The Federal Open Market Committee today told us that while they see signs that "the pace of economic contraction is slowing," they anticipate that economic conditions will be so bad for so long as "to warrant exceptionally low levels of the federal funds rate for an extended period." The main reason they cite for this conclusion is that "substantial resource slack is likely to dampen cost pressures."

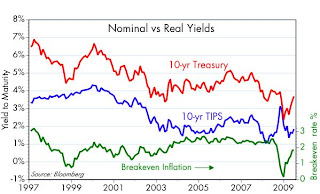

In other words, they are likely to make the same mistake they made in late 2003, when they telegraphed their intention to keep the funds rate at 1% for an "extended period." From their statement today we can infer that the line on this chart will be somewhere in the range of -1 to -3% for the next few years. And that, in turn, means monetary policy will be about as easy as it's ever been. Easy enough to create at least another bubble or two, the main question being where.

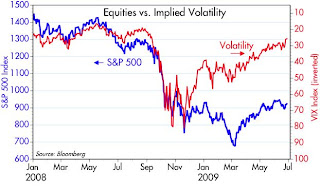

In essence, the Fed is offering the world a free lunch: borrow overnight and buy just about anything that moves—move out the curve and pick up yield, buy real estate, buy stocks of companies that can merely survive, buy commodities. This is the closest thing to a risk-free arbitrage that one can imagine.

If this doesn't result in the banking system putting all those excess reserves that are currently sitting idle at the Fed to work, I don't know what will. Banks themselves now have the ability to engage in almost riskless arbitrage, using their reserves to buy all sorts of things—especially Treasury notes and bonds—that yield more.

As this

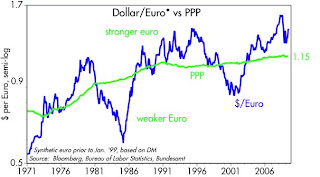

op-ed in yesterday's WSJ reminded us, the Fed made a similar decision in late 2003 which ended up contributing to the bubble in housing prices, oil prices, and commodity prices. At the time, the economy was turning up, and there were plenty of warning signs that the Fed was too easy: the dollar was down, gold was rising, commodity prices were rising. Instead of tightening, they kept the fed funds rate at extremely low levels, in both real and nominal terms, for about two years. Although the signs of a recovery today aren't as strong as they were in late 2003, the warning signs of too much money are much stronger: the dollar is 10% weaker, gold has more than doubled, commodity prices are up 30%, oil has more than doubled, and the yield curve is steeper.

The rationale for all this ease is "slack," which is a codeword for the Phillips Curve theory of inflation. This theory, which has been discredited by several studies by the Fed's own economists and by others, holds that inflation has little or nothing to do with monetary policy, and everything to do with how strong or weak the economy is. The Fed's role, according to this theory, is to raise and lower rates in order to fine-tune how fast or how slow the economy grows, thus indirectly controlling inflation by first controlling economic growth. Unfortunately, hubris has trumped common sense, since no person or committee is smart enough to know what magic overnight interest rate will produce the desired level of growth. And it is arguable whether the Fed has any ability at all to fine-tune growth with its interest rate too. Plus, no one really knows how to estimate "slack," whatever that is. It's a fool's game, but the Fed just keeps playing it.

The bond market sold off today, ostensibly because the FOMC announcement ruled out any increase in the Fed's planned purchases of T-bonds and mortgage-backed securities. That's a fool's game as well, since the Fed has no ability to influence the level of bond yields. Indeed, the more bonds it purchases, the less likely that bond prices will rise; the market will realize that the Fed is monetizing debt, and that will render Treasury bonds instantly less attractive by increasing future inflation.

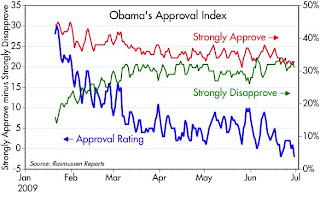

So the real message of the FOMC today was not that it won't increase its bond purchases, it's that the FOMC still believes in the wrong theory of inflation. Consequently, it is more likely to make a monetary error. This error could show up as another asset price bubble somewhere, a faster rate of inflation, a weaker dollar, higher interest rates in the future, and/or higher gold and commodity prices. It is not going to be of great help to the economy today, just as Obama's stimulus plans are more depressing than they are stimulative (because of the very real threat of a significant increase in tax burdens). Quantitative easing made sense when the financial markets and the economy were on the ropes. But now with the economy beginning a recovery and the warning signs of too much money growing, easy money is a fool's game. It only fuels speculative activities, while at the same time reducing investment in the U.S. because it undermines the strength of the dollar and by inference reduces the return on U.S. investments.

Despite this nasty combination of bad fiscal and monetary policy, however, I do remain optimistic. I think the economy can still manage to grow, just not as much as it otherwise could. I think the market is still priced to the belief that growth is going to be almost nonexistent or very weak, so even a modest 3% rate of growth (very modest given how much economic growth has fallen in the past year) going forward would be a welcome surprise.

In the meantime, the Fed is sending investors and households several messages: 1) buy that house you were thinking of buying sooner rather than later; 2) get rid of some of the cash you have stockpiled—since it will likely pay a negative real rate of interest—and buy just about anything else instead; 4) for the money that you want to keep in a really safe place, consider TIPS; and 5) avoid lending any of your money to Treasury (i.e., don't buy Treasury notes or bonds).

Full disclosure: I am long equities, long TIPS, long housing, and short T-bonds as of the time of this writing.