years now; growing and pushing ahead in spite of some significant headwinds in the form of monetary policy uncertainty, mounting regulatory burdens, and rising tax rates.

Many argue that the economy has been growing only because of massive monetary and fiscal policy "stimulus." I think that's just plain wrong. To begin with, monetary policy has no ability to create growth; growth only comes about when the existing factors of production are used more efficiently and more productively.

The Fed hasn't been stimulative at all—it's mainly worked overtime to convert notes and bonds into bank reserves (the functional equivalent of 3-mo. T-bills) to satisfy the world's tremendous appetite for safe assets. Meanwhile, the growing mountain of excess reserves in the banking system has created great uncertainty about the future: will the Fed be able to reverse QE in a timely fashion, or will the banking system use its excess reserves to create too much new money?

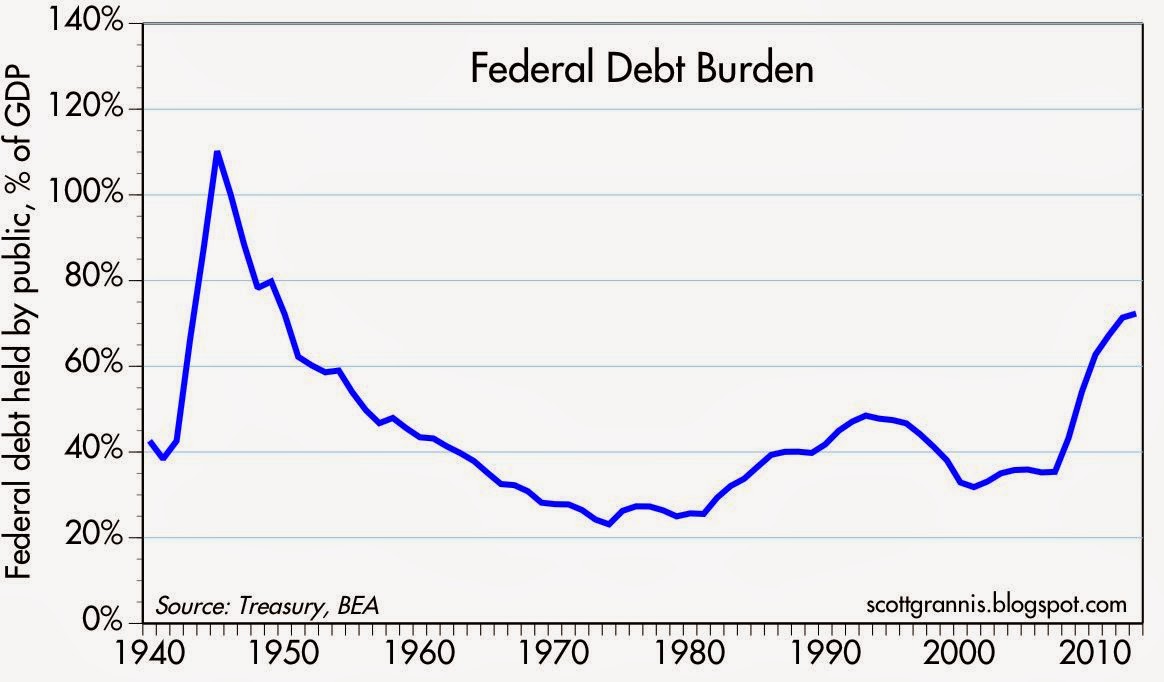

Fiscal "stimulus" hasn't been stimulative either, more than 75% of the ARRA stimulus spending was just transfer payments—taking money from one person and giving it to another. That can't possibly stimulate growth; in fact, it can hurt growth because it creates perverse incentives (i.e., penalizing the productive, rewarding the unproductive). What all the spending did do was create a huge increase in outstanding federal debt, and that in turn told the private sector that the expected burden of future taxes had increased significantly.

