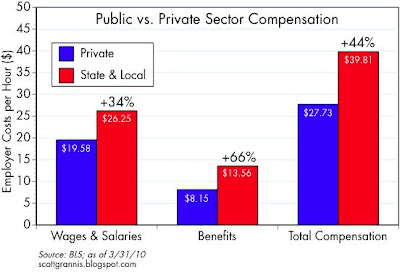

Public sector workers are very highly compensated relative to their private sector counterparts, according to the latest figures from BLS, and this issue promises to be a major focus not only of the November elections but for all the state and local governments that are facing sharply deteriorating finances. Mark Perry has done such a great job in bringing this issue to people's attention that he deserves special recognition, and one way to do that is to recreate his chart and help spread the message here. As he notes,

Government employees are compensated 44% more on average per hour than private-sector employees, with 34.1% higher monetary wages and 66.4% more in benefits. On an annual basis, government workers make almost $80,000 on average with benefits (assuming a 40-hour week for 50 weeks), $24,000 more per year than the average private-sector worker ($55,460 annual compensation).

One of the biggest differences between private and public employees is the "retirement" portion of benefits. Government workers are paid $3.16 in retirement benefits for each hour worked, and almost 90% of these retirement benefits are in the form of "defined benefits" and the other 10% are for "defined contribution." In contrast, private sector employees receive only $0.96 in retirement benefits for each hour worked, and more than 57% of this coverage is for "defined contribution" and less than 43% for "defined benefits."

The fact that retirement benefits for public workers are more than three times as generous as those paid to private sector workers, and the fact that almost all pension programs for government workers are "defined benefits," helps explains why the fastest growing group of millionaires is..... government workers.

I would add that public sector employees earn on average $4.52 per hour in the form of health insurance benefits, which is over twice as much as the $2.08 that private sector employees make. Plus, public sector employees earn on average $3.00 per hour in the form of paid leave (vacation, holiday, sick and personal), 60% more than private sector employees get.

Combine these amazing statistics with the traditional job security enjoyed by public sector workers, and you wonder how much longer taxpayers are going to put up with this.

12 comments:

toncyMy guess, two years 5 months, max.

Just a guess.

The question begs itself: how did government pay/benefits reach this lofty level? Further, how can the productive sector, which is now the lower paid sector, make transfer payments to the unproductive sector, that is higher paid?

The lofty pay and benefits of the unproductive sector, the transfer agent sector that handles and exists due to transfer payments, is likely related to Milton Friedman’s fourth category of spending. That is, when the temporarily appointed heads of many differing bureaucracy making up the government are faced with union demands, we have a situation of other people, spending other people’s money, on other people. It’s a union negotiator’s dream come true!

The US Constitution was a document designed to show one how to “constitute” a limited government. That the unproductive limited government would be a minor but necessary drag on the productive sector. Apparently we have strayed so far off course that limited government and unproductive behavior became vogue at the expense of the productive sector. In other words, incentives exist for government expansion and the expansion of the unproductive sector. Disincentives litter the landscape for the productive sector. Ah, the evil of it all!

best post in a while

Scott,

In Georgia, like many other states, we have a looming unfunded public pension crisis. We have a huge number of six figure school administrators who will retire with pensions valued at over $150K per year. Right now, the state has to fund them no matter what- bankruptcy apparently is not an option. I see a big uprising among younger workers who will be over taxed to pay for these pensions. It's going to get ugly.

Simple answer, the government is the biggest union employer.

The unions are bankrupting municipalities across the country.

I note that this is only about state and local. I have been following the debacle in the Gulf of Mexico closely and one of the things pointed out is that the pay of regulators at MMS can't match the pay of the industry for people doing the work that is being regulated. Thus recent graduates or people with shorter experience may end up overseeing processes the complexity of which is "beyond their paygrade". Also does the data here represent the mass of low paying jobs in the private sector and compare the mass to the public sector jobs which don't include door greeters at Walmart and burger flippers, etc., etc. I question the utility of the comparison except for Bashing the Gummint.

I think the bigger question should be why do people let the private employers get away with such low pay? I think it is a disgrace, speaking from the point of view of someone who has had employees in a VERY small business in the past and still hire a helper on occasion.

It is true that most of my experience is in New Hampshire and in small towns, so my viewpoint may be skewed, but if I were a town worker WEH's comment would really tick me off, as he could just drive his car into a bottomless pothole for all I would care, or his house could go up in smoke if he thinks the local worker should be called an unproductive sector. You guys need to get out more. Your theories have produced a kind of cataract blinding you to anything but anti-government and anti-regulatory, anti-union rhetoric. Shovel your own damned street.

Pension liabilities are systematically understated by rules that permit public pension plans to discount certain future payments to retirees by the expected return on risky portfolios (approx. 8%). This cuts the "cost" of these plans vs. defined contribution plans.

I agree the government is way too big. Lets start by cutting the defense budget in half. Sound good?

Next, lets end the farm subsidies. Everyone on board?

Third, let's sink AIG, GM, FNMA, GNMA, and the FHLMC and get our money back. There should be no incentive to incur debt in this country. We are pilfering our own income streams.

Fourth, lets end the 2 wars. Are we looking better?

Additionally, lets get our money back from the banks. Banks and investment houses should sink in an orderly fashion anytime they go BOOM. Charge the banking sector to clean up the mess.

Finally, turn the oil companies into utilities. This falls under national security and common sense. How electricity is considered a utility while oil is not, is beyond me.

Sadly, picking on 30K school teachers and administrators is not going to save this country but the rich would surely have you believe so...

"I agree the government is way too big. Lets start by cutting the defense budget in half. Sound good?"

No, sounds terrble when there are still plenty of terrorists to kill. Let's get rid of legions of useless, unionized bureaucrats instead.

Paul. 3 Words for you. Move to Russia.

Public,

That's funny, you first. You'd be more at home considering your desire to nationalize the oil industry and keep the dead weight piled on the backs of productive Americans.

Post a Comment