Monday, June 14, 2010

Shipping update

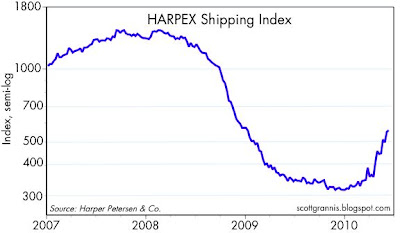

Here's an update to the Harpex Shipping Index, a measure of container shipping costs in the Atlantic. Since I last posted this chart in late May, the index has jumped another 9%. This makes a nice counterpoint to all the doom and gloom news coming out of Europe these days. And while economic bears are pointing to the recent decline in the Baltic Dry Index, from a longer-term perspective the current decline is fairly modest and it appears to still be in a rising trend.

Subscribe to:

Post Comments (Atom)

8 comments:

Scott-

This is very important, shipping investors bet early on the Baltic Dry and dirty tanker indexes b/c they generally reflect the strength of the recovery in emerging markets. No one would touch the container sector because it was more tied to OECD economies which weren't expected to rebound. Now, those container trade routes are perking up and lines are hiring ships at a fast pace to keep up with demand - there have been some very encouraging deals done recentlyt that are indicative of bullish Euro and US trade. This bodes very well.

Thanks, and I agree

wherefrom comes the need to tirelessly cheerlead?

Septizoid-

It is called "analysis". Such "analysis" can then be applied to "investing". Nowhere does cheerleading enter into it. To boot, you'd be hard pressed to read this blog and pinpoint the person or institution that is the target of this putative "cheerleading" which is usually aimed at somebody or something.

donnybaseball---ball four.

septizoniom -

For the last 6 to 9 months Scott has been showing Baltic shipping indexes that portend a future different than called for by the panicked crowd. Even early on he spotted the upturn and its now proven to hold. Ball four? How about strike 2?

b harriman--are you mr grannis's sancho panza?

Treat the Baltic Dry with a great deal of care, its a very strange index especially since so much capacity is coming on line now. We are talking large number of ships. BTW did you all see the number for rail shipping this am. Not a pretty picture at all.

V shape is a goner, U shape is still in play, Hockey stick looks a serious contender -- and matches the effect of a deleveraging economy. W is still off the table.

Post a Comment