Let me be very clear on the economics of President Obama’s State of the Union speech and his budget. He is declaring war on investors, entrepreneurs, small businesses, large corporations, and private-equity and venture-capital funds.

Raising the marginal tax rate on successful earners, capital, dividends, and all the private funds is a function of Obama’s left-wing social vision, and a repudiation of his economic-recovery statements. Ditto for his sweeping government-planning-and-spending program, which will wind up raising federal outlays as a share of GDP to at least 30 percent, if not more, over the next 10 years.

Study after study over the past several decades has shown how countries that spend more produce less, while nations that tax less produce more. Obama is doing it wrong on both counts.

And as far as middle-class tax cuts are concerned, Obama’s cap-and-trade program will be a huge across-the-board tax increase on blue-collar workers, including unionized workers. While the country wants more fuel and power, cap-and-trade will deliver less.

The combination of easy money from the Fed and below-potential economic growth is a prescription for stagflation. That’s one of the messages of the falling stock market.

Essentially, the Obama economic policies represent a major Democratic party relapse into Great Society social spending and taxing.

A great many Obama supporters -- especially hedge-fund types who voted for “change” -- are becoming disillusioned with the performances of Obama and Treasury man Geithner. There is a growing sense of buyer’s remorse.

Friday, February 27, 2009

Kudlow: Obama declares war on growth

Larry Kudlow lays it out pretty clearly in his blog post entitled Obama declares war on investors, entrepreneurs, businesses, and more. Excerpts follow, but be sure to read the whole thing:

Coincidence?

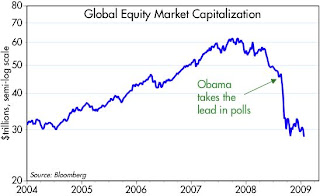

No one can prove that the crash in global equity markets has anything to do with Obama becoming president, but there are reasons to think so.

Obama is seeking to implement virtually overnight a blueprint for an unprecedent expansion of government's size and power, and huge new tax burdens and deficits will be required to fund this. He justifies it all with the unproven and logic-lacking theory that more government spending and intervention can expand the economy. He is rushing to implement a massive shift in the way we use energy by putting in place a politically motivated tax on the cheapest energy available, based on an increasingly smaller "consensus" among scientists that reducing carbon emissions will "save the planet."

In short, Obama is taking monumental risks, not only with his own presidency, but with the future of our country, and ultimately with the well-being of the entire world. He wasn't kidding when he said he was audacious. But it's increasingly looking like his audacity is spinning out of control. In my view, that's what is worrying equity markets all over the world. This is far more serious than the subprime lending and related financial crisis, which is well on its way to getting fixed.

Thursday, February 26, 2009

Raising tax rates doesn't guarantee more revenues

This chart is worth at least 1,000 words on the subject of tax policy, and the Obama administration and Congress would do well to study it carefully before plunging ahead with Obama's plan to raise an extra trillion or dollars in revenues over the next 10 years by raising all sorts of taxes (e.g., higher income and capital gains taxes, new climate taxes, limitations on deductions, etc.).

This chart is worth at least 1,000 words on the subject of tax policy, and the Obama administration and Congress would do well to study it carefully before plunging ahead with Obama's plan to raise an extra trillion or dollars in revenues over the next 10 years by raising all sorts of taxes (e.g., higher income and capital gains taxes, new climate taxes, limitations on deductions, etc.).Note how capital gains revenues soared in the year before the capital gains tax was scheduled to rise in 1987. Taxpayers respond significantly to incentives: if they know taxes will rise in the future they will accelerate income and accelerate the realization of gains. The CBO projected in 1986 that the rise in the capital gains tax would lead to a revenue bonanza over the next several years that completely failed to materialize. In fact, capital gains revenues were abysmally low for the next 8 years.

Note also how a reduction in the capital gains tax in 1997 resulted in a huge increase in capital gains realizations in subsequent years. I would argue that a lower tax on capital helped boost the stock market and the economy, through increased investment, and that in turn led to higher capgains realizations. Of course, then we had the stock market collapse of 2001-2002, brought on largely by tight monetary policy, which resulted in a huge decline in capgains revenue.

The Obama folks are projecting that a 2010 rise in the capital gains tax rate for the rich, to 20%, will result in an extra $118 billion in revenues over 10 years. They are also projecting that the expiration of the Bush tax cuts, and new limitations on personal exemptions and itemized deductions for the rich, will generate over $500 billion in new revenues over 10 years. If history and human nature are any guide, the actual revenue gains could be much less.

As Art Laffer always says, when you tax something less you usually get more of it; and when you tax something more you usually get less. Higher taxes on anyone, coming at a time (next year) when the economy will likely still be struggling to recover, are quite simply a very bad idea.

And this helps explain why the stock market is celebrating Obama's "new era of responsibility" with lower and lower prices.

Obama's "New Era of Responsiblity"

In what could prove to be one of the greatest hypocrisies ever to come out of the Washington D.C., Obama today released his 2010 budget proposal. Titled "A New Era of Responsibility," the document contains a blueprint for the biggest expansion of government spending and deficits since WW II, with heroic assumptions for how much extra tax can be squeezed out of the rich, and how all the extra spending can be reined in at some point in the future.

This chart shows both the history of federal receipts and outlays, and what Obama's budget assumes they will in future years. Federal receipts are assumed to skyrocket at double-digit rates in 2010 and 2011, despite only a modest recovery, as higher taxes and new limits on deductions presumably succeed in grabbing hundreds of billions of extra dollars from the pockets of the rich. Receipts are then expected to stabilize at just over 19% of GDP, even though they have averaged less than 18% of GDP over the past 40 years and have only exceeded 19% for a handful of those years.

Spending will surge this year, but is then expected to perform the never-before-seen feat of not growing at all for the next 5 years, even as the government brings a huge portion of the population under its healthcare wing and countless government programs expand in coming years thanks to the recently passed "stimulus" bill. Spending is expected to stabilize at just over 22% of GDP, even though it has averaged about 20% for the past 40 years and has only barely exceeded 22% in a handful of those years.

Even if you believe these projections, this president has the gall and the daring to label a massive and unprecedented increase in government spending and taxation a "return to responsibility."

The potential pitfalls of this exercise inspire dread rather than optimism. What if higher tax rates don't elicit higher revenues? What if spending just keeps ratcheting higher, as it always has in the past? What if interest rates rise, making trillion dollar deficits massively expensive to finance? What if an expansion of government slows the growth of productivity, which in turn results in an economy that grows below "potential" for many years to come?

I don't think you have to look too far or too hard to realize that this document is, for the market, the Sum of All Fears.

Unemployment claims still rising

I have been expecting to see the rise in unemployment claims to reach a peak, but that has not yet occurred. Things look pretty grim according to this chart, but if you compare claims to the total number of people working, we are about 30% below the levels seen at the peaks of the 1975, 1980, and 1981-2 recessions. This is turning into a painful recession, but it's still far from being the worst.

I have been expecting to see the rise in unemployment claims to reach a peak, but that has not yet occurred. Things look pretty grim according to this chart, but if you compare claims to the total number of people working, we are about 30% below the levels seen at the peaks of the 1975, 1980, and 1981-2 recessions. This is turning into a painful recession, but it's still far from being the worst.

Capital spending weakens

January data for capital spending was decidedly weak, and the numbers for previous months were revised downwards. This does not support my general optimism, since capital spending lays the foundation for future growth. I would note, however, that capital spending has been lagging the growth in corporate profits for most of the past decade—corporations have built up huge stockpiles of cash as a result. When and if conditions improve, there is thus lots of room for new investment and a return to growth. Meanwhile, animal spirits are being depressed daily by the prospect of monstruous increases in government spending in coming years, and the need for similarly large increases in taxes, the burden of which seems destined to fall mostly on the rich and on corporate America.

