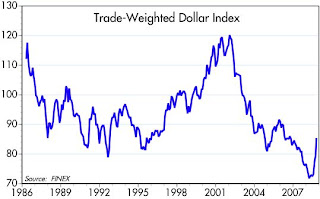

Everything is crashing, it seems, with the very important exception of the dollar, which is up 20% from its all-time low six months ago. The dollar is up against every currency in the world, with the only exception I'm aware of being the yen. Not coincidentally, the yen and the dollar were among the world's weakest currencies six months ago, and now they are both soaring.

Everything is crashing, it seems, with the very important exception of the dollar, which is up 20% from its all-time low six months ago. The dollar is up against every currency in the world, with the only exception I'm aware of being the yen. Not coincidentally, the yen and the dollar were among the world's weakest currencies six months ago, and now they are both soaring.So what does this mean? It's fashionable to talk about how the world is undergoing a massive deleveraging that is resulting in a severe asset price deflation. Real estate is down 20%, commodity prices are down 25%, gold is down 20%, oil is down 50%, and global stock markets are down 50%. It's a vicious cycle, the deflationists say, since falling prices only trigger more sales, and the end isn't yet in sight. That's the glass-half-empty explanation.

I prefer the glass-half-full interpretation. Of course there are many institutions and individuals who are being forced to deleverage, but prices aren't falling into the abyss, they are merely retreating from unsustainably high levels. Everything that is down today is still much higher than it was a few years ago (with the exception of US equities, which are revisiting their 2002 lows). And as the Spot Commodity chart shows, prices are still lofty when viewed from an historical perspective.

In short, the dollar is returning to more normal levels, as are the prices of things like real estate, gold, and energy. While this impoverishes those who bet that "things" would continue to rise in price while the dollar continued to fall, it enriches everyone else. The dollar's new-found strength is boosting the global purchasing power of US citizens, and making everyday living expenses more affordable.

In short, the dollar is returning to more normal levels, as are the prices of things like real estate, gold, and energy. While this impoverishes those who bet that "things" would continue to rise in price while the dollar continued to fall, it enriches everyone else. The dollar's new-found strength is boosting the global purchasing power of US citizens, and making everyday living expenses more affordable.The big story from 2002 until recently was that money was cheap (because the Fed was easy), and everyone started wanting less money and more things. So they borrowed or sold dollars and bought houses, gold, and other currencies. This resulted in a huge shift in relative prices which grew to be unsustainable. We're now reversing that binge. The big story today is that everyone wants more money and fewer things. So they are paying off loans and buying dollars, and selling houses, gold, and other currencies.

Just as the cycle maxed out when prices for things got ridiculously high, it ought to "min" out when prices get ridiculously low. Stocks and corporate bonds already look ridiculously low. As this last chart shows, at the rate we're going it won't be long before commodity prices reach the ridiculously low levels (in real terms) that we saw in the early 2000s.

Prices are changing to accommodate changing preferences. At some point they will stop adjusting and we'll reach a new equilibrium point. Meanwhile, the Fed is furiously accommodating the world's desire for more dollars, and that ought to mitigate the extent to which this cycle swings to the downside.

Prices are changing to accommodate changing preferences. At some point they will stop adjusting and we'll reach a new equilibrium point. Meanwhile, the Fed is furiously accommodating the world's desire for more dollars, and that ought to mitigate the extent to which this cycle swings to the downside.

5 comments:

That is good news to me. We will be in Canada in a couple days. At this time last year, it cost me $1.07 US to get $1.00 Canadian. Today $1.00 US will get me $1.25 Canadian.

It's really a shame that the good news has gotten buried by the bad news.

I think the mainstream financial media's attempts at explaining the recent market volatility is amusing, and their lack of reporting on the dollar's gain not at all so.

They would be best to just report the market's rollercoaster-like movement thusly:

"The Dow is up today. No way, it's back down. Oops, it's up again. Nope, down. Wait, back up. Sorry, back down."

Lather, rinse, repeat.

Post a Comment