I continue to argue that the Fed has essentially reached its inflation target. M2 money growth has been flat to negative for two years, and inflation ex-shelter costs (which are artificially inflated due to the BLS's faulty measurement) has declined to the Fed's target. Moreover, today's interest rates are high enough to almost paralyze the housing market, high enough to keep the dollar strong, and that in turn is enough to depress most commodity prices. Fortunately, credit spreads are still quite low, and, when combined with plentiful liquidity, it's not hard to conclude that monetary policy is not tight enough to precipitate a recession.

The correct way to view the interplay between growth and inflation is to first understand that high inflation is bad for growth, while low and stable inflation is conducive to growth. Economic growth by itself does not cause inflation—only monetary policy does. As my mentor John Rutledge explains it, inflation is like fog on the highway; it forces everyone to slow down because of a lack of visibility. Inflation creates uncertainty about the future value of the dollar, the level of interest rates, and prices. Reducing inflation thus eliminates uncertainty and promotes investment, which in turn drives growth. In short, the economy grew so much last year because inflation fell.

The charts which follow have several messages: 1) interest rates are high enough to cause some serious problems in the housing market, while at the same time boosting the dollar and keeping downward pressure on commodity prices, and 2) some sectors of the economy—manufacturing, international trade, small businesses, commercial real estate, and the service sector in general—are struggling even as the high tech sector continues to boom and corporate profits are showing healthy growth (which is why the stock market is moving higher).

Chart #1

The average rate on mortgages held by the public is 3.9% or so, whereas the current mortgage rate for new 30-yr loans is 7.2%. This creates a powerful incentive to avoid selling one's home, because acquiring a new mortgage is extremely expensive. It also depresses the demand for housing because 7.2% mortgage rates make home prices quite unaffordable for the vast majority of people. Housing supply and demand are both very constrained, with the result that the market is not likely in an equilibrium situation. Conditions could change dramatically at any time.

Chart #1 also shows that the spread between mortgage rates today and 10-yr Treasuries (the backbone of the mortgage market) is elevated. Why? Because investors are reluctant to buy 30-yr mortgages that could turn into very short-term interest rate loans should Treasury yields decline (because those who borrow at today's high rates would rush to refinance if rates fell). In sum, homeowners don't want to sell, buyers don't want to buy, and lenders (investors) don't want to lend. Again, this is not a healthy market and these conditions cannot persist much longer.

Chart #2

As Chart #2 shows, housing hasn't been so unaffordable for many decades.

Chart #3

Chart #3 shows that the volume of new mortgage applications is at very low levels, having dropped by roughly 75% since the heydays of 2005-2006.

Chart #4

As Chart #4 shows, and as is consistent with the big decline in new mortgage applications, the volume of home sales is very low from an historical perspective.

Chart #5

As Chart #5 shows, housing starts are weak because builders are not confident that the outlook for the housing market is healthy. Modest growth in home construction will not be a source of stronger overall growth. What is clear is that the housing market needs a significant decline in interest rates in order to improve.

Chart #6

As Chart #6 shows, industrial production in the US has been flat for several years. Meanwhile, industrial production in the Eurozone is suffering from recessionary conditions. The US economy is the global economy's primary engine of growth these days, but it is not very impressive.

Chart #7

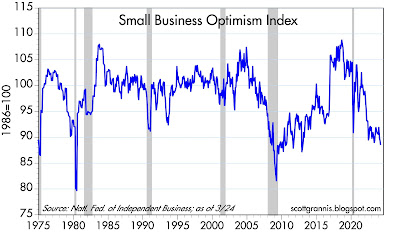

Chart #8

As Chart #8 shows, small business optimism is very low. Small businesses are essential to the overall health of the economy, so this is a troublesome sign. Likely culprits: increasing regulatory burdens, high inflation, high tax burdens, green energy subsidies which incentivize unproductive investment, geopolitical tensions, and the political polarization which increasing divides the economy.

Chart #9

Chart #9 shows that commodity prices have a strong tendency to move inversely to the strength of the dollar. (The dollar is plotted on an inverse y-axis, so a falling blue line means a stronger dollar.) What stands out here is that commodity prices are unusually strong relative to the dollar. But their ability to rise appears to be constrained given the dollar's ongoing strength.

Chart #10

Chart #10 tells us that the dollar's strength owes a lot to the fact that US interest rates are much higher than those in Europe and the rest of the developed world (the blue line represents the spread between 2-yr US and German yields). Stronger US growth and more attractive yields combine to enhance the appeal of the dollar vis a vis other currencies. This is turn helps depress commodity prices, which also helps to restrain inflation.

Chart #11

Chart #12

Chart #13

Chart #14

Chart #14 shows the year over year change in the number of private sector jobs according to the establishment survey. (Private sector jobs are the only ones that really count, in my opinion.) Jobs are growing at a relatively moderate 1.7% annual pace, which is nothing to get excited about. If this were to continue, it would probably be enough to sustain an overall pace of growth for the economy of about 2.5% - 3.0% per year—which is at odds with all the charts above that tell of weakness. What stands out here is the rather significant deceleration of jobs growth since the beginning of 2022. This is not a boom, but neither is it a bust. Yet.

Chart #15

Chart #16

Chart #15 is an updated version of a chart I have been featuring for months. What it says is that if it weren't for the way the BLS computes housing prices (which is based on the year over year change in housing prices 18 months ago), inflation today would be within the Fed's target range today. (The Fed is targeting 2% inflation in the Core Personal Consumption Deflator, which is equivalent to about 2.5% in the CPI, because the CPI tends to exceed the deflator by roughly 0.5% per year.)

Chart #16 all but proves that the BLS uses ancient housing prices to compute today's rate of shelter inflation. The red line has been falling almost exactly in line with the yoy change in housing prices 18 months ago. If this relationship holds, then the red line will fall from 5.8% today to about 2.5% by October, and this would in turn subtract a significant amount of shelter inflation from the overall CPI.

On balance, I see the risks pointing to weaker rather than stronger growth, and lower rather than higher inflation. If the economy weakens, interest rates are quite likely to fall, and that will reduce the threat of further weakness. I think the stock market sees this as well, in the form of what is called a "Fed put," or what is akin to a hedge against recession.