January data for capital spending was decidedly weak, and the numbers for previous months were revised downwards. This does not support my general optimism, since capital spending lays the foundation for future growth. I would note, however, that capital spending has been lagging the growth in corporate profits for most of the past decade—corporations have built up huge stockpiles of cash as a result. When and if conditions improve, there is thus lots of room for new investment and a return to growth. Meanwhile, animal spirits are being depressed daily by the prospect of monstruous increases in government spending in coming years, and the need for similarly large increases in taxes, the burden of which seems destined to fall mostly on the rich and on corporate America.

Wednesday, February 25, 2009

The rich pay most of the taxes already

I've posted this before, but it's good to keep this in mind when listening to Obama casually assume that there is no problem having the rich pay half again as much as they are already paying (see my post on Obama's math from earlier today). This chart shows the cumulative share of taxes paid by top income earners, according to data from 2006 (e.g., the top 1% pay 40% of all income taxes, and the top 10% of earners pay 70% of all income taxes). To be in the top 1% of taxpayers you've got to have adjusted gross income of just under $400,000. Obama defines "rich" as those making at least $250,000, and that would consist of roughly the top 2% of income earners.

I've posted this before, but it's good to keep this in mind when listening to Obama casually assume that there is no problem having the rich pay half again as much as they are already paying (see my post on Obama's math from earlier today). This chart shows the cumulative share of taxes paid by top income earners, according to data from 2006 (e.g., the top 1% pay 40% of all income taxes, and the top 10% of earners pay 70% of all income taxes). To be in the top 1% of taxpayers you've got to have adjusted gross income of just under $400,000. Obama defines "rich" as those making at least $250,000, and that would consist of roughly the top 2% of income earners.As a rule of thumb, the top 2% of taxpayers are probably paying close to 50% of all income taxes, which in 2006 totaled a bit over $1 trillion. Federal revenues for calendar year 2008 were $2.4 trillion, just about exactly the same as they were in 2006, so it's safe to assume that total income taxes haven't changed much since 2006. (Corporate taxes are a little over $300 billion, and payroll taxes are about $650 billion.)

It's hard to keep track of all the new spending Obama is proposing, but between the stimulus bill, universal healthcare and bank bailouts—plus his call for a general increase in the federal budget of 8.5% for the next year—it could easily add up to an extra $300 billion a year for many years to come. Do the math: the "rich" are currently paying about $500 billion per year in income taxes, and he presumably wants them to pay an additional $300 billion—a 60% increase in their tax burden. That is just about impossible in my book. Something has got to give.

Good news recap (10)

Treasury bond yields are up since their all-time lows of late last year. Rising bond yields in the current environment are unequivocally positive signs. Nominal yields have risen much more than real yields on TIPS, which means that investors have lost a good deal of their fear of deflation. The modest rise in real yields can be taken as a sign that investors expect the economy to be a bit stronger (or less weak) in the future. With less risk of deflation and a greater likelihood of a return to growth, the general outlook improves significantly.

Some people worry that higher Treasury yields will be an added burden to the economy, but I don't agree. For now, higher yields can only mean that the outlook is brighter because deflation and depression risk are lower. Consider also that higher interest rates are not necessarily bad in any event. U.S. households have a lot more floating rate assets than they do floating rate debt, so higher interest rates are a boon to the household sector. Think of all the retired folk who are struggling with paltry interest payments on their bank CDs.

Obama needs to do his math again

Obama has defined "rich" as anyone making over $250,000/year. Last night he vowed that nobody earning less than that would pay a dime in extra taxes as a result of all the things he has proposed. If we take that to include the $800 billion stimulus bill, it's tough to see how the numbers add up.

Based on data complied by the Tax Foundation for 2006, here is what we know: The top 1% of income earners (1.4 million taxpayers) had $1.8 trillion of adjusted gross income and paid $400 billion in federal income taxes. It took an income of at least $389,000 to qualify for that distinguished group. The top 2-5% of income earners (5.4 million taxpayers) had $1.2 trillion of AGI and paid $200 billion in federal income taxes. It took an income of at least $154,000 to qualify.

I'm going to assume that incomes aren't significantly higher today than they were a few years ago, and I'm going to interpolate and guess that the top 2% earn at least $250,000 per year, make about $2 trillion in income, and pay about $450 billion in income taxes.

A senior administration official announced today that "Obama will propose $634 billion in tax increases on upper-income taxpayers and cuts to government health spending to fund health reform over 10 years," and that "The proposed tax change would limit the deductions available to people in the highest income tax brackets."

Over the next three years, if he gets his way, I figure he is going to be spending an extra $600 billion or more on a the combination of "stimulus" and universal healthcare. That's probably a conservative estimate, since the Wall Street Journal's Op-Ed today guessed that universal healthcare alone would cost at least $220 billion a year. I don't think he can make significant cuts to health spending, and I figure he is lowballing his cost estimates. If he wants to bring the deficit down and not raise taxes on 98% of taxpayers, that means that the IRS is going to need to take at least an additional $200 billion a year out of the pockets of the "rich," if not much more. That means that the "rich" are going to need to cough up about 50% more in taxes per year, and that money will supposedly come as a result of the expiration of the Bush tax cuts and the elimination of most if not all their deductions. I just don't see how anyone can (or should, for that matter) try to pick the pockets of the rich for that much money. Even Robin Hood would never have been so brazen.

The magnitude of Obama's attempt to expand government at the expense of a tiny minority is just simply mind-boggling; so outrageous, in fact, that it is highly unlikely to work. If he succeeds in getting universal healthcare, the middle class will find themselves eventually saddled with huge new tax burdens and medical care that will be rationed by a group of "enlightened" bureaucrats.

The thing people need to remember about universal healthcare is that it cannot possibly be cost-effective. If you offer healthcare to everyone for "free," the laws of economics and human behavior dictate that the demand for healthcare will exceed the supply of it. Sooner or later it will have to be rationed, just as it is in places like Canada and the U.K.

And to think that we could probably solve 80-90% of the healthcare problem by simply changing the tax code so that anyone, not just employers, could deduct the cost of healthcare insurance. This would reintroduce basic market dynamics to the healthcare market, and that is the only thing that can make healthcare cost-effective and widely available.

Based on data complied by the Tax Foundation for 2006, here is what we know: The top 1% of income earners (1.4 million taxpayers) had $1.8 trillion of adjusted gross income and paid $400 billion in federal income taxes. It took an income of at least $389,000 to qualify for that distinguished group. The top 2-5% of income earners (5.4 million taxpayers) had $1.2 trillion of AGI and paid $200 billion in federal income taxes. It took an income of at least $154,000 to qualify.

I'm going to assume that incomes aren't significantly higher today than they were a few years ago, and I'm going to interpolate and guess that the top 2% earn at least $250,000 per year, make about $2 trillion in income, and pay about $450 billion in income taxes.

A senior administration official announced today that "Obama will propose $634 billion in tax increases on upper-income taxpayers and cuts to government health spending to fund health reform over 10 years," and that "The proposed tax change would limit the deductions available to people in the highest income tax brackets."

Over the next three years, if he gets his way, I figure he is going to be spending an extra $600 billion or more on a the combination of "stimulus" and universal healthcare. That's probably a conservative estimate, since the Wall Street Journal's Op-Ed today guessed that universal healthcare alone would cost at least $220 billion a year. I don't think he can make significant cuts to health spending, and I figure he is lowballing his cost estimates. If he wants to bring the deficit down and not raise taxes on 98% of taxpayers, that means that the IRS is going to need to take at least an additional $200 billion a year out of the pockets of the "rich," if not much more. That means that the "rich" are going to need to cough up about 50% more in taxes per year, and that money will supposedly come as a result of the expiration of the Bush tax cuts and the elimination of most if not all their deductions. I just don't see how anyone can (or should, for that matter) try to pick the pockets of the rich for that much money. Even Robin Hood would never have been so brazen.

