I will be traveling tomorrow morning (headed up to Alaska for a week or so of cruising and sightseeing) when the June payroll numbers come out, but I have some observations that might help interpret whatever the number happens to be. To begin with, there is the issue of about 35K jobs that were lost in May due to a Verizon strike, and which will be added back in June since the strike was resolved. Then there is the issue of the significant undercounting of May jobs according to the BLS vs. what ADP reported. In the past, big swings in the BLS numbers that have not been confirmed by the ADP numbers have been reversed within a month or so. This leads me to think that the June BLS private sector jobs gain should be at the very least 200K, but that is more than the consensus (+160K). If its not at least 200K, then that means we have a slowdown on our hands. But the other data suggest no fundamental weakening of the jobs market, so for now I'm expecting an upside surprise that will only mean that nothing much has changed.

The red line in the chart above is going to have to jump significantly if the June ADP number is to be believed. If it doesn't increase at least 200K, then the likelihood of a weakening in the jobs market rises, and that would not be good.

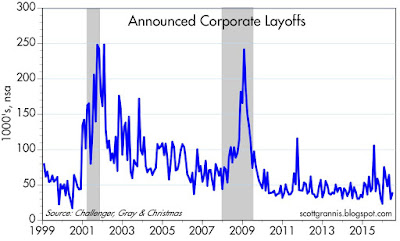

There is no indication of any fundamental deterioration in the labor market. Large corporate layoffs are just not happening.

Weekly unemployment claims continue to trend down. Based on claims, all looks quiet on the labor market front.

26 comments:

Nice call, Scott. 287K is a big number no matter how you slice it.

We live on Lake Winnipesaukee in NH. Our town has a population of 4,000 during the off season and maybe 25,000 during summer. I can tell you flat out that activity is up substantially this year. Boat traffic, restaurant activity, auto traffic, help wanted signs and other extraneous signs are all stronger over the past several years. Just my two cents.

BLS lives matter!

Geez, Scott, you nailed that jobs report. Well done.

If you think about it, the jobs number was damn near perfect for markets to rally. Stronger June number but weaker revisions. Fed has no more fodder to raise rates but no signs of significant slowdown. Man, I would NOT want to be short stocks.

I took some profits from my buys @ the bottom of the Brexit 'dispair'.

Great call by our leader Scott Grannis.

BTW there was little inflation in North Dakota and Texas even at the height of the shale oil boom.

Let us hope the Fed does not tighten in the face of solid job markets---actually I think there is global slack in general and capital everywhere.

We need a long sustained boom!

BTW, I recently came cross the Daily Treasury Statement website.

https://www.fms.treas.gov/dts/index.html

For my fellow econo-geeks out there, fun stuff.

David Stockman has been his usual gloomy self of late, but he does have a point. Withheld income and payroll taxes are hardly budging YOY.

As of July 7, 2016 YTD withheld income and payroll taxes are $1.78 trillion vs. $1.72 trillion same period in 2015.

I have not looked at these numbers before. I suppose there could be growth in the independent contractor sector, which would not have withholding. Or people could be prospering from property rents, investment income, self-employment income.

Stockman says the S&P is trading at higher PEs than a year ago, but perhaps it should given that interest rates are flat as water on calm lake. (Stockman says global interest rates are low due to central bank policies, but that would not explain why 50-year Swiss bonds offer negative yields. Central banks are being so wide-open easy that lenders will part for money for 50 years at negative rates?).

I do get the sense the US economy is growing very slowly, despite plenty of slack, domestically and globally.

Benjamin: That's 3.5% growth in withholding, better than what I would have guessed.

Matthew--shame on me, you are correct sir. I eyeballed it.

I hate to say it, but I am making money these days -- all is going well -- I made no adjustments since Brexit -- just lots of rent and dividend earning buildings and stocks -- my only fear is that the disenfranchised in America will take over the US and hang everyone like me -- should we fear the markets or the killers?

To all: What would be the ramifications of the following program?:

The US govt sends $1000 to every living person (including minors) with a social security number. It also makes clear that in every six month period in which the 10-year breakeven is below 2%, it will send out another $1000.

(Note that I don't advocate a 2% inflation target; I prefer 0%. I also advocate an asset-backed monetary standard, not the fiat nonsense we have now. But reality forces all of us to accept the system we have. Thus, my question.)

I ask this question because we obviously live in extreme monetary times. It's also obvious that the Fed is frustrated in its apparent inability to get inflation up to 2%. But Friedman said that deflation is the easiest thing to fix - just print money. It's true! But the normal mechanism, buying bonds, is running into some problems, most of which have been discussed on this blog and others.

My suggestion of $1000 distributed to everybody would have the appeal of being the most egalitarian of money-printing solutions. It wouldn't penalize the poor, and wouldn't penalize children either. On a relative basis, they'd be slightly advantaged.

Johnny Bee Dawg said...

BLS lives matter!

I second that, JBD! Enough for the meaningless mom employment stats.

