Happily, the one thing that I really got wrong was inflation. Instead of rising from last year's 1.8% level, as I thought it would, inflation according to the CPI fell to just over 1% for the year. That's a blessing in disguise—low inflation is always better than high and/or rising inflation, since it reduces uncertainty. In line with my expectation of higher inflation, I thought commodity prices could benefit from a stronger economy and easy money, but they ended up mixed, with food prices standing out as the big loser. I thought the dollar was likely to strengthen since it was so weak and the economy was likely to beat expectations, but instead the dollar was roughly unchanged on average: up a lot against the yen, but down against the euro and the pound. The euro benefited as Eurozone economies emerged from recession, and because of the ECB's somewhat tighter monetary stance.

I thought Treasury yields, including TIPS real yields, were very likely to rise since the economic outlook would improve, and that was indeed the case. 10-yr Treasury yields soared from 1.75% to 3%, and 10-yr TIPS real yields jumped from -1.5% to -0.3%. This was a major setback for the government bond market, but a welcome sign that the economic fundamentals are improving.

For the fifth year in a row, I thought cash would be a miserable investment relative to most risky assets, with two major exceptions: gold and investment grade corporate bonds. And indeed it was. Gold has lost almost 30% of its value this year, and investment grade corporate debt has suffered some modest losses. High yield debt enjoyed decent returns, but emerging market debt was hit hard.

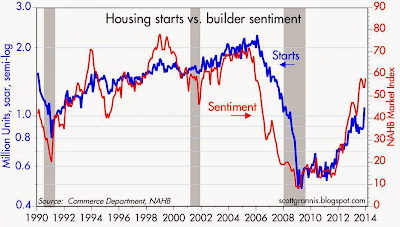

I liked real estate, particularly of the commercial variety, for its yield and its inflation-hedging properties. Residential real estate did quite well this year, while commercial real estate generated only modest returns, held back by concerns over higher interest rates.

Here's what I see in my crystal ball for 2014:

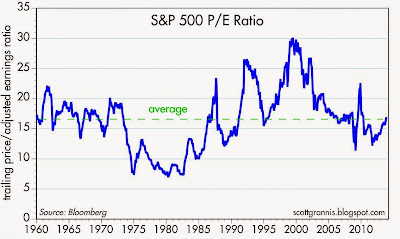

From a big-picture perspective, I think we're somewhere in the middle of what is likely to be a long recovery that is going to continue to be relatively sluggish compared to past recoveries. Markets remain pessimistic about economy's prospects, however, as can be seen in the still-very-low level of short- and intermediate-term interest rates and the merely average level of equity multiples despite record-setting corporate profits. We're unlikely to see a robust recovery soon because the economy still faces some stiff headwinds: very high regulatory burdens, high marginal tax rates, and continued monetary policy uncertainty.

Obamacare will fail, but that will be a bright spot, since it will add to the growing body of evidence that government spending and regulatory initiatives are inferior to what can be achieved when the private sector and free market forces are unleashed. On the margin, this will have the effect of restraining the burden of public sector spending and lightening regulatory burdens, which in turn should lead to a somewhat stronger economy as the year unfolds. Pressures will build for market-based healthcare initiatives, which will strengthen the economy by increasing competition and making the healthcare sector prospectively more efficient.

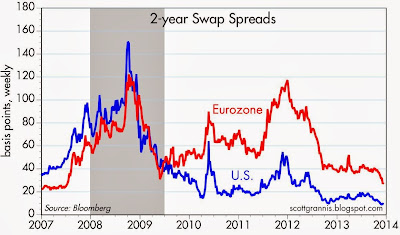

The Fed is going to finish tapering and begin to reverse QE in 2014, and they will probably begin raising the interest rate they pay on reserves sooner than the market expects, but not by much. (Currently the market expects this to happen by the second quarter of 2015.) Still, a sooner-than-expected move to reverse QE and a stronger-than-expected economy will pressure interest rates higher. Tapering and reversing QE will contribute to growth since they help reduce monetary policy uncertainty. With inflation now at very low levels, I continue to believe that it is more likely to rise than to fall, since it is more likely that the Fed will be slow to reverse QE out of concern for the economy, rather than move aggressively.

Real estate should continue to generate attractive returns. It's still a reasonably-priced inflation hedge, and it can benefit from a growing economy and accommodative monetary policy. Real estate-related investments have been depressed of late because of exaggerated concerns over the impact of higher rates and tapering; higher interest rates won't hurt real estate because they will go hand in hand with a healthier economy.

Equities will undoubtedly suffer a painful consolidation at some point this year, if only because they have done so well to date. Profits growth will continue to slow, so further gains in equity prices—which I expect to see over the long run—are going to come mainly from a continued expansion of multiples, which are still trading in the range of fair value. Multiples are likely to be pushed higher in the absence of a recession and with help from very low interest rates.

Investment grade corporate bonds are vulnerable to rising interest rates and thus relatively unattractive, but high-yield and emerging market bonds still offer spreads that should compensate for higher yields.

Gold continues to be an unattractive investment, since it is still priced to a lot more inflation and economic distress than we are likely to see. Commodities are likely to benefit somewhat from an improving outlook for the global economy, but do not offer a compelling investment opportunity at this juncture.

The dollar is likely to strengthen a bit, since it remains very weak and the U.S. economy is likely to once again exceed expectations. An earlier-than-expected shift by the Fed to reverse QE could also help boost the dollar.

If nothing else, 2014 could prove to be very interesting, as we watch the slo-mo Obamacare train wreck unfold, and as the November elections mark a pivotal point in the public's desire for more or less government intervention in the economy. I'm optimistic.