Monetary policy has kept fear and anxiety about the future alive, while fiscal policy has smothered the private sector with regulatory burdens (e.g., Dodd-Frank and Obamacare) and higher taxes. It's a testament to the inherent dynamism and vitality of the U.S. economy that the it has managed to grow as much as it has.

Just a few small changes could have huge, positive consequences. If we dropped the corporate tax rate to, say, 15%, corporations might repatriate many hundreds of billions (even trillions) of profits that they are holding offshore. One reason this has been a weak recovery is that business investment has been weak (which is why jobs growth has been weak) despite the fact that corporate profits have never been so strong (see chart above). Businesses with substantial overseas sales are loathe to pay 35% just for the privilege of repatriating their profits, on which they've already paid overseas taxes. A lower tax rate would instantly improve the competitiveness of U.S. businesses, boosting sales and eventually boosting jobs. It's silly to worry about what a cut in the corporate tax rate might "cost," since corporate tax receipts have been a mere $287 billion in the 12 months ended February—just 11% of total federal revenues. It's better to think of the benefits it would bring, in the form of new investment, new jobs, and rising incomes. You don't have to be a supply-sider to understand that a bigger economy and a bigger tax base could generate enough revenues to offset most or all of the revenue "lost" to a lower corporate tax rate.

One simple change to the tax code could have a transformative impact on the healthcare industry. All we need to do is allow everyone, not just employers, to deduct the cost of healthcare insurance. Another simple change with a huge impact would be to allow insurance companies to sell policies across state lines. Making it easier for individuals to buy their own policies would get rid of the "third party payer" problem, by introducing market-based incentives and competition to an industry that for the past 70 years has been overly regulated by the federal government and distorted by shielding consumers from seeing the true prices of the healthcare services they consume. Make it easy for individuals to buy their own policies and we would fix the portability problem and most likely end up with more people insured.

When fundamental change for the better is so easy, it doesn't make sense, in my view, to be pessimistic because the recovery continues to be disappointingly slow.

6 comments:

What we need is Medicare for All. It is the most cost-effective healthcare insurer there is because it is the single largest provider of healthcare insurance.

Harnessing this pricing power would lead to lower prices for healthcare, and in turn, lower premiums.

And, there would be no middle men skimming significant profits off the top.

Win. Win.

The only way healthcare costs are going to come down, while at the same time improving the overall effectiveness of healthcare services, is if true competition enters the market. That means that buyers and sellers have to interact and prices have to be there for all to see. Handing the whole thing over to Medicare would only aggravate the problem by creating just one buyer and mandated prices.

Lawyer in NJ makes a classic socialist comment. Medicare is fraught with abuse and inefficiency like all large government projects. Yes it does serve people but like SS it is a bit like killing a fly with a hammer. The fly is dead but the table is ruined and the hammer costs 10 times a fly swatter.

To add to Scott's comment, tort reform is the key to unlock the non competitiveness in the medical establishment. Healthcare in America is the best in the world. It's just too damn expensive. To many people in too many industries are getting stinking rich off of the suffering of other people. Competition is the key.

"That means that buyers and sellers have to interact and prices have to be there for all to see."

Absolutely, that would be the best. Unfortunately it is unpractical and unachievable in current "human condition" reality. Perhaps it will be, decades or centuries from now with the right technology where people would get health care at home, for example.

Until then, it would be best to find a practical solution which might not be the ideal but it would be far better than what is now available.

The best known practical solution, that we know of, is already in place in some other countries where the cost is far lower and the output far, far better.

The best economists that I know are those who make a conscious effort not to insert their own ideology/political view/religion into the numbers. Unfortunately, there are not many.

@ Bob

__

Costs for the private healthcare system are rising faster than for Medicare, so to call Medicare inefficient is not factual on a relative basis. When you factor in the at-risk population it serves (old people get sick and die over time), that is truly a remarkable achievement.

I would like to see one independent study that shows more abuse in Medicare than in the private system.

The only truly socialist healthcare system in this country is the VA. Would you like to see that abolished?

Post a Comment