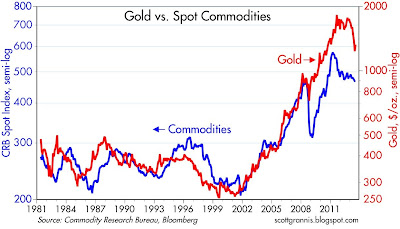

The dollar is weak but improving on the margin, while gold prices and commodities are soft and declining on the margin, but still relatively high from an historical perspective. I think this points to a gradually improving outlook for the U.S. economy (e.g., double-dip inflation fears have now been replaced by a view that the economy can probably sustain modest growth of 2 or maybe 3%), and an ebbing of speculative pressures that had pushed gold and commodities to lofty levels. From a long-term perspective this is all positive. I don't see a reason to worry about deflation at this juncture.

The Fed's calculation of the dollar's inflation-adjusted value against a large basket of currencies and against major currencies is arguably the best measure of the dollar's effective strength vis a vis other currencies. As the chart above shows, as of the end of June the dollar was still quite weak from a long-term historical perspective, but it had risen on the margin in recent years.

Gold and commodities are in many ways the mirror image of the dollar's strength. Both reached very high levels from an historical perspective a few years ago, at the same time the dollar plunged to new all-time lows. Since then, gold has declined and commodity prices have eased, at the same time the dollar has recovered a bit.

The chart above shows the CRB Spot Commodity Index, arguably the best measure of non-energy, non-gold commodity prices, and its 5-year moving average (purple line). Although commodity prices are down from their 2011 highs, they are still above their 5-yr moving average. I show this on the theory that it takes perhaps 5 years for the world to adjust to commodity prices, so any important deviations from the 5-yr average creates problems, either for producers (unexpectedly weak prices) or consumers (unexpectedly strong prices). I note that the last time the U.S. came perilously close to a general deflation was in the late 1990s and early 2000s, and that happened to be a period during which commodity prices were exceptionally weak, both historically and relative to their 5-yr moving average. That's not the case today, so I think that argues against the risk of deflation.

As above chart shows, 5-yr TIPS and Treasury yields are priced to the expectation that inflation over the next 5 years will average about 2%. That is substantially higher than expected inflation was back in the late 1990s and early 2000s, and it is very close to the 2.1% average we have seen since TIPS were first introduced in 1997. In other words, there are no signs of deflation fears in the bond market.

The most likely explanation for what is happening to gold and commodity prices is that they are coming off of speculation-induced highs, not that they are now signaling deflation risk. An ebbing of speculative pressures such as these actually augurs well for the long-term outlook for the economy, since it means that investment decisions are increasingly based not on speculation, but on the economic merits of each decision.

4 comments:

Interesting--but perhaps it would be wise to "back out" corn and oil prices.

Corn prices, a major commodity, have been artificially inflated (and dramatically so) by the mandated US ethanol program, a favorite of the Pink State Socialist Rural empire.

Oil prices are rigged by OPEC, and an unseemly collection of thug states, in which free enterprise, property rights and even government are chimeras, and I speak of Iraq, Iran, Nigeria, Mexico, Russia, Venezuela, Saudi Arabia et al.

There are some strange commodities of which no one ever speaks Aluminum? Trading at 1995 prices. Natural gas?

In short, looking for deflationary or inflationary clues in the USA by looking at globalized commodities markets may be...a very, very tricky undertaking.

The gerat commodities price run-up of the 2000s ushered in...the lowest U.S. rates of inflation in 60 years.

LIPPER FUND FLOW REPORT

Weekly 07/31/2013

Equity Fund Inflows $6.6 Bil;

Taxable Bond Fund Outflows -$955 Mil

xETFs - Equity Fund Inflows $2.4 Bil;

Taxable Bond Fund Outflows -$1.3 Bil

Monthly for June

Equity Fund Outflows -$18.7 Bil;

Taxable Bond Fund Outflows -$51.5 Bil

xETFs - Equity Fund Outflows -$7.1 Bil;

Taxable Bond Fund Outflows -$40.8 Bil

Quarterly for Q2

Equity Fund Inflows $23.1 Bil;

Taxable Bond Fund Outflows -$13.5 Bil

xETFs - Equity Fund Inflows $17.2 Bil;

Taxable Bond Fund Outflows -$15 Bil

I don't hold vast numbers of dollars -- better to hold equities that earn rent and dividends -- the dollar is simply a unit of measure at this point -- personally, I have never understood any fiat currency to hold "value" -- I'm not clear in my own mind as to why anyone cares what a dollar is "worth" -- but, that's just me...

Dr. McKibbin - What currency are the majority of your equities valued in?

Post a Comment