The magnitude of Obama's attempt to expand government at the expense of a tiny minority is just simply mind-boggling; so outrageous, in fact, that it is highly unlikely to work. If he succeeds in getting universal healthcare, the middle class will find themselves eventually saddled with huge new tax burdens and medical care that will be rationed by a group of "enlightened" bureaucrats.

The thing people need to remember about universal healthcare is that it cannot possibly be cost-effective. If you offer healthcare to everyone for "free," the laws of economics and human behavior dictate that the demand for healthcare will exceed the supply of it. Sooner or later it will have to be rationed, just as it is in places like Canada and the U.K.

And to think that we could probably solve 80-90% of the healthcare problem by simply changing the tax code so that anyone, not just employers, could deduct the cost of healthcare insurance. This would reintroduce basic market dynamics to the healthcare market, and that is the only thing that can make healthcare cost-effective and widely available.

Refi now if you can

With mortgage rates about as low as they've ever been, it's time to refinance if you haven't already and if you can. 10-year Treasury yields are already up about 80 bps from their lows, and if they continue to move higher then mortgage rates will be under pressure to rise. Refinancing activity is already well above its historic levels, but not quite as strong as we've seen at other times when Treasury yields dipped to new lows. Undoubtedly this has to do with the fact that many homeowners who would like to refinance can't, because they don't have sufficient equity in their homes.

Tuesday, February 24, 2009

Quick thoughts on Obama's speech tonight

The general thrust of the speech was to claim for government the mantle of progress: e.g., we are a great country today because our ancestors built roads. Going forward, with government's help we can cure cancer, get everyone educated, give everyone healthcare, save the planet from climate destruction and ensure (Obama's favorite word) that everyone who wants it has access to credit for whatever it is he wants, especially cars and more college education—which by the way everyone should do. In Obama's worldview, government is the source of all progress. I think he mentioned the word "entrepreneur" once.

Following Rahm's lead, Obama tried quite unsuccessfully to explain why it is that the roots of the current crisis lie in our failure to develop renewable energy and provide college education and free healthcare to everyone, and our willingess to allow the richest to just get richer thanks to lower tax rates.

Executives of major corporations will be presumed guilty of malfeasance if they fly in private jets. (Obama will claim the mantel of frugality by declining the offer of $11 billion worth of new Lockheed Martin helicopters to replace Marine One, but he will make profligate use of Air Force One.) Banks will be drawn and quartered if they don't use government assistance to expand their lending (but wasn't willy-nilly lending one of the major causes of the housing crisis?).

Rich people who cash out of the corporate rat-race and give all their money to their employees will be lionized. We enter a new age of enforced charity and sacrifice and community service.

After last week imploring Congress to pass without scrutiny a bill that will add trillions of dollars to future deficits, now Obama says he will go to the ends of the earth to "ensure" that the bill will not be wasteful. And he also promises to bring the deficit back down from the lofty heights it is soon to reach, to somewhere just above where he inherited it. (I'm figuring that the deficit as a % of GDP will rocket from about 6% of GDP today to almost 12%, and maybe, if all the stars are aligned perfectly, descend in 3-4 years back down to 7% of GDP.) It would be a miracle if the deficit by the end of Obama's first term is back down to the highest level of the deficit (as a % of GDP) of the Reagan administration.

He will bring the deficit down by "ensuring" that wasteful and unnecessary spending will be dutifully eliminated, and also by ensuring that those making more than $250,000 a year pick up the tab for everything else. Class warfare is so easy once you realize that the vast majority of voters make less than $250,000 a year.

Stephen Green did a great job of drunkblogging Obama's address, by the way.

How he will reconcile his assertion that we can't walk away from the auto industry, but that it must be fully competitive in the global environment was not exactly clear.

To summarize, I don't see anything that holds out the promise of making a significant difference. Sadly but fortunately, that is not new news. I think the market is already priced to no help from an Obama administration. If this is economy is going to recover, it will do so in spite of Obama's supposed ministrations. That's why I will continue to focus on the real-time, market-based indicators of where the economy is moving on the margin.

Following Rahm's lead, Obama tried quite unsuccessfully to explain why it is that the roots of the current crisis lie in our failure to develop renewable energy and provide college education and free healthcare to everyone, and our willingess to allow the richest to just get richer thanks to lower tax rates.

Executives of major corporations will be presumed guilty of malfeasance if they fly in private jets. (Obama will claim the mantel of frugality by declining the offer of $11 billion worth of new Lockheed Martin helicopters to replace Marine One, but he will make profligate use of Air Force One.) Banks will be drawn and quartered if they don't use government assistance to expand their lending (but wasn't willy-nilly lending one of the major causes of the housing crisis?).

Rich people who cash out of the corporate rat-race and give all their money to their employees will be lionized. We enter a new age of enforced charity and sacrifice and community service.

After last week imploring Congress to pass without scrutiny a bill that will add trillions of dollars to future deficits, now Obama says he will go to the ends of the earth to "ensure" that the bill will not be wasteful. And he also promises to bring the deficit back down from the lofty heights it is soon to reach, to somewhere just above where he inherited it. (I'm figuring that the deficit as a % of GDP will rocket from about 6% of GDP today to almost 12%, and maybe, if all the stars are aligned perfectly, descend in 3-4 years back down to 7% of GDP.) It would be a miracle if the deficit by the end of Obama's first term is back down to the highest level of the deficit (as a % of GDP) of the Reagan administration.

He will bring the deficit down by "ensuring" that wasteful and unnecessary spending will be dutifully eliminated, and also by ensuring that those making more than $250,000 a year pick up the tab for everything else. Class warfare is so easy once you realize that the vast majority of voters make less than $250,000 a year.

Stephen Green did a great job of drunkblogging Obama's address, by the way.

How he will reconcile his assertion that we can't walk away from the auto industry, but that it must be fully competitive in the global environment was not exactly clear.

To summarize, I don't see anything that holds out the promise of making a significant difference. Sadly but fortunately, that is not new news. I think the market is already priced to no help from an Obama administration. If this is economy is going to recover, it will do so in spite of Obama's supposed ministrations. That's why I will continue to focus on the real-time, market-based indicators of where the economy is moving on the margin.

How simple policies could make a real difference

Two good friends of mine, Russell Redenbaugh and James Juliano, have come up with a simple and elegant solution to the housing crisis. The basic problem we have today is falling home prices, which signal that the supply of houses exceeds the demand for them. Since the supply of new housing, as measured by housing starts, is at an all-time low and closing in on zero, there's no need to worry about fixing the supply portion of the housing market. It's demand that needs stimulating.

So he proposes to change the incentives of home buyers. He suggests offering an income tax holiday to buyers of existing homes that is tied to the purchase price of the house. The buyer of a $500,000 existing home would receive a tax holiday for, say, six months on $500,000 of income. This idea combines the power of lower income taxes with targeted relief for the troubled housing sector. Buyers would have a big incentive to buy homes because they would receive a significant boost in their after tax income, and many would likely work harder to take advantage of that. Banks would find immediate relief as housing prices stopped falling and began to increase—no more need to write down toxic mortgage paper. Homeowners on the verge of foreclosure would find relief as prices rose.

