Friday, April 2, 2010

Auto sales surge

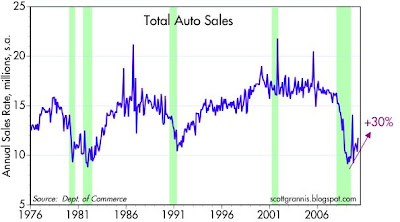

Economy bears say that auto sales are still at extremely low levels (11.8 million at a seasonally adjusted annual rate). Economy bulls prefer to point to the change on the margin: sales have surged some 30% from their low of Feb. '09. I'm in the camp that says this big rise in sales over the past year is another sign of a V-shaped recovery. Improvements like this, even though they are historically modest in size, reflect improving fundamentals in such things as the jobs market, the availability of bank financing, the increased liquidity in the financial markets, and the return of confidence (or should we say the decline of fear and panic). There is no reason to think that this kind of improvement can't continue. I view this as consistent with my expectations for 3-4% growth over the next year or so.

Subscribe to:

Post Comments (Atom)

7 comments:

Scott.....

It goes as long as Wall Street and Government can keep borrowing from our retirement accounts and paying generous salaries plus benefits packages to the over 50,000,000 government employees, health care employees funded mostly by government, and Wall Street companies, like public homebuilders borrowing trillions from our retirement accounts that they will never likely be able to repay.

It appears that the funds may be running out soon as the 10 year hit 3.94% today.

Scott-I was reading the calculated risk blog and he mentioned a statistic that was used by the Atlanta Fed, I think in referring to structural long trem unemployment. Thta stsistic was that fewer people had moved cities or counties in 2008 than any time in the past 50yrs. He hypothesized this was due to underwater home prices. Wgere does that staistic (ie:mobility or th lack thereof) come from??

Scott - is this really a "surge" or is this a reversion toward a long term mean?

Eyeballing your chart, the long term mean looks like about 12.5-130 million cars -- and if the economy is going to return to the "boom" times of the late 1990s / early 2000s (as the stock market seems to want to price in) -- then the long term average is more like 16-17 million cars.

So pardon me, but 11.8 million (and that's seasonally adjusted) is not exactly a surge. At best, it is a reversion to the long term mean (pick whichever mean you like).

In order for this "recovery" to be real, interest rates would need to be normalized -- especially Fed Funds.

As a rough guideline, short term rates are usually about 1% below 10yr rates when things are "normal". That is horseshoes and hand grenades, but its a decent estimate.

Put Fed Funds up to 2.75 or 3% tomorrow and tell me what kind of a recovery we are having. watch your head for all the collapsing money center banks if you do.

Sorry Scott, but this is nothing but a Fed induced sugar high -- not a recovery. And to be quite blunt, with Fed Funds at all time lows, car sales ought to be at all time highs. They are not, because the economy is still very sick.

None of the imbalances of the last "boom" have been fixed. Few (if any) have even been addressed.

Sorry buddy -- this recovery is all a hallucination of the people who thought subprime mortgages financed at 50x leverage was a sound business policy.

These people are fools, and if not for a rather crooked Treasury Secretary (two of them), these banks would be gone.

This recovery is all pretend. Not even Bernanke believes it -- otherwise he would be normalizing rates

Hi George,

One thing I wonder is if the uptick is just a "sugar high" then what about the recoveries abroad? Scott mentioned Brazil in a recent post, for example.

Global rebound or irrelevant?

surge, V, impressive, better, improved, recovery, rise, not bad, strength, stabilized, attractive.

Gary: I've lived through several recoveries, and they are all the same: no one believes it is real until way after the fact. This one is no different. I see all the essential ingredients. Monetary policy has a very limited ability to create growth. So does fiscal stimulus of the kind we have done a lot of. Policymakers like to think they can pull and push the economy's levers, but they really can't. The only kind of policy which makes a difference is the kind that changes incentives.

Scott - officially, most of the 1970s was a recovery. The 1974 recession lasted less than a year, and we were on to great things.

This is the official record, recognized by both political parties and every economic score keeping entity in the land.

But most people remember the 1970s as a disaster economically speaking.

Rampant inflation or stagflation -- to tax / pay for expanded "entitlements".

There was that little war-- I mean police action-- in Vietnam that had to be paid for.

FNMA/FHLMC were "privatized" in the late 1960s by Ken Lay's intellectual guide LBJ. After that accounting scam, it was no longer possible to conceal the government's out of control spending and deficits.

Steel mills, auto companies, textiles -- whole industries collapsed.

Unemployment was very high; under-employment (people had jobs that didnt even come close to using their skills) was epidemic.

Statistically speaking, it was a recovery. But a more down to earth appraisal is that the "recovery" felt a lot like a recession.

From an investor's standpoint, in 1982 (eight years into the "recovery"), the Dow and S&P still hadn't matched their 1968 highs.

There were quite a few cyclical bull markets during that bear market. Nominal corporate earnings increased, while real (after inflation) earnings did not -- so there was significant P/E compression.

Statistically, it was a recovery -- but non-academics simply don't remember the 1970s that way. Today's market is the same.

From a real economic standpoint and from an investor standpoint (not statistics), it might as well have been a recession.

I think most of us reading your blog are investors of one variety or another -- so reality (and how it effects our investing) is far more important than economic statistics.

The "recovery" of the 1970s ended, and real economic recovery started, when the past economic balances were corrected -- and not before. Some were fixed by Paul Volcker, but many more were fixed by the passage of a decade (during which bad debts were inflated away).

Apologies to both Scott and Obama -- this time will not be different

Post a Comment