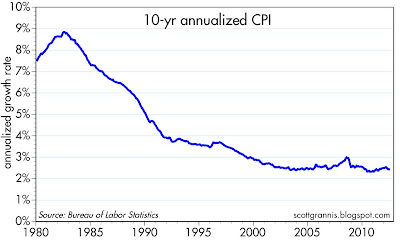

The CPI was unchanged in July, has actually fallen at a -0.8% annualized rate over the past three months, and is up at an annualized rate of only 1.1% in the past six months. However, virtually all the weakness in the headline CPI comes from declining energy prices. As the chart above shows, the Core CPI is up at a 2.2% annualized pace over the past six months.

As the charts above show, energy prices are on the rise again, so the weakness in the headline CPI we have seen has already run its course. Gasoline prices at the pump are up over 10% in the past month, and crude oil prices are up almost 20%. It's best, therefore, to just look at the core CPI as the better measure of inflation for now.

The current rate of increase in core inflation is only slightly less than the increase in overall CPI inflation has been, on average, over the past 15 years. While it's certainly good that inflation is not higher, the best that can be said is that it has been averaging just above the Fed's target for quite some time. As the first chart in this post shows, the Fed was moved to engage in quantitative easing only when the core CPI threatened to enter deflationary territory. That is not the case today, and given the ongoing strength in industrial production and the ongoing increase in jobs, the Fed would have a very hard time justifying more QE at this time. The economy is struggling, but that's not a reason for more monetary stimulus.

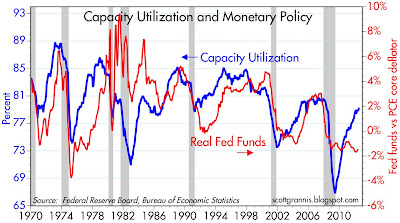

In fact, as this next chart suggests, the Fed has been very accommodative for a long time, and may be overstaying its welcome in accommodative territory. This chart compares the level of capacity utilization, a proxy for the economy's idle capacity, to the real Fed funds rate, the best measure of how easy or tight monetary policy actually is. When capacity utilization rises, signaling declining idle capacity and increasing supply constraints, the Fed almost always tightens policy. When capacity utilization declines, the Fed almost always eases policy. Today the gap between the relatively high level of capacity utilization and the very low level of the real Fed funds rate is rather big and growing. The risk of the Fed remaining "too easy for too long" is rising. The market is sensing this, and it shows up in forward-looking inflation expectations, particularly in the 5-yr, 5-yr forward breakeven inflation embedded in TIPS and Treasury prices: over the past 11 months, this measure of inflation expectations (the Fed's favorite, in fact) is up from 2.0% to 2.7%.

Despite the relative tranquility of consumer price inflation, there is little if anything in the inflation and economic data that would justify further quantitative easing. Increasingly, it's looking like the Fed's next move will be a tightening, not another easing.

7 comments:

RE: Yesterday Discussion of Paul Ryan

David A. Stockman, who was the director of the Office of Management and Budget from 1981 to 1985 under President Reagan wrote an Op Ed article about Ryan's Budget Plan here:

http://www.nytimes.com/2012/08/14/opinion/paul-ryans-fairy-tale-budget-plan.html

Paul Ryan’s Fairy-Tale Budget Plan

Can't have deflation in a fiat world.

"The key event was therefore the Banking Act of 1933. After that, the money supply never fell again. After that, prices never fell again by more than 1 percent. That was in 1955."

http://mises.org/daily/6146/Why-the-Deflationists-Are-Wrong

William: David Stockman, in my view, has never distinguished himself as an economist or policymaker. He criticizes Ryan's budget because Ryan doesn't share the same values as Stockman does. Those values are quite subjective. To me, Ryan's budget looks quite realistic and feasible, and has a very good chance of helping the economy while also reducing the deficit.

Inflation is clearly under control, and a QE III would put the near zero track record of Dr Bernanke at risk -- the good news is that America is likely to see real working wages stagnate or decline for the rest of the century -- the value of a day's wages for a tech worker in China is between $14-28 per day -- real working wages in the US are likely to regress to that same level over the balance of the century -- that's good news for companies that rely upon workers -- by hammering the excess working wages out of the US economy, dividends will increase over the remainder of the century, providing a mulitplier effect upon innovation and productivity improvements -- the future looks bright for accredited investors -- "gotta wear shades..."

Hello, Scott -

Thank you for your reply. I have not read Ryan's proposals. But don't you find it troublesome that (according to Stockman) Ryan doesn't make an effort to decrease Social Security or Medicare spending over the next 10 years.

If true, I would have thought that would puzzle you in terms of doing something about the US annual budget deficits.

Ryan has not yet attempted to tackle Social Security, but I have no doubt he will at some point. Meanwhile, I believe his Medicare proposals will make a significant difference to the future course of health care costs by allowing individuals to make their health insurance purchase decisions. Do read what he has proposed.

Ryan suffers from GOP-itis: No cuts in our largest agencies, such as Defense, VA and Homeland Security. Those three agencies alone have a budget of $1 trillion a year---in a world in which the Soviet Union has collapsed, and our "enemies" are a few punk terrorists. What a waste of money.

Where is Ryan on ethanol? Boosting immigration? Shrinking the annual dole for rural America? Invisible, like Romney.

Why can't the GOP ever run a balanced budget?

Why? They are afraid to really cut Medicare and Socials Security (too many old voters) and they love boosting agency spending. Without question, that has been the GOP record since Reagan. There is no denying it.

I agree with Ryan on the need for vouchers for Medicare (not a bad idea for VA benefits either, but oh no, Ryan won't propose that).

The last time the GOP got control of DC we got into two interminable wars ($4 trillion in costs), defense outlays doubled, our financial system collapsed, our economy began to contract at a 10 per cent annual rate, the federally socialized renewable energy program exploded (ethanol) and we bailed out banks and automakers willy-nilly. evidently on the basis of political patronage. Then Obama took over, and nothing really got any better (okay, mild growth in the GDP).

We want a re-run of that?

Why is Romney different from Bush jr? Are there any policy differences between the two? Can anyone tell me of policy differences between Bush jr, and Romney?

Have Romney or Ryan said boo about monetary policy? If so, what? Really, are they just shells, or is there something to vote for?

Post a Comment