This exercise in creative problem solving highlights the necessary characteristics of effective stimulus plans. They must change incentives in order to expand the economy. We can only grow the economy if our collective work input and output increases. The best way to do that is to increase the incentives for working and investing by lowering taxes on income and capital. Unfortunately, to date the Obama administration has completely ignored this type of stimulus in favor of the discredited and illogical notion that taking money from one person and giving it to another can result in higher levels of output.

So he proposes to change the incentives of home buyers. He suggests offering an income tax holiday to buyers of existing homes that is tied to the purchase price of the house. The buyer of a $500,000 existing home would receive a tax holiday for, say, six months on $500,000 of income. This idea combines the power of lower income taxes with targeted relief for the troubled housing sector. Buyers would have a big incentive to buy homes because they would receive a significant boost in their after tax income, and many would likely work harder to take advantage of that. Banks would find immediate relief as housing prices stopped falling and began to increase—no more need to write down toxic mortgage paper. Homeowners on the verge of foreclosure would find relief as prices rose.

This exercise in creative problem solving highlights the necessary characteristics of effective stimulus plans. They must change incentives in order to expand the economy. We can only grow the economy if our collective work input and output increases. The best way to do that is to increase the incentives for working and investing by lowering taxes on income and capital. Unfortunately, to date the Obama administration has completely ignored this type of stimulus in favor of the discredited and illogical notion that taking money from one person and giving it to another can result in higher levels of output.

Good news recap (9)

Further to my previous post, Total Bank Credit shows no sign of any significant slowdown in banks' lending activities. If anything, one might argue that the pace of bank lending in recent years has been quite a bit more generous than it was during the 2001 recession.

UPDATE: This directly contradicts one of the central tenets of Obama's policies. He claimed in his speech to Congress that "banks aren't lending." This is simply NOT true. Why isn't he being questioned on this?

Good news recap (8)

This is the first appearance of this chart, but it falls under the rubric of "no shortage of money" which has received plenty of attention here over the past several months. We keep hearing and reading that banks are very reluctant to lend money these days, and the economy is suffering as a result. Well, the reality is considerably different from the hype, as this chart demonstrates (data through the end of January '09). Bank lending to consumers has actually accelerated over the course of the past 12-18 months, and currently stands at a new all-time high.

This is the first appearance of this chart, but it falls under the rubric of "no shortage of money" which has received plenty of attention here over the past several months. We keep hearing and reading that banks are very reluctant to lend money these days, and the economy is suffering as a result. Well, the reality is considerably different from the hype, as this chart demonstrates (data through the end of January '09). Bank lending to consumers has actually accelerated over the course of the past 12-18 months, and currently stands at a new all-time high.

Good news recap (7)

Agency spreads are down significantly. The difference between the yield on debt issued by Fannie Mae and Treasury debt of comparable maturity is a measure of the degree of trust investors have in the U.S. government's willingness to stand behind Fannie's debt. Although these spread still indicate a degree of doubt on the part of the market, they are nevertheless substantially lower than when the market first realized that Freddie and Fannie's debt, measured in the trillions of dollars, might be worthless. This is very important, since it has calmed the nerves of foreign investors, among others, who held massive amounts of Agency debt.

Good news recap (6)

Shipping rates have bounced solidly off their lows. As markets collapsed and fears of a global banking crisis soared, consumers sharply curtailed discretionary spending and banks all but shut down the issuance of the letters of credit that are essential to global trade. Global trade virtually ground to a halt, with shipping rates, as shown in this chart, falling to levels that most likely marked the point at which shippers would rather leave their ships at the dock rather than sail them for a loss. Shipping activity is now making a comeback, with shipping rates up dramatically from the early December lows. Doom and gloomers fret that rates will plunge again, as new ships are scheduled to come on line. But that doesn't negate the fact that activity must be up, even if it is only due to China ramping up its stimulus package. Where there's smoke, there's fire.

Shipping rates have bounced solidly off their lows. As markets collapsed and fears of a global banking crisis soared, consumers sharply curtailed discretionary spending and banks all but shut down the issuance of the letters of credit that are essential to global trade. Global trade virtually ground to a halt, with shipping rates, as shown in this chart, falling to levels that most likely marked the point at which shippers would rather leave their ships at the dock rather than sail them for a loss. Shipping activity is now making a comeback, with shipping rates up dramatically from the early December lows. Doom and gloomers fret that rates will plunge again, as new ships are scheduled to come on line. But that doesn't negate the fact that activity must be up, even if it is only due to China ramping up its stimulus package. Where there's smoke, there's fire.

Good news recap (5)

Swap spreads have declined significantly. To be sure, they are still higher than would be considered "normal," but they are now back to levels that preceded the current equity disaster. If anything, lower swap spreads are a sign that the fixed-income market has recovered a good measure of the liquidity it had lost at the height of the panic back in October and November. Lower swap spreads also signify an improvement in people's willingness to accept counterparty risk, and that is in turn a key sign of rising confidence.

I've been disappointed that equities haven't rallied in the wake of the improvement in swap spreads, but I've noted before that while swap spreads have been excellent leading indicators of conditions in other markets, that lags can at times be significant. For example, swap spreads started declining just before the onset of the 2001 recession, and credit spreads didn't start declining until late 2002. So I'm willing to be patient.

Good news recap (4)

The dollar is not collapsing. It has bounced significantly off its all-time lows of last summer. This chart may overstate the dollar's strength, however, since the dollar as well as most other major currencies have declined significantly relative to gold. Still, it is reassuring to note that the dollar still garners respect among the world's investors, despite the Fed's massive quantitative easing program. I think it also means that the U.S. economy is still considered to be among the world's most dynamic and resilient, and thus the dollar represents access to a safe port in the current economic storm.

The dollar is not collapsing. It has bounced significantly off its all-time lows of last summer. This chart may overstate the dollar's strength, however, since the dollar as well as most other major currencies have declined significantly relative to gold. Still, it is reassuring to note that the dollar still garners respect among the world's investors, despite the Fed's massive quantitative easing program. I think it also means that the U.S. economy is still considered to be among the world's most dynamic and resilient, and thus the dollar represents access to a safe port in the current economic storm.

Good news recap (3)

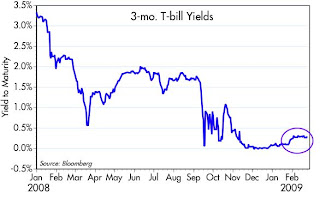

Part of the reason for the decline in the TED spread (see previous post) is the rise in T-bill yields. While the rise is still quite modest, it is nevertheless significant that yields on the world's safest security are no longer zero. Any tendency for Treasury yields to rise from their year-end lows is a good sign that fear is subsiding and markets are gradually regaining a degree of confidence in the future. It's also a sign that defaltion risks are declining, and that means we are not necessarily in the grips of a self-reinforcing cycle of weak demand and falling prices.

Part of the reason for the decline in the TED spread (see previous post) is the rise in T-bill yields. While the rise is still quite modest, it is nevertheless significant that yields on the world's safest security are no longer zero. Any tendency for Treasury yields to rise from their year-end lows is a good sign that fear is subsiding and markets are gradually regaining a degree of confidence in the future. It's also a sign that defaltion risks are declining, and that means we are not necessarily in the grips of a self-reinforcing cycle of weak demand and falling prices.

Good news recap (2)

The TED spread (the difference between 3-mo. LIBOR and 3-mo. T-bill yields, which is a good indication of the market's fear of bank failures) has declined hugely from its all-time high of October 10th. It is still significantly higher than what we would expect to see in normal times, but the market nevertheless does appear to be healing. It took over two and a half years for the TED spread to come back to "normal" levels following the crisis leading up to the Crash of '87. The current crisis hasn't even reached the two-year mark, if you assume it started back in August of 2007. Since this crisis is all about fears of a collapse of the global banking system, progress of this sort is excellent news indeed.

