Friday, June 18, 2010

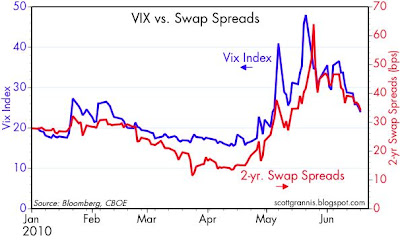

The decline in the Vix and swap spreads looks very bullish for stocks

The Vix index has dropped to 24 after spiking to 48 on May 21st. 2-yr swap spreads are now back to "normal" levels of 34 bps, after spiking to 64 on May 25th. The surge in the Vix and in swap spreads preceded the slump in the S&P 500, which reached a low on June 4th. It would appear to me that with fear, uncertainty and doubt fading fast, the equity market looks poised to enjoy some handsome gains in the days and weeks ahead.

Here's a close-up of the Vix and swap spreads:

Subscribe to:

Post Comments (Atom)

7 comments:

rasmussen has Obama down to 41% today.

Total federal debt outstanding on 6/17: $13.04 billion

Cost of Iraqistan: $3 trillion (CBO).

"Cost of Iraqistan: $3 trillion (CBO)"

National defense is constitutional, unlike, say, Obamacare. And we have Al Qaeda on the run, Saddam at room temperature, and a mountain of dead terrorists to show for it. We have a staging ground to wipe out Iran if necessary. And terrorist plots across the planet have been foiled as a direct result of boots on the ground and the intelligence it brings.

Further, the wars are fertile laboratories for new techniques and technologies. For examle, just saw this story about a pain ray under development in Afghanistan. On the other hand, I guess we could always test it out on the idiots who voted for Obama.

Scott,

A bit off topic, but interested to hear your thoughts on Art Laffer's opinion as published in the WSJ regarding the upcoming tax hikes and an economic collapse:

http://online.wsj.com/article/SB10001424052748704113504575264513748386610.html

Thanks.

Cabodog,

The government has been sucking demand from the future on just about everything.

Others predict a disastrous 2011 as well. I tend to be in agreement. America still doesn't like to pay for its ills today when the assumption is they can put it off until tomorrow.

"I'll gladly pay you Tuesday for a hamburger today"

Cabodog: I commented on Laffer's article about 10 days ago here:

http://scottgrannis.blogspot.com/2010/06/federal-budget-outlook-is-improving-on.html

Post a Comment