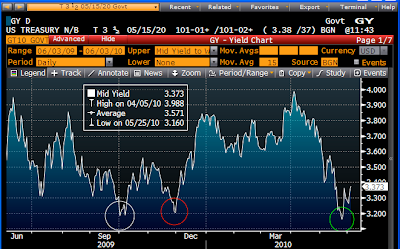

I may be jumping the gun, but this chart of 10-yr Treasury yields tells me that the latest growth scare (i.e., that sovereign debt defaults in Europe could have spillover effects in the U.S. economy) is passing. When the market starts worrying about the health of the economy, we typically see equities decline and 10-yr Treasury yields decline—a flight to quality. When sentiment starts improving, equities rally and yields rise. I've tried to illustrate how to interpret the level of yields in the following chart. The recent decline in yields was a good sign, I think, that the market was really concerned that the economy was on the verge of a double-dip recession, and fears of a euro collapse were the catalyst. As justification, I would argue that 3% yields on 10-yr Treasuries only make sense, from an investor's point of view, if one believes that the economy is very unlikely to experience healthy growth and is instead vulnerable to recessionary conditions.

Thursday, June 3, 2010

Subscribe to:

Post Comments (Atom)

11 comments:

I'm not sure this matters much but Stratfor as well as other news outlets are reporting that Iran is moving E45 billion to US dollars and gold. They were buyers of Euros back when the US$ was tanking and everyone was saying Uncle Buck was done as a reserve currency and a basket of currencies led by the Euro was the future of global finance. Um..looks like 'buy high, sell low' to me....again.

Scott, people are saying that the big drop in the price of commodities such as copper in May is ominous and reminiscent of a previous time when their drop preceded a general economic dive.

I assume you don't agree but I'm curious to know your views on history repeating itself and people looking for key indicators of this ?

Thanks.

Again excellent points...thanks

Here is a more domestic economic 'tell' from a middle america 'mid cap' company. Baldor Electric (BEZ-NYSE)is a Ft Smith Arkansas based manufacturer of industrial electric motors. Only 12% of sales are abroad. The stock is up nearly 9% today after announcing increased earnings and strong incoming orders for all products.

Rob: The "big drop" in copper wasn't any bigger than other drops we've seen over the past 5 years. In any event, I consider commodities to be more of a coincident than a lagging indicator of economic activity. From my point of view, the recent weakness in commodity prices doesn't look at all out of the ordinary or scary. Prices are still significantly higher than they were at the end of 2008.

Rob,

Copper has declined since the end of April, but so have a lot of other things. Oil, fertilizers, natural gas, stocks, lower grade corporate bonds, and so on. I am operating on the assumption that copper and the rest are correlated 'risk off' hedge fund and other high frequency fear related trades and are not necessarily 'telegraphing' anything the others aren't. I believe the yield curve is a better predictor of economic downturns than volitile commodity prices.

Incidently I am anticipating a much better June for the US stock market. Hopefully we saw the lows on the May 24th spikedown. I'm not saying its yahoo, up, up and away but we are still oversold and should work somewhat higher over the next several weeks.

Hope this helps.

Thanks Scott and John, very helpful.

Greetings, Sir. I don't know your current holding status, but you used to occasionally disclose that you were long TBT. At this level (~40), it seems to me that almost all of the downside risk is gone, except for the fear of a "double-dip" scenario touted by some prognosticators. Do you agree, or are there other factors which could make Treasury rates head even lower?

Thanks for all your time and effort.

P.S. At your urging, I obtained a 4.625% 30-year mortgage last year, so an extra "Thank You" is in order!

The point of this post is that I also think that the risk of lower Treasury yields is low at this point. Lots of pessimism is priced into the market these days, lots of fear of double-dip recession. If the economy just keeps growing, albeit moderately, then bond yields are likely to rise and TBT prices would rise as well.

If you don’t have time to read the entire topic and just want to find out what the Best stock For long-term investment. Here is for you...

Manappuram Finance private placement

RIL group

Zoom app

Sundar Pichai compensation

Post a Comment