Good news recap

(Note: This post marks the start of a series in which I plan to recap all the things that I think paint a positive picture of the economy, in order to provide some balance for the depressing stuff you encounter in newspapers and television. With the equity market having fallen by 50% from its recent highs, and credit spreads still incredibly high, the market is essentially forecasting that economic conditions will soon prove to be catastrophically bad, on the order of magnitude of the Great Depression or worse. I've outlined this reasoning in greater detail in this post from last November. So the news doesn't necessarily have to be positive to be significant, it just has to be better than distressingly awful.)

(Note: This post marks the start of a series in which I plan to recap all the things that I think paint a positive picture of the economy, in order to provide some balance for the depressing stuff you encounter in newspapers and television. With the equity market having fallen by 50% from its recent highs, and credit spreads still incredibly high, the market is essentially forecasting that economic conditions will soon prove to be catastrophically bad, on the order of magnitude of the Great Depression or worse. I've outlined this reasoning in greater detail in this post from last November. So the news doesn't necessarily have to be positive to be significant, it just has to be better than distressingly awful.)After plunging 60% from July through November, industrial metals prices have been relatively stable for the past 3 months. This same pattern is repeated for the great majority of commodities as well. That prices are no longer falling is an excellent sign that neither the U.S. nor the global economy is going down a black hole. Indeed, activity appears to be stabilizing. Plus, even though the commodity markets have collapsed, prices are still significantly higher today than they were at the tail end of the 2001 recession. The pessimists argue that we are in the grips of a global deflation driven by weak and declining demand, but I would argue that where commodities are concerned, we've simply seen the popping of another bubble, one that was driven by cheap money and a desire by many institutional investors to add commodity exposure to their portfolios. Things are now back to more reasonable levels, and that can be conducive to growth going forward.

Housing affordability is improving dramatically

Since home prices in major metropolitan areas are falling 2% a month and mortgage rates are down to all-time lows, it is not surprising that measures of housing affordability are skyrocketing. This chart uses data from the National Assoc. of Realtors as of December '08. This is not to say housing can't get cheaper, but it is very good news for anyone who over the past several years has been shut out of the market and/or worried that prices were inflated.

Since home prices in major metropolitan areas are falling 2% a month and mortgage rates are down to all-time lows, it is not surprising that measures of housing affordability are skyrocketing. This chart uses data from the National Assoc. of Realtors as of December '08. This is not to say housing can't get cheaper, but it is very good news for anyone who over the past several years has been shut out of the market and/or worried that prices were inflated.In subsequent posts I'm going to try to recap all of the bits and pieces of news that I think paints a positive picture of what's going on out there in the economy. The headlines news is so overwhelmingly bad, and the direction of policy in Washington so abysmally bad that I need to cheer myself up. Optimism is in very short supply these days, so I'm going to do my best to contribute to fair and balanced coverage of the economy.

Housing prices continue to fall (3)

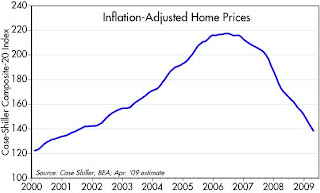

The December data for the Case Shiller housing price index fell at a somewhat faster rate than in previous months, but the message remains clear: housing prices are rapidly adjusting downwards. I posted comments on the seriously lagging nature of this index before, and this chart contains the same assumptions I've used in the past to try and get a picture of where housing prices might actually be today. In short, I'm guessing that real housing prices by this measure have fallen a little over 35% from their high; in real terms, they are about where they were during the 2001 recession.

The faster prices reach levels that clear the market—and anecdotally they appear to have done this in at least a few markets around the country, most notably in California—the quicker this recession will be over. One key to restoring confidence will be the perception that prices and the economy are not going down a black hole, that there is some solid support developing. The bottom shouldn't be too far away. After all, the vast majority of people are still working, there is more money out there than ever before, and mortgage rates are just about as low as they have ever been for the majority of borrowers (i.e., those looking for mortgages that fall within conforming limits).

Monday, February 23, 2009

Wisdom from the past

As my friend Tom Burger pointed out to me over the weekend, economists have known of the dangers of government spending for centuries. Here are some quotes that Tom dug up which date back to the early 1800s. The Hayek quote doesn't go back quite that far, but does provide the explanation for why politicians continue to ignore the wisdom of the ages.

J.S. Mill: “Consumption never needs encouragement.”

J.B. Say: “It is the aim of good government to stimulate production, of bad government to stimulate consumption.”

J.S. Mill: “The usual effect of attempts of government to encourage consumption, is merely to prevent savings; that is, to promote unproductive consumption at the expense of reproductive, and to diminish the national wealth by the very means which were intended to increase it.”

F. A. Hayek: "Knowledge in our field is never established by experiment, but can be acquired only by following a rather difficult process of reasoning. No knowledge can be regarded as established once and for all … you have always to convince every generation anew. In fact, knowledge once gained and spread is simply lost and forgotten.”

Friday, February 20, 2009

No shortage of money (9)

Inspired by a recent post from Mark Perry, I put together this chart which solidly refutes the popular notion that banks are refusing to lend to consumers, thus condemning the economy to a slow but certain death. While the 10% growth rate of loans over the past year isn't the fastest we've seen (which was just over 20% in the late 1970s), it is much faster than the average growth rate in loans over the past 18 years, as this chart shows. And as Mark notes, the growth rate of consumer loans has actually slowed down in every single one of the recessions—except for this one—we've had since the Fed began keeping records on this in 1950.

Inspired by a recent post from Mark Perry, I put together this chart which solidly refutes the popular notion that banks are refusing to lend to consumers, thus condemning the economy to a slow but certain death. While the 10% growth rate of loans over the past year isn't the fastest we've seen (which was just over 20% in the late 1970s), it is much faster than the average growth rate in loans over the past 18 years, as this chart shows. And as Mark notes, the growth rate of consumer loans has actually slowed down in every single one of the recessions—except for this one—we've had since the Fed began keeping records on this in 1950.This is not your typical recession, as I've noted repeatedly. The implication of all this is that the economy can bounce back from this recession a lot faster than most people are prepared to believe.

CPI inflation is not dead

Almost all of the big swings in the consumer price index in recent years comes from volatile energy prices. Abstracting from this, as was the case with the producer price index released yesterday, we see that most other prices continue to rise. The Cleveland Fed's Median CPI throws out all the outliers (the things with big increases or decreases); it shows that prices are up 2.7% in the past year, and in recent months have been running at an annualized rate of about 2% or so. There's been some moderation in the rate of increase in nonenergy prices, but nothing like the deflation that you've heard so much about.

Almost all of the big swings in the consumer price index in recent years comes from volatile energy prices. Abstracting from this, as was the case with the producer price index released yesterday, we see that most other prices continue to rise. The Cleveland Fed's Median CPI throws out all the outliers (the things with big increases or decreases); it shows that prices are up 2.7% in the past year, and in recent months have been running at an annualized rate of about 2% or so. There's been some moderation in the rate of increase in nonenergy prices, but nothing like the deflation that you've heard so much about.As I said yesterday, I think it is significant that nonenergy prices are still rising despite the substantial slump in demand that has occurred. That's a tribute to expansive monetary policy, a weak dollar, and strong gains in gold. It flies in the face of the widespread belief that significant economic results in deflation. It suggests that Treasury yields are too low, and the market's fears of a downward demand and price spiral are unfounded.

One last point: the non-seasonally adjusted CPI, which is used as the inflation adjustment for TIPS, rose by 0.44% percent in January. This is perfectly in line with the seasonal tendencies of the CPI, and compares favorably to the 0.5% increase in this same measure in January 2008. Most importantly, it means that TIPS holders will receive a positive inflation adjustment in the month of March, and that is a welcome change from negative adjustments for the previous five months.

