Thursday, February 25, 2010

Outlook for mortgage rates

Calculated Risk today has a good post on the outlook for mortgage rates now that we are approaching the end of the Fed's MBS purchase plan, which is 96% complete. He concludes that "mortgage rates will rise 35 to 50 bps relative to the Ten Year when the Fed stops buying agency MBS at the end of March."

That's pretty much the same conclusion I've come to. I'll add some charts to the discussion which make the same point from a different approach.

This chart shows the 26-year relationship between Fannie Mae collateral and 10-yr Treasury yields, with the spread on the bottom. Note that the spread has averaged about 125 bps, and currently stands at about 70. The spread has rarely traded at less than 100 bps, which suggests that Fed purchases may have caused spreads to tighten by 30-55 bps.

This next chart shows a more unconventional spread, comparing FNMA collateral to the 5-yr Treasury yield for the period that began with the Lehman collapse in 2008. Note that the Fed first started buying MBS in significant quantities around the middle of March '09. Prior to the start of its MBS purchases, the spread averaged about 240 bps for several months; subsequently it fell to a fairly stable 200 bps. This suggests that Fed purchases could account for a spread tightening of about 40 bps.

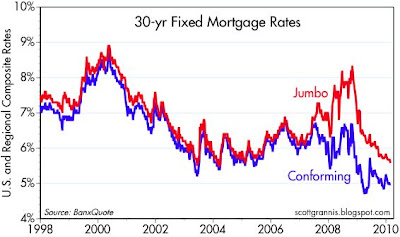

Thus we circle back to the conclusion that when the Fed ceases its MBS purchases at the end of March, we should expect mortgage yields to rise by roughly 30-50 bps relative to Treasury yields. Most of that rise could be absorbed by conforming mortgages, since the spread between jumbo and conforming loans is still quite wide by historical standards. But in any case, the likely rise in mortgage rates will still leave them quite low by historical standards (barring, of course, a major increase in 10-yr Treasury yields). Thus I don't see a big threat to the housing market looming.

The development that stands the biggest chance of causing a significant rise in mortgage rates is a big rise in Treasury yields. As I've pointed out before, however, a big rise in 10-yr Treasury yields is most likely to coincide with and signal a much stronger economic outlook. A stronger economy, in turn, would have the effect of offsetting (via rising incomes and greater optimism) most if not all of the rise in mortgage rates.

Subscribe to:

Post Comments (Atom)

1 comment:

Post a Comment