Again, what needs to be examined, is the macro record for employment,

which if it had been done, would have foretold this currant economic malaise.

http://slopeofhope.com/2016/07/the-truth-behind-the-bls-report.html

"(http://www.bls.gov/news.release/pdf/empsit.pdf, Table A-9) immediately confirmed my suspicion – the critical categories of 20 to 54 years had cumulative job losses of 39k, and the only driver of the report’s strength was job gains of 259k in the 55 years and over category. Intuitively, the jobs created in the latter category are mostly lower-quality jobs – but more on this later."

HANG ONTO YOUR HATS!

"Over the last 10 years, the categories of 20 to 54 years had cumulative job losses of 1.6 million, and the net gain in jobs was driven primarily by the 9.8 million gain in the 55 years and over category. This seemed the opposite of what should happen in a healthy economy, where there is a greater need for young & mid-career professionals with the right skills & education while the older workers transition into retirement."

You wonder why income growth has been so tepid? You wonder why GNP growth has

been so lame? You wonder what the future will be?

Two terms of a demigod and liar such as Hellary Rotham with climbing debt

as well as the unfunded mandates, America will be headed for a series of financial crisis.

That generation will face economic condition not seen since the 30's. The only salvation

will be sweat, blood and tears.

The stupid continue to enjoy and play their Pokey man, all the while America declines

as both a military and economic power.

May God of Mighty have mercy upon this republic.

Matthew: one problem with your suggestion. The Fed can't legally "print money." The Fed can only issue bank reserves, which are not spendable money.

But, Scott, that's a mere technicality. The USG certainly has the means of printing bills and then getting those bills into the hands of whomever it wants.

In terms of the spirit of the idea, isn't this what the government should do? After all, the textbook case against this idea - which I never thought would be reality - is that it would spur inflation. But, shock of all shocks, this is what the Fed wants! No?

(Again, I'm not suggesting I agree with a 2% inflation target. I'm just sick and tired of the Fed acting flustered over too-low inflation according to its own standard. Are you really flustered Fed? Then put into action the incredibly simple solution proffered by the great Milton Friedman.)

Matthew G--there is a serious economic school of thought that "helicopter money" aka "money financed fiscal programs" is the way to go now. The names of Michael Woodford and Lord Adair Turner pop up.

A fascinating lesson from history is Japanese central banker Takahashi Korekiyo sidestepping the Great Depression by printing money.

It is a historical fact that printing money at times leads to greater real output. When an economy hits full-bore then printing more money can lead to inflation. Moderate inflations usually co-exist with robust economic growth.

I disagree with the current globalist central banker view that inflation should be 2% ( as dubiously measured) or some other figure near zero. The ECB's official position is that their only obligation is inflation control.

I prefer robust economic growth and tolerating moderate inflation. To suffocate economies for the sake of a couple points of inflation is nuts.

Nuts!

Yes, the only wrinkle I was proposing was the direct transfer of cash to personal accounts. This would stand in contrast to the historical method of buying bonds. Basically, it has an egalitarian simplicity. It also wouldn't rely upon the not fully-functioning lending and investing mechanisms.

The other wrinkle was my proposal by the Fed to make clear that it would keep doing this every six months until inflation increased to the their goal. This is key as it lends credence to the Fed's stated intention.

Basically, I think (and I'm pretty sure you agree) that we have a monetary circumstance that we shouldn't have right now, or at least one not predicted by the textbooks. If inflation refuses to go higher, then force it higher. This should be even easier if one believes in 2% inflation. (I do not.)

Such a program would also be consistent with a methodology more in line with nominal GDP targeting, a school of thought pushed by Sumner and others. I very much agree with it and especially so in an environment that the Fed has been so wrong about. That is, the Fed keeps thinking it's loose. But velocity refuses to cooperate. So the Fed gets frustrated. I say cut to the chase and force inflation higher. Again, it should be easier for the Fed to get to this opinion than it is for me because they actually believe 2% inflation is a good thing.

The old saying "you can lead a horse to water, but you can't make him drink" applies to the Fed. The Fed only indirectly controls the money supply; banks control it directly. The Fed can set interest rates at a very low level, and traditionally that has encouraged banks to lend more and thus increase the money supply.

Crediting everyone's bank account with cash is not something the Fed is permitted to do, just as the Fed cannot print extra cash and drop it from helicopters.

In any event, I would note that inflation has been running at a 1.5-2% rate for quite some time now, and there is not reason for anyone to be concerned that it is too low. Headline inflation has been lower, but only because of the huge decline in oil prices in recent years. Headline inflation will very soon approach the 1.5-2% level of core inflation due to the fact that oil prices have risen so far this year.

I think the main reason the Fed is "concerned" is because the economy remains very sluggish and they worry that they might be to blame because interest rates are "too high." This is a misplaced concern since monetary policy cannot create growth out of thin air. Monetary policy can facilitate growth, by keeping inflation low and confidence in the currency high, but it cannot increase the productivity of labor, which is what causes growth.

"Monetary policy can facilitate growth, by keeping inflation low and confidence in the currency high, but it cannot increase the productivity of labor, which is what causes growth."