Gold approaches $1000

Gold is approaching $1000/oz. as I write this, and equity markets are declining. The Dow has fallen below its November low, but the S&P 500 still has a few points left before it too hits a new low. The mood is obviously grim. It's a perfect storm of bad economic and political news.

Gold is approaching $1000/oz. as I write this, and equity markets are declining. The Dow has fallen below its November low, but the S&P 500 still has a few points left before it too hits a new low. The mood is obviously grim. It's a perfect storm of bad economic and political news.President Obama's "stimulus" bill contains virtually nothing that is likely to stimulate the economy, yet it will result in the biggest expansion of the federal government in generations and will create deficits as a percent of GDP that are measured in double digits. That in turn will be a millstone around the economy's neck for many years to come, and that's just for openers. On top of that he wants to pump hundreds of billions into the housing market in an attempt to keep prices from falling and families from losing their homes. Instead of boosting incentives to work and invest, he's rewarding those who aren't working and have failed. Instead of trusting the people and the market, he's staking everything on his belief in his own wisdom and the power of government. (As would a community organizer eager to help those who have fallen on bad times.) If the economy recovers it will be in spite of Obama's ministrations.

As for the economy, the good news can be found only if you dig, and only on the margin. If you read the headlines, all you see is doom and gloom.

I'm getting that sick feeling in my stomach that usually comes at market lows. It's time to go take a long walk on the beach.

Thursday, February 19, 2009

Why gold is a good reference point

The late Jude Wanniski in 1995 wrote a classic piece on why gold is so important, titled "A Gold Polaris." As this chart shows, gold holds its value relative to other things over time, so that it can be used as a reference point to measure all other things. Oil is currently becoming cheap relative to gold, since an ounce of gold today buys almost 25 barrels of oil. Just a few months ago, an ounce of gold would only buy you about 9 barrels of oil.

The late Jude Wanniski in 1995 wrote a classic piece on why gold is so important, titled "A Gold Polaris." As this chart shows, gold holds its value relative to other things over time, so that it can be used as a reference point to measure all other things. Oil is currently becoming cheap relative to gold, since an ounce of gold today buys almost 25 barrels of oil. Just a few months ago, an ounce of gold would only buy you about 9 barrels of oil.To give my own analogy for why gold is important and provides a unique reference point for all other prices: I remember many years ago coming into Grand Central Station on a train from Stamford. As I looked out the windows of each side of the train I suddenly became disoriented. I momentarily lost the ability to judge whether my train was moving forward or stopped, and which of the other trains were entering or leaving the station. I had lost a fixed reference point. Gold can provide a fixed reference point in a world where all currencies float up and down against each other, and prices for commodities and real estate rise and fall by significant amounts.

The action in the gold market today is telling us that all the world's currencies, with the significant exception of the Japanese yen, are declining in value. That would presumably follow from the observation that all central banks, with the exception of the Bank of Japan, are taking extraordinary measures to relax monetary policy in order to keep their price levels from falling. By offering to supply more currency than the world wants, the values of their currencies are falling. This is a precursor for the values of all things denominated in those currencies to rise, which is another way of saying that rising gold prices presage rising inflation in most countries around the world. The lag between gold rising and the prices of all other things rising is difficult to know, of course, and it can be variable, but a strongly rising gold price is a good sign that the price level will be rising in the future.

Producer Price Inflation not dead (2)

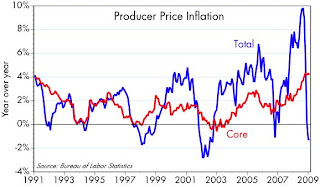

Take out food and energy prices, and you find that producer prices have been rising at a 3-4% rate all throughout this economic crisis. Lots of headline-making prices have plunged of course, with oil being the big standout. But oil prices have now stopped falling, and commodity prices in general are stabilizing if not rising. That means the two lines in this chart should start converging going forward, with the blue line (year over year changes in the headline PPI) moving higher. Inflation at the producer level is definitely not dead.

Take out food and energy prices, and you find that producer prices have been rising at a 3-4% rate all throughout this economic crisis. Lots of headline-making prices have plunged of course, with oil being the big standout. But oil prices have now stopped falling, and commodity prices in general are stabilizing if not rising. That means the two lines in this chart should start converging going forward, with the blue line (year over year changes in the headline PPI) moving higher. Inflation at the producer level is definitely not dead.This is extremely important to the general economic outlook. Much of the market's fear has come from concern that plunging demand worldwide would set up a generalized deflation that central banks would be powerless to stop. Call it a variant on the "liquidity trap," or an offshoot of Phillips Curve thinking. In short, the weaker the economy gets, the more convinced the market becomes that inflation is impossible and deflation is the threat. But now we're seeing that, despite demand hitting a major airpocket all over the world, lots of prices are still rising. That means monetary policy is not powerless, deflation risks are much lower than most people realize, and inflation risk in general is being underestimated.

And that in turn means that way too much money is trying to pile into risk-free securities (e.g., T-bills and T-bonds) that are paying very little in the way of interest. TIPS are a much better alternative to Treasuries if you are concerned about preserving principal and avoiding defaults. As for default risk, that has gone down in line with decreased deflation risk (because deflation is a debtor's worst nightmare), so corporate bonds and emerging market bonds look more attractive.

Full disclosure: I am long TIP, HYG and EMD as of this writing.

Unemployment claims still look toppy (2)

Weekly claims for unemployment were unchanged from last week, and were a tiny bit lower than they were 3 weeks ago. The 4-week moving average of claims rose less than 2%. It's still looking to me like we've seen the worst of the news on the economy.

Weekly claims for unemployment were unchanged from last week, and were a tiny bit lower than they were 3 weeks ago. The 4-week moving average of claims rose less than 2%. It's still looking to me like we've seen the worst of the news on the economy.

Wednesday, February 18, 2009

Equity prices test lows, but fear is far from its highs (2)

This is a follow up to yesterday's post. The point here is that major market bottoms almost always occur when panic reaches exceptionally high levels, as it did last November. If history is a guide (it doesn't always repeat, but it often does rhyme, as the saying goes), then the bear market lows occurred last November 21st. Sure hope so, as this bear market is getting very long in the tooth.

This is a follow up to yesterday's post. The point here is that major market bottoms almost always occur when panic reaches exceptionally high levels, as it did last November. If history is a guide (it doesn't always repeat, but it often does rhyme, as the saying goes), then the bear market lows occurred last November 21st. Sure hope so, as this bear market is getting very long in the tooth.

Housing starts still falling but the bottom is near (2)

We haven't yet hit the bottom, but we must be getting close, if only because starts aren't too far from zero. As I've mentioned before, the level of starts is now so low that further declines have only a negligible impact on GDP. So the big decline in January housing starts is really not significant news, and I post this mainly because the decline has been so impressive from an historical perspective that it warrants attention—this has been the mother of all housing recessions. As Brian Wesbury notes, the current decline in housing starts is clearly not sustainable for much longer, and when it reverses, as it most definitely will, that will be big news.

We haven't yet hit the bottom, but we must be getting close, if only because starts aren't too far from zero. As I've mentioned before, the level of starts is now so low that further declines have only a negligible impact on GDP. So the big decline in January housing starts is really not significant news, and I post this mainly because the decline has been so impressive from an historical perspective that it warrants attention—this has been the mother of all housing recessions. As Brian Wesbury notes, the current decline in housing starts is clearly not sustainable for much longer, and when it reverses, as it most definitely will, that will be big news.

