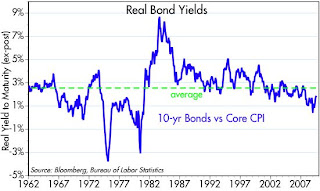

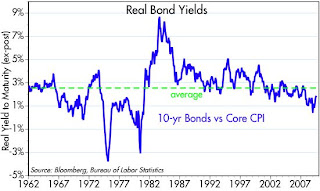

This chart calculates the real yield on T-bonds by subtracting the annual change in the Core CPI from the yield on 10-year Treasury bonds. Note that real yields were chronically low in the 1970s, and were chronically high in the 1980s and 1990s. It's not a coincidence that low real yields in the 70s occurred alongside rising inflation, or that high real yields in the 80s and 90s occurred alongside falling inflation. That's because real yields along the Treasury curve tell you a lot about how easy or how tight monetary policy is expected to be. High real yields reflect an expectation of persistently tight policy, while low real yields reflect an expectation of persistently easy money.

Tight money in the 80s and 90s kept real yields high, and high real yields meant that an investment in bonds was competitive with other investment opportunities in the economy. Thus investors had an incentive to hold bonds, and at the same time, because real borrowing costs were high, they had a disincentive to borrow money. Thus the demand for money was relatively high, and this created a relative shortage of money in the economy. With money in short supply, prices for tangible assets remained relatively low. Indeed, the CRB spot commodities index fell about 30% from the early 1980s to 2002. Not surprisingly, core inflation fell from double digits to 2% over the same period.

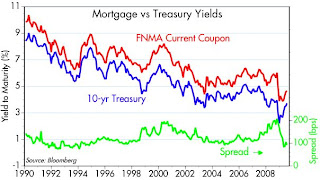

Monetary policy has been relatively easy for the past 5 years now, and particularly easy in the past year or two. The Fed acknowledges that monetary policy is very accommodative, and they tell us they plan to stay that way for quite some time. It's not surprising, then, that T-bonds are relatively unattractive. Looked at from another perspective, there is so much concern out there (in the market and among the Fed governors) that weak economic growth will have adverse consequences, that the market is willing to pay relatively high prices for the safety of T-bonds.

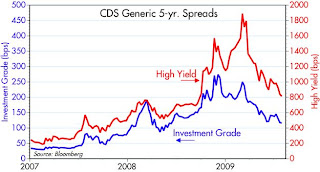

On the margin, however, these concerns are diminishing, as evidenced by the gradual decline in the Vix index, the ongoing decline in credit spreads, and the rising level of equity prices. Borrowing costs are falling for many consumers and businesses, making debt more attractive on the margin. It all adds up to falling money demand, even as the Fed resists tightening money supply. The result is a relative abundance of money, and we see the signs of this in rising commodity prices. We should expect other tangible asset prices, such as housing prices, to begin to rise as well, probably by the end of this year if not sooner. The last shoe to drop will be rising inflation, of course, since it takes time for monetary policy to flow through the economy and hit the CPI. The only thing that is not apparent in all this is how soon inflation will rise, and by how much.