Scott--Of course, any sane person wants increases in productivity, and tax, regulatory codes and culture to encourage as much.

But let us say you have a labor force potential of 10 guys. Five are working. If you can get the sixth guy to work, your production rises by 20%. When an economy has underutilized assets, then a path to growth is by utilizing those assets.

The US and the globe today are swamped with underutilized assets. There is 30% excess capacity in auto factory capacity, and gluts in all commodities, gluts of everything. I am unaware of any industry "going all out" to meet demand, anywhere on the planet. Quite contrary, evidently there way too much capacity in many industries, such as steel, or potash. We have an embarrassment of productive capacity--good news!

If we can get that sixth guy working globally, we get a huge increases in output, even with zero boost in productivity.

As for confidence in the currency, they have had deflation in Japan for more than 20 years. They are extremely confident in their currency, in fact keeping cash in boxes is a great investment in Japan, beating out government bonds. It is not coincident with robust growth.

First, major global central banks should get the global economy humming on high. Boom times. Then they can worry about inflation. We are not even close.

I would reiterate Benjamin's points. Of course we want fiscal reforms (tax, regs) and of course we'd like to bring about productivity gains.

My proposal was not exclusive of these.

In a world in which Benjamin's description is largely accurate, what exactly is the harm in printing money and giving that money to the people? The standard answer to that question is that it would be inflationary. But in an environment such as ours, isn't that a virtue?

As to form, I was highlighting the difference between the QE we've done and the method I propose. In light of the fact that the lending function isn't properly working, I think we should send money directly to people. And politically, it would be seen as fair when a poor family of five gets $5000, instead of some poorly understood transfer of cash for bonds held by a major bank.

But, yes, to your point, Scott, I'd much prefer that Congress get its act together and implement pro-growth policies. Alas, I've given up on that for a good while. But if the restrictor plate of inflation is removed, I say rev it up.

A quick look at the CPI numbers this morning tells me that inflation at the consumer level is rising (albeit slowly) and above 2%. I find it almost inconceivable that inflation is too low and/or presents any sort of problem for economic growth. People should stop pounding the Fed and instead turn their energies toward Congress.

Matthew G---

I do not want to give money to poor people. I want tax cuts for people who work.

Its all about Congress and the Prezzy.

Scott has pointed out repeatedly that effective tax rates on the Makers are at the highest level since they started being measured in 1979, while regulations are in the stratosphere, too. The bottom 60% are net takers. We have the most Progressive tax code in US history, and in the civilized world. And the PUB Congress decided to pass an omnibus bill in December that funded everything BAD that Barack asked for, instead of fighting Him like Gingrich. None of that disfunction has a thing to do with the Fed.

Its the Fiscal swamp, stupid! Instead of fixing the obvious problems, we get lectures about how racist we and the police are. More lawlessness and PC crap, and less Liberty.

TRUMP and Brexit and EU breakup can shake it ALL up, and get GDP rising all over the world!

Just the thought of it is exciting and optimistic.

Imagine the malaise that will occur with 8 years of Hillary. It will be like 2 more terms of FDR misery.

Make America Great Again!!

"This component (shelter) is the factor responsible for the modest increase in the core CPI in recent months. Excluding the shelter component the core CPI actually fell modestly from 1.6 percent to 1.4 percent over the prior twelve months (ended in June)."--Dean Baker

Actually, the Federal Reserve uses the PCE is gauge inflation, and it runs even lower than the CPI.

In any event, inflation is dead, been falling for two generations, and what is measured as inflation is really just artificial pinko-socialist constraints on housing supply, as seen in anywhere along the West Coast, from San Diego, to the Orange Coast to Los Angeles, Santa Barbara and up to the Bay Area.

This is the fundamental structural impediment facing the American economy today. Property zoning! We have plenty of capital, we have plenty of labor, we have plenty of technology.

We just need more demand and some sort of new Supreme Court decision banning property zoning.

Unfortunately, the Supreme Court ruled in favor of property zoning in 1926. It may have been the worst decision in court history, and an incredible negation of property rights and the commerce clause.

What do property rights mean if a city can downzone your property. or tell you what use to put the property? I guess land ownership is the right to run a utility.

People can jibber-jabber about the minimum wage, free trade or immigration, but if we want to help America revive and bring boom times to the middle-class, we would talk about stopping the Fed from suffocating the economy and how to rapidly build millions of units of housing along the West Coast.

It is obvious that half of the people online talking about having the blank

atm card are not real as i have tried getting this with all seriousness

from several companies and i have paid my money to them without me getting

the card and it was so frustrating until i came in contact with

davidbenjaminltd@outlook.com who just in 2 days after i applied with them

and submitted my details i card was delivered to me and its effectiveness

was just as i read about it. I am using this medium to spread the good news

and direct those who are serious about getting this card to the right

company. Seek no further but contact davidbenjaminltd@outlook.com

Buy skimmed ATM cards worth $100-$10000. Email rainsystool@gmail.com

Post a Comment