As disappointed as I am with the reelection of Obama, I don't think the economy is likely to underperform the market's dismal expectations. Misguided monetary and fiscal policy have been behind the economy's sluggish growth, and I don't see that getting worse. Some argue that very slow growth such as we've had increases the risk of a recession, using the analogy of an airplane that approaches "stall speed" being at risk of falling out of the sky, but I don't believe that analogy works for an economy. Recessions happen when unexpected and unpleasant things happen; they don't happen just because growth is disappointingly slow. Besides, the U.S. economy has an inherent dynamism which you underestimate at your peril. Most people want to advance by working harder, smarter, and by taking on extra risk. Americans by nature are problem solvers, and love to overcome obstacles and undertake challenges. And boy do we live in challenging times: successful entrepreneurs and businesses today are more likely to be demonized than appreciated, while some who fail to succeed are bailed out. That's not fair, in my view, but it hasn't stopped people from working harder.

I've argued for years that even though the recovery would be sub-par, the economy was likely to outperform the market's expectations, and for the most part that has been exactly what has happened. Although it is hard for me to be optimistic about another four years of Obama, I still think the economy can generate enough growth (even if it's only 2% per year) to beat the expectations that drive people to buy 10-yr Treasuries with a measly 1.7% yield, and to eschew equities with an earnings yield of 7% in favor of cash yielding zero.

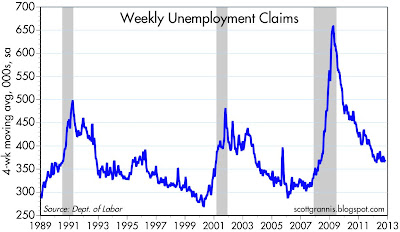

For those who hold cash to be rewarded, the economy has to deteriorate significantly. However, so far there is no sign of any deterioration. Sandy may have caused claims to be a bit lower than expected, but even if they were higher the story would still be the same: seasonally adjusted claims have been flat for almost the entire year.

The above chart takes the numbers from the first chart and compares them to the size of the workforce. What this tells us is that in the past 60 years there have been only about 10 years in which a smaller percent of those working were at risk of losing their job. The economy isn't adding a whole of jobs, but neither is it firing very many. The problem is not layoffs, it's the lack of new jobs.

As this next two charts show, the one thing that has been very different about the last recession and the current recovery is the unprecedented number of people who have received unemployment insurance, thanks to Congress' decision in mid-2008 to create an "Emergency Claims" benefit. That is now winding down, with the result that there are 20% fewer people today receiving unemployment insurance than there were a year ago. This is one of the biggest changes on the margin in today's economy, and it doesn't get the attention it deserves. It's a perfect example of how the influence of government in the labor market is declining to a meaningful degree. Whenever government intervenes in a market, it almost always creates unintended consequences: disincentives to work, corruption, crony capitalism, and bureaucratic waste. As government pulls back, market forces come more into play and things improve. More people now have a greater incentive to find and accept jobs, even though they don't pay as much as they would have liked to get. This isn't fun, but that is the best way for excess labor to be reabsorbed. This is a good indicator that jobs are likely to continue to grow, if only because government is no longer making it easy for people to stay home.

Thursday, November 8, 2012

Subscribe to:

Post Comments (Atom)

11 comments:

• ” A democracy is always temporary in nature; it simply cannot exist as a permanent form of government. A democracy will continue to exist up until the time that voters discover that they can vote themselves generous gifts from the public treasury. From that moment on, the majority always votes for the candidates who promise the most benefits from the public treasury, with the result that every democracy will finally collapse due to loose fiscal policy, which is always followed by a dictatorship. The average age of the world’s greatest civilizations from the beginning of history has been about 200 years. During those 200 years, these nations always progressed through the following sequence:

* From bondage to spiritual faith;

* From spiritual faith to great courage;

* From courage to liberty;

* From liberty to abundance;

* From abundance to complacency;

* From complacency to apathy;

* From apathy to dependence;

* From dependence back into bondage.”

How about the employment situation in California -- all eyes should be on California for the next 3-6 months or so -- as California goes, the nation will go...

