Wednesday, June 9, 2010

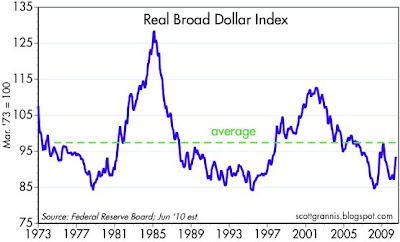

Dollar update: still somewhat weak

I've shown this chart periodically because I think it is arguably the best measure of the dollar's true value against a large basket of currencies. It's not only trade-weighted, but also inflation-adjusted. The Fed recently released data through April, and I've estimated where the line would be in June based on the dollar's recent rise against most major currencies. Although the dollar is king of the hill on the margin these days, from a long-term, inflation-adjusted perspective it is still below average and only about 10% above its all-time lows.

For the curious, the dollar was the all-time champ from 1982-1985, and for good reason. The U.S. had lowered marginal tax rates significantly, at the same time the Federal Reserve was pursuing very tight monetary policy. Lower tax rates helped turbo-charge the economy, while tight money brought inflation down from double-digits to just 4%. This combination meant that demand for dollars soared (everyone wanted to invest in the U.S.) while the supply of dollars was restrained; not surprisingly, the price of dollars surged. That same period also saw the price of gold collapse from $700 to $300/oz.

The dollar then collapsed from 1985 to 1987, due to a concerted effort by the Fed and the world's central banks to bring it down. The Fed did its part by increasing the amount of bank reserves by over 50% in just under three years. It's also worth noting that the marginal appeal of lower tax rates was exhausted by 1987, as the effective capital gains tax surged from 16% to 23%. So in effect the dollar suffered from the double whammy of easier monetary policy and higher tax rates, which in turn boil down to more money supply and less demand for it.

Today the dollar is not collapsing, despite super-accommodative monetary policy and higher expected tax rates, because all currencies are in the same dismal boat.

Moral: when you look for explanations of the really big changes in macroeconomic variables such as the value of the dollar, you don't have to search very far.

Subscribe to:

Post Comments (Atom)

3 comments:

Speaking of 'big changes in macroeconomic variables' BP is collapsing again today due to GOM uncertainties. It is becoming increasingly clear that the odds of BP not surviving in its current form are increasing. While not in the S&P 500 the negative sentiment of the GOM problem is a macro variable. It is freightening to think of all of Florida's economy being affected and the resulting economic drag.

I am sort of near the front lines here in Miramar Beach, Fl. and so far, I can report NO oil or tar balls here. The tourists are still here and the restaurants are full. I'm sure some of that will change when the oil arrives. I will add, however, Walton County has their guns loaded. Heavy equipment, boons, and many hundreds of workers are all procured and standing by to clean our 26 miles of sandy white beaches. I am told the oil will be attacked as relentlessly at it hits our shores.

This coast has endured many catastrophes over the years, mainly from hurricanes, and has always bounced back. We will bounce back from this too. BP, unfortunately, may not be as resiliant.

if your analysis is correct, The dollar is good as dead with our very loose fed and a socialist president.

That's one good reason the dollar has been so weak. If Obama's far-left agenda is not checked by this year's elections, and the Fed remains in panic-easing mode, then I would agree that the future for the dollar looks grim. I'm quite hopeful however that we'll see some positive change here that will keep the dollar from collapsing.

Post a Comment