Tuesday, February 17, 2009

Equity prices test lows, but fear is far from its highs

If you were to just focus on equity prices, which are revisiting their November lows, you would conclude that the market is really afraid of the future. But the VIX index, which essentially measures the fear embodied in those prices, is way down from its October-November highs. I'm not sure if there is a message here, but it is worth highlighting with an update to this chart. If anything, it tells me that equity prices have some decent support here, if only because the degree of fear, uncertainty, and doubt has declined meaningfully in recent months.

If you were to just focus on equity prices, which are revisiting their November lows, you would conclude that the market is really afraid of the future. But the VIX index, which essentially measures the fear embodied in those prices, is way down from its October-November highs. I'm not sure if there is a message here, but it is worth highlighting with an update to this chart. If anything, it tells me that equity prices have some decent support here, if only because the degree of fear, uncertainty, and doubt has declined meaningfully in recent months.

Obama's off to a VERY bad start (2)

Some very unpleasant things have happened in the markets since Obama won the election. Equities are down about 20% and gold prices are up over 30%. That has to be the most devastating rejection of a new president's policies by any market in recent memory. Investors are voting with their feet, running away from equity risk and into the comforting arms of gold. Come to think of it, since Obama's chances of winning the election started to rise meaningfully by the end of September, when the S&P 500 was trading around 1200, we could say the Obama presidency has cut equity values by fully one-third.

Some very unpleasant things have happened in the markets since Obama won the election. Equities are down about 20% and gold prices are up over 30%. That has to be the most devastating rejection of a new president's policies by any market in recent memory. Investors are voting with their feet, running away from equity risk and into the comforting arms of gold. Come to think of it, since Obama's chances of winning the election started to rise meaningfully by the end of September, when the S&P 500 was trading around 1200, we could say the Obama presidency has cut equity values by fully one-third.Those who voted for Obama would argue that he hasn't done anything yet, but the economy has collapsed and it is therefore the growing threat of a global depression that is responsible for the decline in equity values and the soaring price of gold. Things will get better once the spending bill starts to kick in.

At this point everyone is entitled to their opinion, since no one can know precisely what is driving the market, but I think the market is forward-looking and has decided that the "stimulus" bill is not going to be stimulative at all. Furthermore, I take the view that the bill that Obama will be signing today represents the sum of all the market's fears about an Obama presidency: e.g., bigger government, more income redistribution, more regulation, universal healthcare, subsidies for expensive energy sources, price fixing, abrogation of contracts, salary caps, industrial policy, protectionism, etc. There's enough hostility to capital and free markets in this bill to make any market and any rational investor deeply depressed.

A good friend, Eileen Leech, offers a somewhat less partisan view of the mess we're in: "maybe the new socialism didn't cause all of the hole we're stuck in, but it has definitely taken away the ladder."

There's a lot of wisdom in that metaphor. Bad policies and more government spending don't necessarily mean the current recession will turn into a depression, but they do mean that the economy will most likely grow by less than it otherwise could in the future. (For example, Brian Wesbury talks here about how every extra percentage point of government spending reduces potential GDP growth by 0.2%.)

In any event, the question for investors is not who or what caused the mess, but whether all the bad news is fully priced in or not. I still think it is.

I have been highlighting for the past few months a number of indicators that show definite (and in many cases huge) improvement over the past few months: the rise in the Baltic shipping index, higher prices for most commodities, lower swap and credit spreads, lower implied volatility, a declining TED spread, rising T-bill yields, rising TIPS spreads, rising Chinese and Brazilian equity markets, coordinated and aggressive central bank easing, and rising home sales. If we've seen most of the bad news and are nearing the bottom of the recession, as these indicators suggest, even awful policies should not prevent some recovery in equity values. I think the market is still fearful that we're on the brink of a deep global depression, so if the reality falls short of a true nightmare, it will be good news.

Monday, February 16, 2009

Dollar update: still relatively weak

This is probably the best overall measure of the dollar's value relative to other currencies. The Fed calculates this using inflation rates from a large group of major U.S. trading partners. The dollar bounced from its all-time lows starting last summer, but it is still below its long-term average. As I've noted before, the dollar's bounce was roughly coincident with the collapse of most commodity prices. This phenomenon is variously referred to as the unwinding of the carry trade, or a global deleveraging process.

This is probably the best overall measure of the dollar's value relative to other currencies. The Fed calculates this using inflation rates from a large group of major U.S. trading partners. The dollar bounced from its all-time lows starting last summer, but it is still below its long-term average. As I've noted before, the dollar's bounce was roughly coincident with the collapse of most commodity prices. This phenomenon is variously referred to as the unwinding of the carry trade, or a global deleveraging process.Although the dollar has come up from its lows, I don't consider that the dollar is in a strengthening mode, because a) the Fed is not even close to trying to boost the dollar's fundamental value by tightening the supply of dollars (and indeed the Fed seems to be doing everything within its power to increase the supply of dollars), and b) the dollar, as well as all major currencies except the yen, is at or close to all-time lows relative to gold.

No shortage of money (8)

This is my longest-running theme: namely, that this recession has not been the result of a monetary squeeze or a shortage of money, contrary to the popular belief that the economy has ground to a halt because banks are not lending and credit markets are frozen. M2, my favorite measure of money, has grown about 10% in the past year, and has surged at a 17% annualized rate over the past four months. The problem is not a shortage of money but a shortage of buyers, which in turn is the result of a sudden aversion to counterparty risk. Granted, secondary lending activity (of the sort that gave us CDOs and Asset-Backed Securities) has ground to a halt, but that does not mean that credit creation has collapsed. On the contrary, total bank credit is up 4.5% in the past year.

The secondary markets served the function of distributing the credit created by banks from the far corners of the globe, and into the nooks and crannies of our own economy. Indeed, money was funneled from global lenders to borrowers everywhere, which is why the collapse of our housing market has led to losses worldwide. There is plenty of money out there today, but it is harder for some borrowers to get their hands on it. Today, many lenders prefer to only invest in government securities, having been severely burned in the past by lending via asset-backed paper they assumed was relatively safe. This is why the U.S. government will be able to finance a mega-deficit this year and only pay about 2% in interest to do it.

In short, there is an abundance of money out there, but a shortage of holders of that money that are willing to lend it to borrowers with less than sterling credentials. This is the primary justification for all the federal bailout programs, since at the end of the day what those activities amount to is the U.S. government buying the paper that no one wants, in exchange for the Treasury securities that everyone wants.

So the key to restoring our economy to a healthy state is to boost confidence, reduce perceived counterparty risk, and generally increase the market's willingness to take risk. Tax cuts on capital could have gone a long way to fixing the problem, but alas, they have been passed over in favor of politicially motivated spending which will do very little to address the economy's underlying problems.

The doomsayers out there mostly assume that we are caught in the grips of a liquidity trap (in which no amount of money creation is sufficient to boost demand) and/or we are in being sucked into a deleveraging death spiral that won't end until vast sectors of the global economy are devastated. What they most likely ignore is that economies, especially ours, are incredibly dynamic, and that makes forecasting the future very difficult. It is risky to assume that any trend that is readily observable will continue forever. Recessions are not self-perpetuating.

I have been operating under the assumption that the vast majority of the real-estate-related losses have been absorbed by the holders of affected securities. I think that home prices are in many areas already at levels which have stimulated buying demand, thus acting to put a floor under those prices. With money policy extraordinarily easy, I have been thinking that investors will not want to sit on mountains of cash indefinitely, especially when they see that sensitive asset prices (e.g., oil, commodities, real estate) are stabilizing, and especially when that cash is paying them almost nothing in interest. The confidence that has been lacking to date can be restored as animal spirits and the profit motive come back to life. In other words, I am a believer in the market's ability to fix itself, and I see more examples of that happening.