I just read that 2012 Q3 economic output $13.6 trillion and this means we finally surpassed the pre-recession peak of $13.2 trillion from 2007 Q4.

The problem is the current output was reached with 3.75 million fewer workers than worked in Q4 of 2007.

Where are we going to get the massive growth to create these millions of missing jobs?

The capital gains tax and dividend tax increases that take effect in seven weeks are going to fuel this type of growth?

"Just pull the rug under people's feet and the jobs will come"

What kind of twisted logic is that?

$20bn of new student loans a MONTH is fine, but $20bn to bury electric cables on the East Coast is too expensive.

I wonder if Scott will be equally opposed to government intervention when the next "big one" rocks California.

Dave: I see those facts in a different light. Real GDP has reached a new high despite a significant loss of jobs because of strong productivity gains. Businesses have cut costs and improved efficiencies, and as a result, corporate profits are at record highs. Ordinarily those profits would have been invested in new plant, equipment, and jobs. But the economy's animal spirits have been dampened by the prospect of increased tax and regulatory burdens. New investment has been disappointingly low because risk-takers perceive that the after-tax rewards to taking risk are going to be much lower. Therefore there is a lot of investment that has been put on hold or shelved.

You are right to imply that raising capgains and dividend taxes will not improve the outlook for growth. I would only add that it's possible that we have already seen the negative effects of looming higher taxes.

As Milton Friedman says, government spending is taxation. It doesn't matter whether spending is financed by higher taxes or by selling bonds; too much spending is a drag on the economy because government generally spends money less efficiently than the private sector.

"I've argued for years that even though the recovery would be sub-par, the economy was likely to outperform the market's expectations, and for the most part that has been exactly what has happened."

Sorry, you give yourself too much credit. You've been forecasting 3%+ growth 4 years in a row. That's not sub-par. And the actual economic growth has under-performed, not out-performed, at least your expectations. The stock market simply becomes disconnected with economic reality.

Sorry Pragmatic, but you are mistaken. It is widely accepted that the deeper the recession, the stronger the recovery. A "normal" recovery from the Great Recession would have seen growth well in excess of 4-5% per year. That we instead got 2% is why it has been so disappointing and sub-par. Although I forecast 3% or more, than was a lot less than "par" would have been. But even 2% was more than the market was expecting.

In forecasting, success is not a function of hitting the number exactly right. It's enough to get the direction right and to be on the right side of market expectations.

And the proof is in the pudding, because equities have enjoyed a huge rally. That was driven mainly by the fact that the economy has done better than the market expected.

"I just read that 2012 Q3 economic output $13.6 trillion and this means we finally surpassed the pre-recession peak of $13.2 trillion from 2007 Q4"

Real GDP in Q4 2007 was $13,326 billion, which was surpassed in Q4 2011 when it reached $13,441 billion.

BEA tables

Mr., you have a pretty short memory. Take another look at your own predictions in the past 3 years. You forecast 3-4% growth for 2010 & 2012 and 4%+ for 2011. That averages out just under 4%. Go calculate the average GDP growth in the 2nd, 3rd, and 4th year after each recession post world war II. It's below 4%.

For the past 3 and a half years I have said I thought the economy would grow by more than the market expected, but less than what might be considered a "normal" recovery given how deep the recession was. It doesn't matter whether my point forecast was 3% or 4% yet the actual result was 2%. I was still right: the economy has been growing and it has exceeded market expectations, which is why equity and corporate bond prices have risen significantly.

Interesting. So tell me exactly what economic growth the market had expected for 2010, 2011, and 2012 and how you can prove it was below actual growth. Was it 1%, 0.5%, or 0%?

The hard fact was that you were forecasting growth way above what actually happened. You have been dead wrong about that. And you only admitted that growth was sub-par after fact. Actually you have written numerous times that financial crisis and the subsequent deleveraging process would not necessarily cause GDP growth to slow.

Regarding the stock market rally, many factors were driving it, not least because of money printing by the Fed. Look at gold. Moreover, many researchers have done analysis to show that there is no direct relationship between economic growth and stock market performance.

Post a Comment