The market correction—which by the way has affected nearly every equity market in the world so far this year—gathered steam yesterday with the release of a surprisingly disappointing ISM manufacturing report. We've had many such corrections in recent years, and of greater magnitude, so my first reaction is to think that there is little reason to suspect that this one is going to get much worse before it gets better. The ISM report looks like an outlier that was likely caused by the terribly cold winter experienced in most of the country. (California, in contrast, continues to bake in the sun, desperate for some moisture.)

Even if we take the ISM report at face value, the chart above suggests that it is still consistent with overall GDP growth of 2-3%, which is what we've had for the past four years or so. However disappointing the ISM reading, it doesn't imply a change in the status quo. The stronger numbers that came out late last year probably got some people excited about an acceleration of growth, but that might have been too much to hope for given the ongoing headwinds of high marginal tax rate and regulatory burdens.

The export orders index also dropped sharply, but it does that frequently, and it is still at a reasonably strong level. No reason to think that conditions in the rest of the world have deteriorated to any alarming degree all of a sudden.

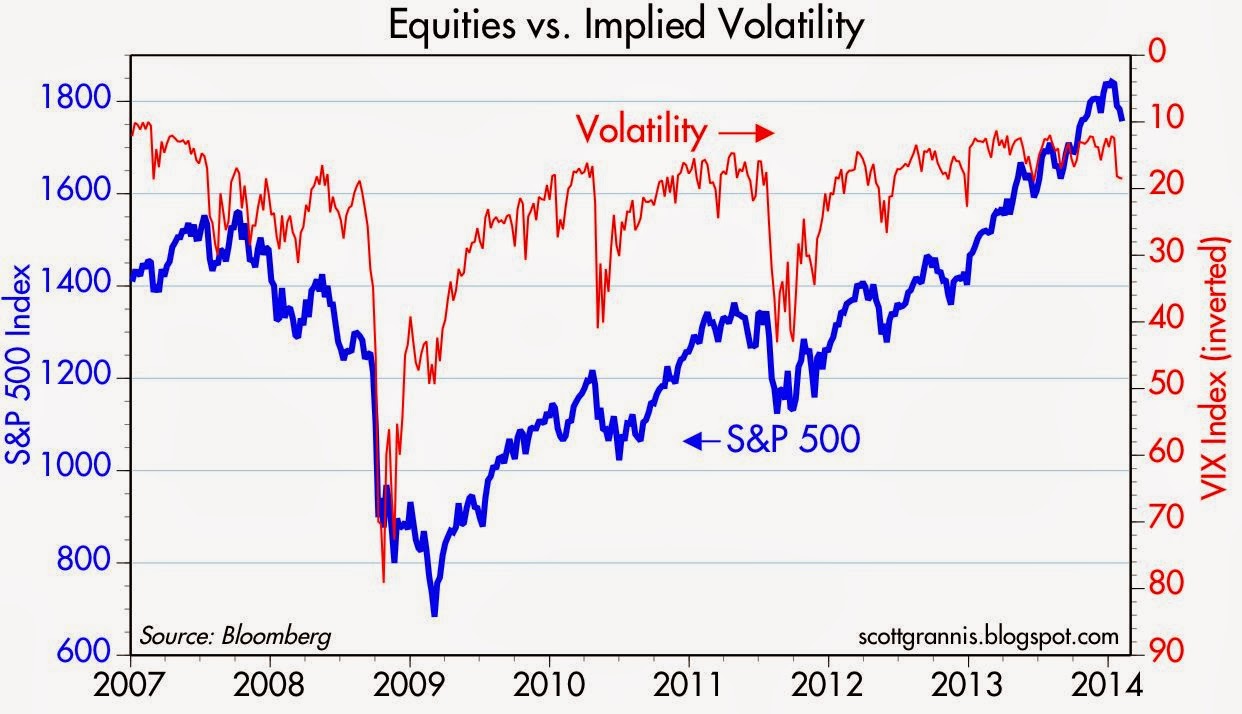

The chart above is designed to show that nearly every selloff/correction since 2008 has been accompanied by a rise in the Vix index, which in turn is a proxy for the market's level of fear, uncertainty, and doubt. But importantly, the really big selloffs were accompanied by huge increases in the Vix index: these were times when markets worried about major dislocations such as the potential collapse of the global financial system (2008), or the collapse/default of major Eurozone economies (2010 and 2011). Since 2012, the Vix index has itself become much less volatile. There's been much less uncertainty, much less to worry about in recent years, and this has contributed to the rising prices of risk assets. In the current correction we've only seen the Vix briefly reach into the low 20s, which is what happened last October, when the market slumped some 5%. As of yesterday's closing low, the S&P 500 had dropped 5.7% from its recent high, and as I write this, the Vix is back down to 18.6 and the market is up almost 1%. So far, this is a garden variety correction.

Unless there is something really terrible brewing out there (and I note that swap spreads remain very low nearly everywhere, suggesting there is not), I doubt we are on the cusp of a major market reversal. The troubles affecting the emerging markets are largely of their own making (e.g., years of rapid money supply growth, falling currencies, anti-growth fiscal policies, and a general lack of confidence), and in any event there's little reason to think that the emerging markets tail will wag the global dog. Besides, the ingredients of a serious threat to emerging market economies—high real interest rates in the U.S., a strong and rising dollar, and falling commodity prices—are simply absent at this time.

9 comments:

Excellent, thank you Scott

The Fed runs the global super currency and is de facto central bank well beyond US borders...the recent history of central banks is that they quit QE too soon...the Fed may be repeating this mistake...

That said, other central banks need to chart more aggressive growth targets...

China? Still growing...

"@Benjamin" who wrote "..the recent history of central banks is that they quit QE too soon.."

You lost me. Would you please remind us specifically of what history you are speaking? Which countries?

Test/.

This is a test of the CBP commenting system. I left a detailed comment last week and it never showed up.

/Test complete

Paul: I have no idea what might have happened to your comment. I can't find any trace of it. Pls try again.

Why is a market decline called a "correction"?

Is it a mistake when markets go up?

William:: Japan tried 2002-6 it was succcessful but they stopped and went back to perma-gloom...then the Fed had QE1 QE2...start and stop...they should have not stopped...

The inflation-hysterics claim QE inevitably leads to inflation but empirically that has not been true...now the voodoo-fear is "QE will cause unintended or unforseeable financial imbalances".

So far, in Japan and USA, QE is associated with growth...

Thank you, Benjamin for clarifying your comment.

Two feeble job reports in a row...stocks iffy...PCE deflator sinking below one percent...Europe stagnant...

Time to taper?

Post a Comment