Tuesday, October 26, 2010

Spread update: still room for improvement

The spread between the yield on risky bonds vs. risk-free Treasury bonds is a key indicator of all sorts of things: financial market health, general liquidity conditions, risk-aversion, economic health, and counterparty risk, to name a few.

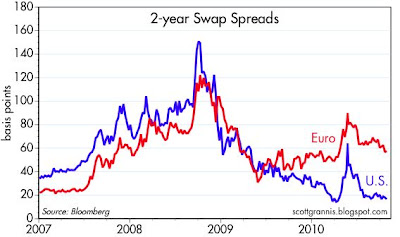

I start here with swap spreads, since they are the most liquid part of the credit market. Swap spreads in the U.S. have been very low this year, suggesting that liquidity is abundant and the economic fundamentals have improved dramatically; the behavior of U.S. swap spreads could even be interpreted as pointing to a stronger-than-expected recovery over the next year. Swap spreads in Europe jumped earlier this year on concerns that a Greek or PIGS default would provoke a financial crisis, but since then they are gradually settling back down, suggesting that crisis conditions in Europe are slowly passing. But considering that German 2-yr yields have doubled since early June—which marked the height of the Greek crisis—the modest but ongoing decline in Euro swap spreads might even be interpreted as pointing to a substantial recovery in the Eurozone economies in the next year.

The second chart features credit default swap spreads on 5-year securities. These spreads have come down dramatically, reflecting sharply lower expected default rates, which in turn has a lot to do with improving economic fundamentals and accommodative monetary policy. When the economy is improving and money is in abundant supply, it's much easier for companies to service their debt, so default rates tend to fall. Despite the rather spectacular decline in spreads since late 2008, spreads are still quite high relative to where they could be if economic and financial conditions were more normal.

The third chart features spreads on corporate bonds in general. Here too we see substantial improvement and lots of room for further gains. Note that today's spreads are at or close to the levels that preceded the 2001 recession. In short, despite all the improvement, the market is still priced to the expectation that conditions will be challenging in the months to come. (We've come a long way from late 2008, when the credit markets were priced to Armageddon; now they are priced to a garden-variety recession.)

Swap spreads have often been leading indicators of other spreads, so the message of these charts is that there likely is a lot of good news still in the pipeline for investors in corporate debt—particularly of the high-yield variety—and a lot of good news regarding the outlook for the economy in general.

The biggest risk to corporate debt right now is that Treasury yields are likely to soar if and when the economic news improves. A significant rise in Treasury yields could put some upward pressure on corporate yields (causing lower prices), but the fact that spreads are still unusually wide should provide a decent cushion against losses. Plus, since higher Treasury yields would likely occur concurrent with improving economic news, spreads would very likely contract in a rising Treasury yield environment—as has almost always been the case in the past.

Full disclosure: I am long investment grade and high-yield debt via a variety of mutual fund vehicles at the time of this writing. (Note to retail investors: buying and selling individual bonds can be extremely expensive for non-institutional investors, due to very wide bid-ask spreads, so commingled vehicles are highly recommended.)

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment