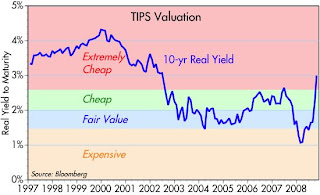

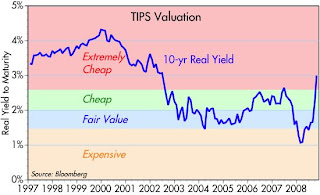

Plunging commodity prices have convinced some traders that inflation is going to be negative for the next 5 years. As a result, the prices of TIPS have plunged, and their real yields have risen. 5-year TIPS being auctioned today will have a real yield that is actually higher than the nominal yield on 5-year Treasuries. The iShares LehmanUS Treasury Inflation Protected Securities Fund (TIP) today is selling at its lowest level (closing price) ever.

With real yields high and expected inflation extremely low, TIPS add up to a very cheap way to buy insurance against inflation.

Plunging commodity prices have convinced some traders that inflation is going to be negative for the next 5 years. As a result, the prices of TIPS have plunged, and their real yields have risen. 5-year TIPS being auctioned today will have a real yield that is actually higher than the nominal yield on 5-year Treasuries. The iShares LehmanUS Treasury Inflation Protected Securities Fund (TIP) today is selling at its lowest level (closing price) ever.

Plunging commodity prices have convinced some traders that inflation is going to be negative for the next 5 years. As a result, the prices of TIPS have plunged, and their real yields have risen. 5-year TIPS being auctioned today will have a real yield that is actually higher than the nominal yield on 5-year Treasuries. The iShares LehmanUS Treasury Inflation Protected Securities Fund (TIP) today is selling at its lowest level (closing price) ever. With real yields high and expected inflation extremely low, TIPS add up to a very cheap way to buy insurance against inflation.

With real yields high and expected inflation extremely low, TIPS add up to a very cheap way to buy insurance against inflation.

2 comments:

Scott,

What kind of effect do you think Lehman's bankruptcy would have on the TIP ETF, if any at all? I don't know how much connect there could or would be, I'm just curious if that would have anything to do with TIP's price falling as much as it has.

It shouldn't have any impact. The assets of the fund belong to the shareholders, not to Lehman or its creditors. TIPS prices have fallen across the board, primarily because investors are speculating that the collapse of commodity prices will result in negative inflation for the next several years. (i.e., Who needs TIPS if inflation is going to be negative?)

Post a Comment