It still pays to be optimistic, even thought the stimulus package is awfully depressing.

Another bounce: used car prices

I'm encroaching on Mark Perry's territory here (a great economist who teaches at the University of Michigan in Flint), and I'll admit to a bias to searching for evidence of an economic bounce whereever I can find it. Still, given the pervasive bearish mood, the more examples I find, the more likely it is that the consensus view on the economy is incorrect. This chart comes from data compiled by Manheim Consulting. "The Index is based on all completed sales transactions at Manheim’s U.S. auctions (A useable sample size of over five million transactions annually)." Here's their explanation for the January '09 bounce:

I'm encroaching on Mark Perry's territory here (a great economist who teaches at the University of Michigan in Flint), and I'll admit to a bias to searching for evidence of an economic bounce whereever I can find it. Still, given the pervasive bearish mood, the more examples I find, the more likely it is that the consensus view on the economy is incorrect. This chart comes from data compiled by Manheim Consulting. "The Index is based on all completed sales transactions at Manheim’s U.S. auctions (A useable sample size of over five million transactions annually)." Here's their explanation for the January '09 bounce:January’s improvement in wholesale pricing reflected dealer attitudes that were boosted by better-than-expected used vehicle operations. The continuing falloff in new vehicle sales activity also pushed trade-in volumes down much further than the demand for used vehicles and, thus, increased the need for auction purchases.

In other words, we have a market that is the process of self-correcting. Reduced demand for new cars has reduced the supply of used cars on the market, and falling prices for used cars have awakened demand for those same cars. We see the same thing happening in real estate markets across the country: lower home prices have stimulated the demand for homes, resulting in significant increases in home sales activity in recent months. Yesterday Mark posted a good series of charts to illustrate that.

Sunday, February 15, 2009

Obama's off to a VERY bad start

This article is a must read: "Obama's Broken Promises Were Entirely Predictable." For my part I must say he has already exceeded my worst fears. Certainly he has proven that every one of my concerns about him were fully justified. At this rate, he is going to be a one-term president. If he continues to get worse, and the Congress follows him, next year's congressional elections could be extremely interesting. Obama is making Bill Clinton's first few years look positively masterful. If you want to know why the stock market is still in the dumps, this article explains it. And we shouldn't be surprised: "What could anyone have possibly expected from a young, overtly leftist Chicago upstart who had accomplished precisely nothing of significance throughout his short career — and yet still promised the world, and more, to his loyal adherents?"

To add outrage to the story, we now learn that "after pushing Congress for weeks to hurry up and pass the massive $878 billion stimulus bill, President Obama promptly took off for a three-day holiday getaway. He's not expected to sign the bill until Tuesday."

By far the largest, most expansive and pork-laden spending bill by any measure in the history of this country, and Congress spent only a few days debating it and not a single member of Congress or the public had the chance to read the bill before it was passed. This is truly outrageous. Let's see some outrage, people!!

To add outrage to the story, we now learn that "after pushing Congress for weeks to hurry up and pass the massive $878 billion stimulus bill, President Obama promptly took off for a three-day holiday getaway. He's not expected to sign the bill until Tuesday."

By far the largest, most expansive and pork-laden spending bill by any measure in the history of this country, and Congress spent only a few days debating it and not a single member of Congress or the public had the chance to read the bill before it was passed. This is truly outrageous. Let's see some outrage, people!!

Monetary Base update

The Fed has pulled about $200 billion out of the system in the past four weeks, but the expansion of the monetary base remains epic in size. We've got to watch this very carefully. So far I would say that most of the expansion of the base (bank reserves and currency) has been in the form of bank reserves and has in turn been in response to a world that is desperately desiring extra safe money of the kind that only the US government can provide. That's not necessarily inflationary. But the recent rise in gold suggests that the Fed's willingness to supply money may be exceeding the market's demand for it. If they don't pull this balancing act off perfectly there could be huge consequences. Stay tuned.

The Fed has pulled about $200 billion out of the system in the past four weeks, but the expansion of the monetary base remains epic in size. We've got to watch this very carefully. So far I would say that most of the expansion of the base (bank reserves and currency) has been in the form of bank reserves and has in turn been in response to a world that is desperately desiring extra safe money of the kind that only the US government can provide. That's not necessarily inflationary. But the recent rise in gold suggests that the Fed's willingness to supply money may be exceeding the market's demand for it. If they don't pull this balancing act off perfectly there could be huge consequences. Stay tuned.

Friday, February 13, 2009

Signs of global recovery (3)

All sorts of things were trashed in the September-November time frame last year, especially commodities and emerging market equities and bonds. I've noted before how commodities appear to be bouncing, and suggested that the bounce is becoming contagious. Brazilian equities, valued in dollars, are now up 44% from their low of last November 21st. That's a nice bounce, and if the global economy continues to improve on the margin, emerging market securities have a lot of upside potential left. Continued strength in gold prices, as I noted yesterday, bode well for commodity prices in general, as gold tends to be the leader.

All sorts of things were trashed in the September-November time frame last year, especially commodities and emerging market equities and bonds. I've noted before how commodities appear to be bouncing, and suggested that the bounce is becoming contagious. Brazilian equities, valued in dollars, are now up 44% from their low of last November 21st. That's a nice bounce, and if the global economy continues to improve on the margin, emerging market securities have a lot of upside potential left. Continued strength in gold prices, as I noted yesterday, bode well for commodity prices in general, as gold tends to be the leader.Full disclosure: I am long EMD and SLAFX as of the time of this writing.

Thursday, February 12, 2009

If the stimulus bill fails...

I'll go to bed tonight with a prayer that the faux-stimulus bill fails in the Senate tomorrow. There is still a slim chance it might happen. Ted Kennedy won't be voting tomorrow, which means that Snowe, Collins, or Specter (RINOs, Republicans in Name Only) will cast the deciding 60th vote. Presumably none of them wants to be the deciding vote. I can dream, can't I?

If by some miracle the bill fails tomorrow and the stock market falls as a result, that would be a fantastic buying opportunity. Without the bill the economy has a decent chance of recovering. With it, the road to recovery will be steeper.

If by some miracle the bill fails tomorrow and the stock market falls as a result, that would be a fantastic buying opportunity. Without the bill the economy has a decent chance of recovering. With it, the road to recovery will be steeper.

A better way to stimulate: trust the people who want to work

Thomas Friedman penned a column the other day ("The Open-Door Bailout") that is a must-read for anyone thinking about solutions to our current crisis. The problem with Obama's faux-stimulus bill is that it relies almost entirely on government handouts and government spending programs. It's all top-down, with little or no bottom-up. It's chock-full of Keynesian pump-priming, income redistribution and expanded government programs. It's completely missing measures designed to attract and incent people who want to work and create new jobs. Here are some key excerpts from Friedman's column but please read the whole thing.

HT: Ramiro

Leave it to a brainy Indian to come up with the cheapest and surest way to stimulate our economy: immigration.

“All you need to do is grant visas to two million Indians, Chinese and Koreans,” said Shekhar Gupta, editor of The Indian Express newspaper. “We will buy up all the subprime homes. We will work 18 hours a day to pay for them.

America, please remember how you got to be the wealthiest country in history. It wasn’t through protectionism, or state-owned banks or fearing free trade. No, the formula was very simple: build this really flexible, really open economy, tolerate creative destruction so dead capital is quickly redeployed to better ideas and companies, pour into it the most diverse, smart and energetic immigrants from every corner of the world and then stir and repeat.

If there is one thing we know for absolute certain, it’s this: Protectionism did not cause the Great Depression, but it sure helped to make it “Great.”